Summary:

* S&P 500 Index posted its fourth consecutive month of gains

* Active portfolio management beat the index

* 2Q 2021 portfolio rebalancing activity

Commentary:

The S&P 500 Index[i] posted its fourth consecutive month of gains, up +0.7% in May. International markets performed better than the U.S. with the MSCI EAFE net up +2.9% and the MSCI Emerging Markets gaining +2.1% given continued U.S. dollar weakness[ii]. The Bloomberg Commodity Index[iii] returned +2.7% led by Gold, +7.7% and Crude Oil, +4.3%.[iv] Year-to-date, The Bloomberg Commodity Index has increased 18.9%.

As we talked about in our 2021 Outlook, since the 2008-2009 Great Financial Crisis, many passive index investors have been conditioned to buy short-term market pullbacks and have been rewarded as markets have continued to move to all-time highs. In our view, stocks, especially in the United States, continue to be expensive from a valuation standpoint. The Buffet Indicator, the ratio of the total market capitalization of U.S. equities to Gross Domestic Product, was 199.3% at the end of May. As we have discussed previously, to put this in perspective, at the peak of the dot-com bubble in March 2000, this ratio reached 142.9%.[v]

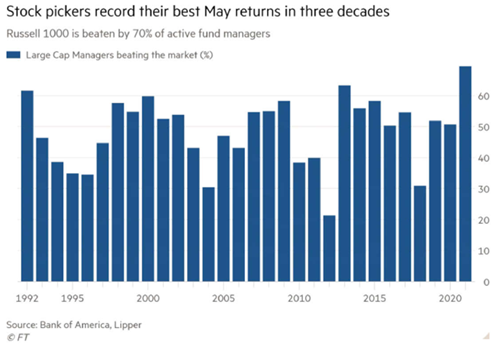

The month of May saw a return to active portfolio management. According to Bank of America U.S. Equity Strategist Ohsung Kwon, 70% of active managers beat the Russell 1000 Index in May, making it the best May in 30 years.[vi] We continue to believe that active management will benefit clients as we continue through uncharted economic and market territory, as we have discussed in our recent CIG Asset Management Reviews “Sir Isaac, Groucho, and the Gods” and “Do you have enough time? Why is this time different?“

Many large cap technology names such as Apple (-6.6% return) and Amazon (-7% return)[vii] were down for the month. The weighting of these two names, Apple 5.7% and Amazon 4.0%, dominate the S&P 500 index.[viii] Last month, Apple and Amazon were a large drag on performance of the S&P 500. Given lawsuits and other company-specific issues, we should not discount the possibility that further losses in these two companies could continue to negatively impact the S&P 500.

Generally, May featured several ups and downs in the U.S. stock market. In our opinion, broad market optimism was tempered by inflation concerns. In our minds, the recently released May Consumer Price Index[ix] confirms rising inflation. But as we recently explained in MarketWatch, lesser-heralded indicators like the Producer Price Index are flashing even more urgent warning signs that impending price increases may be still higher, and are more deeply embedded in the economy than the CPI would suggest. We may experience more volatile months like May, as market participants continue to debate whether inflation is transitory or not and how the Federal Reserve will react.

Given our views, we have continued to add to investments which may outperform if inflation is not transitory. We are in the process of rebalancing CIG managed client portfolios. We are decreasing our exposure to technology, adding an actively managed emerging market fund, adding an industrial holding that is focused on aerospace and defense, adding to our energy pipeline holding, reallocating a portion of our gold holdings into an actively managed mining fund and adding a volatility position that may benefit if market volatility perks up.

We continue to take a risk balanced approach to this historically expensive market in these uncertain times. We are not sitting still.