Update From CIG Asset Management: Time to Reconsider Regret

When you or your advisor make changes to your investment portfolio, it’s natural to feel regret. When you buy investments, there’s always a chance you’ll regret it later. More importantly, if you sell some of your investments and the market keeps rising, you might regret selling too soon—especially if you must pay taxes on the gains. On the other hand, if you sell and the market drops dramatically, you may regret not selling more.

In 2021, we discussed the concept of regret [i], and it turned out to be an important moment for many of our clients. By making timely adjustments to their portfolios, in 2022 our CIG Dynamic Growth Strategy avoided 60% of the growth benchmark’s -17.3% loss and our CIG Dynamic Balanced Strategy avoided 65% of the balanced benchmark’s -15.8% loss. [ii] Here’s what we highlighted:

“It is so easy at this stage, to miss the disconnect between the real-world economy and the stock market and be tempted to chase stock valuations that as a whole are trading near all-time highs based on many historical measures. One could follow narratives like, “stocks only go up over the long term” while listening to CNBC and ever bullish Wall Street strategists and act against your best interest.” [iii]

Today, we’re witnessing and hearing about a continuous stream of almost daily market records, based on the extreme concentration in the passive indices. Meanwhile, Wall Street strategists emphasize that survival in the evolving business landscape very well may hinge on embracing AI-driven innovations. [iv]

If you invest based on this information, your maximum regret may be missing out on the current surge in these markets.

Our perspective diverges from the consensus. The economic landscape remains challenging for everyday consumers. During the COVID crisis, consumers saved more money than usual. However, the Federal Reserve now reports that these “excess savings” have been fully spent. [v] Consumers drive nearly two-thirds of the U.S. economy. Unfortunately, many are financially strained – credit card delinquencies are at their highest level in over a decade and auto loan delinquencies are also soaring. [vi] No surprise – May retail sales were weaker than expected. When adjusted for inflation, they’ve been negative year-over-year throughout 2024. [vii]

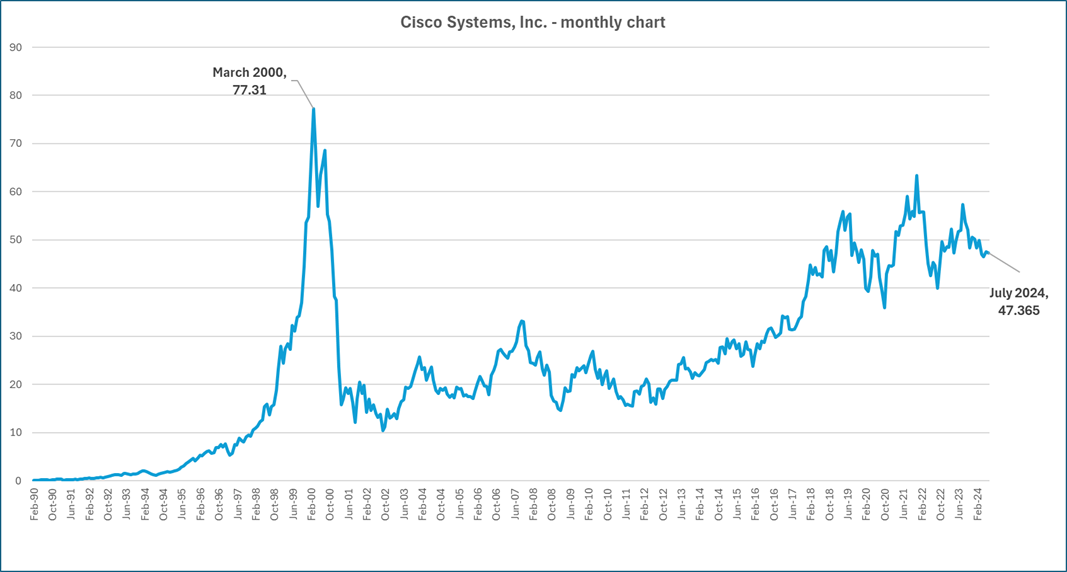

While Wall Street remains bullish on AI, some companies are taking a different stance. Lucidworks, in a survey of over 2,500 business leaders, found that only 63% of companies surveyed plan to increase AI spending versus 93% in 2023. [viii] AI investments, once hyped as the next big thing, are now facing company scrutiny. AI’s trajectory resembles that of the Internet in 2000. Back then, the Internet was a long-term success story, but many companies struggled to turn it into a profitable investment. We wonder if Nvidia – whose sales of its advanced AI platform is driving enormous sales growth and its market capitalization to over $3 trillion [ix] – will suffer the same fate as Cisco Systems. Cisco’s routers were an integral part of connecting to the internet in the late 1990s. While Cisco soared to great heights during the dot-com boom, its long-term stock chart reveals that it lost 87% of its March 2000 value when the bubble burst and it has never fully recovered to those highs. [x]

Chart by CIG Asset Management using data from Barchart.com

Given the current market conditions—where we see extreme valuations, unusual market indicators, and daily anomalies abound—we’ve increased our vigilance and are adjusting as needed. Our primary goal is to align risk with our clients’ financial plan targets. We’re cautious, and strive to avoid unnecessary risks. We don’t want to fight against the Federal Reserve or make hasty judgments. The Federal Reserve plays a significant role in stabilizing the economy. However, recent poorly received Treasury auctions raise questions about its effectiveness in a market slump this time.

If you invest and ignore this information, and stocks fall, your maximum regret could be not being able to retire, donate or spend when you choose or create your desired legacy.

Balancing risk and reward is at the heart of successful investing. Our primary goal is safeguarding our clients’ financial health. We achieve this by maintaining both intellectual and emotional distance. Drawing from game theory, we consider “mini-max regret” to guide our decisions. This means minimizing the maximum potential regret while pursuing client goals. Since 2020, we’ve emphasized that the journey matters as much as the destination. Even during speculative peaks, immediate significant market losses aren’t guaranteed. Historical examples reveal that markets can recover and even surpass previous highs for a time.

Given the inevitable twists and turns, we don’t attempt to make crystal ball forecasts; instead, we observe and endeavor to adapt. Flexibility is our compass in ever-changing market conditions. If you’re a passive or do-it-yourself investor, you may want to brace yourself for potential portfolio roller coasters. Wild market swings can lead to substantial losses of greater than 25%. History reminds us that the S&P 500 can lag Treasury bill returns for a decade or more. [xi] Regardless of your investment style, we suggest you analyze your risk exposure carefully and understand your maximum regret threshold.

We continue to believe that there are other ways to potentially make money in the stock market outside of the Magnificent 7 stocks. On July 11, 2024, the June CPI release showed inflation fell -0.1% – the first month to month drop since May 2020. [xii] On this same day, the Magnificent 7 stocks, as measured by the Roundhill Magnificent Seven ETF (MAGS), fell -4.5%. The Russell 2000 small-cap index, which year-to-date was only up +1.2% the day before, gained +3.6%! Three of our clean transition investments which we own in our dynamic growth and dynamic balanced strategies – all gained over +2.0% on this day. [xiii] The small-cap outperformance on July 11 was historical. The Russell 2000 ETF (IWM) outperformed the S&P 500 ETF (SPY) by 4.5% – the second largest outperformance on record. The only day that saw larger small-cap outperformance was October 10, 2008, in the throes of the Great Financial Crisis and right before the Fed’s Quantitative Easing program began. [xiv] One day does not make a trend, but we are encouraged that market participation may broaden out to investments outside of the Magnificent 7.

Now, more than ever, having a professional fiduciary by your side is crucial. If you would like to explore ways to safeguard your financial interests during this wild ride, please contact Brian Lasher (blasher@cigcapitaladvisors.com) or Eric T. Pratt (epratt@cigcapitaladvisors.com).

[i] CIG Asset Management Review: Outlook 2021

[ii] Figures calculated based on CIG Composite returns. Full composite returns are available upon request. Performance has been attested to by ACA Group for the period August 1, 2018, through December 31, 2022. Strategy returns are calculated independently on a daily basis and linked geometrically to produce a monthly return. Total investment performance includes realized and unrealized gains and losses, dividends, and interest. Accrual accounting is used to record interest income while dividends are recorded on a cash basis. Trade date accounting is used for calculation and valuation purposes. Past performance is not indicative of future results.) The Growth Benchmark is a blend of 60% Russell 3000, 25% MSCI All-Country World ex US and 15% Bloomberg US Aggregate Bond indices. The Balanced Benchmark is a blend of 45% Russell 3000, 10% MSCI All-Country World ex US and 45% Bloomberg US Aggregate Bond indices.

[iii] https://cigcapitaladvisors.com/cig-asset-management-review-outlook-2021/

[iv] Merrill Lynch report: Artificial intelligence: The next great tech wave?

[v] Federal Reserve Bank of San Francisco: Pandemic Savings Are Gone: What’s Next for U.S. Consumers? May 3, 2024

[vi] Federal Reserve Bank of New York: Household Debt and Credit Report. Q1 2024.

[vii] https://www.advisorperspectives.com/dshort/updates/2024/06/18/the-big-four-recession-indicators-real-retail-sales-up-0-1-in-may

[viii] https://lucidworks.com/ebooks/2024-ai-benchmark-survey/

[ix] Nvidia market capitalization as of July 15, 2024 – finance.yahoo.com

[x] Calculated by CIG Asset Management using data from Barchart.com

[xi] Hussman Market Comment – “Cluster of Woe” February 2024

[xii] John Hancock weekly market recap 7/12/2024.

[xiii] Calculated by CIG Asset Management using data from finance.yahoo.com

[xiv] https://bilello.blog/2024/the-great-reversal-chart-of-the-day-7-11-24

Update from CIG Asset Management – What’s Your Benchmark?

Do you compare your investment portfolio’s performance to a popular stock that you hear about on CNBC?

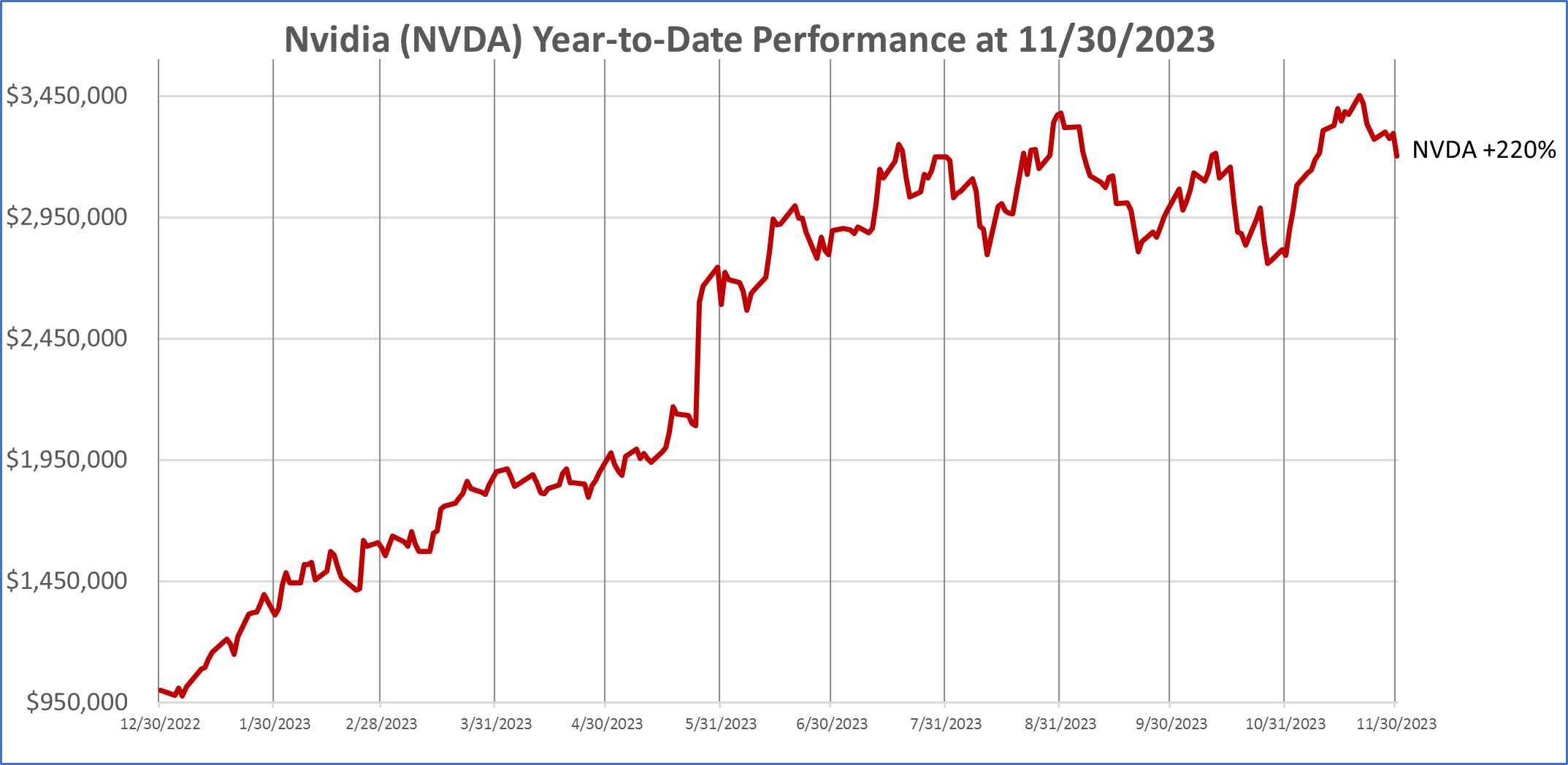

This is the daily chart for Nvidia, a single stock that soared +220% year-to-date through November 30, 2023. [i]

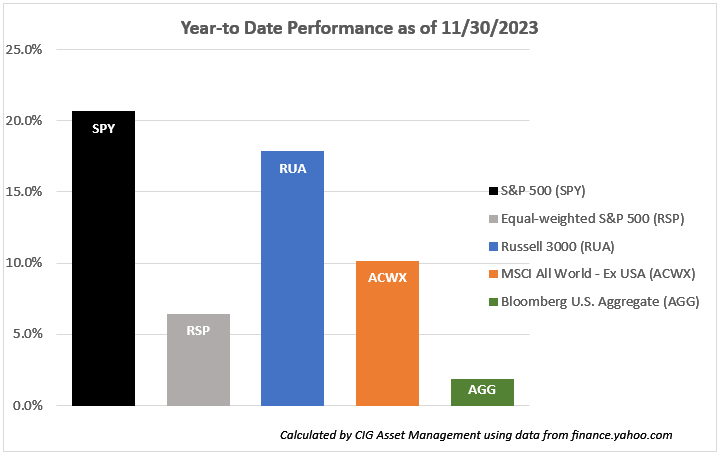

Maybe you compare your portfolio to the S&P 500.

Year-to-date through November 30, 2023, the S&P 500, represented by the SPDR S&P 500 ETF (SPY), is up +20.7%. [ii] It might be appropriate to use the S&P 500 as your benchmark if you invest all your money in large and mid-sized companies that are domiciled in the United States. However, if you are using an important tool like many investors in managing investment risk – diversification – that is, spreading your investments among and within different asset classes, then comparing your performance to the S&P 500 is likely to leave you disappointed.

This year, that disappointment is likely to be WORSE because as we discussed last month in Year-to-Date U.S. Stock Performance in Pictures, the S&P 500 performance thus far this year had been dominated by just 7 stocks – the Magnificent 7 – which Torsten Slok, Chief Economist at Apollo Asset Management said were becoming more and more overvalued and, in our view, more dangerous to invest in. [iii] Are we headed toward a big loss like post the year 2000, when the dot com stocks fell and the S&P 500 had fallen -49% from its peak on March 27, 2000, to its low On October 9, 2022? [iv]

At CIG, we believe in the adage, “Don’t put all your eggs in one basket”. We employ active asset allocation to employ varying levels of exposure to various sectors of domestic and international stocks, fixed income, and alternatives, such as gold and commodities, in an attempt to manage risk throughout market cycles.

How do we compare our strategies’ performance?

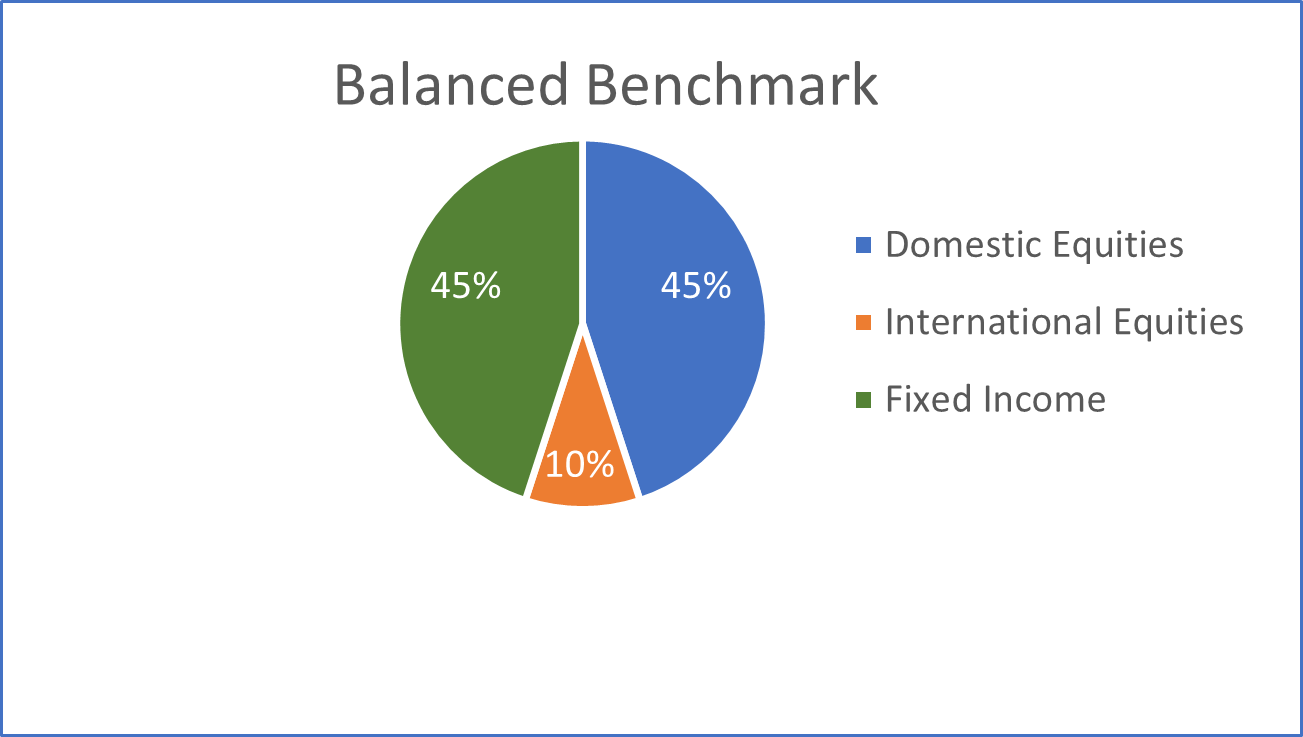

At CIG, we utilize benchmarks that are invested in a blend of three major asset classes- domestic equities, international equities, and fixed income.

- Domestic equities are represented by the Russell 3000 Index, a market capitalization-weighted index which measures the performance of the 3,000 largest U.S. companies and representing approximately 96% of the investible U.S. equity market. [v]

- International equities are represented by the MSCI ACWI ex USA Index, an index covering approximately 85% of the global equity opportunity set outside of the United States. [vi]

- Fixed income is represented by the Bloomberg U.S. Aggregate Index, an index composed of investment-grade government and corporate bonds. [vii]

The pie chart below illustrates the weightings of the three major asset classes in our balanced benchmark. We compare the performance of our clients whom we generally describe as balanced investors to the performance of this balanced benchmark.

In the following bar chart, we compare year-to-date performance of the components of our balanced benchmark to the S&P 500 and Equal-Weighted S&P 500 as of November 30, 2023.

Year-to-date, the Russell 3000 – the domestic equity index we use in our benchmarks – gained +17.8%. The Russell 3000 has a similar issue to Magnificent 7 stock dominance, with 24% of the index invested in these seven stocks but not to the same extent as the S&P 500, with 28%. [viii] Over the same period, the MSCI ACWI ex USA index (ACWX) gained +10.1%, less than half of the S&P 500, and the Bloomberg U.S. Aggregate Index (AGG) was only up +1.9%. [ix] This year, if you employed diversification – spreading your investments among and within different asset classes in the chart above instead of only investing in the S&P 500, you clearly experienced lower returns than the S&P 500.

Now that we have told you about our balanced benchmark, what is the appropriate period to assess how one has done versus the benchmarks? Should you look at it every day? How should we be looking at returns and the amount of risk you are taking?

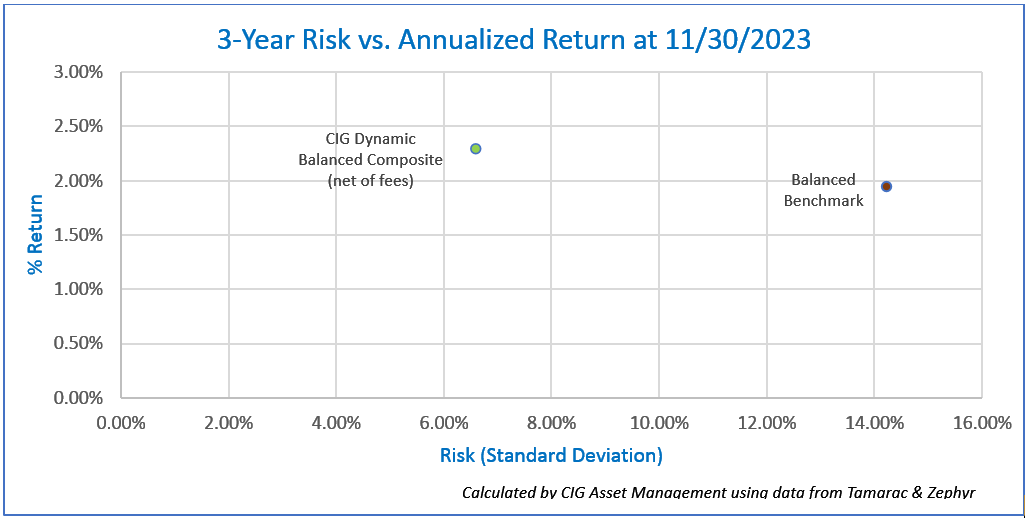

We prefer to look at returns and risk over a trailing 3-year period. We measure risk using the standard deviation of returns. The CIG Dynamic Balanced Composite trailing 3-Year annualized return as of November 30, 2023, is +2.30%, net of fees, and the 3-year standard deviation is 6.6%. [x] The Balanced Benchmark’s trailing 3-year annualized return as of November 30, 2023, is +1.95% and the 3-year standard deviation is 14.2%. [xi]

You can see in the chart below that the CIG Dynamic Balanced Composite is taking less than half (46%) of the risk, as measured by the standard deviation of annualized three year returns, of the balanced benchmark [xii] and is returning 118% of the balanced benchmark’s return on a trailing 3-year annualized basis. [xiii]

At CIG, we believe in risk-balanced investing. We believe investors should consider how much risk they are taking to achieve returns. We think that we should be striving to reach the return necessary to meet the various needs of our client’s financial plans while, at this point in the market cycle, taking as little risk as possible to meet that goal. We want you to sleep at night.

Speaking of risk, let’s go back to the first chart on page one, Nvidia (NVDA). Nvidia has experienced many booms and busts over the years. The stock is currently booming, up +220% year-to-date through November 30, 2023, due to surging sales of its artificial intelligence chip. [xiv] As of December 31st, 2023, we own a small amount of Nvidia in our dynamic and strategic balanced and growth models [xv] via our iShares Semiconductor ETF SOXX holding.

We are very cautious regarding NVDA, the company has experienced two large losses in the past five years. In the fourth quarter of 2018, NVDA stock suffered a -56% drawdown in 82 days [xvi] due to the company warning about excess inventory of graphic chips for gaming. [xvii] In 2022, NVDA stock suffered a -66% drawdown in 329 days [xviii] as cancelled orders from personal computer makers and weakness in crypto mining orders negatively impacted sales and earnings. [xix]

So, what is your benchmark, an individual stock like Nvidia that fell -66% in 329 days in 2022, or an index like the S&P 500 that fell -49% from its peak on March 27, 2000, to its low On October 9, 2022?

We counsel investors to understand what they are invested in – typically a diversified portfolio – and measure their results with the appropriate diversified, blended benchmark. Life is too short to be frustrated.

If you are not a client, we are happy to review how much risk that you are taking to achieve your returns. Please reach out to Brian Lasher (blasher@cigcapitaladvisors.com), Eric T. Pratt (epratt@cigcapitaladvisors.com) or the rest of the CIG team.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] calculated by CIG using data from finance.yahoo.com

[ii] Calculated by CIG Asset Management using data from finance.yahoo.com

[iii] The Daily Spark, published by Apollo 10/18/2023

[iv] Calculated by CIG Asset Management using data from finance.yahoo.com

[v] https://www.lseg.com/en/ftse-russell/indices/russell-us

[vi] https://www.msci.com/documents/10199/86494e1f-914e-4aa5-82a9-2e29ed5adbbf

[vii] https://www.investopedia.com/terms/l/lehmanaggregatebondindex.asp

[viii] The Magnificent 7 is a term coined by Bank of America analyst Michael Hartnett. The seven stocks are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla. Calculated by CIG Asset Management as of 01/02/2024 using data from State Street Global Advisors and iShares. The S&P 500 index is represented by the SPDR S&P 500 Trust and the Russell 3000 index is represented by the iShares Russell 3000 ETF.

[ix] Calculated by CIG Asset Management using data from finance.yahoo.com

[x] Calculated by CIG Asset Management using data from Zephyr and Tamarac.

[xi] Calculated by CIG Asset Management using data from Tamarac and Zephyr

[xii] The Balanced Benchmark is a blend of 45% Russell 3000, 10% MSCI All-Country World ex US and 45% Bloomberg US Aggregate Bond indices.

[xiii] Calculated by CIG Asset Management using data from Zephyr and Tamarac

[xiv] CFRA research report dated December 8, 2023.

[xv] CIG Dynamic Growth Strategy, CIG Dynamic Balanced Strategy, CIG Strategic Growth Strategy, CIG Strategic Balanced Strategy.

[xvi] Calculated by CIG Asset Management using data from barchart.com

[xvii] https://www.cnbc.com/2018/11/16/nvidia-stock-falls-on-revenue-and-guidance-miss.html

[xviii] Calculated by CIG Asset Management using data from barchart.com

[xix] https://finance.yahoo.com/news/nvidia-stock-dropped-11-rough-231731668.html

agreement

Image: Canva

Safeguarding Your Wealth with Proper Asset Protection Planning

Protecting accumulated wealth should be a cornerstone of your financial plan. A solid financial plan will address who or what poses the threat of taking away what you have earned and puts measures in place to limit the severity of those threats. These threats are often unseen and not easily predictable and therefore may cause a derailment from the path to your goals if your plan is not properly structured. Do you understand what your plan has put in place for asset protection?

Risk Management

It is not easy to think about, but just imagine that today was your last day alive. Who will be there tomorrow to protect your family and the assets you leave behind? Who will replace the high amount of income that you provide? Will your current savings be enough to provide for the day-to-day basics, let alone the big expenses of the future such as college tuition? Proper planning aims to assess the capital needs of an individual and his or her family to ensure that given any unfortunate event, the family will be taken care of first. A less often considered, but nonetheless important, scenario is disability due to injury or sickness. Will you still be able to pay your mortgage, car loan or other payments? What if this disability is for an extended period of time? You must, again, ask what your financial plan has in place for the future of your family and goals.

Personal and Business Liabilities

For physicians and other highly visible professionals, the possibility of becoming the defendant in a lawsuit based on work performed or expertise given is not out of the question. How is your medical practice structured? Which of your personal assets will be exposed to liabilities? There are particular are strategies to help protect and separate your business assets from your personal assets (Domestic Asset Protection Trusts).

Estate Planning & Titling

Do your estate planning documents match your intentions? Your estate plan may be designed to leave assets to your children; however, if your accounts and assets are not titled properly, your children may not receive those assets as intended. For example, accounts titled as Joint Tenants with Rights of Survivorship, all assets will remain in the account under control of the surviving owner, regardless of the estate plan documents. It is critical that your account titling matches your estate plan documents to avoid unintended consequences.

Mistakes and Unforeseen Problems

Without proper planning, your accumulated wealth could be exposed to numerous risks. With proper planning, those risks can be mitigated. CIG Capital Advisors Wealth Management team can make sure your wealth plan accounts for unforeseen personal events (death, disability or lawsuit) as well as financial hazards that could jeopardize the assets you’ve built over a lifetime. It can take many years, often decades, of hard work to accumulate significant assets. Unfortunately, it can only take one event to erase your progress. Contact a CIG Capital Advisors professional to prepare for the unexpected.

CIG Asset Management Update April 2020: Uncharted Territory

Equity markets embarked on their own version of the much hoped-for “v” shaped economic recovery during the month of April, even as economic data continued to record nasty numbers. The S&P 500(1) gained +12.7%, recovering much of the prior month’s losses. Outside of the U.S., the MSCI EAFE net(2) was up +6.5% and the MSCI Emerging Markets Index was up +9.2%(2). Within fixed income, the Barclays U.S. Aggregate Total Return Index (3) returned +1.8% and the Barclays U.S. High Yield Index(3) increased +4.5% for the month.

In April, there was a continued tug-of-war between economic reality and hopes that the worst of the pandemic may be behind us:

On Friday, April 3, it was reported that the March unemployment rate rose to 4.4%, the highest since August 2017.(4) Over the following weekend, many anecdotal news stories came out, spreading hope that COVID-19 was peaking. The ensuing Monday, April 8, the S&P 500 was up +7.03% for the day(5).

The weekly unemployment report on April 9 showed another 6.6 million in weekly claims(6), only to be quickly forgotten about as the Federal Reserve issued a statement within seconds of the Department of Labor release. The Fed announced a $2.3 trillion relief package including the Main Street Lending Program, to lend money to mid-sized businesses, and a municipal and corporate bond buying program. This latest Fed action put them far past anything they attempted during the 2008 Great Financial Crisis.

The April 16 weekly unemployment claims were 5.2 million(6), and the following day, a report that Remdesivir, an anti-viral drug may help treat symptoms of COVID-19, was made public.

Then on April 21, West Texas Intermediate oil futures settled at a negative number – never before had that happened! The following day, President Trump tweeted that we could shoot Iran boats down in the Persian Gulf, and of course, the oil and the stock markets rallied.

On April 23, weekly unemployment claims totaled 4.4 million(6). The following day, April 24, President Trump said that Apple CEO Tim Cook told him in a private conversation that he believes there will be a “v” shaped economic recovery, and markets moved higher.

April 30 weekly report brought another 3.8 million unemployed claims(6). The following weekend, several states began to gradually reopen their economies.

As can be clearly seen in the above timeline, every extremely negative economic statistic that was reported in April was met soon after by either a Federal Reserve announcement, a Trump tweet or positive news stories about pandemic hopes.

No rallies are more violent than bear market rallies and seeing April produce one of the most forceful rallies in decades fits that playbook. We would argue that the markets just followed a historic playbook given historic interventions on the monetary and fiscal fronts. Warren Buffett indicated at his May shareholders’ meeting that he’s not finding places of value to invest and has announced the selling of all airline shares with the view that the impacts of the recent crisis will not magically disappear but will take time to filter through the system.

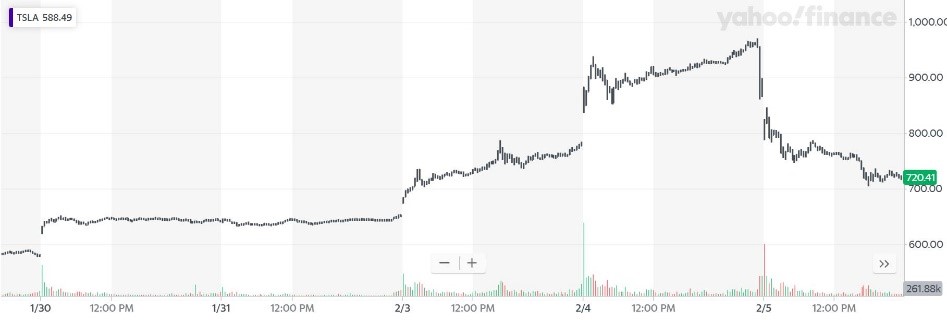

In the meantime, what is driving the performance of the S&P 500 Index? To oversimplify, it comes down to five companies; Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL). The acronym that most on Wall Street use is FAAMG. Year-to-date through April 30, the FAAMG stocks are up an average of +10% versus the other 495 companies in the S&P 500 down -13%(7).

The performance spread between the FAAMG stocks and rest of the S&P 500 will most likely narrow over time. The lagging 495 stocks could begin to catch up with the leaders, FAAMG could start underperforming, or a combination of the two.

We have mentioned before that it’s not possible to forecast the path of the pandemic. In contrast to the above, states reopening and the massive Federal stimulus have already produced “green shoots” suggesting that the economy could begin to recover. Starbucks announced on May 5 they planned to open 85% of its locations by the end of the week, with contactless pickup and cashless payments. Simon Properties, the country’s largest shopping mall operator, announced it would open malls as states allow it. Recent activity on the Apple map app is showing signs that driving activity is starting to rebound. We would especially like to strike an optimistic tone on that last point.

Here at CIG we continue to be proactive and nimble as we see how long this bear market rally and tug-of-war can continue.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

SOURCES:

- Calculated from data obtained from Yahoo Finance, as of May 1, 2020.

- MSCI, as of May 1, 2020

- NEPC

- Bureau of Labor Statistics, April 3, 2020

- Calculated from data obtained from Yahoo Finance, as of May 1, 2020

- United States Department of Labor.

- FactSet, Goldman Sachs Global Investment Research

Financial Resiliency Amid Disruption: Your Healthcare Practice

Your medical or dental practice may have to adjust to a “new normal” as states slowly return to broader care permissions after weeks or months of tight, lockdown restrictions. Have you taken advantage of the programs offered to help medical and dental practices survive and what changes can you make to help ensure your practice thrives in a post-lockdown environment?.

Here are some management aspects dentists and physician-owners may want to consider in planning for financial resiliency amid the global disruption brought by the pandemic:

Cash Flow Summary

With so much uncertainty, being able to visualize your cash flows for the next 12 months is crucial. Taking proactive measures to forecast your incoming cash flows will allow you to implement a strategy early on and to timely take appropriate steps. The process includes analyzing your historical revenue stream and collection rates with an objective to forecast your future collections. Reviewing your procedure mix will help you determine what the impact of delaying non-essential procedures will be to your top-line.

Expenses should be adjusted to reflect cost management strategies and cash inflows from government establishments and banking institutions should be factored in to estimate cash balances throughout the pandemic as well as into the recovery period. Conducting a sensitivity analysis may also be beneficial to envision best case/worst case scenarios.

Telehealth

During the COVID-19 crisis, CMS has significantly expanded access to telehealth services for Medicare beneficiaries. This includes the easing of many of the stringent regulations set place by various government entities. Time should be spent reviewing the latest changes, highlighting the different opportunities available to you, and researching different telehealth platforms to see which is most appropriate for your practice.

Due diligence should also be conducted to highlight services that you may virtually perform and bill via telehealth. Disseminating the service to your patients as well as the general public is key to optimizing this tool.

A/R Management

Insurance companies don’t typically pay out as fast as many dental and medical practice managers would like. Understanding tools available to healthcare providers during the crisis could allow you to speed up your collection process. For example, CMS is expanding its payment acceleration program and HHS has announced a provider relief program. Your billing staff may also be utilized to effectuate collections through aggressive A/R management.

Expense Management

Having a handle on your expenses is one key to sustaining a positive cash flow. A first step may be to look into your historical expenses as a percentage of revenue as well as the year-over-year trends. Recent changes should be taken into consideration as well to prudently forecast your budget.

Fixed expenses are typically the biggest threat. However, there may be options available to you depending on the language in your contracts. Review the contracts and agreements you have in place and look for ways to renegotiate with an objective to defer or abate payments. It may be in your best interest to terminate some agreements.

Grant and Loan Opportunities

Keeping businesses up and running is almost just as crucial to owners as it is to the economy. For that reason, there are many grants and loans available to assist you with perfecting your payroll, rent and other costs. Time should be spent pinpointing your situation, reviewing various programs available to you, and working with your financial institution and accountant to pursue loan programs, grants, and line of credits to supplement your cash reserves.

Business Continuity and Recovery Planning

Having a Business Continuity Plan in place is imperative not only to weather crisis times but also to transition back to what many are calling the new normal. This involves reviewing your remote work capabilities, adjusting staff tasks to keep them engaged, increasing oversight of vendors, and other organizational modifications.

Let us help

As experienced medical and dental practice business advisors, we can dig deeper into your numbers and show where you can make changes that will improve your practice’s bottom line. Let us help support your practice’s resiliency by scheduling an initial complimentary consultation with Brian Lasher.

Important Client Announcement Related to COVID-19

| At CIG Capital Advisors, the health and safety of our clients, business partners and team is our first priority. Amid the growing concerns around COVID-19, we are taking substantial measures to ensure the welfare of our clients and employees is protected: Moving In-Person Meetings to Virtual Meetings: In an effort to minimize any potential exposure, we are taking the highest level of precaution and are strongly encouraging all client service meetings be conducted in a virtual format. Should you agree to change your in-person meeting to a virtual meeting via either our secure video conference system or telephone, please contact your CIG Capital Advisors senior wealth manager. Social Distancing and our Business Continuity Plan: The Centers for Disease Control and Prevention (CDC) recommends social distancing as a measure that can help prevent the spread of COVID-19. This could eventually extend to our office environment, so in an abundance of caution, CIG Capital Advisors will conduct a trial run of a full-staff remote work day on Tuesday, March 17. Should you need to contact a CIG Capital Advisors staff member on Tuesday, the usual channels of communication like email and phone will be available per our Business Continuity Plan. Our leadership team is monitoring the situation daily, taking into account guidance from the CDC, public health agencies and state officials. We will adapt our protocols as necessary and keep you apprised of all updates and changes. Investment Management: While health and wellness must be our priority, the financial health of your portfolio is a fiduciary responsibility we take seriously every day, no matter the macro-economic conditions. However, during times of economic instability like we have seen in recent weeks, it’s natural to seek information about how your asset manager is reacting amidst the turmoil. To discuss our prudent response to the uncertainty in the global markets, we’ve scheduled a special client-only webinar on Wednesday, March 18 at 1 p.m. The webinar will last approximately 30-45 minutes. All clients are invited to register for the webinar, hosted by CIG Capital Advisors Managing Principal Osman Minkara and Vice President of Asset Management Brian Lasher; you may also want to refer to our monthly Asset Management updates and recent 2019 Asset Management Year in Review letter, all of which were previously emailed to you and can also be found on our website here. REGISTER FOR THE WEBINAR HERE: https://zoom.us/webinar/register/WN_BSWP4BA_Q-yxk9J68wm2cA Please reach out to the CIG Capital Advisors team with any questions in the meantime, and we look forward to “seeing” you virtually in the webinar on Wednesday. |

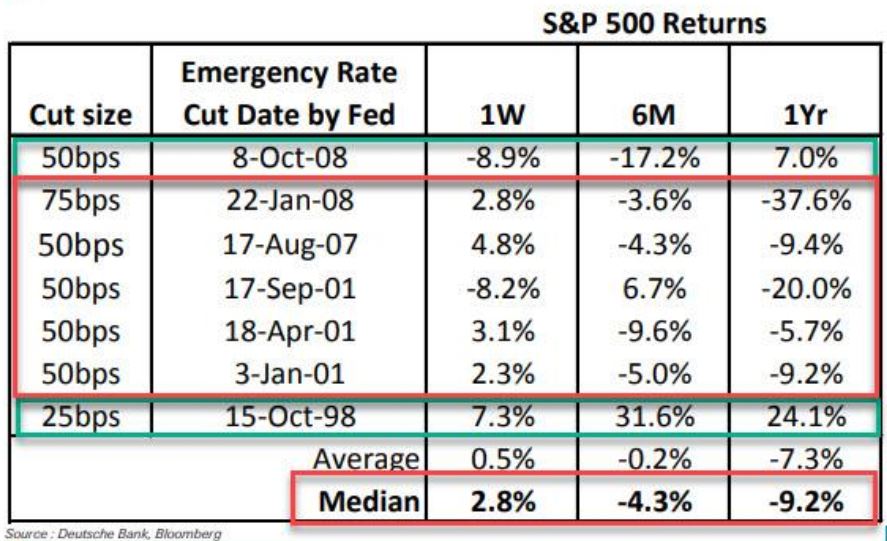

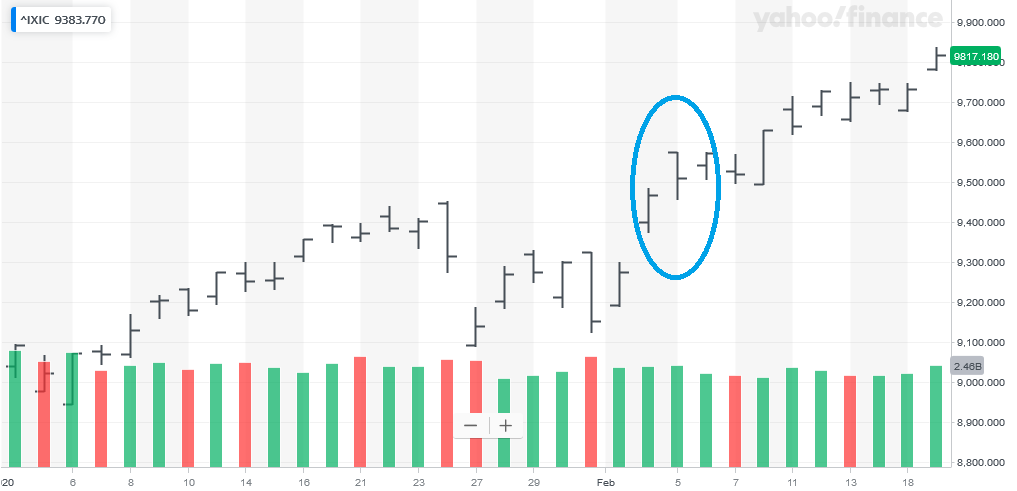

CIG Asset Management Update February 2020: The Unknown Unknowns and Our Thoughts on COVID-19

| Market volatility spiked starting at the end of February and continues today at extreme levels. Long time readers of our updates know that we have been warning about asset bubble and Central Banks’ recent actions since last year. On March 3rd, The Federal Open Market Committee (FOMC) cut the federal funds rate by 0.5 percentage points to a 1 to 1.25% range. An emergency interest rate cut between regular meetings is very rare. The last such cut was during the Great Financial Crisis (GFC) in October 2008. In fact, there have only been 7 emergency actions since October 1998. Interestingly, the FOMC took this action after only a -8.2% decline in February for the S&P 500 Total Return Index(1). Similarly other markets around the world showed “orderly” selling – the MSCI EAFE Net index of Developed Markets was down only -9.0% while Emerging Markets, as measured by the MSCI Emerging Markets Net Index, lost only -5.3% during the month(2). How have stocks performed in the past after the FOMC cuts rates unexpectedly? The answer in the table below(3) is that they tend to go lower the following 12 months. The average one year return on the S&P 500 following an emergency cut is -7.3%. The October 15, 1998 emergency cut was in reaction to a hedge fund, Long Term Capital Management (LTCM), imploding. Excluding the LTCM cut, the average one year return after the other six actions was much worse, -12.5%.  On February 20 and 21, FOMC speakers were cheerleading the market and saying that no rate cuts were necessary. We must ask ourselves, why did the Federal Reserve deem it necessary to act so suddenly? Ultimately, fears intensified over the new coronavirus (COVID-19) turning into a pandemic given that the number of new cases appearing outside of China were outpacing those within China, all this without adequate testing in many places. However, we remain skeptical that monetary policy can solve the global economic issues. Amazon, Google, Facebook and Microsoft are now pushing working from home(6). All, in addition to Apple, JP Morgan, Proctor & Gamble and others, have limited employee travel(6). Major events such as the St. Patrick’s Day Parade in Dublin have been cancelled, and forthcoming cancellations will be likely, too. Corporate management teams know that they will be forgiven if they lump as much bad news as possible into the first half of 2020 whether it is COVID-19-related or not. The bad news is likely to keep coming and the economic damage may be significant. It is possible that that Central Banks can regain control as Central Banks have managed to restrain volatility for the six previous times issues arose since the GFC. However, with the VIX at 60+, they appear to be more challenged than ever post-2008. Already, Treasury yields have reached record lows in February. Accordingly, the Barclays U.S. Long Treasury Index increased 6.7% during the month(4). Market participants are now anticipating three interest rate cuts to occur in 2020(5) and in March, Treasury yields have reached unprecedented low levels! The 30-year Treasury is below 1% as we write(1). In this high volatility environment, anything is possible and we are watching the markets and economy like a hawk. The CIG-managed portfolios have benefited from being positioned for late cycle volatility since October, with the Dynamic portfolios even more so since late February. There is massive risk to the downside as well as the upside. On the plus side, we may get a global fiscal stimulus package which would in turn boost markets. In that case, markets are very oversold, meaning assets that have traded lower/ gotten cheaper have the potential for a price bounce. On the other hand, the constant subsidy of the markets and the economy has led us to a large bond and stock market bubble and very high debt levels while the Federal Reserve has left themselves with way fewer tools. We have plans for both scenarios. CIG has a robust business continuity plan to lessen any interruption to service and allow us to remain fully operational at all times. We can accommodate a fully remote staff if necessary. We believe the communication procedures that we have in place will help ensure that there is no disruption to your service. We remain committed to meeting your expectations regarding meeting attendance and recognize that some clients may prefer conference calls or videoconferencing in lieu of in-person gatherings. Finally, we are persistently following the investment markets and repercussions of COVID-19 and will continue to communicate with you when appropriate about the portfolio impact and opportunities that are created. Until then, please stay well and support your friends and neighbors. The elderly who are deeply concerned now and neighbors without alternative childcare will need our help. As long as it is advisable, please visit your service vendors like restaurants and tip generously. We also ask that you generously give to local organizations who support the needs of lower-income families who might rely on travel, retail and hospitality sources of income. They will suffer disproportionately. Even if COVID-19 burns out in the coming months, as we hope it will, the economic issues could possibly linger for some time. This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. SOURCES: 1. Calculated from data obtained from Yahoo Finance, as of February 28, 2020. 2. MSCI, as of February 28, 2020 3. Deutsche Bank report using Bloomberg Data 4. NEPC 5. https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html as of March 9, 2020. 6. https://www.businessinsider.com/companies-asking-employees-to-work-from-home-due-to-coronavirus-2020 |

CIG Asset Management Update January 2020: How Much to Dance?

| Meanwhile, the worsening of the coronavirus appears to have caused a plunge in bond yields in January as investors seek additional safe havens and the VIX Index(2) (the CBOE Volatility Index® which measures U.S. equity market volatility) has also risen. Consequently, we have acted in client portfolios to adjust to our perception of the ongoing exaggeration of the market environment that we talked about above and in the recent year-end letter (we highly encourage you to read it if you have not done so already.) Given these risks in the market, we continue to proceed with caution and feel that portfolio discipline remains paramount. While recessionary concerns remain low given the massive central bank stimulus around the globe, CIG’s outlook can rapidly adjust as a result of a material change in economic indicators or a dramatic shift in central bank policy. Accordingly, we ask ourselves, “How and how much do we want to dance with this market today?” |

Easing into Retirement

Given the physical and emotional demands of their profession, it’s little wonder that some physicians look forward to retirement. However, many other doctors nearing retirement age are reluctant to turn their backs completely on their profession and would rather find a way to ease into retirement.

What should you do if retirement is on the horizon but you would prefer to transition gradually into retirement by working part-time? Here are some things to consider if you are thinking of cutting back on your work hours:

1. Review Your Finances

First off, determine if you can afford the reduction in earnings that reducing your work hours will entail. Pay particular attention to any debt you are carrying (mortgages, etc.). Ideally, you don’t want to be overly burdened with debt once you are no longer practicing full-time.

A review of your current net worth can give you a clearer picture of your overall financial standing. Net worth takes into account the value of all your assets as well as your outstanding liabilities.

If you’ve been funding a tax-favored retirement plan, hopefully you have accumulated sufficient assets to provide a steady stream of income for all the years you may be retired. If you still haven’t met your goal, you’ll want to determine if your earnings from part-time work will allow you to comfortably continue adding contributions to your retirement plan. You’ll also want to determine when you can start taking penalty-free withdrawals from your plan(s) and project what your tax situation will look like. These are all issues we can help you assess.

2. Look at Your Options

If you are part of a multi-physician practice, talk to your colleagues about what arrangements can be made for you to start cutting back your hours. You may need to revise your practice agreement to incorporate a new compensation arrangement. Typically, such arrangements are based on the productivity of the part-time physician less a share of practice overhead expenses.

If you are a solo practitioner, you may find it hard to practice part-time without creating problems with your current patient base. Patients may feel that you can’t deliver the type of patient care they expect if you are practicing part-time. Bringing in a physician assistant may be helpful. However, recruiting another physician who would eventually take over the practice may be the most effective route for solo practitioners.

Give careful consideration to the financial arrangements you make with the new physician. When it comes time to sell, you’ll want to have a formal purchase agreement that outlines all of the rights, obligations, and responsibilities of the buyer(s) and the seller. It should also include a valuation of the practice.

3. Consider Malpractice Insurance

Don’t ignore the issue of malpractice insurance when you are weighing the pros and cons of going part-time. You need to be certain you will be covered during your part-time years and after you stop practicing completely. “Tail coverage” can protect you against any malpractice claims that may be filed against you after you retire.

CIG Capital Advisors Can Help with Retirement Planning

Whether you are serious about transitioning to part-time work or are simply exploring your options, be sure to consult with us. We can help evaluate your personal financial preparedness for retirement and assess the need for other steps, like medical practice valuation or a partnership exit strategy. Schedule a complimentary consultation with a CIG Capital Advisors professional to discuss your specific situation.

CIG Asset Management Update October 2019: The Undercurrent in the Markets

Equity markets finished a challenging third quarter of 2019 with positive returns. While the last three months have been held back by worries about trade relations and slowing economic growth, the quarter’s other dominating force of Central Bank (CB) easing won out in September, especially in Europe. International stocks, as measured by MSCI EAFE Net(1), […]