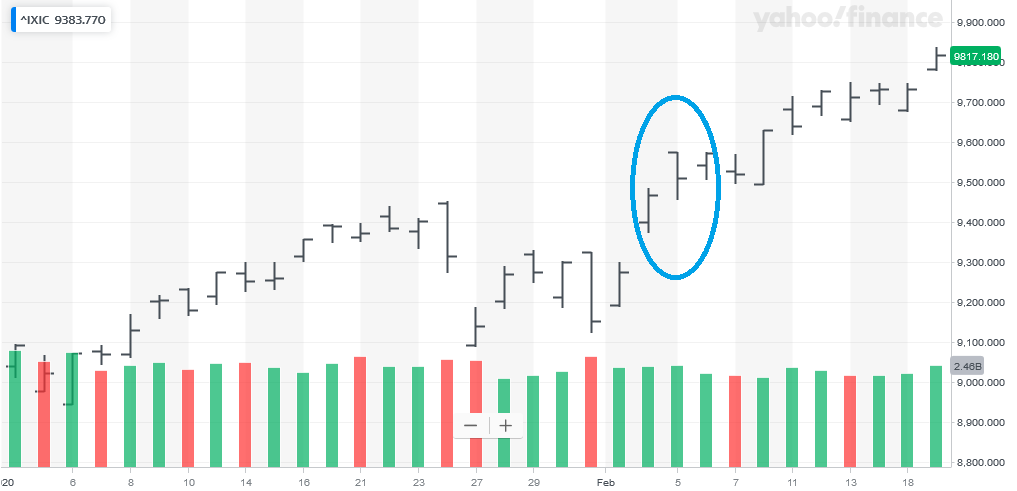

| Meanwhile, the worsening of the coronavirus appears to have caused a plunge in bond yields in January as investors seek additional safe havens and the VIX Index(2) (the CBOE Volatility Index® which measures U.S. equity market volatility) has also risen. Consequently, we have acted in client portfolios to adjust to our perception of the ongoing exaggeration of the market environment that we talked about above and in the recent year-end letter (we highly encourage you to read it if you have not done so already.) Given these risks in the market, we continue to proceed with caution and feel that portfolio discipline remains paramount. While recessionary concerns remain low given the massive central bank stimulus around the globe, CIG’s outlook can rapidly adjust as a result of a material change in economic indicators or a dramatic shift in central bank policy. Accordingly, we ask ourselves, “How and how much do we want to dance with this market today?” |