OUR LATEST INSIGHTS

Brian J. Lasher

Head of Business Advisory, Wealth and Investment Management

WORK WITH US

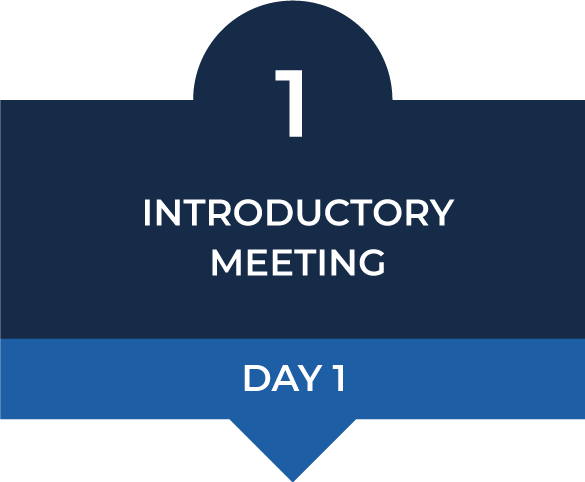

Completion of a Financial Needs Analysis (FNA)

Assessment and commitment to develop Financial Plan

Scheduling of Data Gathering (DG) Meeting

Provide CIG Wealth Organizer

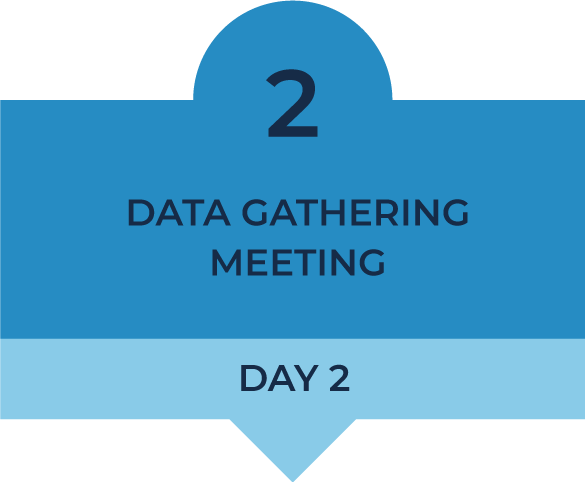

Validation of all information extracted during FNA & in CIG Wealth Organizer

Receive Client Documentation

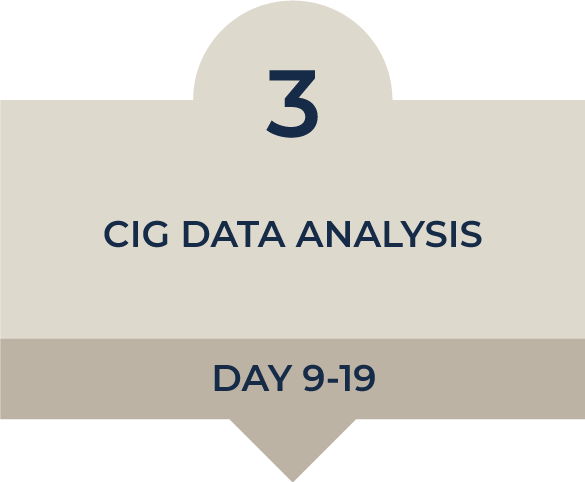

Analysis by CIG Wealth Management Team

Wealth Management team analyzes Client data and Refines Client Objectives

Develop initial Client Wealth Plan – including (as applicable):

Initial Development of Strategies and Solutions

Roundtable discussion with CIG Wealth Management, Asset Management and Executive Team which provides a true vetting process to confirm all recommendations are in the best interest of the Client and reflects our best ideas and philosophies to meet Client goals and objectives

Scheduling of Strategy & Implementation (S&I) Meeting

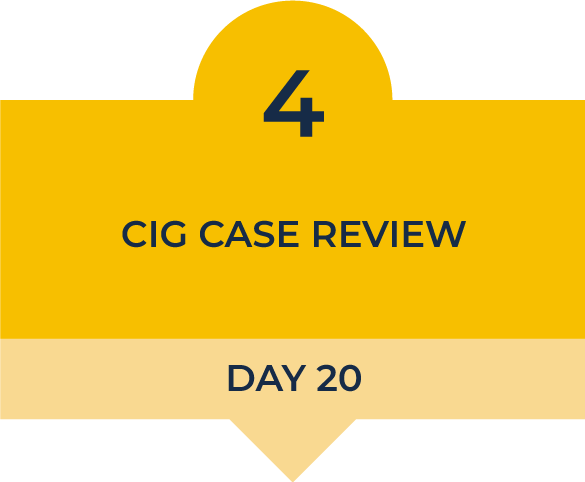

Presentation of Client Wealth Plan

Discussion, prioritization and approval of strategic recommendations

Execution of Investment Policy Statement (IPS) as applicable

Execution of Investment Advisory Agreement (if appropriate)

Completion of all new account documentation

Execution of account transfer request authorizations

Coordination of asset/account transfers

Timelines established for reallocation of assets to align with IPS

Initial meeting with Client post-implementation meeting

Review Action Items completed and outstanding:

Determine on-going meeting schedule (e.g. semi-annual

CIG Wealth Manager & Asset Management conducts ongoing review of action items to ensure alignment with IPS, goals and objectives

Ongoing team validation of strategy and solutions

Investment Committee meet bi-weekly to review Capital Markets and Client portfolios for opportunities to protect and enhance wealth

Schedule Performance Review/Planning/Client Meeting

Ongoing regularly scheduled client meeting

Provide portfolio review reports;

Assess progress to plan and make adjustments as needed;

Schedule next meeting as agreed

WORK WITH US

Please enter your information in order to access this download.

Please enter your information in order to access this download.

Please enter your information in order to access this download.