Summary:

* Best month for the S&P 500 since November 2020[i]

* The Fed raises short-term interest rates +0.75%

* Contrarian thinking and active investing

July 2022 Returns:

Commentary:

U.S. equities, as measured by the S&P 500, were up +9.2%, the best month since November 2020. International Equities were up +5.0%[x]. Fixed income gained +2.4% as measured by the Bloomberg U.S. Aggregate Index.[xi] Gold fell -2.3%[xii] and crude oil lost -6.8%[xiii] as the U.S. Dollar Index gained +1.3%.[xiv]

On Wednesday, July 27, the Federal Open Market Committee raised the Federal Funds Rate (the interest rate at which depository institutions trade federal funds [balances held at Federal Reserve Banks] with each other overnight) by +0.75% to a range of 2.25% to 2.50%.[xv] During the press conference that followed the rate announcement, Federal Reserve Chair Jerome Powell said the Fed had already reached a “neutral” level of interest rates—one that neither boosts nor restricts economic activity. The S&P 500 gained +3.8% from the start of Powell’s press conference at 2:30p.m. July 27 through the close on July 29.[xvi] Many market observers attribute the post-FOMC meeting rally to Powell’s “neutral” comment. Has the Fed already done the heavy lifting? We think not and believe we are not alone in this thinking. Former Treasury Secretary Lawrence Summers said on Wall Street Week, “Jay Powell said things that, to be blunt, were analytically indefensible,” and “There is no conceivable way that a 2.5% interest rate, in an economy inflating like this, is anywhere near neutral.” Mohamed El-Erian, Chief Economic Adviser to Allianz SE and President of Queen’s College, said that “the zip code for neutral is above where we are now.”[xvii]

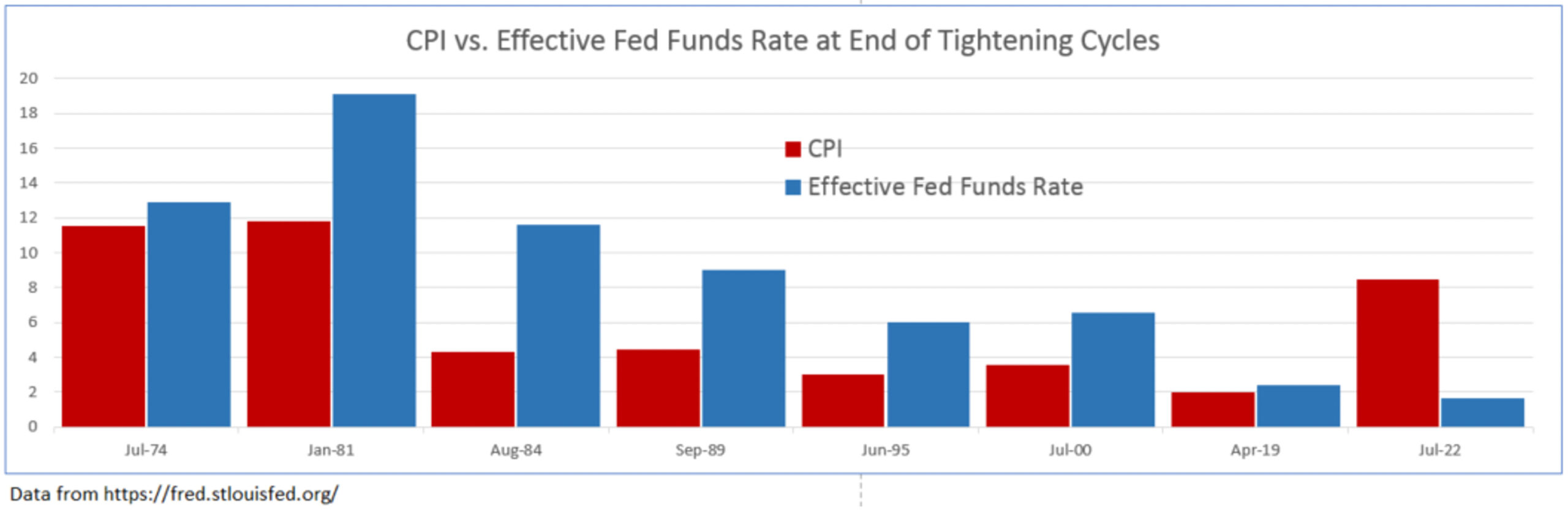

We have illustrated below just how far behind the curve the Fed currently is in its fight against inflation. In the previous seven tightening cycles, the Federal Reserve raised the Fed Funds Rate to a level higher than the inflation rate, as measured by CPI at that time, to bring prices down. As recently as April 2019, the effective Fed Funds Rate, the volume-weighted median rate, was 2.4% while CPI was up +2.0% year-over-year.[xviii]

July 2022 CPI was up +8.5% year-over-year, while the effective Fed Funds Rate is only 1.68%.[xix] We find it incredulous that with over four times the amount of inflation now versus in 2019 and with the effective Fed Funds Rate lower than it was, that the Fed is at “neutral”. The Fed may very well need to raise short-term interest rates a lot more to combat inflation. If it does, we believe stocks will have a sell off.

Having stock, interest rate, and other views that diverge from the collective wisdom of the market can be quite rewarding. In 1997, Apple Inc. launched the “Think Different” advertising campaign. The slogan was launched shortly after Steve Jobs returned to Apple to counter IBM’s slogan at the time, “Think”, a campaign for their ThinkPad.[xx] Apple’s market capitalization in 1997 was around $2.3 billion[xxi] and grew to $2.6 trillion at the end of July 2022.[xxii] IBM’s market cap in 1997 was around $86 billion[xxiii] and only grew to about $119 billion at the end of July 2022.[xxiv] “Think Different” has been very rewarding for Apple—not because of the slogan, but their strategies. Over that 25-year period, excluding dividends, an investment in Apple grew over +100,000% versus IBM’s +38% growth. Howard Marks, legendary investor and co-founder of Oaktree Capital Management, recently wrote a memo to investors titled, I Beg to Differ.[xxv] Marks’ memo highlighted, among many other things, how active investing and contrarian investing are some of the few ways that investors can achieve better returns than the market. In other words, think different.

Marks’ memo has fortified our investment committee’s approach to the entire investment decision-making process. Here we list nine items that we live by each day.

1. Most investors will have average returns. They may be good or bad, but they will be average.

2. If you are happy with average returns, buy index funds and allocate the same as the respective benchmark.

3. To be above average, one must stray from consensus behavior and do something different. One must over/underweight sectors, asset classes and markets. This is “active investing”.

4. Active investing carries both the risk of below average returns and the potential reward of above average returns.

5. When one departs from the herd of passive index investing, they need to use “second-level thinking” to dig deep to develop their investment strategy.

6. Second-level thinking, as Marks describes it is different, deep, convoluted and complex. It takes into account questions, such as:

a. What is the range of future outcomes?

b. What outcome do I think will occur?

c. What is the probability I’m right?

d. What does the consensus think?

e. How does my expectation differ from consensus?

7. Contrarian thinking can be beneficial at market extremes. To effectively act contrary to the masses one must know what the herd is doing, why it is doing it, why they are wrong and what your solution is.

8. Active investing and contrary thinking carry with it the risk of being wrong in hopes of reaping the reward of being right. An active investor seeks better returns than the herd at risk of falling ehind.

9. Howard Marks says it best, “Unconventional behavior is the only road to superior investment results, but it isn’t for everyone. In addition to superior skill, successful investing requires the ability to look wrong for a while and survive some mistakes.”

The CIG investment committee takes great pride in “Think Different”. We are currently over or underweight sectors, asset classes and markets in an attempt to limit risk while seeking to provide a return to meet our clients’ goals in their financial plans. The following are just a few items that we have a different opinion on than the conventional wisdom of many investors, a group that we call “the herd”.

1. The U.S. equity markets are still historically very overvalued—the herd is “buying the dip”.[xxvi]

2. Markets likely have not priced in an extended Russia/Ukraine conflict or the possibility of a China/Taiwan conflict, even though Blackrock rates the likelihood of both “high”.[xxvii]

3. The Fed raising rates at the fastest pace since 1981 and possible quantitative tightening as we head into a recession will be quite damaging to the economy and stock markets—the herd is already placing bets on the timing of the first interest rate cut.[xxviii]

4. Inflation will remain elevated for longer than most economists forecast—The herd believes inflation has peaked and will rapidly come down and the Fed will stop raising interest rates in the near term.[xxix]

Thinking differently is what allowed us to position our portfolios defensively in 2021 and as a result, year-to-date through July 31, our CIG Dynamic Growth Strategy composite has avoided approximately 54% of the growth benchmark’s losses and our CIG Dynamic Balanced Strategy composite has avoided approximately 61% of the balanced benchmark’s losses.[xxx]

Thinking differently does not mean being universally bearish or bullish about the future. Our thinking differently at CIG is about embedding imagination, like Steve Jobs did at Apple, in repeatable processes. In our case, we assess a wide range of scenarios and possible outcomes which are dependent on the path of critical, potentially life-transformative events to help clients succeed, regardless of how interesting the times are—now or at any point in the future.

We would welcome the opportunity to connect with you via voice or email to discuss how you think (differently) about life… about the markets and the value of active investment management.