CNBC television frequently has a guest, Cathie Wood, Founder & CEO of ARK Invest. Oftentimes Cathie will tout the funds and stocks that are held in the funds she manages. On April 12, 2022, Cathie Wood said the following live on CNBC, “Over the next five years we’re expecting a 50% compound annual rate of return for the next five years.” [i]

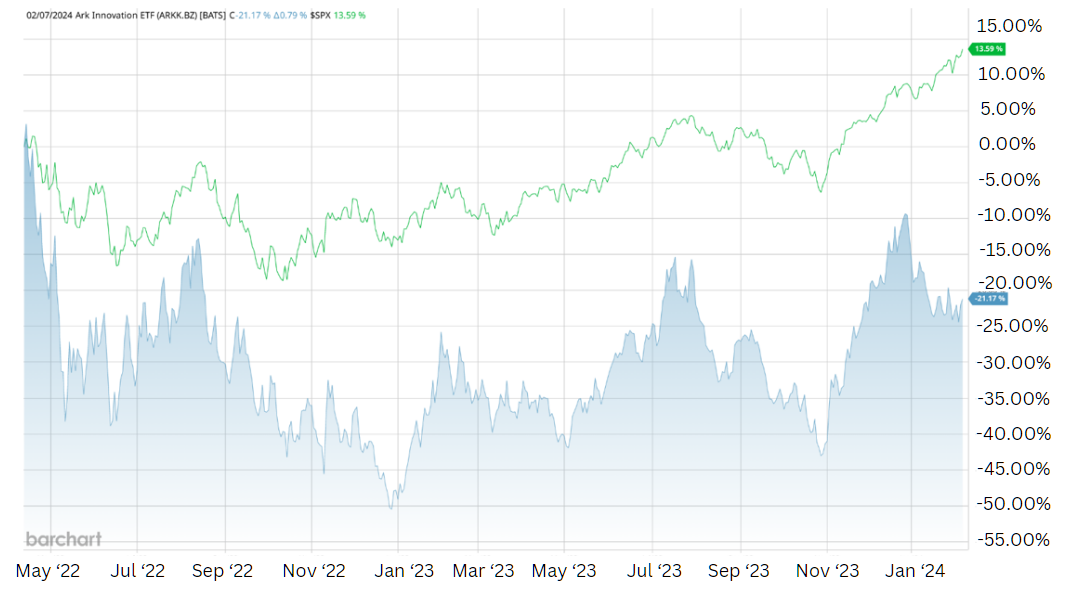

How has the performance of ARK Invest’s Flagship Fund, the ARK Innovation ETF (ARKK), been since her bold statement in April 2022? As seen in the chart below, the shaded area representing ARKK shows a decline of -21.2% from April 12, 2022, to February 7, 2024! In contrast, the S&P 500 has gained+13.6% over this same period! [ii]

The current performance of ARRK, as indicated in the chart above, doesn’t appear to align with the 50% rate of return forecasted in her April 2022 statement. Cathie has made multiple appearances on CNBC since April 2022, and two of her latest appearances have caught our attention.

On January 23 ,2024, Cathie discussed Bitcoin ETFs and said, “This is one of the most important investments of our lifetime.” [iii] This was only 12 days after ARK Invest launched the ARK 21shares Bitcoin ETF (ARKB). [iv] ARKB has fallen -11.7% since its launch on January 11, 2024, to February 7, 2024. Bitcoin itself only fell -5.0% during that same period. A cryptocurrency investor lost over twice as much owning ARKB versus Bitcoin itself during this period of time! [v]

On February 7, 2024, Cathie appeared on CNBC’s program “Last Call”. Cathie spoke about Tesla and said, “Robo-taxis are a software as a service model” and that “EVs will be the bulk of the auto market in the next 5 years.” [vi] As of February 8, 2024, Tesla is ARKK’s second largest holding. [vii] Tesla is down -25% year-to-date as of February 7, 2024. [viii]

As you read this you may be thinking, “CIG is being very critical of Cathie Wood and her ARK Funds.” We at CIG are not alone in our criticism. Morningstar recently published a report- “15 Funds That Have Destroyed the Most Wealth Over the Past Decade”. According to Amy C. Arnott, CFA and author of the report, “The ARK family wiped out an estimated $14.3 billion in shareholder value over the 10-year period—more than twice as much as the second-worst fund family on the list. ARK Innovation alone accounts for about $7.1 billion of value destruction over the trailing 10-year period.”[ix] More importantly, this is not about Cathie Wood or ARK rather about objective data analysis versus media coverage.

We urge our clients and all investors to refrain from being swayed by the hype seen on CNBC or encountered while browsing the internet. Some guests on these platforms are “talking their book”, meaning they are trying to drum up interest in the investment that they already own, such as Tesla, as highlighted earlier. They also may offer the hope of beating the market or make grand predictions about their future performance similar to Cathy’s 50% comment. Instead, we ask investors to listen to the sage advice of Benjamin Graham, as the “father of value investing” and mentor to Warren Buffett. [x] In his book, “The Intelligent Investor” Graham wrote the following:

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”[xi]

The guests on financial channel talk shows tend to highlight their successes from the previous year and the promising opportunities they foresee for the current year, yet they often overlook discussing their less-than-successful experiences in 2022. Retail investors also occasionally exhibit this behavior. We counsel investors to understand what they are invested in – usually a diversified portfolio – and measure their results with the appropriate diversified, blended benchmark and how they are doing versus their financial plan. The rest is just noise.

Please reach out to Brian Lasher (blasher@cigcapitaladvisors.com), Eric T. Pratt (epratt@cigcapitaladvisors.com) or the rest of the CIG team.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.