CIG Asset Management Review: The Return of Active Portfolio Management

Summary:

* S&P 500 Index posted its fourth consecutive month of gains

* Active portfolio management beat the index

* 2Q 2021 portfolio rebalancing activity

Commentary:

The S&P 500 Index[i] posted its fourth consecutive month of gains, up +0.7% in May. International markets performed better than the U.S. with the MSCI EAFE net up +2.9% and the MSCI Emerging Markets gaining +2.1% given continued U.S. dollar weakness[ii]. The Bloomberg Commodity Index[iii] returned +2.7% led by Gold, +7.7% and Crude Oil, +4.3%.[iv] Year-to-date, The Bloomberg Commodity Index has increased 18.9%.

As we talked about in our 2021 Outlook, since the 2008-2009 Great Financial Crisis, many passive index investors have been conditioned to buy short-term market pullbacks and have been rewarded as markets have continued to move to all-time highs. In our view, stocks, especially in the United States, continue to be expensive from a valuation standpoint. The Buffet Indicator, the ratio of the total market capitalization of U.S. equities to Gross Domestic Product, was 199.3% at the end of May. As we have discussed previously, to put this in perspective, at the peak of the dot-com bubble in March 2000, this ratio reached 142.9%.[v]

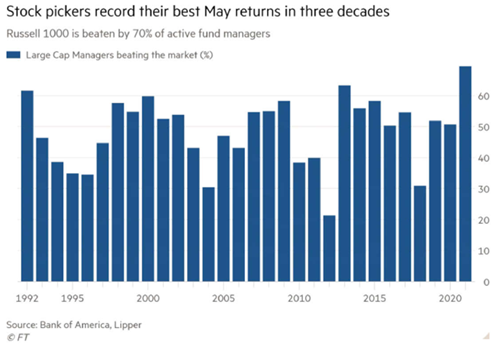

The month of May saw a return to active portfolio management. According to Bank of America U.S. Equity Strategist Ohsung Kwon, 70% of active managers beat the Russell 1000 Index in May, making it the best May in 30 years.[vi] We continue to believe that active management will benefit clients as we continue through uncharted economic and market territory, as we have discussed in our recent CIG Asset Management Reviews “Sir Isaac, Groucho, and the Gods” and “Do you have enough time? Why is this time different?“

Many large cap technology names such as Apple (-6.6% return) and Amazon (-7% return)[vii] were down for the month. The weighting of these two names, Apple 5.7% and Amazon 4.0%, dominate the S&P 500 index.[viii] Last month, Apple and Amazon were a large drag on performance of the S&P 500. Given lawsuits and other company-specific issues, we should not discount the possibility that further losses in these two companies could continue to negatively impact the S&P 500.

Generally, May featured several ups and downs in the U.S. stock market. In our opinion, broad market optimism was tempered by inflation concerns. In our minds, the recently released May Consumer Price Index[ix] confirms rising inflation. But as we recently explained in MarketWatch, lesser-heralded indicators like the Producer Price Index are flashing even more urgent warning signs that impending price increases may be still higher, and are more deeply embedded in the economy than the CPI would suggest. We may experience more volatile months like May, as market participants continue to debate whether inflation is transitory or not and how the Federal Reserve will react.

Given our views, we have continued to add to investments which may outperform if inflation is not transitory. We are in the process of rebalancing CIG managed client portfolios. We are decreasing our exposure to technology, adding an actively managed emerging market fund, adding an industrial holding that is focused on aerospace and defense, adding to our energy pipeline holding, reallocating a portion of our gold holdings into an actively managed mining fund and adding a volatility position that may benefit if market volatility perks up.

We continue to take a risk balanced approach to this historically expensive market in these uncertain times. We are not sitting still.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Morningstar: S&P 500 TR USD

[ii] https://www.msci.com/end-of-day-data-search

[iii] Bloomberg.com

[iv] Data from finance.yahoo.com

[v] Gurufocus.com

[vi] Financial Times, June 8, 2021

[vii] Calculated from data from finance.yahoo.com

[viii] https://www.slickcharts.com/sp500 as of 6/15/2021

[ix] https://www.bls.gov/news.release/pdf/cpi.pdf

Stock charts photo: Nicholas Cappello/Unsplash

Advisor photo: cottonbro/Pexels

CIG Asset Management Review: Sir Isaac, Groucho, and the Gods

Summary:

* S&P 500 Index posted its third consecutive month of gains

* Financial market history books might offer lessons

* Understanding human behavior may be the most important requirement right now

- Commentary:

-

April featured a macro environment that tilted positive. The market reacted favorably to i) the Federal Reserve continuing to increase its balance sheet (greater than $1.2t over the last year), ii) a rebound in U.S. durable-goods orders, and iii) a record 21.1% increase in U.S. household income in March[i].

We noted that the service PMI index of prices increased to 61% in April (manufacturing PMI also continues to suggest a greater inflation risk) and the COVID resurgence pushed the Eurozone into a double-dip recession[ii]. These potential risks seemed far from investor’s minds.

Accordingly, the S&P 500 Index[iii] posted its third consecutive month of gains, up 5.3% in April. International markets did quite well with the MSCI EAFE net up 2.7% and the MSCI Emerging Markets gaining 2.4% given U.S. dollar weakness[iv]. U.S. Treasury Bonds had a good month after a significant selloff in March while the Bloomberg Barclays High Yield Bond index[v] returned 1.1%. Higher inflation expectations were supported by an 8.3% increase in the Bloomberg Commodity Index[vi] and a 7.4% increase in crude oil[vii] during the month.

Recently, we have been reflecting on what the end game for financial markets might look like after reading noted economist Mohamed El-Erian’s May 3rd opinion piece in the Financial Times entitled “Fed framework holds central bank hostage[viii].” We have been digging out our financial market history books to examine previous bubbles and manias and inflationary episodes to see what lessons they might offer for our immediate future and beyond. Of course, we cannot divine the timing of any eventual market shift. We recall Sir Isaac Newton’s famous quote in 1720 after initially making money in the South Sea Bubble, re-entering the scam, and then losing multiples more of his profit: “I can calculate the motions of the heavenly bodies, but not the madness of people[ix].”

We have often mentioned in these updates how today reminds us of the Internet Bubble of 2000 and what we read from past bubbles echoes our experience then and what we are seeing today. What is a bubble? Nobel Laureate Franco Modigliani offered an insightful definition: “The expectation of growth produces growth, which confirms the expectation; people will buy it because it went up. But once you are convinced that it is not growing anymore, nobody wants to hold a stock because it is overvalued. Everybody wants to get out and it collapses, beyond the fundamentals[x].”

Last year’s unprecedented market recovery which we talked about in the March Blog, this year’s GameStop democratization of the markets and cryptocurrencies’ ascendence, all seem familiar. In Charles Mackay’s “Extraordinary Popular Delusions and the Madness of Crowds”, first published in 1841, he recounts, “Many individuals suddenly became rich. A golden bait hung temptingly out before the people, and, one after the other, they rushed to the tulip marts, like flies around a honey-pot. Everyone imagined that the passion for tulips would last forever, and that the wealthy from every part of the world would send to Holland, and pay whatever prices were asked for them. The riches of Europe would be concentrated on the shores of the Zuyder Zee, and poverty banished from the favoured clime of Holland. Nobles, citizens, farmers, mechanics, seamen, footmen, maidservants, even chimney sweeps and old clotheswomen, dabbled in tulips. People of all grades converted their property into cash and invested it in flowers.[xi]”

Like the recently announced second NBA-star-sponsored Shaq SPAC[xii], the 1920s stock market attracted the celebrities and “social media influencers” of that age including Groucho Marx, who borrowed over a quarter of a million dollars to play the stock market. He wrote in his memoirs, during that bull market there was no need to employ a financial advisor, “You could close your eyes, stick your finger any place on the big board and the stock you bought would start rising[xiii].” Marx along with Irving Berlin and Eddie Cantor of Ziegfield Follies fame speculated heavily and eventually lost fortunes[xiv]. (We will see how Elon Musk does with his cryptocurrency holdings.)

Understanding human behavior may be the most important requirement right now and we have also looked to classic literature to understand the narratives that we tell ourselves at this point in the market cycle. It is easy to take these narratives and what you are being told by CNBC into your heart and act against your best interest. We reflect on the narrative, known as Nihonjinron, that the Japanese told themselves during their bubble of the 1980s – that Japan is unique and better[xv]. But such hubris is often a precursor to bubbles.

Shakespeare’s observation about fortune seems truer that “she is turning and inconstant . . . the poet makes a most excellent description of it.[xvi] Exceptionalism is usually fleeting. To that end, we offer Rudyard Kipling’s poem, “The Gods of the Copybook Headings[xvii]” written post the 1918 pandemic and just prior to the 1920s bubble discussing the constancy of the human condition. The last two stanzas are chilling in reflecting on today’s market. We continue to pursue a risk balanced approach to the market – not fight the Federal Reserve or run for the hills; be in the game – it could last a long time; and maintain the appropriate emotional distance. We endeavor to not be the “bandaged finger [that] goes wabbling back to the Fire.”

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Macro data is from Evercore ISI’s Weekly Economic Summary 5/2/21.

[ii] Macro data is from Evercore ISI’s Weekly Economic Summary 5/2/21.

[iii] Morningstar: S&P 500 TR USD

[iv] https://www.msci.com/end-of-day-data-search

[v] Morningstar: BBgBarc High Yield Corporate TR USD

[vi] www.Bloomberg.com

[vii] www.finance.yahoo.com

[viii] https://www.ft.com/content/d4b53d27-59b8-4b16-b59b-ef2fe4c0289e

[ix] Kindleberger, Charles P., Manias, Panics, and Crashes – A History of

Financial Crises. Revised ed., Basic Books, 1989, page 38. An excellent

textbook which is required reading at most business schools.

[xi] Mackay, Charles, Extraordinary Popular Delusions and the Madness of Crowds.

Harriman Definitive ed., Harriman House LTD, 2018, page 79.

[xii] https://finance.yahoo.com/news/shaq-spac-2-0-coming-133637566.html

[xiii] Chandler, Edward. Devil Take the Hindmost – A History of Financial Speculation.

Plume Books, 2000, page 207. A more narrative focused account of speculation

from Rome to the Japanese bubble economy.

[xiv] Ibid. p. 203.

[xv] Ibid. p. 283.

[xvi] Shakespeare, William. Henry V. Library of Alexander, 1956, Act III, Sc. 6.

[xvii] First published in the Sunday Pictorial (London) October 26, 1919, and – as “The

Gods of the Copybook Margins” – in Harper’s Magazine in January 1920. It

has also been called “Maxims of the Market Place”. ‘Copybook

headings’ were proverbs or maxims printed at the top of 19th century British

schoolboys’ copybook pages. http://www.kiplingsociety.co.uk/poems_copybook.htm

CIG Asset Management Review: Do you have enough time? Why is this time different?

Summary:

* Re-openings and even MOAR stimulus

* We may have to wait a long time

* A not so typical market recovery

- Commentary:

- In March 2021, equity markets continued to rally as Texas eased all business restrictions and lifted its mask mandate and the $1.9 trillion COVID-19 relief bill was passed by Congress and signed by President Biden, sending $1,400 payments directly to many Americans. Almost immediately after the bill signing, the Biden administration turned its attention to a $2 trillion infrastructure bill. Federal Reserve Chairman Powell reassured investors after the March FOMC meeting that the Fed is not planning on raising interest rates until 2022-2023 at the earliest. March went out with a bang, with the collapse of over leveraged hedge fund Archegos Capital which lost $20 billion in two days.[i]

- For the month, the S&P 500 Index was up +4.4%[ii] while the international stocks in developed economies, as measured by the MSCI EAFE Index Net, gained +1.8%[iii]. Emerging Market stocks (MSCI EM) were down -1.7%[iv]. Value stocks, measured by the Russell 1000 Value Index, added +5.9% and the Russell 1000 Growth Index, a measure of growth stocks, was up +1.7%[v]. Small-cap stocks, represented by the Russell 2000 Index were up +1.0%[vi]. Crude oil fell -3.8% for the month and Gold fell -0.8% [vii].

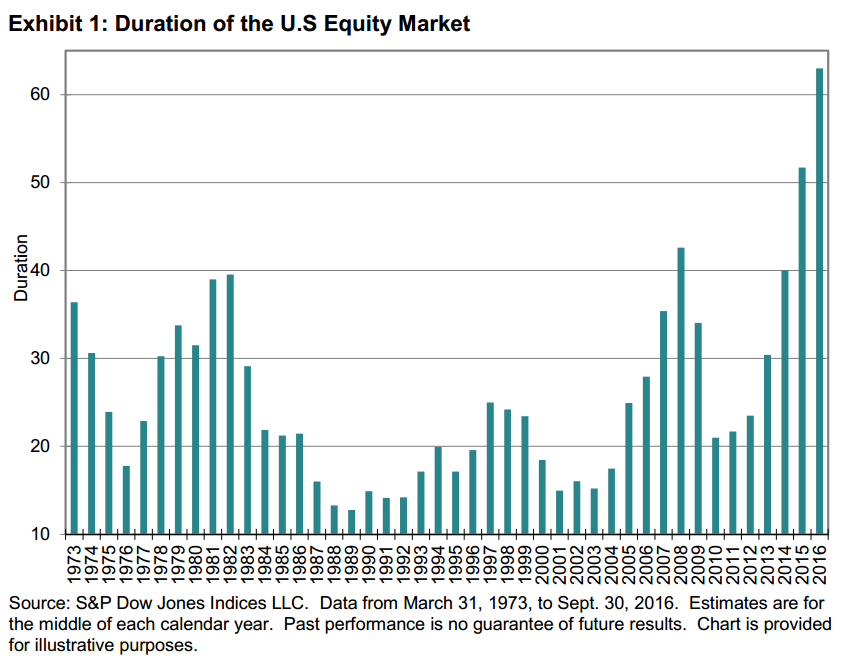

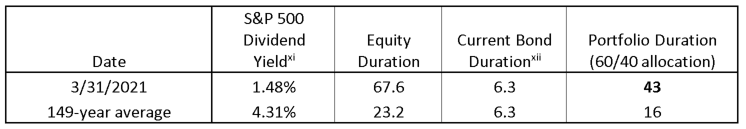

- Recently, we found a 2017 study by S&P Global[viii] that is informative for the current environment. As you may know, every investment is a claim on future cash flows that can be anticipated to be delivered to the investor over time. While the concept of “duration” is most used for bonds, it’s actually applicable to any investment and can be defined in two ways: i) the weighted average number of years it takes for the investment to deliver its payments[ix] and ii) the percentage change in the investment’s value in response to a change in the underlying gross rate of return. The second definition allows us, with some math, to convert a stock’s dividend yield to duration.

- As shown in the chart below by S&P Global, the duration for equities (i.e., the S&P 500 Index) over the past 149 years ending September 2016 has ranged from 13 to 63 years.

We have calculated the average duration for equities (i.e., the S&P 500 Index) over the past 149 years ending September 2016 to be approximately 23.2 years[x]. In a balanced portfolio like what we frequently structure at CIG, the historical average duration of a 60% equity/40% bond allocation is 16 years during that 149-year timeframe. Meaning if the markets decline significantly and do not recover, investors could reasonably expect that if they could stay invested (i.e., not sell at depressed prices), over time they may recover their investment via dividends or other cashflows.

Source: CIG Asset Management using data from S&P Global, www.multpl.com and www.ishares.com

Currently as shown in the table above, we calculate the equity duration at 67 years. The average duration for a balanced 60/40 portfolio is now 43 years, over 2.5 times the historical average!

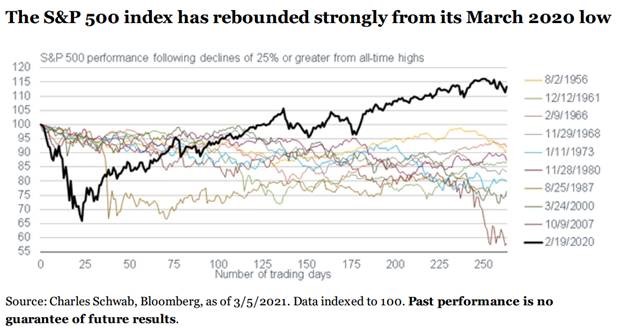

Meanwhile, the risk of a significant pullback continues to increase given that the current market recovery is unlike any in recent history. In the prior nine greater-than-25% declines in the S&P 500 Index over the past 64 years as shown in the chart below, none of those occurrences saw markets fully recover to their previous high in the one year following, let alone hit new highs.

This time is different because the Federal Reserve has printed enormous amounts of money and the US Government has plans to spend it. We have argued and still believe i) this “Fed backstop” is largely psychological and quite fragile and ii) the underlying economy remains in bad shape with for example, 18 million people receiving some kind of unemployment assistance. We suspect that any sustained downturn will occur just when the entire economy, including client businesses and medical practices are starting to suffer – a double whammy to everyone’s psyches.

At CIG, we define risk as “how bad could it be” and “how likely is this bad outcome.” Given high stock and bond valuations, investors could have to wait multiple decades for their portfolios to recover versus much shorter time periods like in 1989 or 2001. While it is quite possible that we are in an asset bubble right now, it is hard to know for sure when you are in it and, more importantly, when it will end. As you may recall from previous blogs, we have warned that risks are building in the market and this bad outcome is becoming more likely. So, we are staying the course of risk balanced investing – attempting to strike the right aggressiveness versus defensiveness in client portfolios in uncertain times.

Do you have enough time?

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] www.bloomberg.com

[ii] Morningstar

[iii] https://www.msci.com/end-of-day-data-search

[iv] https://www.msci.com/end-of-day-data-search

[v] https://www.ftserussell.com

[vi] https://www.ftserussell.com

[vii] https://finance.yahoo.com/

[viii] “Applying Equity Duration to Pension Fund Asset Allocation: A Review of S&P 500® Duration” https://www.spglobal.com/spdji/en/documents/research/research-applying-equity-duration-to-pension-fund-asset-allocation.pdf

[ix] Intuitively, if one buys the S&P 500 Index for a price of 22 times its annual earnings. Assuming the S&P 500 Index companies pay the investor all their earnings, absent a sale, it will take the investor 22 years to get paid back.

[x] Source: CIG Asset Management using data from S&P Global, www.multpl.com and www.ishares.com

CIG Asset Management Update February 2021: History Rhymes

Summary:

- Value stocks outperformed growth

- Speculative trading in WallStreetBets stocks

- February Non-farm Payrolls +379,000

Commentary:

In February 2021, the S&P 500 Index was up +2.8%[i] while the international stocks in developed economies, as measured by the MSCI EAFE Index Net, gained +2.1%[ii]. Emerging Market stocks (MSCI EM) returned +0.7%[iii]. Value stocks, measured by the Russell 1000 Value Index gained +6.0% and the Russell 1000 Growth Index a measure of growth stocks, was flat at 0.0%[iv]. Small-cap stocks, represented by the Russell 2000 Index were up +6.2%[v]. Crude oil surged +17.8% for the month and Gold fell -6.5% [vi].

February continued to see speculative trading in small capitalization and highly shorted stocks. On January 31, Elon Musk tweeted, “On Clubhouse tonight at 10pm LA time”. The next day, Clubhouse Media Group (CMGR) gained over 100%. CMGR is actually a healthcare company based in Guangxi, China, not the privately-owned social media app that Musk was refering to.[vii] Highly shorted stocks, such as GameStop, continued to be targeted by hoards of retail investors following the Reddit forum, WallStreetBets. These traders bought stock and options in stocks that had a very large amount of shares short[viii] to try to drive the prices higher. This is known as a short squeeze. A common phrase used on discussion forums such as Reddit is “to the moon”, followed by a rocket emoji. This type of activity was seen as manipulatative to some and market volatility grew as several large hedge funds were on the losing side of many of these trades.[ix] This unusual market activity caught the attention of Congress and on February 18, The House Financial Services Committee held a hearing, “Game Stopped? Who Wins and Loses When Short Sellers and Retail Investors Collide,” During the hearing, WallStreetBets trader Keith Gill, – aka “Roaring Kitty”, who owns a large position in GameStop, proclaimed, “I am not a cat” in his self introduction. Some of the focus of the hearing was on the Wallstreetbets Reddit message board, a widely followed forum where many retail investors have recently sought out investment advice and acted upon that advice by trading on online trading platforms like Robinhood. Reddit CEO Steve Huffman said at the hearing, “On Reddit, I think the investment advice is actually probably among the best because it has to be accepted by many of thousands of people before getting that vote of visability.”[x]

The Clubhouse and WallStreetBets trading above bring to mind the famous Mark Twain quote, “History doesn’t repeat itself, but it often rhymes.” Wall Street Journal writer Jason Zweig recently shared a copy of what he wrote in the October 19, 1999 Outstanding Investor Digest. “it’s not just the Vanguard Index Fund that’s making everybody in this room, including the gentlemen to my left, look kind of stupid. It’s the taxi dispatcher or the shoe salesman who reads that FHX is going to go up like a rocket in some chat room, then buys it at E-trade and sells it 43 minutes later. Never mind the fact that the guy doesn’t know what FHX stands for, what it makes, or for that matter, one single, solitary thing about FHX. Never mind the fact that he actually meant to buy FDX. He’s a genius and you’re not.”[xi] The NASDAQ lost -78% from its March 2000 peak to its October 2002 trough.[xii] While we are not forcasting a drawdown in the stock market to that extreme today, we feel there is reason to be cautious due to current investor speculation and market valuations.

As we have stated in previous letters, it is our belief thateither the economy picks up and unemployment moderates or stocks decline. February nonfarm payrolls increased by +379,000[xiii]. 355,000 of those jobs[xiv] were in the hospitality sector as the pace of vaccinations increased and States began to open up. The growing number of cases in the U.S. of the Brazilian, UK and South African COVID-19 variants are worrisome but we are hopeful that as the rate of vaccinations accelerate we will be able to head off the growth of these more contagious strains and see a gradual reopening of the economy. The rate of COVID-19 vaccinations in the United States has now reached 2.2 million shots per day.[xv].

We continue to endeavor to reach a balance between offense and defense positions to take just enough risk to generate attractive returns to meet client financial goals in what are still uncertain times.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Morningstar

[ii] https://www.msci.com/end-of-day-data-search

[iii] https://www.msci.com/end-of-day-data-search

[iv] https://www.ftserussell.com

[v] https://www.ftserussell.com

[vi] https://finance.yahoo.com/

[vii] FT.com “Clubhouse’s stock is surging. It’s the wrong Clubhouse.”

[viii] Short stock positions will profit when a stock’s price declines the price where the short was initiated.

[ix] Wall Street Journal 02/17/2021 “Melvin Capital Says It Was Short GameStop Since 2014.”

[x] https://financialservices.house.gov/calendar/eventsingle.aspx?EventID=407107

[xi] Twitter: @jasonzweigwsj 03/06/2021

[xii] Data from https://finance.yahoo.com/

[xiii] U.S. Department of Labor, unemployment release 3/5/2021.

[xiv] U.S. Department of Labor, unemployment release 3/5/2021.

[xv] Reuters 03/08/2021

CIG Asset Management Review: Outlook 2021

Summary:

- From 2009 to 2018, the structural bull market conditioned many investors to believe that despite short-term pullbacks, the market will always head higher over the intermediate and long term thereby rewarding dip buying and passive investing.

- From 2009 to 2018, the structural bull market conditioned many investors to believe that despite short-term pullbacks, the market will always head higher over the intermediate and long term thereby rewarding dip buying and passive investing.

- Now, the markets are historically expensive, fragile, and disconnected from the real economy. A 60/40 Static Allocation portfolio4 has a 12-year projected return of -2.2%, the lowest in U.S. history[i]. CIG’s aim is to exceed client’s goals, which are higher, in a thoughtful way.

We held off providing our 2021 Outlook until now because of several known unknowns (e.g., the election) and some unknown unknowns (e.g., GameStop)[1]. With some resolution of these unknowns, we offer a historical perspective, an outlook, and a viewpoint on success.

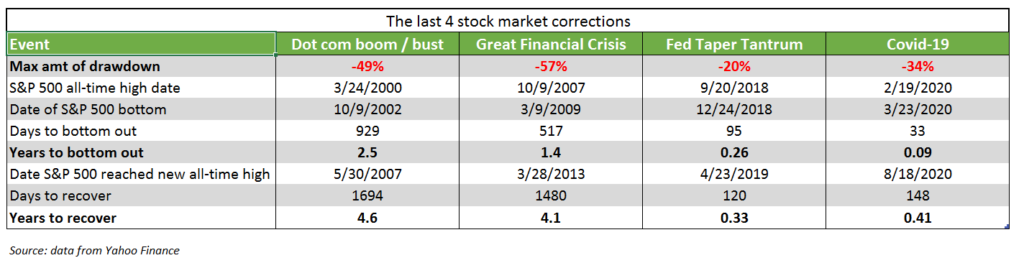

A Historical Return Perspective:

We first need to look at the last four major corrections in the US stock market, as measured by the S&P 500 Index. The last two major corrections, the Fed Taper Tantrum and most recently the Covid-19 sell-off, have seen markets bounce back very quickly as governments added trillions of dollars in liquidity by adding trillions of dollars of debt and running an enormous trillion dollar budget deficit. Yes, over time stock markets go higher, but we will inevitably see corrections in future years. Will the next major market sell-off look similar to the most recent two, where markets rebound quickly, or will the experience be more like the Dot com and Great Financial Crisis sell-offs where it took years to recover losses? An investor who retired in March of 2000 or October 2007 likely suffered their share of sleepless nights as the stock market ground lower and took years to recover.[2]

Prior to October 2018, the market was supported by the Fed’s quantitative easing (i.e., money printing) and zero interest rate polices, companies buying back their shares, and some economic growth.

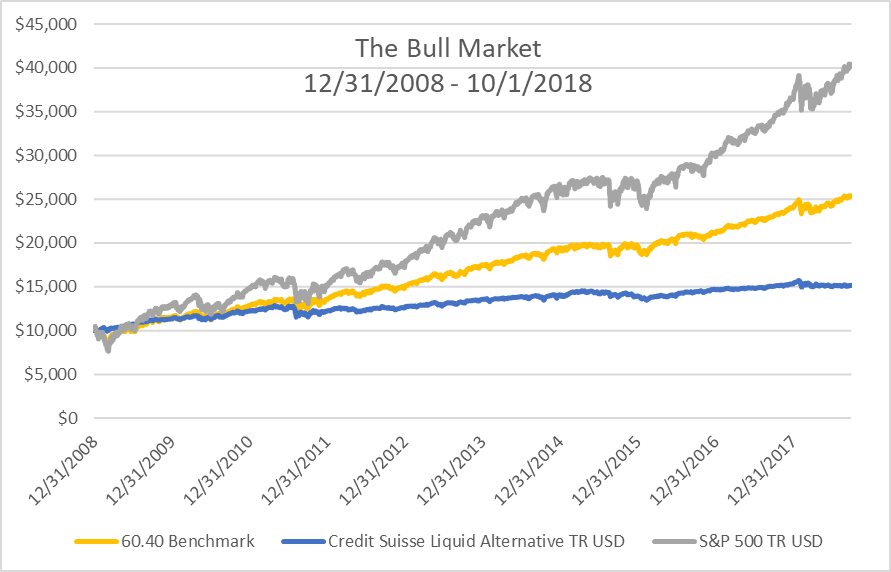

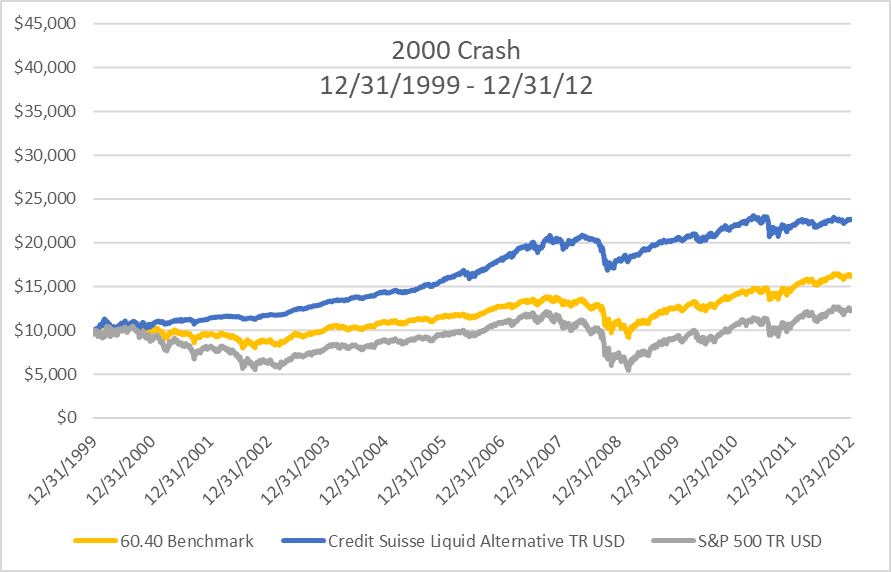

From 2009 to 2018, a 60/40 Static Allocation (60% S&P 500 Total Return Index / 40% Bloomberg Barclay Aggregate Bond Index) returned approximately 10.0%[3] on an annualized basis while an index approximating active management[4] returned about 4.4%[5]on an annualized basis. Please see the chart below showing the daily performance of a hypothetical $10,000 investment in the 60/40 Static Allocation, the Active Management Index, and the S&P 500 Index.

Source: Morningstar

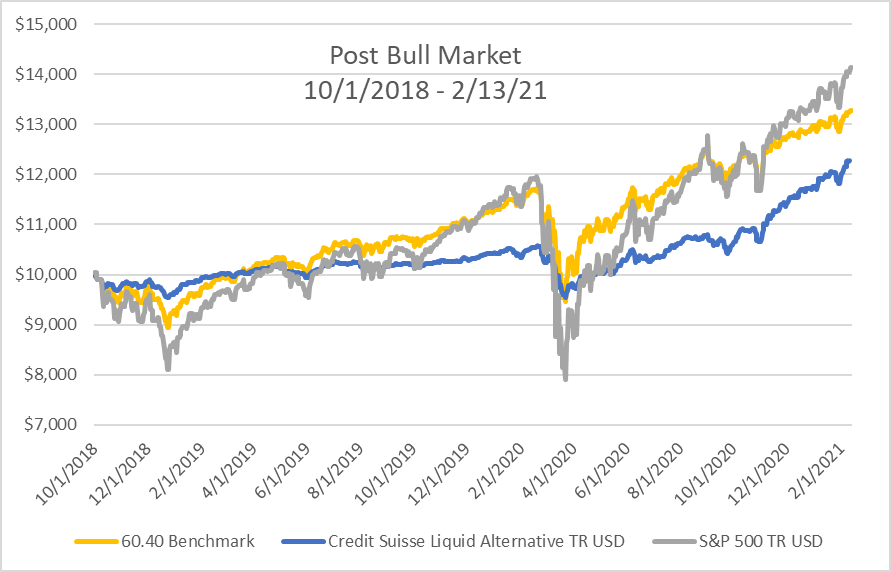

That structural bull market ended in October 2018 when the Fed tried to raise interest rates and corporate share buybacks no longer worked. This event is known as the “Taper Tantrum”. Since

October 2018, it has been a much bumpier ride. Still, the 60/40 Static Allocation has returned 12.7%4 on an annualized basis while the gap has closed between it and the “Active Management” index’s5 annualized return of 9.0%6. Please see the chart below tracking this performance over this period.

Source: Morningstar

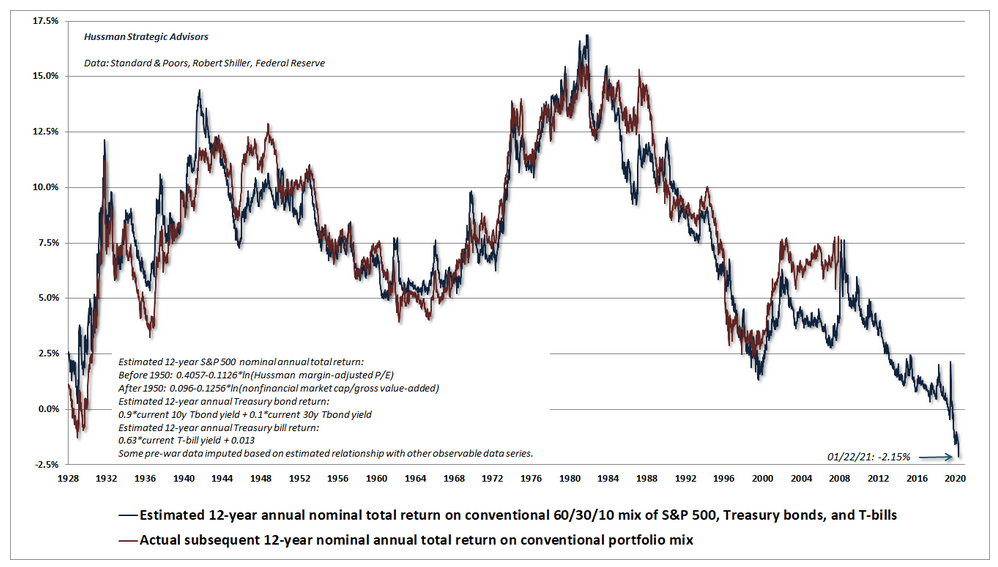

While we have come through this period, one estimate of average annual nominal total returns by John Hussman, a prominent market strategist, for a 60/40 static allocation has a 12-year projected return of -2.2%, the lowest in U.S. history, including the extreme low associated with the 1929

market peak1. Even if the markets remain at peak valuations and pre-pandemic margins are sustained into the future, the upside range of that forecast is about 3%1.

Source: Hussman Strategic Advisors

The Outlook:

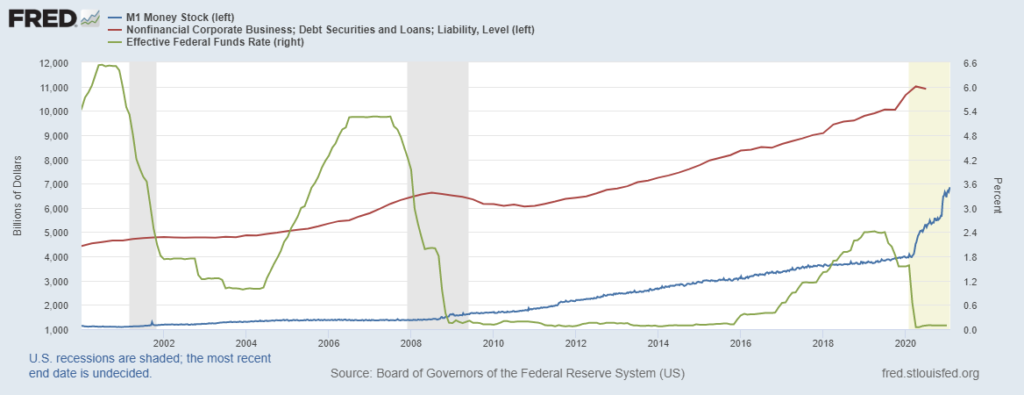

The smooth returns from 2008 to 2018 were aided by governments, businesses, and households taking on more and more debt. Companies started issuing more bonds in the late 1990’s, households took on too much debt in 2003-2008 to buy houses (remember the foreclosure crisis), and finally the US government post the 2008 crisis (all shown in the red line in the chart below) – all to maintain economic growth. When you have a large amount of debt, one cannot afford high interest rates and the Fed kept rates very low (green line below). The Fed also increased the money supply (blue line

below). Investors were conditioned to buy the dip (BTD) and that there were no alternatives (TINA) to stocks. Both instilled a fear of missing out (FOMO).

Source: Federal Reserve of St. Louis[6]

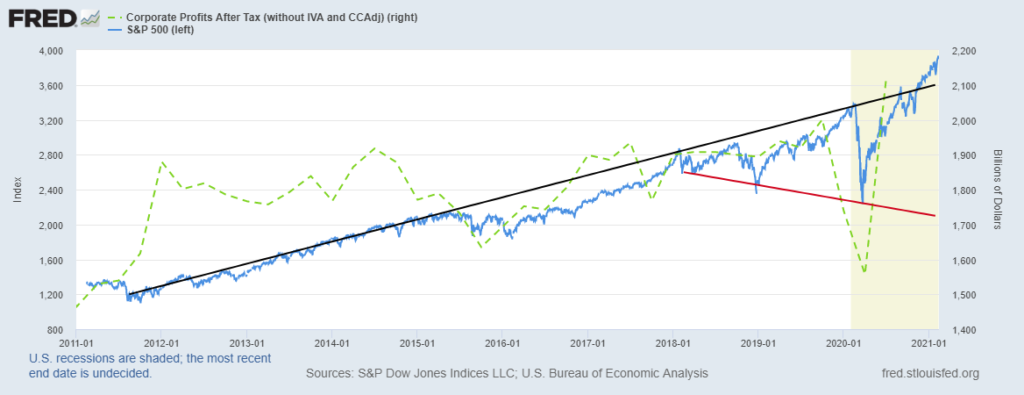

The S&P 500 broke its 2009 uptrend in December 2018. The Fed reacted by cutting interest rates and they started buying securities in the market. This led to not only to a massive rally in 2019, but easy money also produced the one of the greatest investment traps of all time which all came to a dramatic end in March 2020 when COVID hit the world economy and the S&P 500 Index declined by 34%. The structural problems that started long ago still have not been addressed, including the lack of corporate profit growth (the green line on this graph). Now we are left with potentially ever widening extremes in the market as shown below.

Source: Federal Reserve of St. Louis[7]

The stock market is back at all-time highs and is expensive on a valuation basis. In past similar

circumstances, a 60/40 Static Allocation likely did not meet your investment goals. From 12/31/1999 to 12/31/2012, the Static Allocation returned just 3.8%4 on an annualized basis versus 6.5%6 for “Active Management.5” In 1999, the market was similarly expensive and driven by a handful of

technology companies. A recent Gavekal Research report9 showed that if you had bought the 10 large-cap technology darlings back in January 2000 – after reinvesting all the dividends, you would have been left two decades later with one winner Microsoft – and a 1.4% compounded return[8].

Over the shorter period to 2012, an investor would have needed to diversify into other sectors and bonds to produce the low single digits return above.

Source: Morningstar

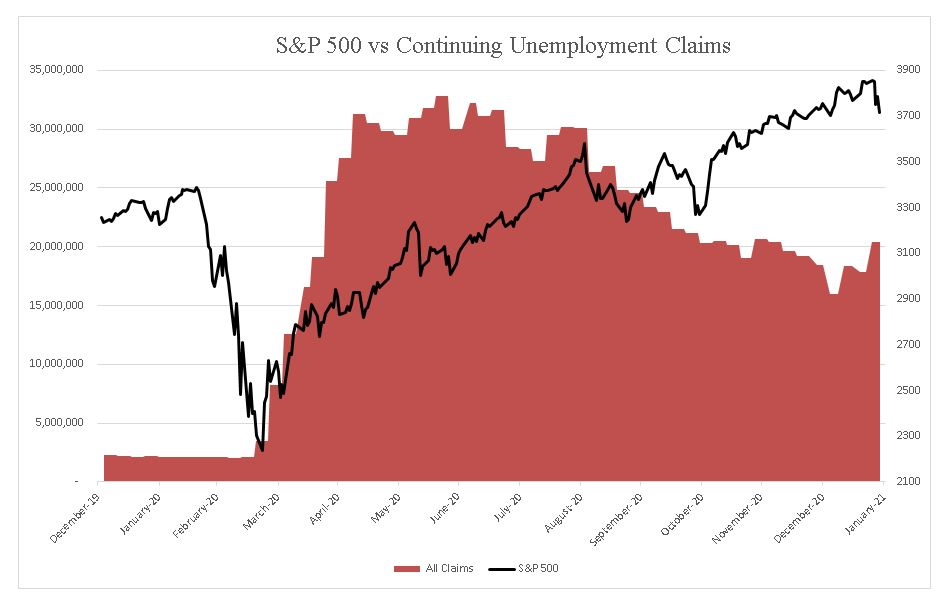

Central Banks and National governments seemed to have thrown everything that they could at the crash starting at the end of March 2020. It has made people chase distorted asset prices since April 2020, given a fear of missing out. Markets now appear completely disconnected from the economy – just look around. One in 8 Americans, more than 27 million adults, reported they sometimes or often didn’t have enough food to eat in the past week, according to Census Bureau survey data collected in late November and early December[9].

Unemployment skyrocketed in 2Q 2020 and continuing unemployment claims have remained high (see the red area in the chart below while the S&P 500 continues to rise).

Source: CIG using data from Yahoo Finance and the U.S. Department of Labor[10]

In our view, either the economy picks up and unemployment moderates or stocks decline. Economic pick-up suggests inflation while stock declines may indicate a deflationary event like more COVID. Active Management seeks to avoid risk to your financial plan while a static allocation to stocks could mean some sleepless nights. How do we do that: a proprietary volatility signal to proactively add or subtract risk; extensive market technical analysis on indices and individual securities; a consultant who uses Natural Language Processing (NPL) on media sources to understand investor Zeitgeist; and value-added positions featuring disparities in value by asset class, sector and geography. Our Investment Committee meets bi-weekly to discuss these inputs, model potential outcomes, and agree on future actions.

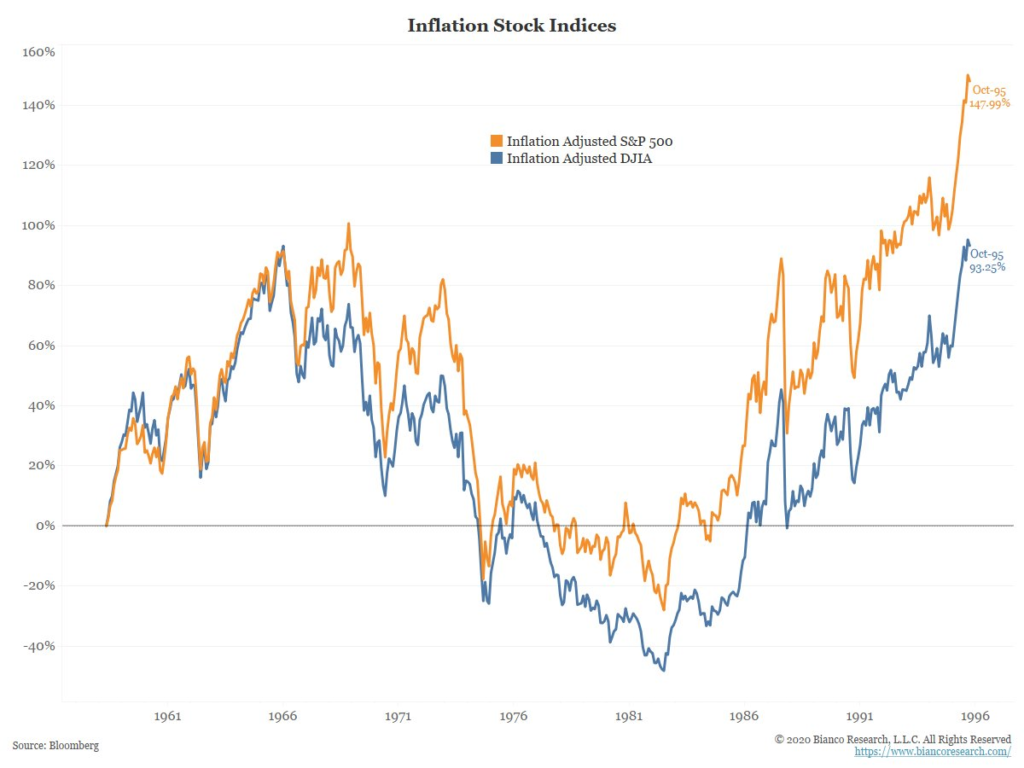

From our Investment Committee discussion, here are the extremes that are possible given the excesses of the current market. Below is the inflation-adjusted S&P 500 Index (SPX, orange line) and Dow Jones Industrial Average (DJIA, blue) from 1958 to 1995. From the 1968 peak to the 1982 low, the SPX lost 65% of its inflation-adjusted value. It was not until 1993 that the inflation-adjusted SPX exceeded its 1968 peak! 1995 for the DJIA!

Source: Bianco Research LLC

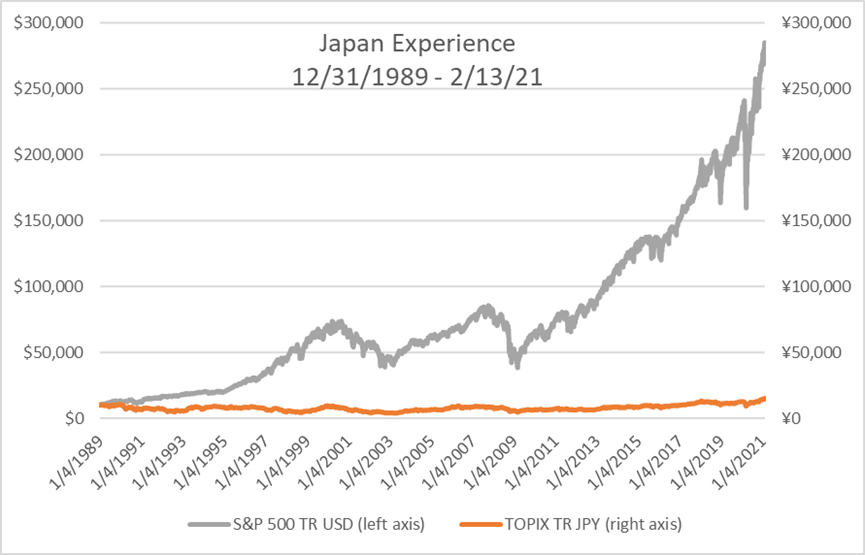

Below is the return of the Japanese stock market which experienced a long-term deflationary environment. Despite the stock market benefiting from the Bank of Japan’s huge stimulus drive, in which it has bought exchange traded funds (ETFs) and its monetary easing to drive down the yen, helping exporters, the annualized return is 1.30%[11] from 12/31/89 to 2/13/21. After 30 years, this market is only now reaching new highs.

We are always striving for a balanced view. From these discussions, striking the right aggressiveness

versus defensiveness incorporates the possibility that corporate profits could boom in 2021 based on some significant lifts to economic activity:

- Massive global monetary stimulus.

- Vaccine inspired economic recovery.

- The housing boom and higher consumer net

worth. - A declining US Dollar to support

multi-national companies.

Of course, risks to the outlook include:

- Inflation accelerates, bond yields surge, and the Fed hints at tapering sooner than expected.

- COVID gets out of control, vaccinations hit some bumps in the road, and the global economy is impacted, even China.

Success

Due to the above, now more important than ever is to have a professional fiduciary looking out with you for your monetary interest. It is so easy at this stage, to miss the disconnect between the real-world economy and the stock market and be tempted to chase stock valuations that as a whole,

are trading near all-time highs based on many historical measures. One could follow narratives like, “stocks only go up over the long term” while listening to CNBC and ever bullish Wall Street strategists and act against your best interest. The recent GameStop affair is the best example. If you are investing

based on this information, likely your maximum regret would be not participating in the last leg up in these markets.

In contrast, we’ve talked a lot about risk balancing. In practical terms, we do not want to fight the Federal Reserve, run for the hills, or make judgments on how others make money. Rather it is important to be in the market and have the proper intellectual and emotional distance to achieve client goals while avoiding scenarios and regimes that can damage your long-term success. We believe your true maximum regret would be not being able to retire, donate or spend when you choose.

In 2021, minimizing this maximum regret is of greatest importance to us at CIG. In our view, either the economy picks up or stocks decline. Economic pick-up suggests inflation while stock declines portend a deflationary event like more COVID. Our preference is for better economic growth without excess inflation. Continuing our theme for 2020 – “The Ride”[12], we will keep on actively managing the portfolios and applying the risk balancing framework to help clients achieve their goals and sleep well at night.

[1] https://www.hussmanfunds.com/comment/mc210201/

[2] https://en.wikipedia.org/wiki/There_are_known_knowns

[3] https://finance.yahoo.com/quote/%5EGSPC?p=%5EGSPC

[4] Source: Morningstar as calculated by CIG

[5] https://lab.credit-suisse.com/#/en/index/CSLAB/CSLAB/overview

[6] Source: Morningstar

[7] https://fred.stlouisfed.org/graph/?g=B6jj

[8] https://fred.stlouisfed.org/graph/?g=B6mv

[9] Gavekal Research/ Macrobond

[10] https://www.washingtonpost.com/business/2020/12/31/stock-market-record-2020/

[11] https://www.dol.gov/sites/dolgov/files/OPA/newsreleases/ui-claims/20210261.pdf

[12] Source: Morningstar

[13] https://cigcapitaladvisors.com/june-2020-asset-management-update-the-ride/

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

CIG Asset Management Update December 2020: Farewell 2020

Summary:

- Global stocks built on November’s gains notwithstanding lackluster economic news

- Two large IPOs reflect the extent of FOMO (Fear of Missing Out)

- Positives: The coronavirus vaccine rollout, U.S. stimulus bill finally passed and Great Britain reached Brexit deal

Commentary:

In December 2020, the S&P 500 Index was up +3.7%[i] while the international stocks, as measured by the MSCI EAFE Index Net, gained +4.6%. Emerging Market stocks (MSCI EM) returned +7.2%[ii]. Certain areas of the market continued November’s large gains. Small-cap stocks, represented by the Russell 2000 Index were up +8.7%[iii]. Crude oil added +7.0% to the prior month’s +26.7% gain and Gold was up +6.6%[iv].

As equity valuations continued to trade near all-time highs, U.S. economic data continues to be lackluster. The BLS November Employment Situation Summary showed a gain of only +245,000 jobs versus analysts estimated +440,000[v]. Retail sales for the month of November were down -1.1%[vi].

“Fear Of Missing Out (FOMO)” was exemplified this past month in two red hot IPOs. DoorDash gained +86% and AirBNB’s shares soared +113% on their first day of trading. There was such frenetic buying of Airbnb shares that investors mistakenly clamored to buy call options on ABB, a large European industrial company.[vii] This type of speculative activity continues in the equity markets as the Federal Reserve continues to create more liquidity. Federal Reserve Chairman Jerome Powell said, “Our guidance is outcome-based and is tied to progress toward reaching our employment and inflation goals. Thus, if progress toward our goals were to slow, the guidance would convey our intention to increase policy accommodation through a lower expected path of the federal funds rate, and a higher expected path of the balance sheet.”[viii] Investors seem to believe that the Federal Reserve will come to the rescue and provide even more liquidity if the economy slows.

Several positive events transpired regarding Covid-19. Mid-month, the Pfizer vaccine was rolled out in the United States and United Kingdom. President Trump signed a $900 billion stimulus bill to aid struggling Americans[ix]. Also on a positive note, Great Britain reached a Brexit deal with the European Union on Christmas Eve[x]. Negative events in December included Facebook being sued by the Federal Trade Commision and 48 states[xi] and Apple announcing that it was closing all of its California stores due to the rampant spread of the virus. On January 4, Prime Minister Boris Johnson announced a countrywide lockdown in the UK effective through mid-February as a mutated strain of Covid-19 hit the country hard[xii]. It remains to be seen how hard this latest shutdown action will effect the European economy.

As we start the new year, we remain focused on the big picture. The U.S. stock market continues to be overvalued and equal to over 187% of the country’s GDP[xiii]. Beyond valuation, we keep on being concerned that the markets appear to be divorced from socioeconomic reality. On Wednesday, January 6, the Dow Jones Industrial Average finished at a record high and the Russell 2000 Index was up almost 4% despite the U.S. Capital being breached and the national guard being called out.

Consequently, we continue to apply diversification and vigulent risk management in client portfolios. We endeavor to reach a balance between offense and defense positions to take just enough risk to generate attractive returns to meet client financial goals in these very uncertain times. On Christmas Eve, we added an equity holding to growth and balanced portfolios that may benefit from people working and shopping from home.

We bid the year 2020 adieu and are hopeful as we enter 2021 that vaccines prove to be effective combating the pandemic and the global economy continues to recover. We look forward to taking advantage of positive developments as 2021 progresses.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] https://finance.yahoo.com/

[ii] https://www.msci.com/end-of-day-data-search

[iii] https://www.ftserussell.com

[iv] https://finance.yahoo.com/

[v] https://www.bls.gov/news.release/empsit.nr0.htm

[vi] https://www.census.gov/retail/marts/www/marts_current.pdf

[vii] Barron’s “From Airbnb to Tesla, It’s Starting to Feel Like 1999 All Over Again. It May End the Same Way.” 12/11/2020

[viii] https://www.cnbc.com/2020/12/16/fed-meeting-live-updates-watch-jerome-powell-speech.html

[ix] https://www.washingtonpost.com/us-policy/2020/12/27/trump-stimulus-shutdown-congress/

[x] https://fortune.com/2020/12/24/after-years-of-negotiations-the-u-k-has-finally-reached-a-christmas-eve-trade-deal-with-the-eu/

[xi] https://www.ftc.gov/news-events/press-releases/2020/12/ftc-sues-facebook-illegal-monopolization

[xii] https://www.cnn.com/2021/01/04/uk/uk-lockdown-covid-19-boris-johnson-intl/index.html

CIG in the News: MarketWatch, “Three ways to maximize your wealth”

With rising taxes and inflation likely on the horizon, what are you doing to adjust your wealth management plan? CIG Capital Advisors’ managing principal Osman Minkara outlines a three-bucket strategy to help you prepare in MarketWatch.

CIG Asset Management Update November 2020: Change and Balance

Summary:

- November was an extraordinary month for stocks globally.

- 0% interest rates and a 64% increase in the money supply create months of speculation, like November.

- Our most important job is to balance the amount of offensive and defensive investments in portfolios given an uncertain near-term future.

Commentary:

Positive vacine news from Pfizer, Moderna and AstraZeneca helped make November an extraordinary month for stocks globally, despite the pandemic still raging in many areas.

Last month, the S&P 500 Index was up +10.8%[i] while the international stocks, as measured by the MSCI EAFE Index Net, gained +15.5%[ii]. Emerging Market stocks (MSCI EM) returned +9.3%[iii]. The standout country returns were two long-term laggards – Spain and Brazil (as calculated by MSCI) – which both increased in the neighborhood of +30%[iv]. Some of the most beaten-down areas of the U.S. market soared in November, including small companies, energy, financials and industrials[v]. CIG’s client accounts tied to growth and balanced approaches generally had one of their best months in the last five years.

Where do we go from here? Near-term performance can be notoriously difficult to predict. As we mentioned in our October update, underneath the surface of a post-election rising market tide, our measures of the underlying health of the markets continue to worsen. For example, on a small scale, recently Zoom Media (ZM) was down more than -15% one day – despite being an essential tool for many and beating investor expectations seemingly on almost every conceivable metric[vi]. When good news doesn’t translate into good stock returns but rather a sharp decline, we perk up our ears.

We, however, remain focused on the big picture. Global stock markets are now worth over $100 trillion, rising to a record high[vii] and equal to 115% of global Gross Domestic Product (GDP), i.e., the sum of all the goods and services produced[viii]. In the U.S., the stock market is unprecidentally expensive and equal to over 180% of the country’s GDP[ix]. While there is great variability about the future, it is likely a mistake to not be careful and thoughtful when buying stocks this expensive.

In markets like November, where the “Fear Of Missing Out (FOMO)” is seemingly driving participants, indepth study of stocks and economies are displaced by emotional biases which are supported by 0% interest rates and a 64% increase in the money supply[x] by the Central Banks. Such speculative behavior is the nature of market cycles and one of the primary elements necessary to create the proper setting for an eventual reversion or change. Last month, we discussed how it appeared that investors in October started to choose between decelerating and expensive large companies versus opportunities in growing and cheaper small companies. Small cap stocks, as measured by the Russell 2000 Index, had their best month ever in November 2020 and gained 18.3%[xi]. Overall, small company stocks are up dramatically off the March 2020 lows[xii] when we added to investments there. While still unconfirmed, evidence of change appears to be beginning.

Our most important question today is how the balance should be set today between aggressiveness and defensiveness in clients portfolios to take just enough risk to generate attractive returns to meet their financial goals in these very uncertain times. Then, how do we apply an active tactical approach and find undervalued investments that are poised to enter a period of market outperformance like the cheaper small companies mentioned above and where client portfolios already have some investments. All year, we have had a plan for more offensive investments if the economy does get better as well as a plan for the opposite outcome. In December, we added to an investment which we expect would increase in value if people stay and shop at home more. As always, we will continue to apply diversification and balance between the appropriate risk and returns.

Please be well and stay safe. We are encouraged by the latest vaccine results but expect a dark, uncertain winter. We suggest continuing to monitor the Johns Hopkins University’s Daily COVID-19 Data in Motion video.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] https://finance.yahoo.com/

[ii] https://www.msci.com/end-of-day-data-search

[iii] https://www.msci.com/end-of-day-data-search

[iv] https://www.msci.com/end-of-day-data-search. MSCI Spain Index Net and Brazil ADR Index Net.

[vi] https://finance.yahoo.com/quote/ZM/history?p=ZM

[vii] https://www.reuters.com/article/us-global-markets/world-shares-hold-close-to-record-highs-u-s-markets-close-for-thanksgiving-idUSKBN28601F

[viii] Bloomberg. WCAUWRLD Index as of 12/5/2020.

[ix] https://www.gurufocus.com/stock-market-valuations.php

[x] https://fred.stlouisfed.org/series/M1

[xi] https://finance.yahoo.com/

[xii] https://finance.yahoo.com/quote/%5ERUT/history?p=%5ERUT

CIG in the News: Marketwatch, “How to cut tax bills with smart charitable giving strategies”

As we enter the holiday season, plans for charitable giving are moving to the forefront. This year, the pandemic has reduced giving opportunities while simultaneously increasing need, causing donors to carefully review philanthropic options that include tax advantages. CIG Capital Advisors’ Senior Wealth Managers Eldin Foco and Martin Swiecki outline two strategies to consider in MarketWatch:

How to cut tax bills with smart charitable giving strategies

As we enter the holiday season, many naturally turn their thoughts to charitable giving. This year —clearly a highly unusual one in so many ways — there is even more need to carefully review philanthropic options that also have tax advantages. Click here to read more.

Measure Your Medical Practice’s Performance

Is your medical practice moving forward, standing still, or losing ground? You’ll know the answer if you compare different aspects of your practice’s operations to appropriate benchmarks (as you can do here using the CIG Capital Advisors Medical Practice Dashboard). Benchmarking can give you the data you need to make informed management decisions about the direction of your practice.

What To Measure

There are two types of benchmarking: Performance and process. Performance benchmarking compares a practice’s operating performance internally over time and externally against other practices of a similar size in the same specialty. Process benchmarking compares a practice’s work protocols. By tracking key benchmarks from quarter-to-quarter or year-to-year, you can identify the areas in which progress is being made.

Start by choosing a few indicators that are important to you. For each indicator, determine your objective and define what you’ll measure and how you’ll do it. Keep tracking the data regularly so that you can make meaningful comparisons over time. Here are some of the indicators your practice may want to use in its analysis.

Profitability/Cost Management

Look at measures such as net income (or loss) per full-time equivalent physician and operating cost per physician. Other useful areas to analyze would include operating costs as a percentage of total medical revenue and total support staff cost per physician.

Billings and Collections

What percentage of submitted claims is rejected by third-party payers? Is that percentage higher or lower than it has been in the past? If you determine that the number is increasing, you’ll need to review the quality of your coding. If coding errors are at fault, it’s critical that you tackle this issue immediately.

Examine the percentage of accounts receivable over 120 days. Is it higher or lower than what has been your experience? What about your practice’s fee for service collection percentage or the dollar amount of bad debts per physician? These are measures that you can evaluate.

If you track your copay collection rate for several quarters and see that it is deteriorating, have your front desk staff pull up each patients’ records when making appointments and remind them about past due payments. In addition, remind your front desk employees to ask for copays at the time of service and to request any outstanding amounts.

Patient No-shows

If your measurement of patient no- shows reveals an uptick in the numbers, consider having your staff make reminder calls or charging for missed appointments.

Time Patient Spends in Office

Patients resent lengthy waiting times. You can track the average time patients spend waiting to see a physician or physician’s assistant. Start by giving a percentage of patients (10%, for example) a card that your receptionist time stamps on arrival and collects and stamps again on departure. If the data reveal an increase in wait times, overbooking may be an issue. If that’s the case, you’ll want to reexamine your procedures and time blocking. You may even have to look into adding another physician, physician’s assistant, or nurse practitioner.

There are other indicators your practice can use to evaluate how well it is doing. Keep tracking the data regularly so that you can make meaningful comparisons over time, and be sure to try our Medical Practice Dashboard to see how your medical practice compares to other peer practices nationally. For a confidential consultation with a CIG Capital Advisors medical practice advisor, email Brian Lasher.