CIG Asset Management Review: Market Unknowns

Summary:

* S&P 500 declined for the first month since January 2021

* Increasing economic and geopolitical uncertainty

* Market volatility rising

* Do we know?

Commentary:

The S&P 500 index fell -4.65% in September, its first monthly decline since January 2021 and the worst monthly decline since March 2020.[i] In overseas markets, the MSCI EAFE net index declined -3.19% and the MSCI Emerging markets fell -4.25%.[ii] Chinese stocks, represented by the SSE Composite Index, gained +0.68%[iii] and was one of the very few equity markets with positive performance for the month. Fixed income did not offer much protection against the decline in stocks as the Bloomberg US Agg Bond Index fell -0.87%.[iv]

What changed in the month of September? Economic and geopolitical uncertainty appears to have increased.

On September 3rd, the Federal Reserve Bank of New York issued a suspension notification for Nowcast, its official forecast for growth in the U.S. Gross Domestic Product (the total value of goods produced and services provided during one year) stating the following, “The uncertainty around the pandemic and the consequent volatility in the data have posed a number of challenges to the Nowcast model. Therefore, we have decided to suspend the publication of the Nowcast while we continue to work on methodological improvements to better address these challenges.”[v] Upon hearing this announcement, we were reminded of Yogi Berra, the great baseball player and sometimes philosopher who once said “It’s tough to make predictions, especially about the future.”[vi]

Later in the month, Federal Reserve Chairman Powell held a very unconvincing press conference after the FOMC meeting on September 22. Regarding inflation, Powell said the current inflation is “a very modest overshoot. You’re looking at 2.2[%] and 2.1[%], you know, two years and three years out. These are very, very – I don’t think that households are going to, you know, notice a couple of tenths of an overshoot.”[vii] Did investors notice on September 23 that the National Association of Realtors’ August existing homes sales report showed that the median sales price of existing single-family homes in the U.S. rose +14.9% year over year to $356,700?[viii] Did investors notice that the price of U.S. natural gas hit a 12-year high of 6.325 as of October 5, 2021?[ix]

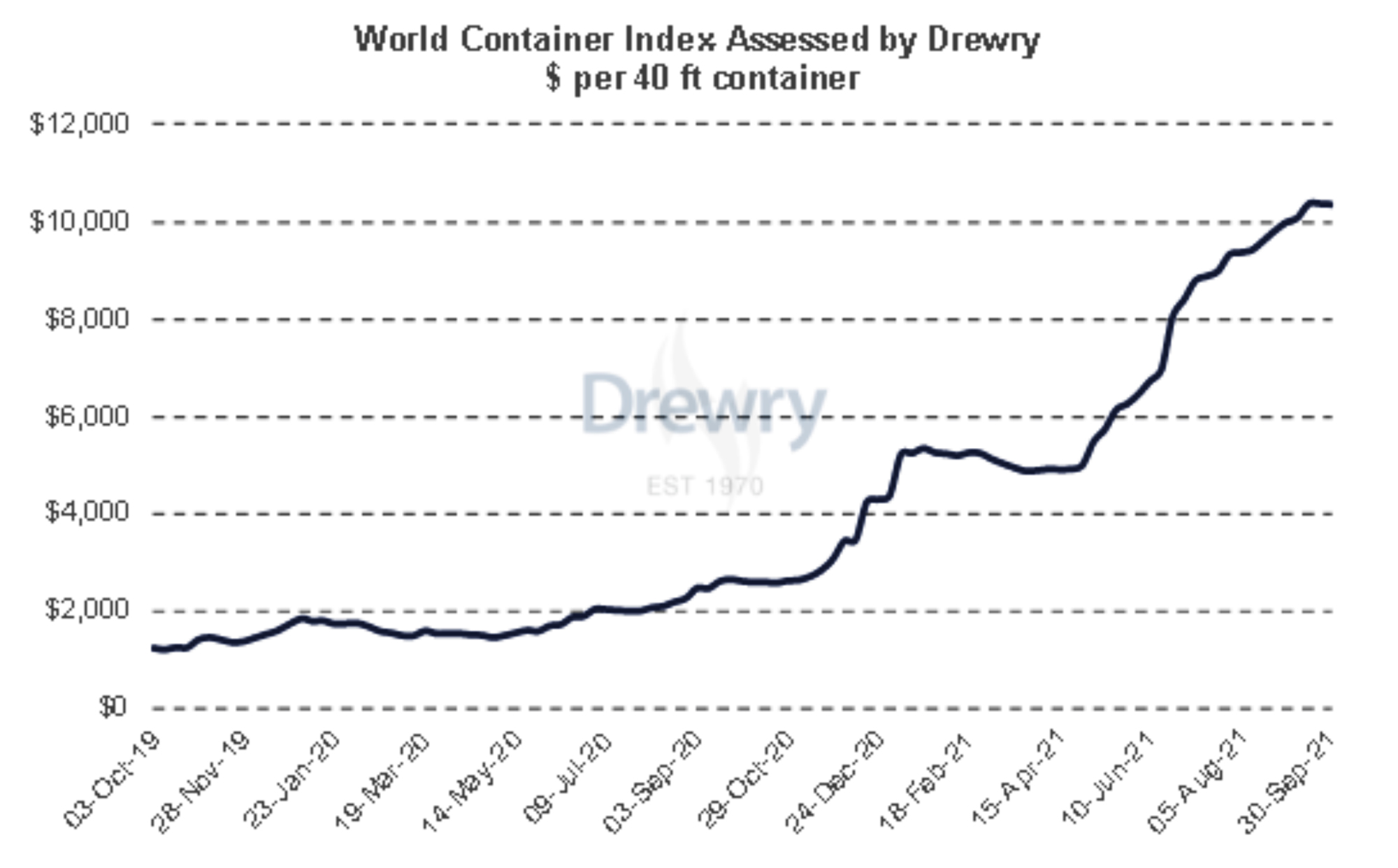

Chairman Powell also said the current inflation is a “reflection of bottlenecks and shortages that…seem to be going to be with us at least for a few more months and perhaps into next year.” As of September 24, there were 600 large container ships waiting to dock at ports in Asia, Europe, and North America. In June there was an average 14-hour delay of ships arriving to Canadian and U.S. ports. Now the delay is almost 10 days![x] There is not much in the way of historical data regarding the current world-wide supply chain issues. But, as the Drewry World Container Index chart below shows, shipping prices have more than doubled year to date.

Source: Drewry.co.uk

Actionable idea: buy your year-end holiday gifts early and locally.

To make things worse, tensions with China are growing and Taiwan is extremely important to the world economy. Semiconductor companies in Taiwan generated almost 65% of global revenues from outsourced chip manufacturing in the first quarter of 2021. Taiwan Semiconductor (TSMC) alone accounted for 56% of global revenues. Most of the 1.4 billion smartphone processors are made by TSMC.[xi] On Friday, October 1, as China celebrated the National Day of the People’s Republic of China, the People’s Liberation Army (PLA) flew 38 warplanes into Taiwan’s air defense identification zone (ADIZ). October 2 saw 39 planes and on October 3, 16 more planes entered the ADIZ. On October 3 the United States State Department issued a statement urging Beijing to “cease its military, diplomatic, and economic pressure and coercion against Taiwan.” China responded on Monday, October 4, by sending a record 56 Chinese warplanes into the ADIZ.

We do not know i) how much GDP will grow next year, ii) whether supply chain issues will abate soon, or iii) if China and the U.S. will lower tensions. This economic and geopolitical uncertainty appears to be contributing to stock market volatility. Historically we have observed that usually when volatility increases by a large margin, stock markets head lower. In market terms, it has been a long while since we had such volatility.

Meanwhile equity markets are near record highs and record valuations. So, we continue to stay the course of risk balanced investing – take enough risk to reach your goals but not much more. We remain focused on striking the right aggressiveness versus defensiveness in client portfolios given the evolving uncertainty in the markets and the economy.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Morningstar: S&P 500 TR USD

[ii] https://www.msci.com/end-of-day-data-search

[iii] Finance.yahoo.com

[iv] Morningstar: Bloomberg US Agg Bond TR USD

[v] https://www.newyorkfed.org/research/policy/nowcast

[vi] https://www.economist.com/books-and-arts/2007/05/31/the-perils-of-prediction

[vii] Federalreserve.gov Transcript of Chair Powell’s Press Conference, September 22, 2021

[viii] https://www.nar.realtor/blogs/economists-outlook?page=1

[ix] https://twitter.com/Schuldensuehner/status/1445489330865115152/photo/1. Futures price.

[x] https://www.wsj.com/articles/germanys-christmas-king-gets-caught-up-in-shipping-chaos-11632475801

[xi] https://www.wsj.com/articles/the-world-relies-on-one-chip-maker-in-taiwan-leaving-everyone-vulnerable-11624075400

Container ship photo: Ian Taylor/Unsplash

Bottle photo: Bobby Donald/Unsplash

CIG Capital Advisors Market Update Video: September and Volatility

In September, the S&P 500 TR Index had its worst month since March 2020[i]. Will volatility continue to head higher?

Brian Lasher and Eric Pratt of CIG Asset Management give a quick posting on the markets.

Please click on the 3-minute market update video attached below.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Morningstar: S&P 500 TR USD

CIG Capital Advisors Market Update: Risk Happens Fast

CIG’s inaugural 3-minute market update is attached. This soon-to-be regular conversation between Brian Lasher and Eric T. Pratt of CIG Asset Management focuses on an important aspect of the current stock market environment. If you have questions post viewing, please do not hesitate to contact your CIG wealth manager.

For more information on this 3-minute market update, please click here.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

CIG Asset Management Review: Risk Happens Fast

Summary:

* S&P 500 advances for seventh month in a row

* Strong corporate profits and the Fed’s not tapering yet

* A long time without a 5% pullback

Commentary:

The S&P 500 index rose for the seventh month in a row, gaining +3.0% in August[i]. Growth stocks continued July’s outperformance over value stocks with the Russell 1000 Growth Index up +3.7%[ii] while the Russell 1000 Value Index advanced +2.0%[iii] last month. Small-capitalization stocks as measured by the Russell 2000 Index gained +2.2%[iv]. Overseas, MSCI Emerging Markets led, rising +2.4% while developed stock markets, measured by MSCI EAFE net, gained +1.5%[v]. Chinese stocks, as represented by the SSE Composite Index, recovered a portion of July’s -5.4% drop, gaining +4.3% in August[vi].

On August 26, the U.S. Bureau of Economic Analysis (BEA) released its updated estimate for second quarter 2021 gross domestic product. The data in the report was encouraging, showing the economy grew at a +6.6% annual growth rate. Delving deeper into the report, second quarter growth in corporate profits was +9.2% which is even better than the +5.1% growth seen in the first quarter. Domestic corporate profits are now above their 2019 pre-pandemic peak.[vii] Historically, strong growth in profits leads to increased capital spending, wage increases and job creation.

Federal Reserve Chairman Jerome Powell spoke at the virtual Jackson Hole symposium on August 27. Investors were looking for a signal for when the Federal Reserve would begin tapering the purchase of at least $120 billion per month of bonds and they appeared to be encouraged by his comments, inferring that a taper was not imminent. Powell said, “We have much ground to cover to reach maximum employment,” and “The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test.” Chairman Powell also added, “Today, with substantial slack remaining in the labor market and the pandemic continuing, such a mistake could be particularly harmful,” and “We know that extended periods of unemployment can mean lasting harm to workers and to the productive capacity of the economy.” [viii]

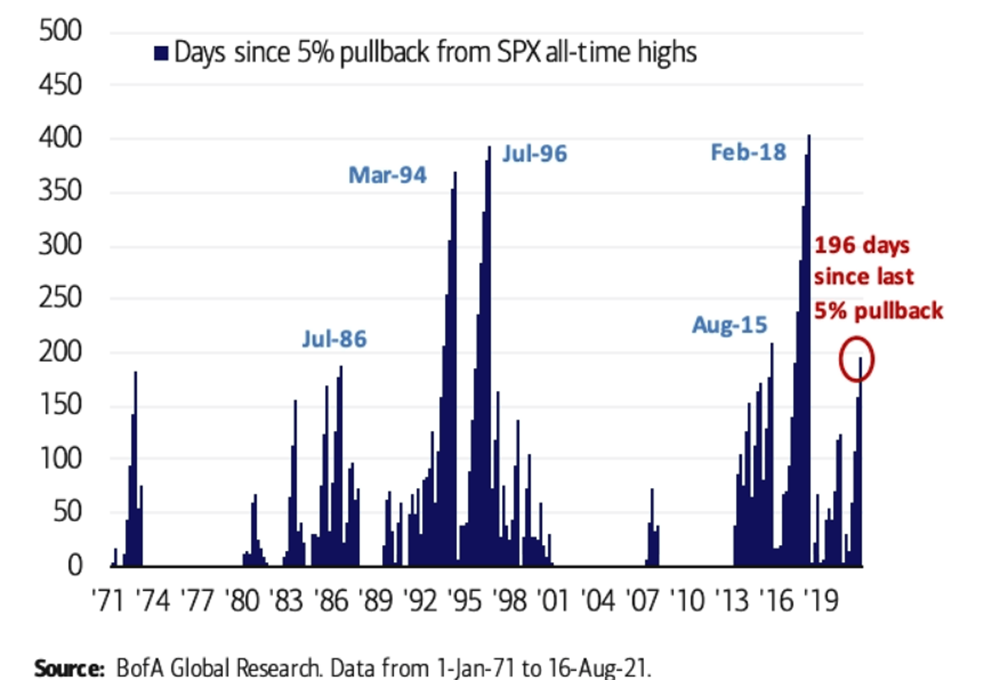

Despite the encouraging growth and a dovish Federal Reserve, we started to suspect that it has been quite a while since we have seen even a minor pullback which is usually necessary for market “health.” Exploring the data, we found that such suspicions were correct as seen in the chart below.

We haven’t had a 5% drop in the S&P 500 since the above chart was published on August 16, 2021. The S&P 500 has now gone 210 trading days without a 5% pull-back.[ix] During the past 50 years, there have only been five longer streaks than the one we currently enjoy. During such streaks, investors can become complacent, but risk happens fast.

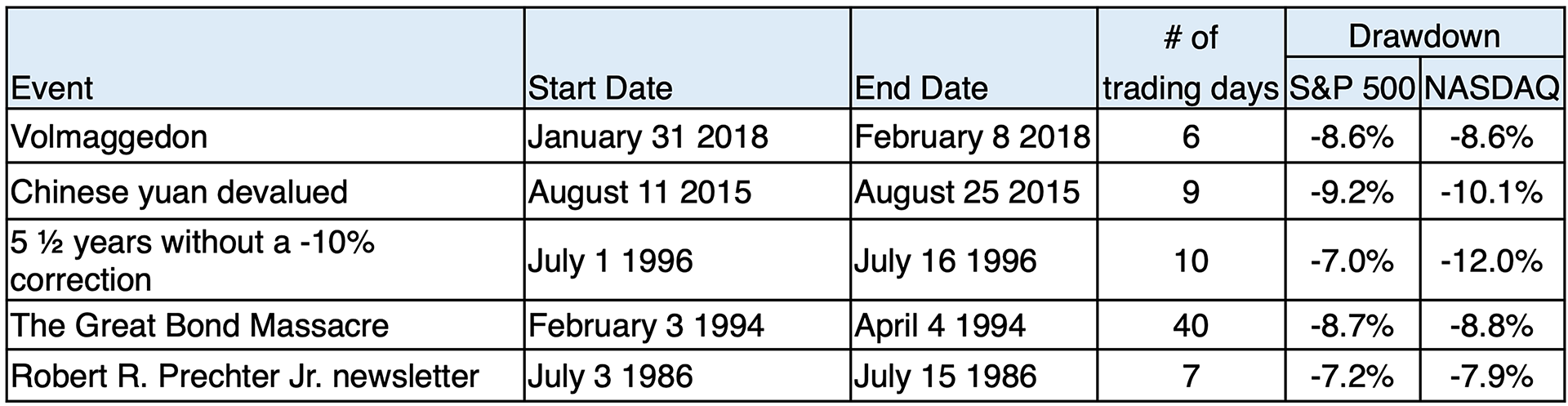

As seen in the table below, those five streaks all ended swiftly and out of the blue, with drawdowns, or losses, in the S&P 500 ranging from -7.0% to -9.2% and the NASDAQ -7.9% to -12.0%. Volmaggedon in early 2018 saw a spike in volatility that caused ETFs holding leveraged bets on calm markets to lose most of their value.[x] In 2015 China suddenly devalued its currency, the yuan.[xi] The Great Bond Massacre in 1994 was set into motion when Federal Reserve Chairman Alan Greenspan suddenly started to raise short term interest rates for the first time in five years.[xii] July 1996 marked the end of a 5½ year long bull market[xiii], and on July 7, 1986, after an extended Fourth of July weekend, Robert R. Prechter Jr. told his investment newsletter subscribers to “sell everything right away.”[xiv] Interestingly enough, even though Prechter’s 1986 call was short-lived, he nailed it on October 5,1987 when he told subscribers to get out just days before the October 19, 1987 crash.[xv]

Drawdown calculated using data from finance.yahoo.com

Another interesting statistic came to our attention for last month’s S&P 500 performance. The S&P 500 made 11 new intraday all-time highs in August 2021, tying the record set in 1929 – a year that did not turn out well. The next best August on record? August 1987 saw 10 intraday all-time highs.[xvi] As we recall, the October 1987 market crash was brutal.

The current bull market may continue, with the Federal Reserve delaying a taper in bond purchases but given its historic run we may be overdue for at least a small drawdown. Equity valuations are in the stratosphere. Current price to earnings ratio on the S&P 500 is 35.36, more than double the historical average of 15.95.[xvii] Current total U.S. market cap is 207.5% of U.S. GDP. At the peak of the dot com boom, this ratio was 142%.[xviii] How extreme are some valuations? On August 27, electric truck company Rivian filed for an IPO, seeking an $80 billion valuation. Elon Musk, whose investment in Tesla has made him the world’s second richest man with a net worth around $190 billion as of this writing[xix], commented on this news, tweeting on August 28, “I thought 1999 was peak insanity, but 2021 is 1000% more insane!” [xx]

During this period of record equity markets and record valuations we continue to stay the course of risk balanced investing – take enough risk to reach your goals but not much more. We continue to focus on striking the right aggressiveness versus defensiveness in client portfolios given the evolving positives and negatives in the markets and the economy.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Morningstar: S&P 500 TR USD

[ii] Morningstar: Russell 1000 Growth TR USD

[iii] Morningstar: Russell 1000 Value TR USD

[iv] Russell 2000 TR USD

[v] https://www.msci.com/end-of-day-data-search

[vi] finance.yahoo.com

[vii] https://fred.stlouisfed.org/series/A053RC1Q027SBEA

[viii] https://www.cnbc.com/2021/08/27/powell-sees-taper-by-the-end-of-the-year-but-says-theres-much-ground-to-cover-before-rate-hikes.html

[ix] Data from finance.yahoo.com

[x] https://www.cfainstitute.org/en/research/financial-analysts-journal/2021/volmageddon-failure-short-volatility-products

[xi] https://www.investopedia.com/trading/chinese-devaluation-yuan/

[xii] https://fortune.com/2013/02/03/the-great-bond-massacre-fortune-1994/

[xiii] https://www.latimes.com/archives/la-xpm-1996-07-16-mn-24708-story.html

[xiv] https://www.washingtonpost.com/archive/business/1989/04/23/where-have-all-the-gurus-gone/853f8ead-ae7a-4364-8315-0bc0439e01dc/

[xv] https://www.nytimes.com/2007/10/13/business/13speculate.html

[xvi] Carter Braxton Worth, August 27, 2021 @CarterBWorth

[xvii] https://www.multpl.com/s-p-500-pe-ratio

[xviii] https://www.gurufocus.com/stock-market-valuations.php

[xix] https://www.forbes.com/real-time-billionaires/#471cc9893d78

[xx] https://twitter.com/elonmusk/status/1431499453618327554

Rollercoaster photo: Incygneia/Pixabay

Light effects photo: Ryan Stone/Unsplash

CIG Asset Management Review: Above Trend but for How Long?

Summary:

* Diverse stock market returns in July

* Watch FRONTLINE’s “The Power of the Fed”

* Is the market in a bubble?

Commentary:

Returns within stock markets varied during the month of July. The S&P 500 index rose +2.4%.[i] The Russell 1000 Growth Index was up +3.3%[ii] while the Russell 1000 Value Index only gained +0.8%.[iii] Small-capitalization stocks as measured by the Russell 2000 Index lost -7.0%.[iv] Overseas, developed stock markets as measured by MSCI EAFE net, gained a modest +0.7%.[v] Chinese stocks, as represented by the SSE Composite Index, fell -5.4%[vi] as China tightened regulatory policies over technology companies. MSCI Emerging Markets, which has a third of its weighting in China and exposure to under-vaccinated emerging countries, lost -7.0%.[vii]

As a follow-up to last month’s Asset Management Review, we encourage you to watch the recent FRONTLINE investigative episode called “The Power of the Fed.”[viii] While we do not agree with everything that the journalist and the interviewees say, this award-winning, long-form investigative journalism show does highlight how the Federal Reserve’s excessive money printing may lead to asset bubbles and exacerbate wealth inequality, which we believe could be damaging to the long-term health of the economy and the capital markets.

Given our belief that the market has become increasingly more fragile, which we talked about last month, we believe that investors may see single digit returns on a year-to-date basis in the short term before they see a return to the current mid-teens year-to-date return in the S&P 500 Index. The VIX, the measure of equity market volatility, in our opinion seems to be a coiled spring that continues to be tightened further and further. Right now, it seems like nothing bothers this market for long, e.g., Dr. Fauci worried about more deadly variants than Delta; computer chip shortages; or housing/ auto/ gas inflation. We expect more volatility later in the year.

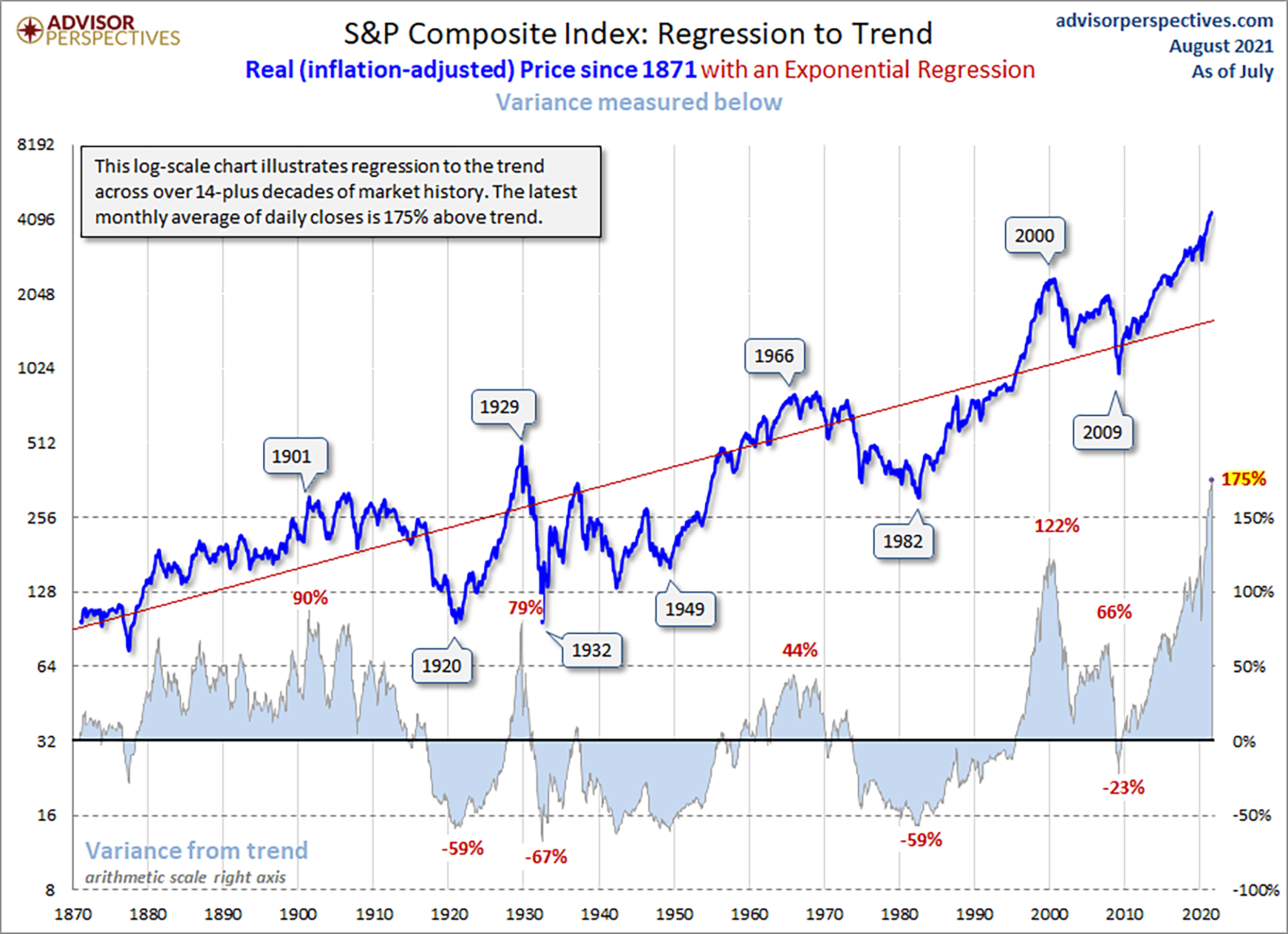

The chart below does concern us. As you can see, there is significant cyclicality to the S&P Composite when it is adjusted for inflation. “Over earning” in the stock market for many years often leads to underperformance and losses over long periods. We have written in the past about how anecdotally and qualitatively 2021 reminds us of 2000. Quantitatively, the market’s 175% above trendline performance dramatically tops the 122% in 2000 and the 79% in 1929.[ix] Historically, markets have reverted to the red long-term trend line. Will this time be different than the large market drawdowns subsequent to the 1901, 1929, 1966 or 2000 peaks?

Source: Advisor Perspectives

It is quite possible that we are in an asset bubble right now. It is hard to know for sure when you are in it. The only sure-fire way to know if there is a market bubble is after it pops. We agree with John Hussman, who recently wrote in The Folly of Ruling Out a Collapse, “The problem with a speculative bubble is that you can’t make the short-term outcomes better without making the long-term outcomes worse, and you can’t make the long-term outcomes better without making the short-term outcomes worse. Now it’s just an unfortunate situation.”[x]

Our approach to this possible market bubble? Stay the course of risk balanced investing – take enough risk to reach your goals but not much more. We continue to focus on striking the right aggressiveness versus defensiveness in client portfolios given the positives and negatives in the markets and the economy.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Morningstar: S&P 500 TR USD

[ii] Morningstar: Russell 1000 Growth TR USD

[iii] Morningstar: Russell 1000 Value TR USD

[iv] Morningstar: Russell 2000 TR USD

[v] https://www.msci.com/end-of-day-data-search

[vi] finance.yahoo.com

[vii] https://www.msci.com/end-of-day-data-search

[viii] https://www.pbs.org/wgbh/frontline/film/the-power-of-the-fed/

[ix] https://www.advisorperspectives.com/dshort/updates/2021/08/04/regression-to-trend-another-look-at-long-term-market-performance

[x] Hussmanfunds.com

Tightrope photo: Dmitry Kovalchuk/iStock

Bubble photo: Mathieu Turle/Unsplash

CIG Asset Management Review: Inflation and Fragility

Summary:

* The Federal Reserve struck a more hawkish tone mid-month

* U.S. stocks rebound after a dip

* Markets appear increasingly fragile

Commentary:

Markets were stunned on June 16th as the Federal Reserve struck a more hawkish tone. Federal Reserve committee member’s projections now pointed to two interest-rate hikes in 2023 versus none before. The U.S. dollar jumped higher on the news, while many commodities reversed course from the prior month as inflation-focused investments suffered. Although the S&P 500 Index initially fell -1.6%, it fully recovered within days to end the month of June up +2.3%.[i] Overseas stock markets lost money during the same period with the MSCI EAFE net down -1.3% and the MSCI Emerging Markets losing -0.1% given U.S. dollar strength.[ii]

During the month, we reflected on the increasing criticism of the Federal Reserve by market commentators like Mohamed El-Erian, president of Queens’ College, Cambridge University, and adviser to Allianz. He believes the Federal Reserve is ignoring so-called transitory inflation at its own peril. In a June 30 Financial Times op-ed[iii], he referenced a Bank of America survey that suggests the markets are currently driven by a consensus around “durable high global growth, transitory inflation, and ever-friendly central banks.”[iv] El-Erian argues that possibility of unanticipated non-transitory inflation could upset this happy market consensus leading to significant economic and financial damage.

El-Erian has been very right in the past in our opinion. In a CNBC interview on February 3, 2020, he warned about the risks of the newly discovered COVID-19 virus. “It is big. It’s going to paralyze China. It’s going to cascade throughout the global economy. We should pay more attention to this. And we should try and resist our inclination to buy the dip”, said El-Erian.[v] The S&P 500 reached its then all-time high two weeks after that interview and then fell -35% until it reached the March 23, 2020 low.[vi]

More recently, on February 16, 2021, El-Erian warned in a CNN interview, “Investors are chasing what someone labeled the ‘rational bubble’. While they are fully aware asset prices are high, they expect prices could go even higher thanks to massive central bank liquidity and prospects of fiscal injections. Basically, investors feel confident riding what is a massive historical liquidity wave.”[vii] So far, investors have not heeded El-Erian’s warning. Indeed, as of July 9, 2021, the S&P 500 has rallied +11% from the CNN interview.[viii] The massive historical liquidity wave that El-Erian warned about in February 2021 continues to grow. Federal Reserve asset purchases shown in the green shaded area in the chart below has dramatically increased the discomfort of holding cash with 0% yield and amplified the desirability of buying risky stocks which investors expect offer higher returns.

data from https://fred.stlouisfed.org and finance.yahoo.com

Constant intervention by the Federal Reserve and other central banks since 2009 have led to an environment of self-reinforcing speculation and a rising S&P 500 index shown in the black line. Reckless fiscal policy since 2017 has only augmented the atmosphere. In our opinion, entire investment strategies have now been built around the perceived certainty of Federal Reserve and central bank support. Retail traders’ share of stock market volume has surged since the lockdowns, and the number of individuals opening brokerage accounts is at a record pace in 2021[ix]. We believe that most bubbles end when the last marginal investor is fully invested.

The belief that central bank liquidity has the capacity to support elevated markets indefinitely creates a reflexive response by the market as more and more investors jump on the bandwagon. Thus, the market becomes increasingly fragile. Consequently, a more aggressive Federal Reserve intervention is required with each market downturn which one can see in the chart above. El-Erian’s op-ed hints at the dynamics of certainty and fragility. Now markets move downward based on the Fed pretending to inch a teensy bit toward maybe raising rates over 18 to 30 months from now[x].

No matter what real world inflation we might be experiencing currently, debating the transitory nature of inflation is likely to continue to produce periodic setbacks for inflation-focused investments. Inflation expectations are changing, and it will take time for the debate to be settled in some fashion. Until these expectations are cemented in an alternative vision of the world by investors, market commentators and powerful institutions, we might expect the market to move in short order from calm to quite volatile.

For CIG’s clients, we will continue to take a risk balanced approach to this historically expensive market in these uncertain and fragile times. Risk balancing means moderating portfolios’ exposure to the consensus views of other investors as well as using hedging strategies like owning publicly traded hedge funds, gold, and volatility strategies.

Understanding and paying attention to this environment is important to achieving your financial planning goals.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Morningstar: S&P 500 TR USD

[ii] https://www.msci.com/end-of-day-data-search

[iii] https://www.ft.com/content/77ed35a0-cf91-4c7e-b779-a57ecc6b1045

[iv] Ibid.

[v] CNBC.com February 3, 2020

[vi] Calculated using data from finance.yahoo.com

[vii] CNN.com February 16, 2021

[viii] Calculated using data from finance.yahoo.com for the period February 16 to July 9, 2021

[ix] https://www.palmvalleycapital.com/fundletter

[x] See so-called dot plots comparing March and June targets in this article: https://cnb.cx/2TygcxY

Eccles Federal Reserve Board Building photo: APK/CC BY-SA 3.0

Wave photo: Jeremy Bishop/Unsplash

CIG Asset Management Review: The Return of Active Portfolio Management

Summary:

* S&P 500 Index posted its fourth consecutive month of gains

* Active portfolio management beat the index

* 2Q 2021 portfolio rebalancing activity

Commentary:

The S&P 500 Index[i] posted its fourth consecutive month of gains, up +0.7% in May. International markets performed better than the U.S. with the MSCI EAFE net up +2.9% and the MSCI Emerging Markets gaining +2.1% given continued U.S. dollar weakness[ii]. The Bloomberg Commodity Index[iii] returned +2.7% led by Gold, +7.7% and Crude Oil, +4.3%.[iv] Year-to-date, The Bloomberg Commodity Index has increased 18.9%.

As we talked about in our 2021 Outlook, since the 2008-2009 Great Financial Crisis, many passive index investors have been conditioned to buy short-term market pullbacks and have been rewarded as markets have continued to move to all-time highs. In our view, stocks, especially in the United States, continue to be expensive from a valuation standpoint. The Buffet Indicator, the ratio of the total market capitalization of U.S. equities to Gross Domestic Product, was 199.3% at the end of May. As we have discussed previously, to put this in perspective, at the peak of the dot-com bubble in March 2000, this ratio reached 142.9%.[v]

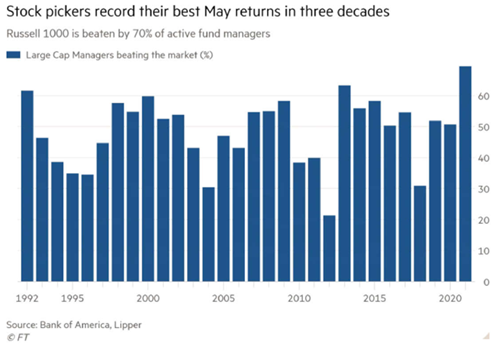

The month of May saw a return to active portfolio management. According to Bank of America U.S. Equity Strategist Ohsung Kwon, 70% of active managers beat the Russell 1000 Index in May, making it the best May in 30 years.[vi] We continue to believe that active management will benefit clients as we continue through uncharted economic and market territory, as we have discussed in our recent CIG Asset Management Reviews “Sir Isaac, Groucho, and the Gods” and “Do you have enough time? Why is this time different?“

Many large cap technology names such as Apple (-6.6% return) and Amazon (-7% return)[vii] were down for the month. The weighting of these two names, Apple 5.7% and Amazon 4.0%, dominate the S&P 500 index.[viii] Last month, Apple and Amazon were a large drag on performance of the S&P 500. Given lawsuits and other company-specific issues, we should not discount the possibility that further losses in these two companies could continue to negatively impact the S&P 500.

Generally, May featured several ups and downs in the U.S. stock market. In our opinion, broad market optimism was tempered by inflation concerns. In our minds, the recently released May Consumer Price Index[ix] confirms rising inflation. But as we recently explained in MarketWatch, lesser-heralded indicators like the Producer Price Index are flashing even more urgent warning signs that impending price increases may be still higher, and are more deeply embedded in the economy than the CPI would suggest. We may experience more volatile months like May, as market participants continue to debate whether inflation is transitory or not and how the Federal Reserve will react.

Given our views, we have continued to add to investments which may outperform if inflation is not transitory. We are in the process of rebalancing CIG managed client portfolios. We are decreasing our exposure to technology, adding an actively managed emerging market fund, adding an industrial holding that is focused on aerospace and defense, adding to our energy pipeline holding, reallocating a portion of our gold holdings into an actively managed mining fund and adding a volatility position that may benefit if market volatility perks up.

We continue to take a risk balanced approach to this historically expensive market in these uncertain times. We are not sitting still.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Morningstar: S&P 500 TR USD

[ii] https://www.msci.com/end-of-day-data-search

[iii] Bloomberg.com

[iv] Data from finance.yahoo.com

[v] Gurufocus.com

[vi] Financial Times, June 8, 2021

[vii] Calculated from data from finance.yahoo.com

[viii] https://www.slickcharts.com/sp500 as of 6/15/2021

[ix] https://www.bls.gov/news.release/pdf/cpi.pdf

Stock charts photo: Nicholas Cappello/Unsplash

Advisor photo: cottonbro/Pexels

CIG Asset Management Review: Sir Isaac, Groucho, and the Gods

Summary:

* S&P 500 Index posted its third consecutive month of gains

* Financial market history books might offer lessons

* Understanding human behavior may be the most important requirement right now

- Commentary:

-

April featured a macro environment that tilted positive. The market reacted favorably to i) the Federal Reserve continuing to increase its balance sheet (greater than $1.2t over the last year), ii) a rebound in U.S. durable-goods orders, and iii) a record 21.1% increase in U.S. household income in March[i].

We noted that the service PMI index of prices increased to 61% in April (manufacturing PMI also continues to suggest a greater inflation risk) and the COVID resurgence pushed the Eurozone into a double-dip recession[ii]. These potential risks seemed far from investor’s minds.

Accordingly, the S&P 500 Index[iii] posted its third consecutive month of gains, up 5.3% in April. International markets did quite well with the MSCI EAFE net up 2.7% and the MSCI Emerging Markets gaining 2.4% given U.S. dollar weakness[iv]. U.S. Treasury Bonds had a good month after a significant selloff in March while the Bloomberg Barclays High Yield Bond index[v] returned 1.1%. Higher inflation expectations were supported by an 8.3% increase in the Bloomberg Commodity Index[vi] and a 7.4% increase in crude oil[vii] during the month.

Recently, we have been reflecting on what the end game for financial markets might look like after reading noted economist Mohamed El-Erian’s May 3rd opinion piece in the Financial Times entitled “Fed framework holds central bank hostage[viii].” We have been digging out our financial market history books to examine previous bubbles and manias and inflationary episodes to see what lessons they might offer for our immediate future and beyond. Of course, we cannot divine the timing of any eventual market shift. We recall Sir Isaac Newton’s famous quote in 1720 after initially making money in the South Sea Bubble, re-entering the scam, and then losing multiples more of his profit: “I can calculate the motions of the heavenly bodies, but not the madness of people[ix].”

We have often mentioned in these updates how today reminds us of the Internet Bubble of 2000 and what we read from past bubbles echoes our experience then and what we are seeing today. What is a bubble? Nobel Laureate Franco Modigliani offered an insightful definition: “The expectation of growth produces growth, which confirms the expectation; people will buy it because it went up. But once you are convinced that it is not growing anymore, nobody wants to hold a stock because it is overvalued. Everybody wants to get out and it collapses, beyond the fundamentals[x].”

Last year’s unprecedented market recovery which we talked about in the March Blog, this year’s GameStop democratization of the markets and cryptocurrencies’ ascendence, all seem familiar. In Charles Mackay’s “Extraordinary Popular Delusions and the Madness of Crowds”, first published in 1841, he recounts, “Many individuals suddenly became rich. A golden bait hung temptingly out before the people, and, one after the other, they rushed to the tulip marts, like flies around a honey-pot. Everyone imagined that the passion for tulips would last forever, and that the wealthy from every part of the world would send to Holland, and pay whatever prices were asked for them. The riches of Europe would be concentrated on the shores of the Zuyder Zee, and poverty banished from the favoured clime of Holland. Nobles, citizens, farmers, mechanics, seamen, footmen, maidservants, even chimney sweeps and old clotheswomen, dabbled in tulips. People of all grades converted their property into cash and invested it in flowers.[xi]”

Like the recently announced second NBA-star-sponsored Shaq SPAC[xii], the 1920s stock market attracted the celebrities and “social media influencers” of that age including Groucho Marx, who borrowed over a quarter of a million dollars to play the stock market. He wrote in his memoirs, during that bull market there was no need to employ a financial advisor, “You could close your eyes, stick your finger any place on the big board and the stock you bought would start rising[xiii].” Marx along with Irving Berlin and Eddie Cantor of Ziegfield Follies fame speculated heavily and eventually lost fortunes[xiv]. (We will see how Elon Musk does with his cryptocurrency holdings.)

Understanding human behavior may be the most important requirement right now and we have also looked to classic literature to understand the narratives that we tell ourselves at this point in the market cycle. It is easy to take these narratives and what you are being told by CNBC into your heart and act against your best interest. We reflect on the narrative, known as Nihonjinron, that the Japanese told themselves during their bubble of the 1980s – that Japan is unique and better[xv]. But such hubris is often a precursor to bubbles.

Shakespeare’s observation about fortune seems truer that “she is turning and inconstant . . . the poet makes a most excellent description of it.[xvi] Exceptionalism is usually fleeting. To that end, we offer Rudyard Kipling’s poem, “The Gods of the Copybook Headings[xvii]” written post the 1918 pandemic and just prior to the 1920s bubble discussing the constancy of the human condition. The last two stanzas are chilling in reflecting on today’s market. We continue to pursue a risk balanced approach to the market – not fight the Federal Reserve or run for the hills; be in the game – it could last a long time; and maintain the appropriate emotional distance. We endeavor to not be the “bandaged finger [that] goes wabbling back to the Fire.”

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Macro data is from Evercore ISI’s Weekly Economic Summary 5/2/21.

[ii] Macro data is from Evercore ISI’s Weekly Economic Summary 5/2/21.

[iii] Morningstar: S&P 500 TR USD

[iv] https://www.msci.com/end-of-day-data-search

[v] Morningstar: BBgBarc High Yield Corporate TR USD

[vi] www.Bloomberg.com

[vii] www.finance.yahoo.com

[viii] https://www.ft.com/content/d4b53d27-59b8-4b16-b59b-ef2fe4c0289e

[ix] Kindleberger, Charles P., Manias, Panics, and Crashes – A History of

Financial Crises. Revised ed., Basic Books, 1989, page 38. An excellent

textbook which is required reading at most business schools.

[xi] Mackay, Charles, Extraordinary Popular Delusions and the Madness of Crowds.

Harriman Definitive ed., Harriman House LTD, 2018, page 79.

[xii] https://finance.yahoo.com/news/shaq-spac-2-0-coming-133637566.html

[xiii] Chandler, Edward. Devil Take the Hindmost – A History of Financial Speculation.

Plume Books, 2000, page 207. A more narrative focused account of speculation

from Rome to the Japanese bubble economy.

[xiv] Ibid. p. 203.

[xv] Ibid. p. 283.

[xvi] Shakespeare, William. Henry V. Library of Alexander, 1956, Act III, Sc. 6.

[xvii] First published in the Sunday Pictorial (London) October 26, 1919, and – as “The

Gods of the Copybook Margins” – in Harper’s Magazine in January 1920. It

has also been called “Maxims of the Market Place”. ‘Copybook

headings’ were proverbs or maxims printed at the top of 19th century British

schoolboys’ copybook pages. http://www.kiplingsociety.co.uk/poems_copybook.htm

CIG Asset Management Review: Do you have enough time? Why is this time different?

Summary:

* Re-openings and even MOAR stimulus

* We may have to wait a long time

* A not so typical market recovery

- Commentary:

- In March 2021, equity markets continued to rally as Texas eased all business restrictions and lifted its mask mandate and the $1.9 trillion COVID-19 relief bill was passed by Congress and signed by President Biden, sending $1,400 payments directly to many Americans. Almost immediately after the bill signing, the Biden administration turned its attention to a $2 trillion infrastructure bill. Federal Reserve Chairman Powell reassured investors after the March FOMC meeting that the Fed is not planning on raising interest rates until 2022-2023 at the earliest. March went out with a bang, with the collapse of over leveraged hedge fund Archegos Capital which lost $20 billion in two days.[i]

- For the month, the S&P 500 Index was up +4.4%[ii] while the international stocks in developed economies, as measured by the MSCI EAFE Index Net, gained +1.8%[iii]. Emerging Market stocks (MSCI EM) were down -1.7%[iv]. Value stocks, measured by the Russell 1000 Value Index, added +5.9% and the Russell 1000 Growth Index, a measure of growth stocks, was up +1.7%[v]. Small-cap stocks, represented by the Russell 2000 Index were up +1.0%[vi]. Crude oil fell -3.8% for the month and Gold fell -0.8% [vii].

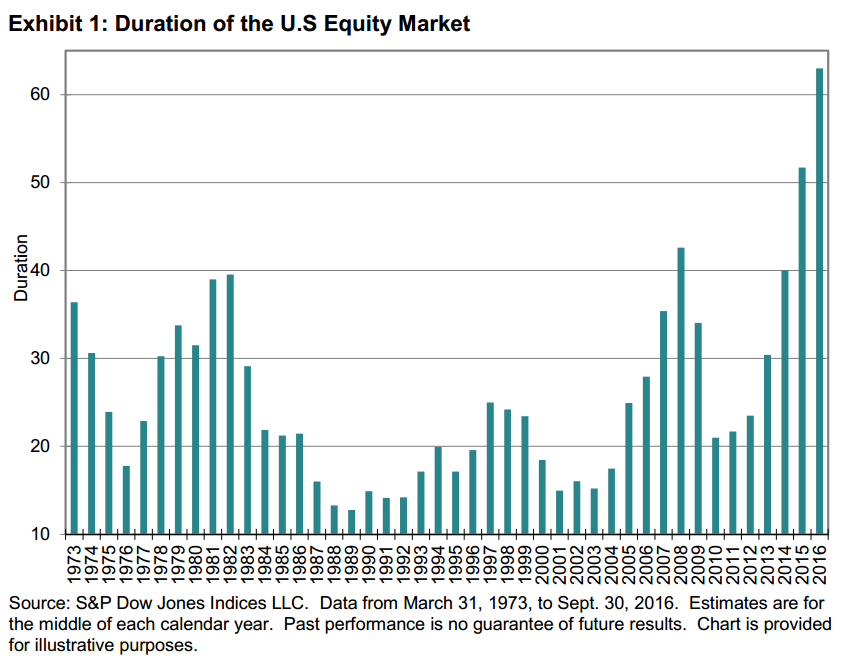

- Recently, we found a 2017 study by S&P Global[viii] that is informative for the current environment. As you may know, every investment is a claim on future cash flows that can be anticipated to be delivered to the investor over time. While the concept of “duration” is most used for bonds, it’s actually applicable to any investment and can be defined in two ways: i) the weighted average number of years it takes for the investment to deliver its payments[ix] and ii) the percentage change in the investment’s value in response to a change in the underlying gross rate of return. The second definition allows us, with some math, to convert a stock’s dividend yield to duration.

- As shown in the chart below by S&P Global, the duration for equities (i.e., the S&P 500 Index) over the past 149 years ending September 2016 has ranged from 13 to 63 years.

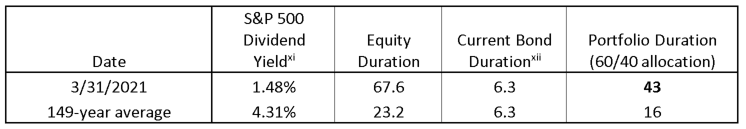

We have calculated the average duration for equities (i.e., the S&P 500 Index) over the past 149 years ending September 2016 to be approximately 23.2 years[x]. In a balanced portfolio like what we frequently structure at CIG, the historical average duration of a 60% equity/40% bond allocation is 16 years during that 149-year timeframe. Meaning if the markets decline significantly and do not recover, investors could reasonably expect that if they could stay invested (i.e., not sell at depressed prices), over time they may recover their investment via dividends or other cashflows.

Source: CIG Asset Management using data from S&P Global, www.multpl.com and www.ishares.com

Currently as shown in the table above, we calculate the equity duration at 67 years. The average duration for a balanced 60/40 portfolio is now 43 years, over 2.5 times the historical average!

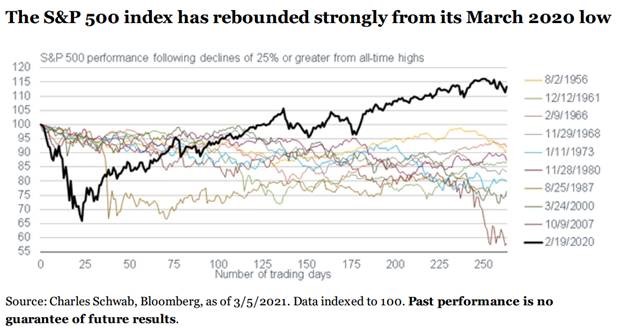

Meanwhile, the risk of a significant pullback continues to increase given that the current market recovery is unlike any in recent history. In the prior nine greater-than-25% declines in the S&P 500 Index over the past 64 years as shown in the chart below, none of those occurrences saw markets fully recover to their previous high in the one year following, let alone hit new highs.

This time is different because the Federal Reserve has printed enormous amounts of money and the US Government has plans to spend it. We have argued and still believe i) this “Fed backstop” is largely psychological and quite fragile and ii) the underlying economy remains in bad shape with for example, 18 million people receiving some kind of unemployment assistance. We suspect that any sustained downturn will occur just when the entire economy, including client businesses and medical practices are starting to suffer – a double whammy to everyone’s psyches.

At CIG, we define risk as “how bad could it be” and “how likely is this bad outcome.” Given high stock and bond valuations, investors could have to wait multiple decades for their portfolios to recover versus much shorter time periods like in 1989 or 2001. While it is quite possible that we are in an asset bubble right now, it is hard to know for sure when you are in it and, more importantly, when it will end. As you may recall from previous blogs, we have warned that risks are building in the market and this bad outcome is becoming more likely. So, we are staying the course of risk balanced investing – attempting to strike the right aggressiveness versus defensiveness in client portfolios in uncertain times.

Do you have enough time?

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] www.bloomberg.com

[ii] Morningstar

[iii] https://www.msci.com/end-of-day-data-search

[iv] https://www.msci.com/end-of-day-data-search

[v] https://www.ftserussell.com

[vi] https://www.ftserussell.com

[vii] https://finance.yahoo.com/

[viii] “Applying Equity Duration to Pension Fund Asset Allocation: A Review of S&P 500® Duration” https://www.spglobal.com/spdji/en/documents/research/research-applying-equity-duration-to-pension-fund-asset-allocation.pdf

[ix] Intuitively, if one buys the S&P 500 Index for a price of 22 times its annual earnings. Assuming the S&P 500 Index companies pay the investor all their earnings, absent a sale, it will take the investor 22 years to get paid back.

[x] Source: CIG Asset Management using data from S&P Global, www.multpl.com and www.ishares.com

CIG Asset Management Update February 2021: History Rhymes

Summary:

- Value stocks outperformed growth

- Speculative trading in WallStreetBets stocks

- February Non-farm Payrolls +379,000

Commentary:

In February 2021, the S&P 500 Index was up +2.8%[i] while the international stocks in developed economies, as measured by the MSCI EAFE Index Net, gained +2.1%[ii]. Emerging Market stocks (MSCI EM) returned +0.7%[iii]. Value stocks, measured by the Russell 1000 Value Index gained +6.0% and the Russell 1000 Growth Index a measure of growth stocks, was flat at 0.0%[iv]. Small-cap stocks, represented by the Russell 2000 Index were up +6.2%[v]. Crude oil surged +17.8% for the month and Gold fell -6.5% [vi].

February continued to see speculative trading in small capitalization and highly shorted stocks. On January 31, Elon Musk tweeted, “On Clubhouse tonight at 10pm LA time”. The next day, Clubhouse Media Group (CMGR) gained over 100%. CMGR is actually a healthcare company based in Guangxi, China, not the privately-owned social media app that Musk was refering to.[vii] Highly shorted stocks, such as GameStop, continued to be targeted by hoards of retail investors following the Reddit forum, WallStreetBets. These traders bought stock and options in stocks that had a very large amount of shares short[viii] to try to drive the prices higher. This is known as a short squeeze. A common phrase used on discussion forums such as Reddit is “to the moon”, followed by a rocket emoji. This type of activity was seen as manipulatative to some and market volatility grew as several large hedge funds were on the losing side of many of these trades.[ix] This unusual market activity caught the attention of Congress and on February 18, The House Financial Services Committee held a hearing, “Game Stopped? Who Wins and Loses When Short Sellers and Retail Investors Collide,” During the hearing, WallStreetBets trader Keith Gill, – aka “Roaring Kitty”, who owns a large position in GameStop, proclaimed, “I am not a cat” in his self introduction. Some of the focus of the hearing was on the Wallstreetbets Reddit message board, a widely followed forum where many retail investors have recently sought out investment advice and acted upon that advice by trading on online trading platforms like Robinhood. Reddit CEO Steve Huffman said at the hearing, “On Reddit, I think the investment advice is actually probably among the best because it has to be accepted by many of thousands of people before getting that vote of visability.”[x]

The Clubhouse and WallStreetBets trading above bring to mind the famous Mark Twain quote, “History doesn’t repeat itself, but it often rhymes.” Wall Street Journal writer Jason Zweig recently shared a copy of what he wrote in the October 19, 1999 Outstanding Investor Digest. “it’s not just the Vanguard Index Fund that’s making everybody in this room, including the gentlemen to my left, look kind of stupid. It’s the taxi dispatcher or the shoe salesman who reads that FHX is going to go up like a rocket in some chat room, then buys it at E-trade and sells it 43 minutes later. Never mind the fact that the guy doesn’t know what FHX stands for, what it makes, or for that matter, one single, solitary thing about FHX. Never mind the fact that he actually meant to buy FDX. He’s a genius and you’re not.”[xi] The NASDAQ lost -78% from its March 2000 peak to its October 2002 trough.[xii] While we are not forcasting a drawdown in the stock market to that extreme today, we feel there is reason to be cautious due to current investor speculation and market valuations.

As we have stated in previous letters, it is our belief thateither the economy picks up and unemployment moderates or stocks decline. February nonfarm payrolls increased by +379,000[xiii]. 355,000 of those jobs[xiv] were in the hospitality sector as the pace of vaccinations increased and States began to open up. The growing number of cases in the U.S. of the Brazilian, UK and South African COVID-19 variants are worrisome but we are hopeful that as the rate of vaccinations accelerate we will be able to head off the growth of these more contagious strains and see a gradual reopening of the economy. The rate of COVID-19 vaccinations in the United States has now reached 2.2 million shots per day.[xv].

We continue to endeavor to reach a balance between offense and defense positions to take just enough risk to generate attractive returns to meet client financial goals in what are still uncertain times.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Morningstar

[ii] https://www.msci.com/end-of-day-data-search

[iii] https://www.msci.com/end-of-day-data-search

[iv] https://www.ftserussell.com

[v] https://www.ftserussell.com

[vi] https://finance.yahoo.com/

[vii] FT.com “Clubhouse’s stock is surging. It’s the wrong Clubhouse.”

[viii] Short stock positions will profit when a stock’s price declines the price where the short was initiated.

[ix] Wall Street Journal 02/17/2021 “Melvin Capital Says It Was Short GameStop Since 2014.”

[x] https://financialservices.house.gov/calendar/eventsingle.aspx?EventID=407107

[xi] Twitter: @jasonzweigwsj 03/06/2021

[xii] Data from https://finance.yahoo.com/

[xiii] U.S. Department of Labor, unemployment release 3/5/2021.

[xiv] U.S. Department of Labor, unemployment release 3/5/2021.

[xv] Reuters 03/08/2021