CIG Asset Management Update: Where are we now?

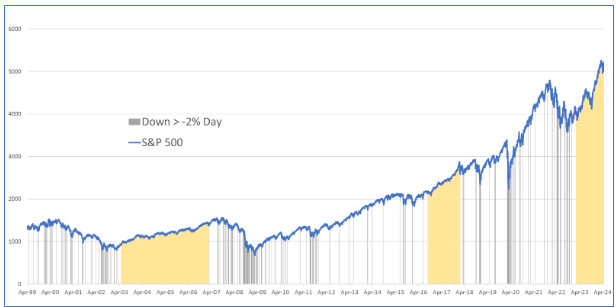

The S&P 500 currently is experiencing its third longest period in the past 25 years without a single-day decline of over 2%. Yes, including last month. The graph below depicts the past 25 years, highlighting every day when the S&P 500 fell over 2% (indicated by black vertical lines). These occurrences aren’t rare.

Chart by CIG Asset Management using data from barchart.com

The mustard-colored shaded areas represent extended periods without a 2% down day. The first yellow shaded area, 1,380 days, (from May 20, 2003, to February 27, 2007) coincided with Freddie Mac’s announcement that they would no longer buy sub-prime mortgages. [i] This marked the beginning of the great financial crisis, leading to a significant stock market drawdown over the next two years. The second longest period was 511 days, (September 12, 2016, to February 1, ) This calm period in the market ended with what became known as Volmaggedon – an event where many structured products that bet against stock market volatility lost over 90% of their value. [ii] The most recent shaded area began on February 21, 2023, and continues beyond May 9, . (443 days as of this writing) [iii] Notably, despite the S&P 500 falling -4.1% in April 2024, we still didn’t experience a single -2% down day.[iv] History teaches us that long quiet periods can often precede sudden volatility and drawdowns.

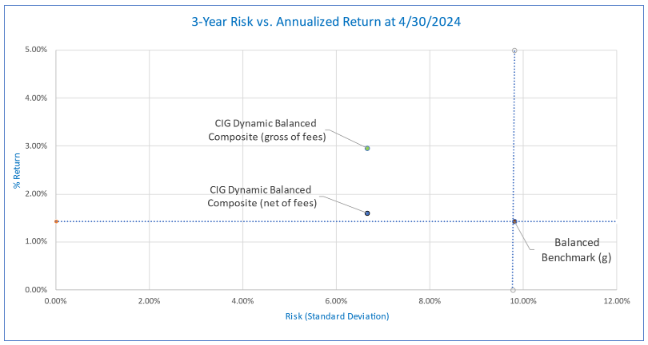

While no one can predict the future, we are currently taking less risk than the benchmarks in our managed strategies. The following chart shows the risk/return of the CIG Dynamic Balanced Composite versus the balanced benchmark for the three-year period ending April 30, 2024. Gross of fees, the balanced composite captured 207% of the benchmark’s return while only taking 68% of the Balanced Benchmark’s risk, as measured by standard deviation of returns over that 3-year period. Net of fees, the balanced composite captured 113% of the benchmark’s return. [v]

CIG Asset Management, Tamarac

The graph above illustrates the performance of the CIG Dynamic Balanced Composite over the past three years. Specifically, the annualized return of this strategy is above the horizontal dotted blue line which represents the annualized return of the balanced benchmark. Additionally, the strategy’s risk level is to the left of the vertical dotted blue line, which corresponds to the balanced benchmark’s risk. This positioning indicates good diversification: achieving higher returns than the benchmark while assuming less risk. However, achieving this balance isn’t easy, especially in a potentially euphoric market, and requires careful decision-making and strategic asset allocation.

Why are we focused on risk and what are we trying to avoid? Prolonged Downturns. Consider this graph, which first appeared in our update titled ‘What if the Bubble Bursts?’ on November 8, 2021.

CIG Asset Management, barchart.com

Imagine an investor who put their money in the S&P 500 on March 27, 2000—the peak of the dot-com boom. They would have waited 7 years to break even by May 21, 2007. Briefly, there was a window to exit and remain whole until October 31, 2007. Then came the Great Financial Crisis, requiring another 5 plus years to recover by March 4, 2013. [vi]Our Question for Investors – Are you comfortable waiting 5, 7, or even close to 13 years to break even? For those nearing retirement or relying on investments for living expenses, the answer is likely no. While this period was extraordinary, it wasn’t that long ago. And now, the AI bubble appears to have striking similarities to the dot-com era. As of April 22,2024, the information technology sector was 30.3% of the S&P 500, nearing the dot-com record of 34.8% in March 2000. [vii]

At CIG, we take a thoughtful and balanced approach to investment management. As we navigate the ever-changing economic and geopolitical landscape, our outlook remains cautiously optimistic. In this phase of the market cycle, our primary goal is to achieve returns that align with our clients’ diverse financial plans while minimizing risk. We draw inspiration from Benjamin Graham’s wisdom in his book, The Intelligent Investor. “The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go. In the end, what matters isn’t crossing the finish line before anybody else but just making sure that you do cross.”

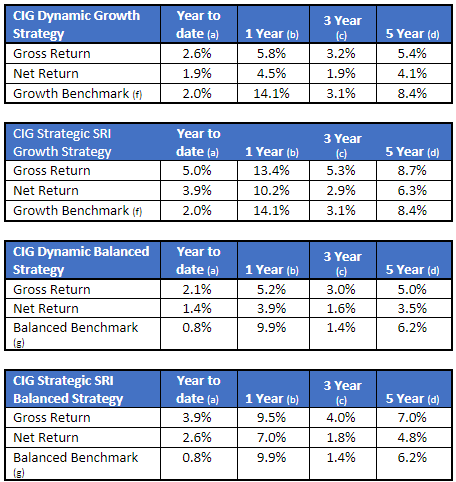

Strategy Returns as of 4/30/2024:

Performance has been attested to by ACA Group for the period August 1, 2018, through December 31, 2022.

Strategy returns are calculated independently on a daily basis and linked geometrically to produce a monthly return. Total investment performance includes realized and unrealized gains and losses, dividends, and interest. Accrual accounting is used to record interest income while dividends are recorded on a cash basis. Trade date accounting is used for calculation and valuation purposes.

Past performance is not indicative of future results.

(a) Represents performance from January 1, 2024, through April 30, 2024.

(b) Represents performance from May 1, 2023, through April 30, 2024.

(c) Represents annualized performance from May 1, 2021, through April 31, 2024.

(d) Represents annualized performance from May 1, 2019, through April 31, 2024.

(f) The Growth Benchmark is a blend of 60% Russell 3000, 25% MSCI All-Country World ex US and 15% Bloomberg US Aggregate Bond indices.

(g) The Balanced Benchmark is a blend of 45% Russell 3000, 10% MSCI All-Country World ex US and 45% Bloomberg US Aggregate Bond indices.

[i] https://fraser.stlouisfed.org/title/freddie-mac-5132/freddie-mac-announces-tougher-subprime-lending-standards-help-reduce-risk-future-borrower-default-518857

[ii] https://rpc.cfainstitute.org/en/research/financial-analysts-journal/2021/volmageddon-failure-short-volatility-products

[iii] Calculated by CIG Asset Management using data from barchart.com

[iv] Calculated by CIG Asset Management using data from finance.yahoo.com

[v] Calculated by CIG Asset Management using data from Tamarac

[vi] Calculated by CIG Asset Management using data from barchart.com

[vii] https://www.investopedia.com/best-25-sp500-stocks-8550793, https://www.bespokepremium.com/interactive/posts/think-big-blog/historical-sp-500-sector-weightings

CIG Asset Management Update: The Stock Market Rally May Be Broadening

In October 2023, we shared the CIG Asset Management Update: Year-to-Date U.S. Stock Performance in Pictures and we discussed how the Magnificent 7[i], seven mega-cap growth stocks, were driving the returns of the S&P 500.

This outperformance continued through year end as you can see in the December 31, 2023 FinViz heat map below.

Source: FinViz as of 12/31/2023

In the year, 2023, the Magnificent 7 stocks experienced an average return of +111% while the S&P 500 Index only gained +26%. The Equal-Weighted S&P 500 Index only gained +12%. If you removed the Magnificent 7 stocks from the Equal-Weighted S&P 500 Index, you would have only gained +8%. [ii]

The strong performance of the Magnificent 7 stocks has extended into 2024. As of February 29, 2024, these seven stocks have gained +12.7%, outpacing the S&P 500’s increase of +7.1% and the Equal-Weighted S&P 500 Index’s gain of +3.2%.[iii]

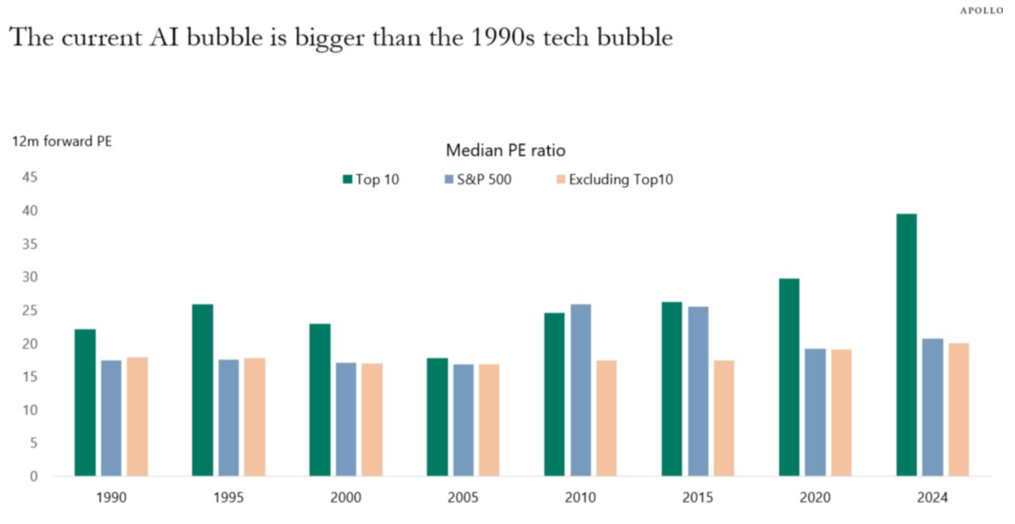

We believe the Magnificent 7 stocks are currently trading at levels considered expensive compared to historical standards. Torsten Slok, Apollo’s Chief Economist, has recently showed that when you compare the median 12-month forward price-to-earnings (PE) ratio of the top ten companies in the S&P 500, which include all of the Magnificent 7 stocks, they are much more expensive now than they were during the tech bubble of the 1990s. [iv]

Source:Bloomberg, Apollo Chief Economist. Note: Data as of January 31, 2024.

With that being said, we are seeing some encouraging signs that the stock market rally may finally be starting to broaden out. For the week ended 3/6/2024, we saw four of the Magnificent 7 stocks; Microsoft (MSFT), Apple (AAPL), Alphabet (GOOG), and Tesla (TSLA) move lower as many other stocks outside of the technology sector rose. You can see this in the March 6, 2024 FinViz heat-map below.

Source: FinViz as of 3/6/2024

While we find it encouraging to see a wider equity market participation, we still believe strongly in the value of diversification. Diversification is not supposed to maximize returns, it is designed to reduce investment risk. A diversified portfolio at times won’t keep up with the market when the bulk of returns are concentrated in a small group of stocks like the Magnificent 7. We strive to diversify our investments amongst industries and sectors, size (large-cap and small-cap), geography, growth versus value and alternative asset classes. Some of these investments are negatively correlated to the stock market – what that means is historically when the stock market traded lower – these investments gained in value. Past performance is not a guarantee of future results, but history helps guide us.

At CIG, we believe in risk-balanced investing. We believe investors should consider how much risk they are taking to achieve returns. We think that we should be striving to reach the return necessary to meet the various needs of our client’s financial plans while, at this point in the market cycle, taking as little risk as possible to meet that goal. We want you to sleep at night.

Please reach out to Brian Lasher (blasher@cigcapitaladvisors.com), Eric T. Pratt (epratt@cigcapitaladvisors.com) or the rest of the CIG team.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] The Magnificent 7 stocks are: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon.com (AMZN), Nvidia (NVDA), Tesla (TSLA), and Meta Platforms (META)

[ii] https://www.forbes.com/sites/greatspeculations/2024/01/22/2023-in-review/?sh=78aab8bd690b

[iii] Calculated by CIG Asset Management for the Roundhill Magnificent Seven ETF (MAGS) using data from finance.yahoo.com

[iv] The Daily Spark, February 25, 2024 – Apollo Academy

Update from CIG Asset Management – Wealth Destroyer – As Seen On TV

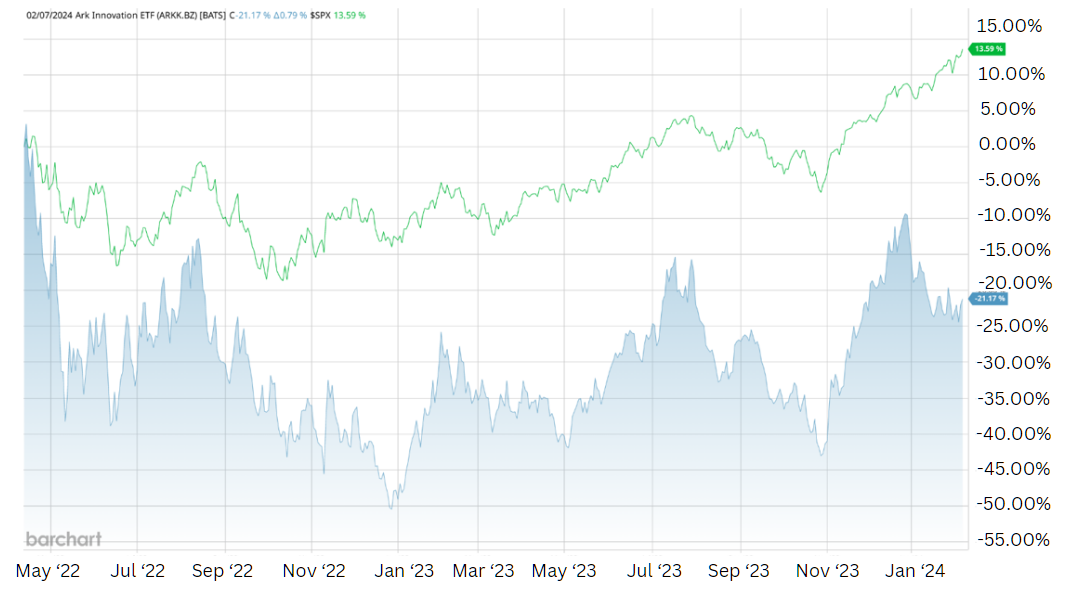

CNBC television frequently has a guest, Cathie Wood, Founder & CEO of ARK Invest. Oftentimes Cathie will tout the funds and stocks that are held in the funds she manages. On April 12, 2022, Cathie Wood said the following live on CNBC, “Over the next five years we’re expecting a 50% compound annual rate of return for the next five years.” [i]

How has the performance of ARK Invest’s Flagship Fund, the ARK Innovation ETF (ARKK), been since her bold statement in April 2022? As seen in the chart below, the shaded area representing ARKK shows a decline of -21.2% from April 12, 2022, to February 7, 2024! In contrast, the S&P 500 has gained+13.6% over this same period! [ii]

The current performance of ARRK, as indicated in the chart above, doesn’t appear to align with the 50% rate of return forecasted in her April 2022 statement. Cathie has made multiple appearances on CNBC since April 2022, and two of her latest appearances have caught our attention.

On January 23 ,2024, Cathie discussed Bitcoin ETFs and said, “This is one of the most important investments of our lifetime.” [iii] This was only 12 days after ARK Invest launched the ARK 21shares Bitcoin ETF (ARKB). [iv] ARKB has fallen -11.7% since its launch on January 11, 2024, to February 7, 2024. Bitcoin itself only fell -5.0% during that same period. A cryptocurrency investor lost over twice as much owning ARKB versus Bitcoin itself during this period of time! [v]

On February 7, 2024, Cathie appeared on CNBC’s program “Last Call”. Cathie spoke about Tesla and said, “Robo-taxis are a software as a service model” and that “EVs will be the bulk of the auto market in the next 5 years.” [vi] As of February 8, 2024, Tesla is ARKK’s second largest holding. [vii] Tesla is down -25% year-to-date as of February 7, 2024. [viii]

As you read this you may be thinking, “CIG is being very critical of Cathie Wood and her ARK Funds.” We at CIG are not alone in our criticism. Morningstar recently published a report- “15 Funds That Have Destroyed the Most Wealth Over the Past Decade”. According to Amy C. Arnott, CFA and author of the report, “The ARK family wiped out an estimated $14.3 billion in shareholder value over the 10-year period—more than twice as much as the second-worst fund family on the list. ARK Innovation alone accounts for about $7.1 billion of value destruction over the trailing 10-year period.”[ix] More importantly, this is not about Cathie Wood or ARK rather about objective data analysis versus media coverage.

We urge our clients and all investors to refrain from being swayed by the hype seen on CNBC or encountered while browsing the internet. Some guests on these platforms are “talking their book”, meaning they are trying to drum up interest in the investment that they already own, such as Tesla, as highlighted earlier. They also may offer the hope of beating the market or make grand predictions about their future performance similar to Cathy’s 50% comment. Instead, we ask investors to listen to the sage advice of Benjamin Graham, as the “father of value investing” and mentor to Warren Buffett. [x] In his book, “The Intelligent Investor” Graham wrote the following:

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”[xi]

The guests on financial channel talk shows tend to highlight their successes from the previous year and the promising opportunities they foresee for the current year, yet they often overlook discussing their less-than-successful experiences in 2022. Retail investors also occasionally exhibit this behavior. We counsel investors to understand what they are invested in – usually a diversified portfolio – and measure their results with the appropriate diversified, blended benchmark and how they are doing versus their financial plan. The rest is just noise.

Please reach out to Brian Lasher (blasher@cigcapitaladvisors.com), Eric T. Pratt (epratt@cigcapitaladvisors.com) or the rest of the CIG team.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] https://www.cnbc.com/video/2022/04/12/ark-invest-ceo-cathie-wood-says-she-expects-50-percent-compound-annual-rate-of-return-for-the-next-five-years.html

[ii] Data and chart from barchart.com

[iii] https://www.cnbc.com/video/2024/01/23/cathie-wood-on-bitcoin-etf-this-is-one-of-the-most-important-investments-of-our-lifetime.html

[iv] https://www.prnewswire.com/news-releases/the-ark-21shares-bitcoin-etf-arkb-is-available-now-302031988.html

[v] Calculated by CIG Asset Management using data from finance.yahoo.com.

[vi] https://www.cnbc.com/video/2024/02/07/ark-invest-ceo-cathie-wood-evs-will-be-the-bulk-of-the-auto-market-in-the-next-5-years.html

[vii] ARK Invest holdings data as of February 8, 2024

[viii] Calculated by CIG Asset Management using data from finance.yahoo.com.

[ix] “15 Funds That Have Destroyed the Most Wealth Over the Past Decade” – published by Morningstar 2/2/2024

[x] https://www.investopedia.com/terms/b/bengraham.asp#toc-notable-accomplishments

The Intelligent Investor, Benjamin Graham

[xi] The Intelligent Investor, Benjamin Graham, https://www.arborinvestmentplanner.com/quotes-from-the-intelligent-investor-revised-edition/ p.220

CIG Press Release: CIG Capital Advisors Announces New Advisory Board as They Posture for Growth in 2024

Contact: Joan Frank

Tel: (248) 330-0001

Email: joan@bfrankcommunications.com

www.bfrankcommunications.com

FOR IMMEDIATE RELEASE:

November 29, 2023 — Southfield, MI —CIG Capital Advisors is gearing up for major strategic growth in the upcoming years, starting with the introduction of its new CIG Advisory Board, which will play a pivotal role in advising and shaping the company’s strategic direction and future growth.

A leading independent wealth management and business advisory services firm, CIG has recruited a distinguished group of thought leaders and innovators to serve on this board, including experts in health care, financial services, investment, and international management to enrich and elevate services for the firm’s expanding client base.

The Advisory Board members include:

- Dr. Mark Kelley, MD – Chair – Former chief executive officer, Henry Ford Medical Group and senior lecturer at Harvard Medical School

- Osman Minkara – Founder and chief executive officer at CIG Capital Advisors

- Jeff Davidson – Former head of investment at Taubman Family Office and senior consultant

- Nigel Thompson – Former president and chief executive officer, Yazaki North America

- Dina Richard – Senior vice president, treasurer and chief investment officer at Trinity Health

- Dr. Raza M. Khan, MD, FACS – Senior partner at Uropartners

- Mindy Richards – Embedded health care consultant and CEO of ChangeScape, Inc.

- Dr. Samer Y. Kazziha, MD, FACC – Senior and head of Cardiovascular Consultants P.C.

The expertise of the Advisory Board will be invaluable in growing CIG’s specialized wealth management and business advisory solutions for successful entrepreneurs and senior executives. The Advisory Board will enhance CIG’s ability to deliver strategic thinking and innovative approaches to a broad range of clients looking to grow their professional or personal wealth opportunities.

“We are honored to welcome these accomplished individuals to our Advisory Board,” said Osman Minkara, founder and CEO of CIG Capital Advisors. “Their guidance and insights will be invaluable as we continue to innovate, grow, and adapt to the ever-changing wealth management and business advisory landscape. We believe that their collective wisdom will help us steer CIG toward new horizons.”

That dedication to excellence is embraced by the Advisory Board, underscoring CIG’s determination to further expand its leadership in the financial industry. “As advisory board members, our mission is to drive innovation and bring about positive change through collective expertise and collaboration,” says Dr. Mark Kelley. “We aim to stay ahead of the curve by anticipating trends and proactively addressing challenges.”

CIG Capital Advisors has built robust integrated services that elevate the client experience. Serving as their clients’ trusted partner, CIG is committed to providing unique solutions to complex problems and to guiding clients on their individualized financial journeys. That forward thinking will drive the firm’s growth in the years ahead, as they offer robust guidance and expertise with the same personalized attention that sets CIG apart from the crowd.

About CIG Capital Advisors

Founded in 1997, CIG Capital Advisors (CIG) is a wealth management and business advisory services firm serving high-net-worth clients—enabling these individuals and families to focus on what is most important to them. CIG tailors its delivery of service based on the situation, goals, and aspirations of each client it works with. The firm seeks to provide exceptional client benefit through its independent, objective, and transparent strategic thinking and implementations. CIG is based in Southfield, MI.

For more information on CIG Capital Advisors visit cigcapitaladvisors.com. Media inquiries contact Joan Frank at B. Frank Communications at (248) 330-0001 or joan@bfrankcommunications.com.

Advisory Board

Image: Conny Schneider/Unsplash

CIG Asset Management Update: Year-to-Date U.S. Stock Performance in Pictures

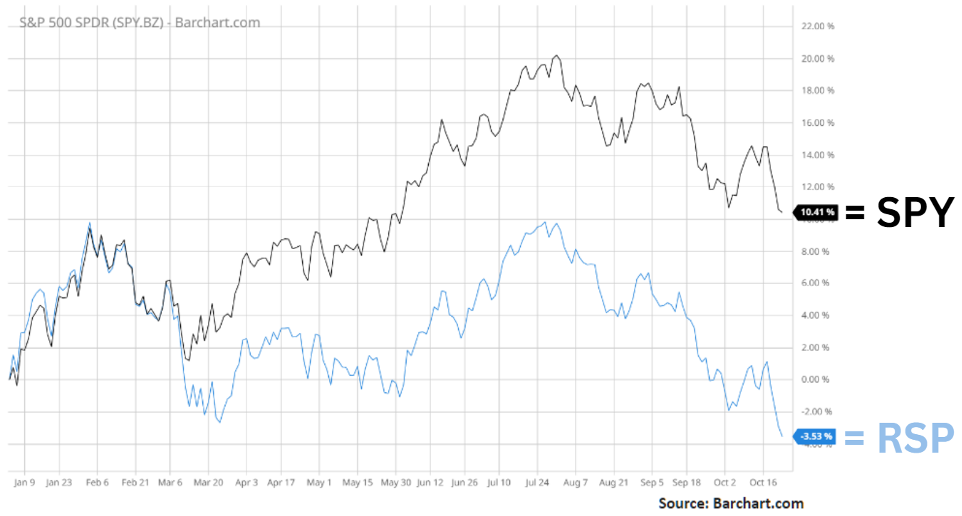

The chart below shows the year-to-date performance through October 20, 2023, of the market cap-weighted S&P 500 – represented by the SPDR S&P 50 ETF (SPY) gaining +10.4% versus the equal-weighted S&P 500 – represented by the Invesco S&P 500 Equal Weight ETF (RSP) falling -3.5%. [i]

Source: Barchart.com

Why is there such a big difference in returns between the two indices?

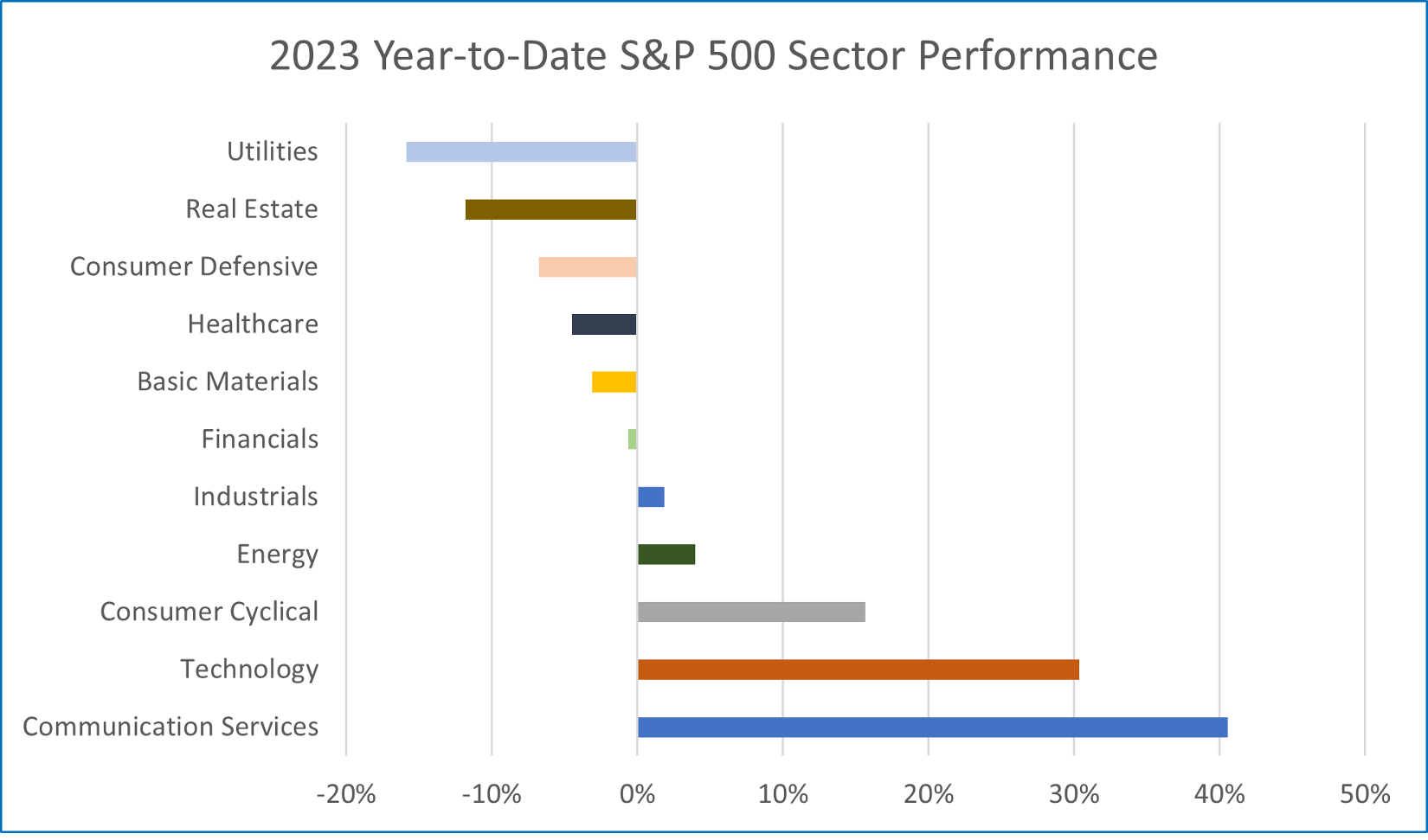

Year-to-date through October 24, 2023, the performance of the stock market and its 11 major S&P sectors may best be described as the battle between the “haves” and the “have nots”.

Three sectors, Communication Services, Technology, and Consumer Cyclicals are outperforming the other eight by a wide margin. As seen in the chart below, six sectors are down year-to-date.

Source: FinViz.com as of October 24, 2023

What is driving the performance of the three outperforming sectors? Why is performance so skewed?

The answer to why there is such a big difference in returns between the equal-weighted S&P 500 and the size-weighted S&P 500 and in returns between sectors lies in this heat map which shows all 500 companies that are included in the S&P 500. [ii]

Source: FinViz.com as of October 24, 2023

The answer lies with the seven large bright green boxes with their symbols circled in yellow. All seven of these stocks are in one of the three outperforming sectors previously identified on the S&P 500 Sector Performance bar chart. Bank of America analyst Michael Hartnett has called this group of seven stocks the “Magnificent 7”.[iii] Currently, over 25% of the S&P 500’s total market capitalization is in these Magnificent 7 stocks. [iv]

According to Torsten Slok, Chief Economist at Apollo Asset Management, “The bottom line is that returns this year in the S&P 500 have been driven entirely by returns in the seven biggest stocks, and these seven stocks have become more and more overvalued.”[v] Apollo Asset Management manages over half a trillion dollars in assets.

Why is this so remarkable and when will this situation end?

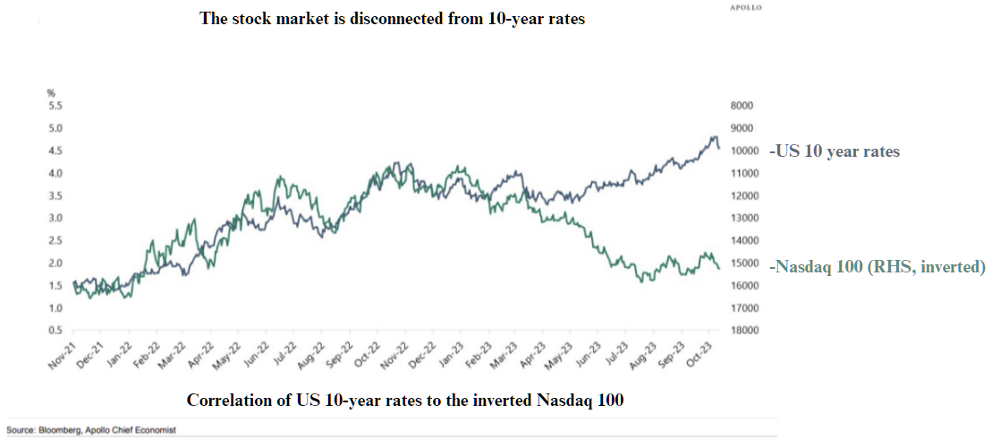

Slok concludes that “tech valuations are very high and inconsistent with the significant rise in long-term interest rates… In short, something has to give. Either stocks have to go down to be consistent with the current level of interest rates. Or long-term interest rates have to go down to be consistent with the current level of stock prices.”[vi]

Year-to-date through September 30, if you invested in a DIVERSIFIED portfolio with 60% invested in the Equal Weighted S&P 500 (RSP) and 40% invested in Bloomberg Barclay Aggregate Bond Index (AGG), you would have generated lower returns than if one chased only these Magnificent 7 stocks. [vii]

Some investors might describe us at CIG as being bearish because we don’t find the Magnificent 7 attractive, but we’re not so pessimistic as to believe there are only seven growth opportunities in the entire global equity market. In particular, we feel that we have identified an investment theme for long-term investors.

We are beginning to allocate money into Clean Transition Investing – a theme where one invests in different areas that work towards net zero emissions, or clean energy. The Paris Agreement of 2015 outlined the long-term goal of reaching net zero emissions by the year 2050.[viii] Fixing the electrical grid, focusing on renewable energy, hydrogen, energy storage, electric vehicles and the required infrastructure that goes along with them, sustainable mining, and smart agriculture are just examples of what need to be worked on.

While the eventual changing of sector leadership across cycles tends to be accompanied by significant market volatility, we will be there to guide you through these changes. CIG’s goals are to provide a financial roadmap for our clients and their families – over both near-term and long-term time horizons – as we implement structures to potentially increase protection of your assets and optimize investment risks and returns, and aid in the creation of legacy platforms.

We would welcome a conversation with you regarding how we can help you navigate these interesting times. We would like to hear from you. Please reach out to Brian Lasher (blasher@cigcapitaladvisors.com), Eric T. Pratt (epratt@cigcapitaladvisors.com) or the rest of the CIG team.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Data from Barchart.com as of October 20, 2023

[ii] The S&P 500 is a size-weighted index – the larger the size of the box, the larger the impact on the returns of the index.

[iii] The ”Magnificent 7” stocks are Apple (AAPL), Microsoft (MSFT), Nvidia (NVDA), Alphabet (GOOG), Meta Platforms (META), Amazon (AMZN) and Tesla (TSLA). https://www.nasdaq.com/articles/the-easiest-way-to-remember-the-magnificent-7-stocks-and-why-you-should-care

[vi] Calculated by CIG using data from https://www.slickcharts.com/sp500 as of 10/24/2023

[v] The Daily Spark, published by Apollo 10/18/2023

[vi] The Daily Spark, published by Apollo 10/18/2023

[vii] https://www.fool.com/investing/2023/07/31/mama-ant-helps-you-recall-the-magnificent-7-stocks/

[viii] https://www.un.org/en/climatechange/paris-agreement

Image: Silviu Zidaru/Unsplash

Find Your Optimal Staffing Level

If your practice has too few staff members, patient care may suffer and collections may slow down. If you have too many, you’ll face rising operational costs. Is there an optimal level that will allow you to operate your practice efficiently without letting your costs get out of control and creating dissatisfaction among patients?

Start by using medical industry benchmarks for comparison. Various organizations collect a wide variety of data on staffing levels. You’ll want to compare apples to apples, so it’s important that you use data from practices similar to yours in terms of practice area(s), size, annual revenues, and the number of physicians employed. It’s also important to follow the same methods used in the survey when determining your practice’s numbers for comparison.

Look at These Key Benchmarks

Two benchmarks you should look at are the average number of support staff per full-time-equivalent (FTE) physician and the percentage of gross practice revenue used for support staff salaries. The first benchmark is the number of full-time staff (not including mid-level providers) required to support one full-time physician. The percentage of gross revenue is total staff salary expense divided by gross revenue over the same period.

Be Ready To Adjust

If your physicians see more or fewer patients daily than the average patient load, you’ll likely want to compensate for that difference when you compare your practice with benchmarks. Looking at the number of patient visits per year or week or the gross charges per physician can help you gauge your support staff to FTE physician ratio. Similarly, your practice may require more support staff than a benchmark indicates if your ratio of mid-level providers to physicians is higher than a benchmark survey suggests. By the same token, your need for support staff may be lower if you have no mid-level providers.

Start by using medical industry benchmarks for comparison.

We Can Help

To schedule a complimentary consultation with a CIG Capital Advisors professional, click here.

Article Links:

https://www.medicaleconomics.com/view/making-medicine-better-for-women

https://insidexpress.com/lifestyle/health/the-only-guide-that-make-hiring-for-your-private-medical-practice-easy/

https://www.ama-assn.org/practice-management/private-practices/tips-help-private-practices-lessen-sting-staffing-shortages

images: iStock by Getty Images

Practice Resolutions for the New Year

The end of the year is a time for reflection. It’s also a chance to apply the lessons of the past going forward. If one of your 2022 goals is to improve the operational, administrative, and financial aspects of your medical practice, here are some ideas you might be able to incorporate in your list of New Year’s resolutions.

Review Current Patient Service Approaches

The delivery of superior patient service takes leadership and commitment to patient needs. You can resolve to use staff meetings and personal example in the coming year to reinforce your practice’s values concerning patient treatment and care.

Superior care translates into high rates of patient satisfaction. Patient surveys have been found to be a particularly effective tool in providing feedback regarding a wide range of patient care and customer service issues.

Monitor Financial Performance Regularly

Tracking your practice’s financial results during the year allows you to identify trends and make changes as needed.

You may want to put a dedicated staff member in charge of focusing on several key indicators or metrics, such as your practice’s collection rate, overhead percentage, and number of office visits. These indicators should be reviewed at regular intervals as the year progresses.

We can help you interpret what the numbers are saying and see the big picture. Staying on top of performance throughout the year can enhance your practice’s financial management.

Improve Collections and Billing

Finding a way to streamline and simplify payment for services rendered may be a goal for your practice in the coming year. One approach that can work to reduce both billing expenses and collection difficulties: Have your receptionist ask for copays before your patients leave your office – or even better, when they arrive.

Ensuring that you bill for all of your hospital services in the coming year is another worthwhile resolution. When you are seeing patients at a hospital, be sure to make a record of your work promptly and transmit the information to your billing staff. Though it’s more efficient to call your billing office immediately after you complete procedures, if that’s not feasible, create electronic or written notes for later use by your billing staff.

Establish a process for following up on unpaid accounts. Make follow-up calls within a certain number of days of when services were provided or when the original bill was due.

Establish a Training Plan

Staff training can pay off in increased productivity, improved morale, and a more efficient operation. Look into what ways your support and administrative staff could benefit from training, seminars, and other educational opportunities. Budget for a specific dollar amount to be spent on staff development each year. Online seminars and training sessions can be a cost-effective alternative.

Plan for Capital Expenditures

As you prepare your budget, identify the equipment you intend to replace and set priorities for the systems and technologies your practice will need going forward. Determine what, if any, areas in your current facility need to be remodeled or expanded.

Preparing a detailed plan with a very specific timetable for achieving goals can help you clarify what needs to be done to keep your practice competitive.

We can help identify and prioritize the measures that will help your practice run more efficiently in the coming year. Please contact us for assistance.

Finding a way to streamline and simplify payment for services rendered may be a goal for your practice in the coming year.

To schedule a complimentary consultation with a CIG Capital Advisors professional, click here.images: iStock by Getty Images

Easing into Retirement

Given the physical and emotional demands of their profession, it’s little wonder that some physicians look forward to retirement. However, many other doctors nearing retirement age are reluctant to turn their backs completely on their profession and would rather find a way to ease into retirement.

What should you do if retirement is on the horizon, but you would prefer to transition gradually into retirement by working part-time? Here are some things to consider if you are thinking of cutting back on your work hours.

Review Your Finances

First off, determine if you can afford the reduction in earnings that reducing your work hours will entail. Pay particular attention to any debt you are carrying (mortgages, etc.). Ideally, you don’t want to be overly burdened with debt once you are no longer practicing full-time.

A review of your current net worth can give you a clearer picture of your overall financial standing. Net worth takes into account the value of all your assets as well as your outstanding liabilities.

If you’ve been funding a tax-favored retirement plan, hopefully you have accumulated sufficient assets to provide a steady stream of income for all the years you may be retired. If you still haven’t met your goal, you’ll want to determine if your earnings from part-time work will allow you to comfortably continue adding contributions to your retirement plan. You’ll also want to determine when you can start taking penalty-free withdrawals from your plan(s) and project what your tax situation will look like. These are all issues we can help you assess.

Look at Your Options

If you are part of a multi-physician practice, talk to your colleagues about what arrangements can be made for you to start cutting back your hours. You may need to revise your practice agreement to incorporate a new compensation arrangement. Typically, such arrangements are based on the productivity of the part-time physician less a share of practice overhead expenses.

If you are a solo practitioner, you may find it hard to practice part-time without creating problems with your current patient base. Patients may feel that you can’t deliver the type of patient care they expect if you are practicing part-time. Bringing in a physician assistant may be helpful. However, recruiting another physician who would eventually take over the practice may be the most effective route for solo practitioners.

Give careful consideration to the financial arrangements you make with the new physician. When it comes time to sell, you’ll want to have a formal purchase agreement that outlines all of the rights, obligations, and responsibilities of the buyer(s) and the seller. It should also include a valuation of the practice.

Consider Malpractice Insurance

Don’t ignore the issue of malpractice insurance when you are weighing the pros and cons of going part-time. You need to be certain you will be covered during your part-time years and after you stop practicing completely. “Tail coverage” can protect you against any malpractice claims that may be filed against you after you retire.

We Can Help with Retirement Planning

Whether you are serious about transitioning to part-time work or are simply exploring your options, be sure to consult with us. We can help you run the numbers and evaluate your financial preparedness for retirement.

If you are part of a multi-physician practice, talk to your colleagues about what arrangements can be made for you to start cutting back your hours.

To schedule a complimentary consultation with a CIG Capital Advisors professional, click here.

images: iStock by Getty Images

Exiting Your Practice? Important Issues to Consider

Providers exit their practices for a variety of reasons — dissatisfaction with the demands of running a business, the desire for a less strenuous work schedule, frustration with insurers, retirement. If you are thinking about exiting your practice, there are several steps you should take now that will help you maximize the purchase price and ensure a relatively smooth transaction.

Lay the Groundwork

Start by taking a critical look at your practice’s current financial condition. Identify areas of weakness. For example, does your practice experience poor collections or weak cash flow? How do your staffing levels compare to those of similar practices? Issues such as these can reduce the appeal of your practice. It’s to your benefit to deal with them well before you put your practice on the market.

You’ll want to have a realistic appraisal of your practice’s potential worth before you put it up for sale. Tangible assets, such as health care equipment, computers, and furniture, are relatively easy to value, though they generally make up only a small part of a health care practice’s total value. Goodwill is an intangible asset that can be difficult to value. But there are methods that can be used to establish a reasonable estimate. Some other widely used methods include the discounted cash flows and market multiples methods.

Identify Potential Buyers

You may receive an unsolicited offer. If you don’t, consider reaching out locally or contacting a broker who specializes in exiting health care practices. An experienced broker can identify and contact qualified potential buyers.

The speed with which a sale may occur will largely depend on the deal you’re seeking. Do you want a buy-out that will let you continue to practice as an employee? In that case, looking for a group practice, hospital, or other corporate buyer may be the best route. If the sale goes through to one of these entities, you will be able to continue to work in health care without the responsibilities of ownership.

If retirement is your goal, you may opt for a gradual buy-in by a provider who will take over your practice. Typically, this arrangement requires you to employ the prospective buyer and, under the terms of the deal, after a trial period of a year or two, offer a partnership with a documented exit arrangement for you. This arrangement could be in the form of a severance package.

Review All Offers Carefully

If you receive an offer, your focus should be on the would-be buyer’s financial condition and the payment terms if you plan on retiring. If you plan to continue working at the practice with the individual or entity who may buy it, you should carefully review all ramifications, including transfer expenses and malpractice terms involved in the sale.

Apart from satisfying yourself about the financial and legal issues involved in the sale, you should also feel that you will be able to fit into the potential buyer’s organization and that your advice and input will be welcomed.

Remember, whatever way your practice’s sale is structured, there will be tax implications. Let us help you secure the most tax-advantageous sale terms. Please contact us if you would like assistance.

The speed with which a sale may occur will largely depend on the deal you’re seeking.

We Can Help

To schedule a complimentary consultation with a CIG Capital Advisors professional, click here.

Dental tools photo: Succo/Pixabay

Stethoscope photo: Julio César Velásquez Mejía/Pixabay

Maximize Revenues and Trim Expenses by Streamlining Practice Operations

Improving operational efficiencies should be an ongoing process for all medical practices. Reevaluating and examining existing procedures can help identify areas of weakness that can drain revenues and increase costs, lowering the bottom line. The following suggestions may help jump-start your own thoughts about ways you can maximize your practice’s revenue stream and reduce costs without sacrificing patient care.

Keep Coding Current

Miscoding is expensive: It can reduce reimbursements and cause delays or denied claims. Miscodes are often due to old data, under coding to avoid penalty risk, or leaving coding decisions to inexperienced support staff.

For more accurate coding, maintain updated coding manuals and software, keep a code reference summary handy in exam rooms, and use online coding resources. If you make notes during each patient visit, you’ll be able to bill more accurately. Taking coding refresher courses will help your staff stay current with coding practices.

Finally, periodic assessments of your practice’s coding accuracy can help uncover problem areas. These assessments could include a review of your practice’s forms and a comparison of billing codes with the actual services that were provided.

Improve Employee Productivity

Consider these ideas for improving productivity:

-

-

- Set productivity goals and offer incentives to your staff for reaching those goals

- Delegate administrative functions (ensure that physicians spend most of their day doing only what physicians can do)

- Plan patient flow so that physician and medical assistant billable time is maximized

-

Exercise More Efficient Control over Staff Time

It is often possible to trim overtime expenses without reducing the quality of patient care. Start by reviewing the payroll records of your non-exempt employees to determine who worked overtime and why. Find out if your practice was fully staffed and simply busy or if it was short one or more employees on the days when the overtime occurred. If overtime was necessary because you were short-staffed, see if this was due to vacations or some other controllable situation. It may be time to revise your practice’s policy on vacation time if scheduled time off was the cause of the jump in overtime.

Update Fee Schedules

Patients can be price conscious and resistant to fee increases. Nevertheless, if your practice hasn’t raised fees in some time, you may want to consider appropriate increases. In addition, you should periodically examine the reimbursement rates of all the plans you participate with and reevaluate whether it makes economic sense to continue accepting patients from some of the ones that reimburse poorly.

Improve Your Purchasing Practices

Medical and office supplies can be a significant part of a practice’s expenses. Busy practices may take the path of least resistance and continue ordering from the vendors that have always supplied them. That can be an expensive mistake. Choose several of your practice’s “high-volume” items and find out how much other vendors are charging. Use that information to negotiate lower prices with your current suppliers, consolidate orders with fewer vendors, or switch to new suppliers to save money.

We Can Help

We can help you identify areas where streamlining operations may help optimize your practice’s bottom line. Please call.

. . . if your practice hasn’t raised fees in some time, you may want to consider appropriate increases.

To schedule a complimentary consultation with a CIG Capital Advisors professional, click here.