Update from CIG Asset Management: Extremes May Create Opportunities

The stock market rally continues. Through June 13, 2024, the S&P 500 has gained +14.7% year-to-date and we still haven’t seen a single-day decline of over 2% in 479 days, the third longest stretch in the past 25 years. [i] We wrote about this extraordinary winning streak in last month’s update, Where are we now?

This year, some investors who have a diversified portfolio that owns many stocks across many sectors, may feel like they are missing out on the current rally. They may see on CNBC or read in the Wall Street Journal that the market is at its all-time high, yet their own portfolio is not.

Closely examining the following extreme market internals; narrow sector performance, large market cap outperformance and S&P 500 index concentration can help explain what is happening beneath the surface.

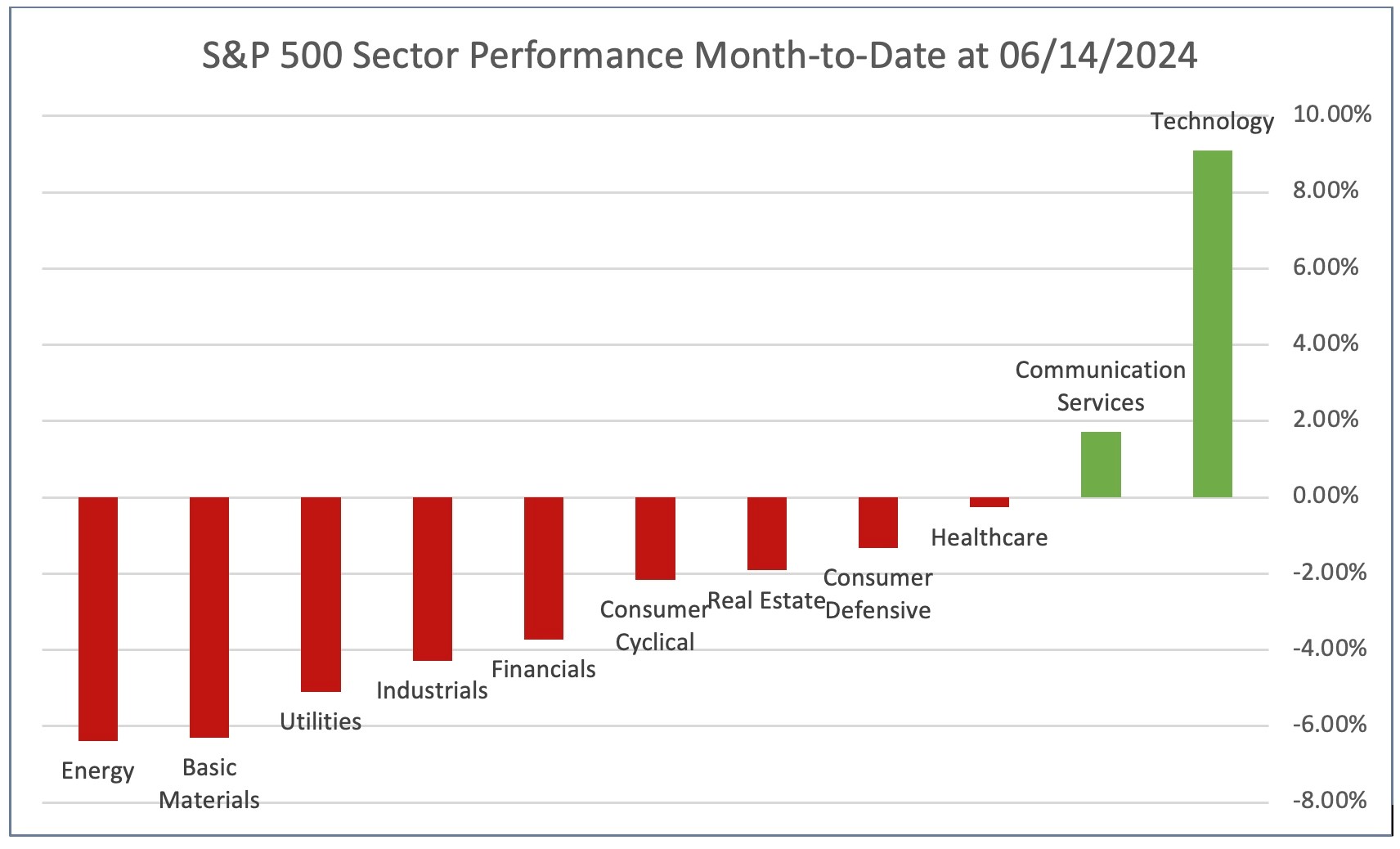

Sector performance is narrowing again. In our CIG Asset Management Update on April 1, 2024, we discussed encouraging signs that the stock market rally may be broadening. We may have been early on that call. As you can see in the chart below, month-to-date at June 14, 2024, the technology sector has gained +9.1%, communication services – which is mostly comprised of Meta and Google – advanced +1.7%, and the other nine of the eleven S&P 500 sectors were all down. [ii]

Chart by CIG Asset Management using data from FinViz

Chart by CIG Asset Management using data from FinViz

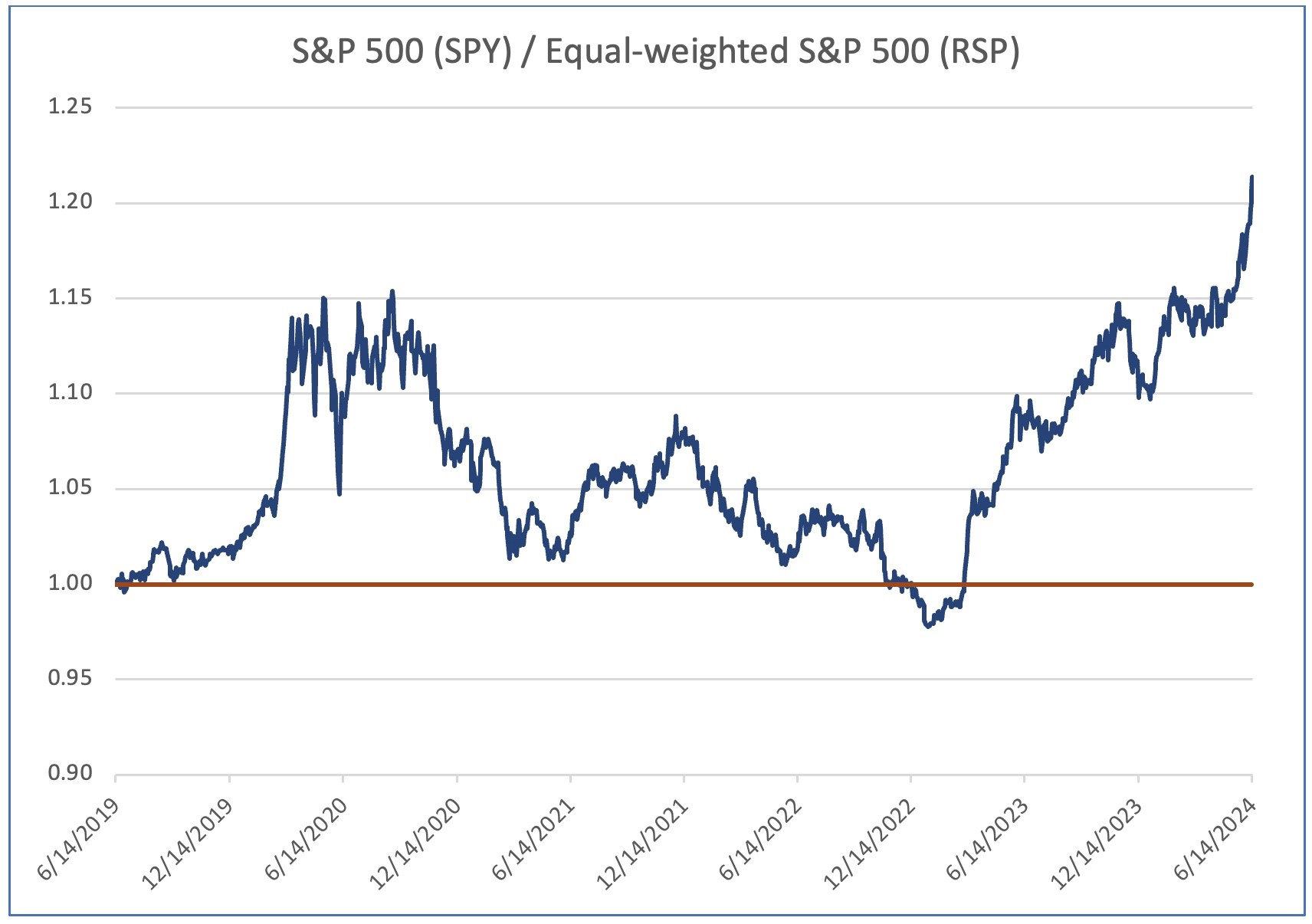

Large market-cap out performance. The S&P 500 index is weighted by market capitalization– that is, the larger the total value of the company, the higher the weighting in the index. It’s currently experiencing historic outperformance versus the equal-weighted S&P 500. In fact, while the S&P 500 – represented by the SPDR S&P 500 ETF Trust (SPY) has advanced +14.6% year-to date through 06/14/2024, the equal-weighted S&P 500 500 – represented by the Invesco S&P 500 Equal Weight ETF (RSP) is only up +4.2%. [iii] .

The following chart shows the relative performance of the market-cap weighted S&P 500 (SPY) versus the equal-weighted S&P 500 (RSP) for the 5-year period ending June 14, 2024. When the blue line is below 1.0, RSP is outperforming SPY. As you can clearly see, this has been a rarity over the past five years.

Chart by CIG Asset Management using data from Barchart.com.

Chart by CIG Asset Management using data from Barchart.com.

The slope of the blue line has recently been increasing – this indicates that the outperformance is widening. This tells us that the larger companies are outperforming the smaller companies. What companies are outperforming? The answer is large-cap stocks in the technology sector, and we believe their returns are being driven by the hopes that Artificial Intelligence (AI) will contribute massive revenues and earnings to this sector.

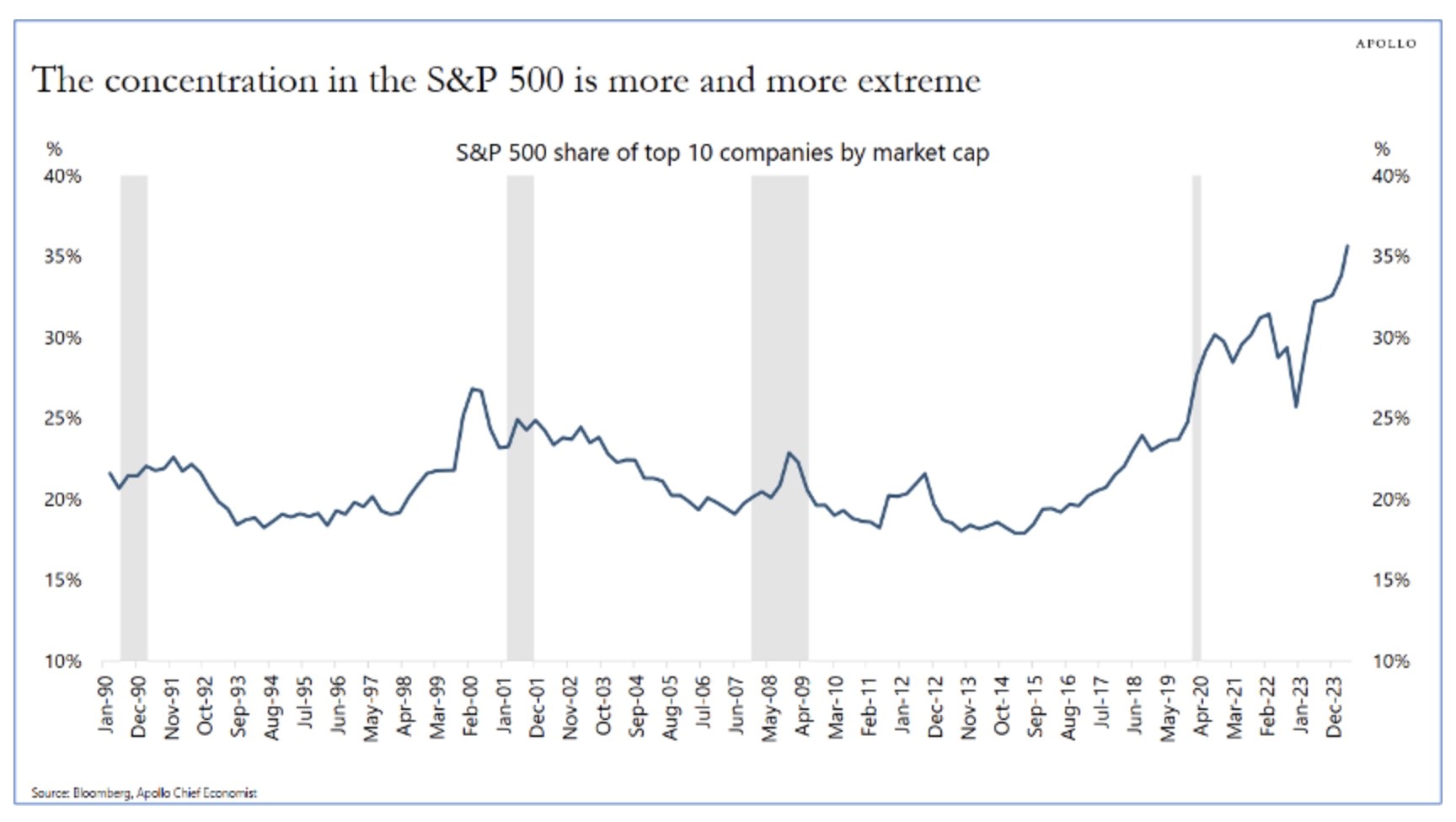

S&P 500 index concentration. On June 9, 2024, Apollo Chief Economist Torsten Slok posted the following chart in The Daily Spark.

Source: Apollo The Daily Spark 06/09/2024

Source: Apollo The Daily Spark 06/09/2024

Currently, ten out of the 500 stocks in the S&P 500 account for over a third of its total value. These high-growth stocks have been major contributors to recent S&P 500 returns. Such extreme concentration is rare. Only three of those ten largest companies are outside of the Technology or Communications sectors: Berkshire Hathaway, Eli Lilly and JP Morgan. [iv] This is great when the top ten are moving higher and add excess returns to the market cap weighted S&P 500 index but can have the opposite effect if the hopes that AI will produce enormous profits for the companies involved does not prove to be true.

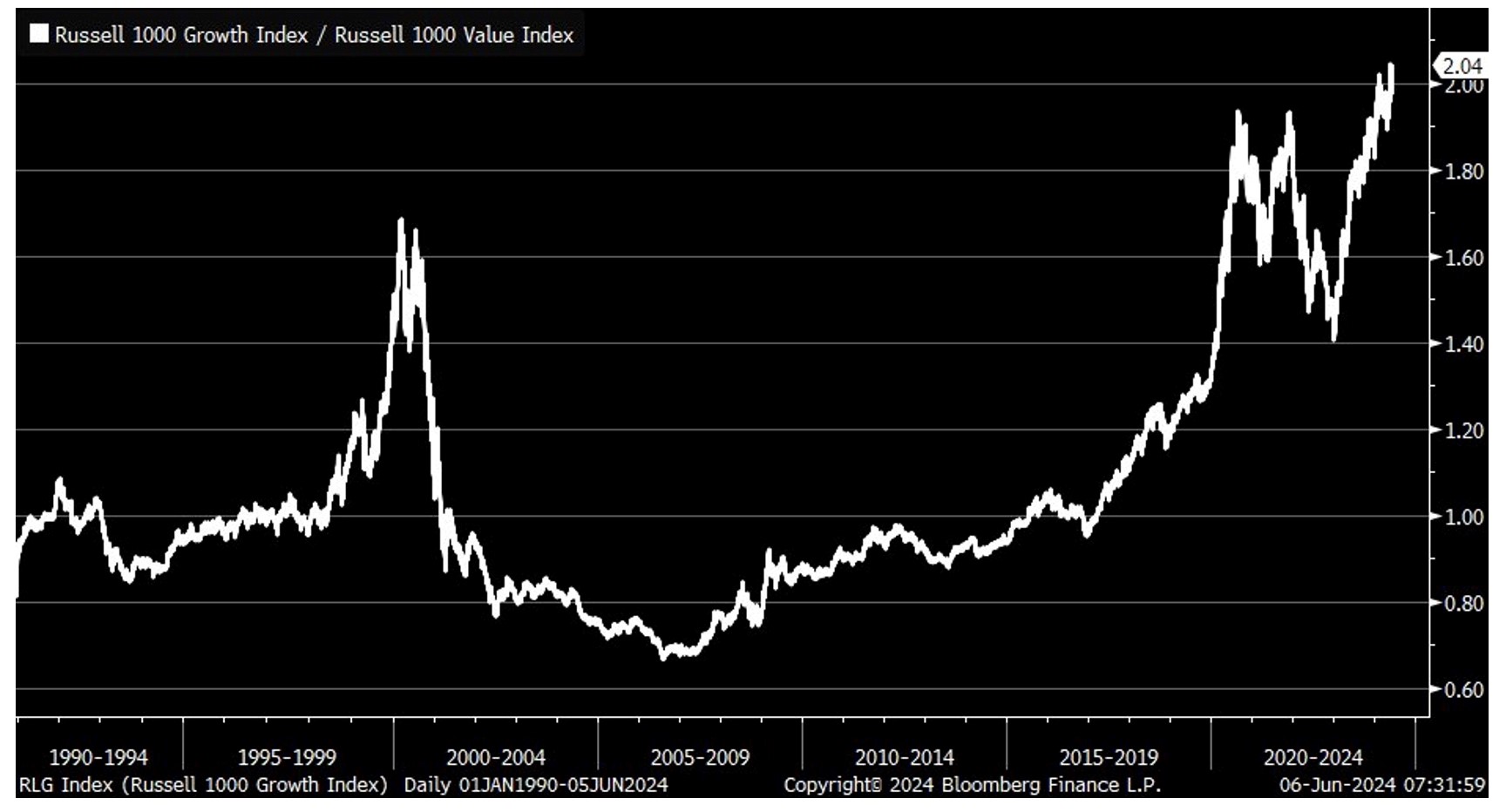

Growth versus Value. The following chart shows the ratio of the indexed returns of the Russell 1000 Growth Index and the Russell 1000 Value Index. The Russell 1000 Growth Index is currently outperforming the Russell 1000 Value Index by the biggest margin in decades! As of June 14, 2024, nine of the top ten stocks in the iShares Russell 1000 Growth ETF – which tracks the index – were technology related stocks and were a total of 53%, of the index. [v]

Source: Bloomberg 06/06/2024

Source: Bloomberg 06/06/2024

1. Value may once again outperform growth. The significant spike in the year 2000 during the dot-com bubble serves as a historical reference. Right now, we’re witnessing another surge in large-cap technology stocks, which we attribute to an AI bubble. In 2000, after the dot-com bubble burst, value stocks outperformed growth stocks. We’ve strategically positioned our clients’ portfolios to potentially benefit from this trend if the AI bubble deflates.

2 Profit-Taking and Rebalancing: When a sector or set of stocks significantly outperforms, we consider taking profits and rebalancing client portfolios. This can be an attractive exit point. We will look for tax harvesting opportunities as well as we rebalance.

3. Buying Opportunities: Conversely, when a sector or set of stocks underperforms, it may present an opportune entry point. To take advantage of this opportunity, we look to add positions before a sector recovers.

4. Contrarian Approach: Small-cap stocks and value stocks, often overlooked during market extremes, might be particularly appealing to contrarian investors right now. Year-to-date through [June 14, 2024], the Russell 2000 index of small-cap stocks is down -1.0%. [vi]

In navigating these market dynamics, we recognize that extremes can create opportunities. Whether it’s profit-taking, rebalancing, or adopting a contrarian approach, staying informed and maintaining an active management strategy will be crucial. In doing so, we continue to manage diversified strategies for the long run.

Please reach out to Brian Lasher (blasher@cigcapitaladvisors.com), Eric T. Pratt (epratt@cigcapitaladvisors.com) or the rest of the CIG team.

[i] Calculated by CIG Asset Management using data from finance.yahoo.com

[ii] Calculated by CIG Asset Management using data from finance.yahoo.com

[iii] Calculated by CIG Asset Management using data from finance.yahoo.com

[iv] Calculated by CIG Asset Management using data from finance.yahoo.com

[v] https://www.ishares.com/us/products/239706/ishares-russell-1000-growth-etf

[vi] Calculated by CIG Asset Management using data from finance.yahoo.com

CIG Asset Management Update: Where are we now?

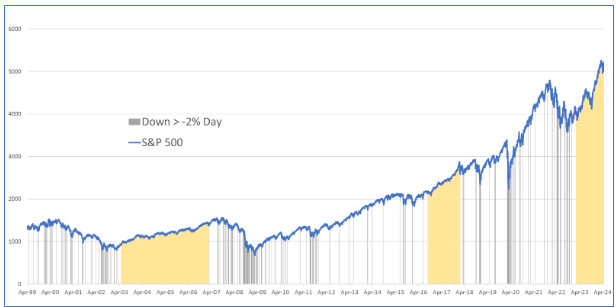

The S&P 500 currently is experiencing its third longest period in the past 25 years without a single-day decline of over 2%. Yes, including last month. The graph below depicts the past 25 years, highlighting every day when the S&P 500 fell over 2% (indicated by black vertical lines). These occurrences aren’t rare.

Chart by CIG Asset Management using data from barchart.com

The mustard-colored shaded areas represent extended periods without a 2% down day. The first yellow shaded area, 1,380 days, (from May 20, 2003, to February 27, 2007) coincided with Freddie Mac’s announcement that they would no longer buy sub-prime mortgages. [i] This marked the beginning of the great financial crisis, leading to a significant stock market drawdown over the next two years. The second longest period was 511 days, (September 12, 2016, to February 1, ) This calm period in the market ended with what became known as Volmaggedon – an event where many structured products that bet against stock market volatility lost over 90% of their value. [ii] The most recent shaded area began on February 21, 2023, and continues beyond May 9, . (443 days as of this writing) [iii] Notably, despite the S&P 500 falling -4.1% in April 2024, we still didn’t experience a single -2% down day.[iv] History teaches us that long quiet periods can often precede sudden volatility and drawdowns.

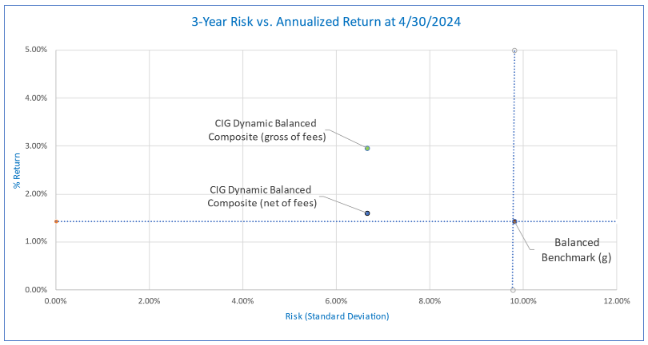

While no one can predict the future, we are currently taking less risk than the benchmarks in our managed strategies. The following chart shows the risk/return of the CIG Dynamic Balanced Composite versus the balanced benchmark for the three-year period ending April 30, 2024. Gross of fees, the balanced composite captured 207% of the benchmark’s return while only taking 68% of the Balanced Benchmark’s risk, as measured by standard deviation of returns over that 3-year period. Net of fees, the balanced composite captured 113% of the benchmark’s return. [v]

CIG Asset Management, Tamarac

The graph above illustrates the performance of the CIG Dynamic Balanced Composite over the past three years. Specifically, the annualized return of this strategy is above the horizontal dotted blue line which represents the annualized return of the balanced benchmark. Additionally, the strategy’s risk level is to the left of the vertical dotted blue line, which corresponds to the balanced benchmark’s risk. This positioning indicates good diversification: achieving higher returns than the benchmark while assuming less risk. However, achieving this balance isn’t easy, especially in a potentially euphoric market, and requires careful decision-making and strategic asset allocation.

Why are we focused on risk and what are we trying to avoid? Prolonged Downturns. Consider this graph, which first appeared in our update titled ‘What if the Bubble Bursts?’ on November 8, 2021.

CIG Asset Management, barchart.com

Imagine an investor who put their money in the S&P 500 on March 27, 2000—the peak of the dot-com boom. They would have waited 7 years to break even by May 21, 2007. Briefly, there was a window to exit and remain whole until October 31, 2007. Then came the Great Financial Crisis, requiring another 5 plus years to recover by March 4, 2013. [vi]Our Question for Investors – Are you comfortable waiting 5, 7, or even close to 13 years to break even? For those nearing retirement or relying on investments for living expenses, the answer is likely no. While this period was extraordinary, it wasn’t that long ago. And now, the AI bubble appears to have striking similarities to the dot-com era. As of April 22,2024, the information technology sector was 30.3% of the S&P 500, nearing the dot-com record of 34.8% in March 2000. [vii]

At CIG, we take a thoughtful and balanced approach to investment management. As we navigate the ever-changing economic and geopolitical landscape, our outlook remains cautiously optimistic. In this phase of the market cycle, our primary goal is to achieve returns that align with our clients’ diverse financial plans while minimizing risk. We draw inspiration from Benjamin Graham’s wisdom in his book, The Intelligent Investor. “The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go. In the end, what matters isn’t crossing the finish line before anybody else but just making sure that you do cross.”

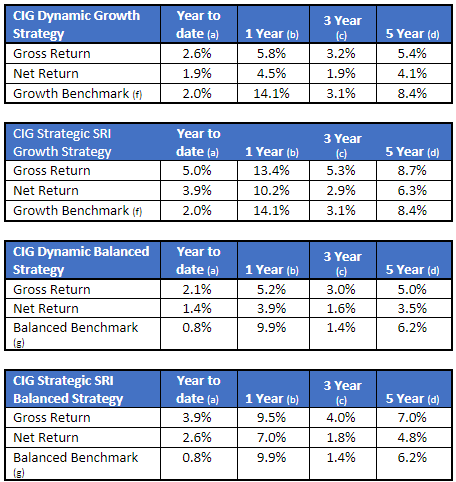

Strategy Returns as of 4/30/2024:

Performance has been attested to by ACA Group for the period August 1, 2018, through December 31, 2022.

Strategy returns are calculated independently on a daily basis and linked geometrically to produce a monthly return. Total investment performance includes realized and unrealized gains and losses, dividends, and interest. Accrual accounting is used to record interest income while dividends are recorded on a cash basis. Trade date accounting is used for calculation and valuation purposes.

Past performance is not indicative of future results.

(a) Represents performance from January 1, 2024, through April 30, 2024.

(b) Represents performance from May 1, 2023, through April 30, 2024.

(c) Represents annualized performance from May 1, 2021, through April 31, 2024.

(d) Represents annualized performance from May 1, 2019, through April 31, 2024.

(f) The Growth Benchmark is a blend of 60% Russell 3000, 25% MSCI All-Country World ex US and 15% Bloomberg US Aggregate Bond indices.

(g) The Balanced Benchmark is a blend of 45% Russell 3000, 10% MSCI All-Country World ex US and 45% Bloomberg US Aggregate Bond indices.

[i] https://fraser.stlouisfed.org/title/freddie-mac-5132/freddie-mac-announces-tougher-subprime-lending-standards-help-reduce-risk-future-borrower-default-518857

[ii] https://rpc.cfainstitute.org/en/research/financial-analysts-journal/2021/volmageddon-failure-short-volatility-products

[iii] Calculated by CIG Asset Management using data from barchart.com

[iv] Calculated by CIG Asset Management using data from finance.yahoo.com

[v] Calculated by CIG Asset Management using data from Tamarac

[vi] Calculated by CIG Asset Management using data from barchart.com

[vii] https://www.investopedia.com/best-25-sp500-stocks-8550793, https://www.bespokepremium.com/interactive/posts/think-big-blog/historical-sp-500-sector-weightings

CIG Asset Management Update: The Stock Market Rally May Be Broadening

In October 2023, we shared the CIG Asset Management Update: Year-to-Date U.S. Stock Performance in Pictures and we discussed how the Magnificent 7[i], seven mega-cap growth stocks, were driving the returns of the S&P 500.

This outperformance continued through year end as you can see in the December 31, 2023 FinViz heat map below.

Source: FinViz as of 12/31/2023

In the year, 2023, the Magnificent 7 stocks experienced an average return of +111% while the S&P 500 Index only gained +26%. The Equal-Weighted S&P 500 Index only gained +12%. If you removed the Magnificent 7 stocks from the Equal-Weighted S&P 500 Index, you would have only gained +8%. [ii]

The strong performance of the Magnificent 7 stocks has extended into 2024. As of February 29, 2024, these seven stocks have gained +12.7%, outpacing the S&P 500’s increase of +7.1% and the Equal-Weighted S&P 500 Index’s gain of +3.2%.[iii]

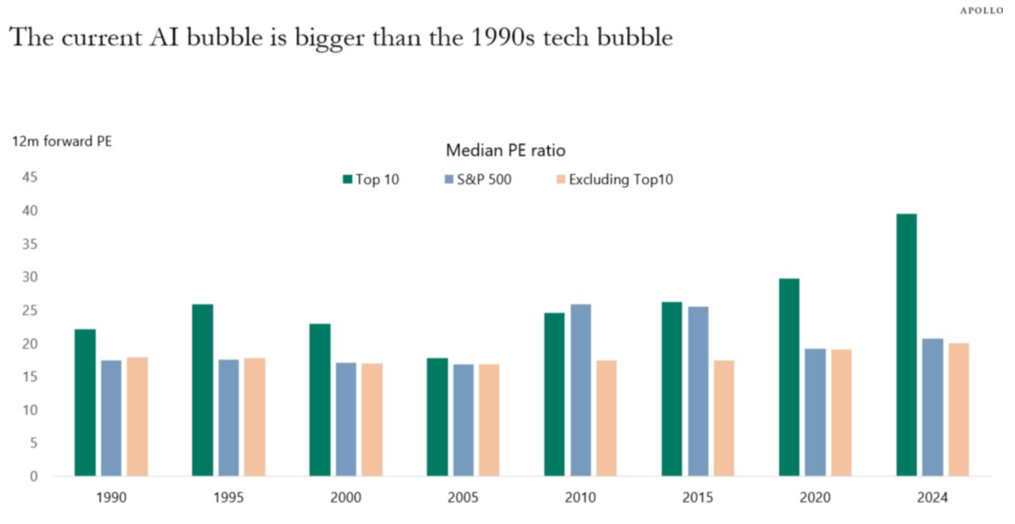

We believe the Magnificent 7 stocks are currently trading at levels considered expensive compared to historical standards. Torsten Slok, Apollo’s Chief Economist, has recently showed that when you compare the median 12-month forward price-to-earnings (PE) ratio of the top ten companies in the S&P 500, which include all of the Magnificent 7 stocks, they are much more expensive now than they were during the tech bubble of the 1990s. [iv]

Source:Bloomberg, Apollo Chief Economist. Note: Data as of January 31, 2024.

With that being said, we are seeing some encouraging signs that the stock market rally may finally be starting to broaden out. For the week ended 3/6/2024, we saw four of the Magnificent 7 stocks; Microsoft (MSFT), Apple (AAPL), Alphabet (GOOG), and Tesla (TSLA) move lower as many other stocks outside of the technology sector rose. You can see this in the March 6, 2024 FinViz heat-map below.

Source: FinViz as of 3/6/2024

While we find it encouraging to see a wider equity market participation, we still believe strongly in the value of diversification. Diversification is not supposed to maximize returns, it is designed to reduce investment risk. A diversified portfolio at times won’t keep up with the market when the bulk of returns are concentrated in a small group of stocks like the Magnificent 7. We strive to diversify our investments amongst industries and sectors, size (large-cap and small-cap), geography, growth versus value and alternative asset classes. Some of these investments are negatively correlated to the stock market – what that means is historically when the stock market traded lower – these investments gained in value. Past performance is not a guarantee of future results, but history helps guide us.

At CIG, we believe in risk-balanced investing. We believe investors should consider how much risk they are taking to achieve returns. We think that we should be striving to reach the return necessary to meet the various needs of our client’s financial plans while, at this point in the market cycle, taking as little risk as possible to meet that goal. We want you to sleep at night.

Please reach out to Brian Lasher (blasher@cigcapitaladvisors.com), Eric T. Pratt (epratt@cigcapitaladvisors.com) or the rest of the CIG team.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] The Magnificent 7 stocks are: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon.com (AMZN), Nvidia (NVDA), Tesla (TSLA), and Meta Platforms (META)

[ii] https://www.forbes.com/sites/greatspeculations/2024/01/22/2023-in-review/?sh=78aab8bd690b

[iii] Calculated by CIG Asset Management for the Roundhill Magnificent Seven ETF (MAGS) using data from finance.yahoo.com

[iv] The Daily Spark, February 25, 2024 – Apollo Academy

Update from CIG Asset Management Team – Asset Manager Annual Checkup

In an era of consolidation in the wealth management industry, an annual check-up of who is managing your assets is important. With firms like LPL, Wealth Enhancement Group, Stratos Wealth Partners, it raises the question: Who is actually managing your money? Do you know the individuals on the company’s website?

We suggest that you conduct an Asset Manager checkup.

Annual Asset Manager Check Up List

Basics

ü Have you ever talked to the people who directly manage your hard-earned life savings?

ü If so, how often could/do you meet with them?

ü If not, how do they determine my risk tolerance and investment objectives and get to know you?

ü Is your advisor really doing the trades and asset allocation for your portfolio?

Advanced – Is the asset management offering compelling in regard to the following?

ü Performance- How does the strategy perform during up and down periods?

ü Selection- Do they actively manage the portfolio or is it invested in big technology companies all the time?

ü Insight- Is there common sense anchored in factual data, without rosy forecasts like we may often hear on TV?

ü New Ideas- Is there delivery of unique value through compelling theses? For example, Gold or Energy Sector investments at the right time.

ü Diversification- Do they utilize a variety of investments which complement existing illiquid holdings?

ü Trust- Are you going to trust this group to help you through the inevitable difficulties in the market? When risk appetites are high, are they good at restraining your exuberant actions? When risk appetites are low, will you feel comfortable restraining fearful activities and buying low?

At the end of the day, what kind of “ride” or investment experience are they offering you? People don’t retire on %’s but on actual dollars. How did you do in 2022? If you were down, are you back to even with stocks soaring this year?

In our last letter, What’s Your Benchmark, we talked about comparing your investment portfolio to an appropriate benchmark and comparing your investment portfolio’s 3-year risk and return. As of November 30, 2023, our analysis revealed that the CIG Dynamic Balanced Composite achieved a trailing 3-Year annualized return of +2.30%, net of fees. This performance surpassed the Balanced Benchmark’s +1.95% return, all while assuming only half the risk of the benchmark, as indicated by the standard deviation of returns that 3-year timeframe. [i]

In 2023, U.S. stock performance has been largely dominated by the Technology sector and Communication Services sector. [ii]

We believe that many investors are currently experiencing recency bias – the tendency to place too much emphasis on experiences that are freshest in their memory – even if they are not the most relevant or reliable. How quickly investors have forgotten about the very negative returns in 2022!

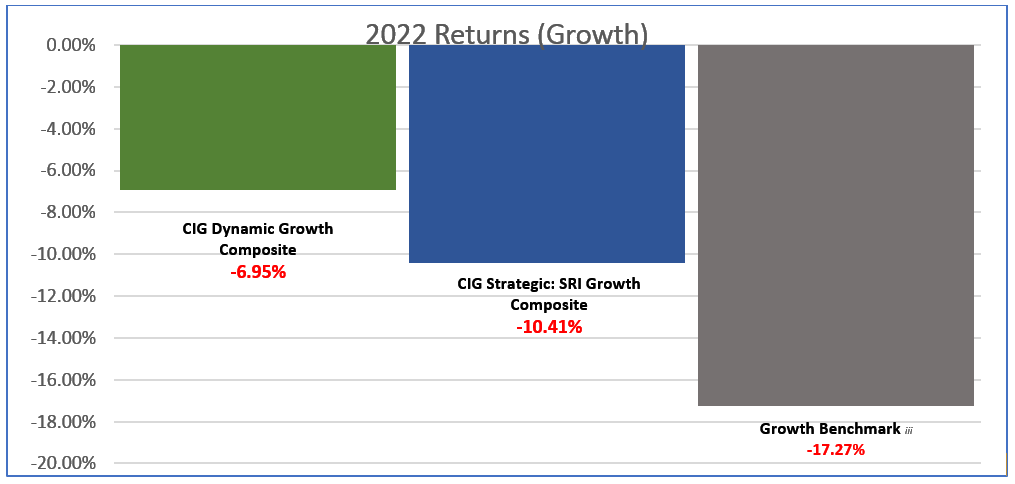

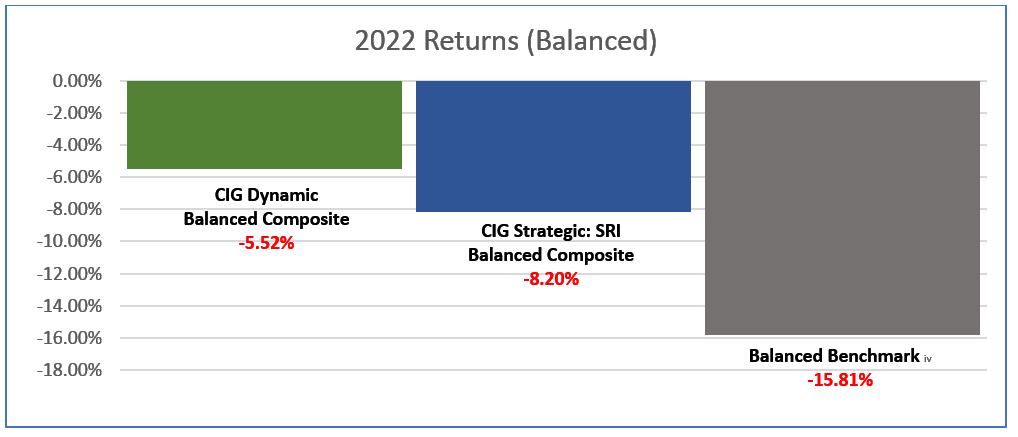

As seen in the two following bar charts, in 2022 at CIG, the CIG Dynamic Growth Composite avoided 60% and the CIG Strategic: SRI Growth Composite avoided 40% of the growth benchmark’s -17.27% loss. Net of fees.[iii] The CIG Dynamic Balanced Composite avoided 65% and the CIG Strategic: SRI Balanced Composite avoided 48% of the balanced benchmark’s -15.81% loss. Net of fees. [iv]

Calculated by CIG Asset Management using data from Tamarac. Represents performance from January 1, 2022, through December 31, 2022. Past performance is not indicative of future results. [v]

Calculated by CIG Asset Management using data from Tamarac. Represents performance from January 1, 2022, through December 31, 2022. Past performance is not indicative of future results.[vi]

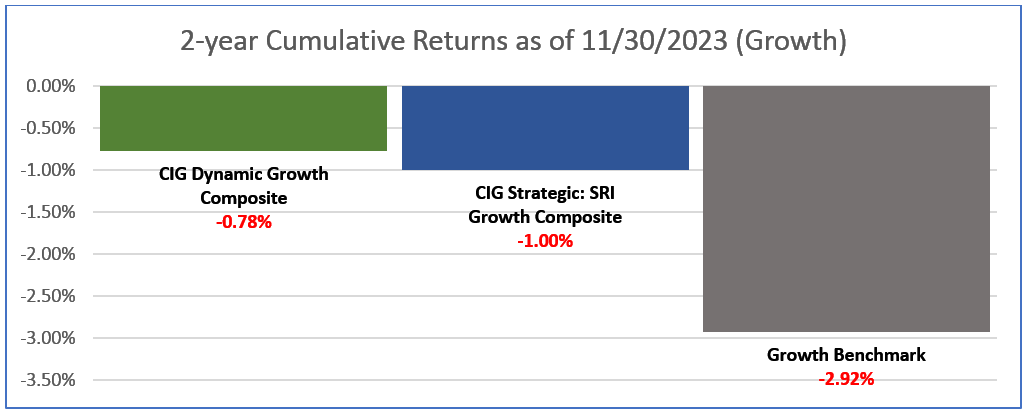

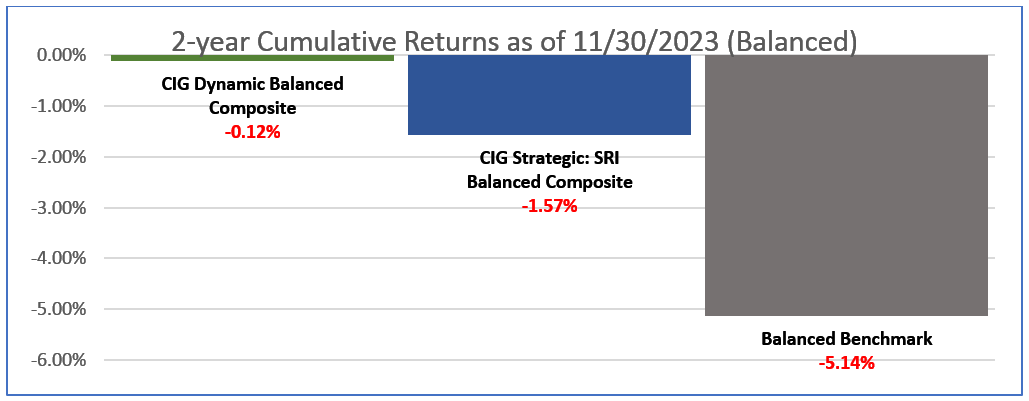

Year-to-date through November 30th, 2023, domestic and international equities along with fixed income have rallied with some significant returns in equities.[vii] As seen in the following two bar charts our CIG growth and balanced composites continue to outperform their respective benchmarks on a 2-year cumulative basis through November 30th, 2023. Net of fees. [viii]

Calculated by CIG Asset Management using data from Tamarac. Represents performance from January 1, 2022, through December 31, 2022. Past performance is not indicative of future results. [ix]

Calculated by CIG Asset Management using data from Tamarac. Represents performance from January 1, 2022, through December 31, 2022. Past performance is not indicative of future results. [x]

As illustrated above, the ride with the CIG composites is smoothed out during volatile conditions and over the two-year period, the CIG composites are much closer to break-even than the benchmarks. For example, the difference as shown above between the Balanced Benchmark and the CIG Dynamic Balanced Composite is +5.02%.

Of course, in addition to portfolio construction, risk and returns, you need to ask if the overall organization that includes asset management is helping you achieve your goals. Your success is about looking at the whole picture:

ü Have they created a plan to help you drive meaningful levels of savings toward your goals?

ü Together, are you executing effective estate, tax, and philanthropy management programs?

ü Do they provide business consulting if you are an entrepreneur and business owner?

You hopefully get a medical check-up each year. What about holistic check of your wealth manager?

At CIG, we believe in risk-balanced investing. We believe investors should consider how much risk they are taking to achieve returns. We think that we should be striving to reach the return necessary to meet the various needs of our client’s financial plans while, at this point in time as described in our two most recent letters, taking as little risk as possible to meet that goal. We want you to sleep at night.

We counsel investors to understand what they are invested in – usually a diversified portfolio – and measure their results with the appropriate diversified, blended benchmark. Life is too short to be frustrated.

If you would like to discuss the results of your annual check or review how much risk that you are taking to achieve your returns, please contact Eric Pratt or Brian Lasher who would be happy to speak with you.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data that believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Calculated by CIG Asset Management using data from Tamarac and Zephyr

[ii] FinViz.com/map as of 12/28/23

[iii] Calculated by CIG Asset Management using data from Tamarac. The Growth Benchmark is a blend of 60% Russell 3000, 25% MSCI All-Country World ex US and 15% Bloomberg US Aggregate Bond indices.

[iv] Calculated by CIG Asset Management using data from Tamarac. The Balanced Benchmark is a blend of 45% Russell 3000, 10% MSCI All-Country World ex US and 45% Bloomberg US Aggregate Bond indices.

[v] Performance has been attested to by ACA Group for the period August 1, 2018, through December 31, 2022.

Strategy returns are calculated independently on a daily basis and linked geometrically to produce a monthly return. Total investment performance includes realized and unrealized gains and losses, dividends, and interest. Accrual accounting is used to record interest income while dividends are recorded on a cash basis. Trade date accounting is used for calculation and valuation purposes.

Past performance is not indicative of future results.

[vi] Performance has been attested to by ACA Group for the period August 1, 2018, through December 31, 2022.

Strategy returns are calculated independently on a daily basis and linked geometrically to produce a monthly return. Total

investment performance includes realized and unrealized gains and losses, dividends, and interest. Accrual accounting is used to record interest income while dividends are recorded on a cash basis. Trade date accounting is used for calculation and valuation purposes.

Past performance is not indicative of future results.

[vii] Calculated by CIG Asset Management from finance.yahoo.com. YTD – 11/30/23 S&P 500 =20.8%

Bloomberg Agreeable Bond Index- AGG to 1.89%

[viii] Calculated by CIG Asset Management team using data from Tamarac.

Performance has been attested to by ACA Group for the period August 1, 2018, through December 31, 2022.

Strategy returns are calculated independently on a daily basis and linked geometrically to produce a monthly return. Total investment performance includes realized and unrealized gains and losses, dividends, and interest. Accrual accounting is used to record interest income while dividends are recorded on a cash basis. Trade date accounting is used for calculation and valuation purposes.

Past performance is not indicative of future results.

[ix]Performance has been attested to by ACA Group for the period August 1, 2018, through December 31, 2022.

Strategy returns are calculated independently on a daily basis and linked geometrically to produce a monthly return. Total investment performance includes realized and unrealized gains and losses, dividends, and interest. Accrual accounting is used to record interest income while dividends are recorded on a cash basis. Trade date accounting is used for calculation and valuation purposes.

Past performance is not indicative of future results.

[x] Performance has been attested to by ACA Group for the period August 1, 2018, through December 31, 2022.

Strategy returns are calculated independently on a daily basis and linked geometrically to produce a monthly return. Total investment performance includes realized and unrealized gains and losses, dividends, and interest. Accrual accounting is used to record interest income while dividends are recorded on a cash basis. Trade date accounting is used for calculation and valuation purposes.

Past performance is not indicative of future results.

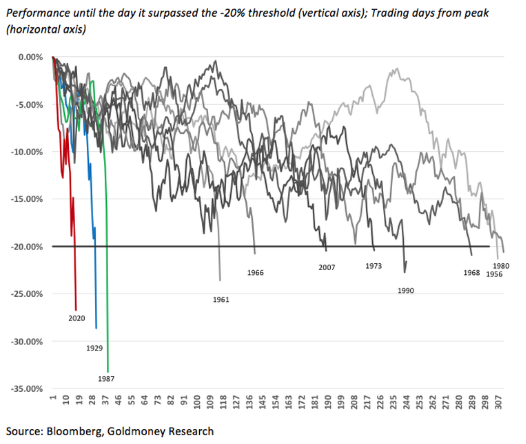

Diversification Can Help Protect Against Market Crashes

The idea of diversification is very old and can be, in

some cases, useful for survival. How many times in life have we heard “Don’t

put your eggs all in one basket?” In investment terms, market crashes like the

one we witnessed in March 2020 can happen. Losses such as these can be bad for your

financial and mental health as well as your ability to meet your financial plan

or retire. Diverse investment strategies and assets can behave differently in

various crashes, and this differentiation of responses increases the chance

your portfolio will survive a market crash. Here’s why a diversification

strategy is important:

Diversification

in terms of investing became more popular in the early 1990s and really took

off in the early 2000s. Whether it is emerging market bonds, wind parks, real

estate, etc., the diversification argument became more obvious after the DotCom

Crash of 2000. At its core, diversification forces you to “buy low and

sell high,” an adage that is arguably commonplace and easily mocked. But

it really works. Just look at March 2020’s market returns.

In March 2020, COVID-19 appeared to impact most asset

classes. As a result of our investment strategy and process, we became worried

about the asset valuations in early to mid-2019. This led us to diversify away

from an over-concentration in stocks and into a more varied portfolio of

assets. Consequently, we were better

prepared for March 2020 and had exposure to longer-dated Treasury bonds and

gold, which were some of the only major asset classes up last month.

In 2019, prudence and

diversification came under fire. With the S&P 500 Index up a massive 31%[i], investors

with diversified portfolios felt like they left money on the table. In 2020,

diversification came roaring back as investors realized the above-mentioned benefits

of having parts of their portfolio perform when risky assets struggle. What a

difference a few weeks and months can make! March 2020’s crash was the quickest

decline in stock market history[ii]. During

market crashes, diversification not only helps to potentially shore up returns,

but also provides a source of money for rebalancing. With a 20% decline in

equities in just under a couple of weeks, buying low and selling high is paramount

for investment success over the long term.

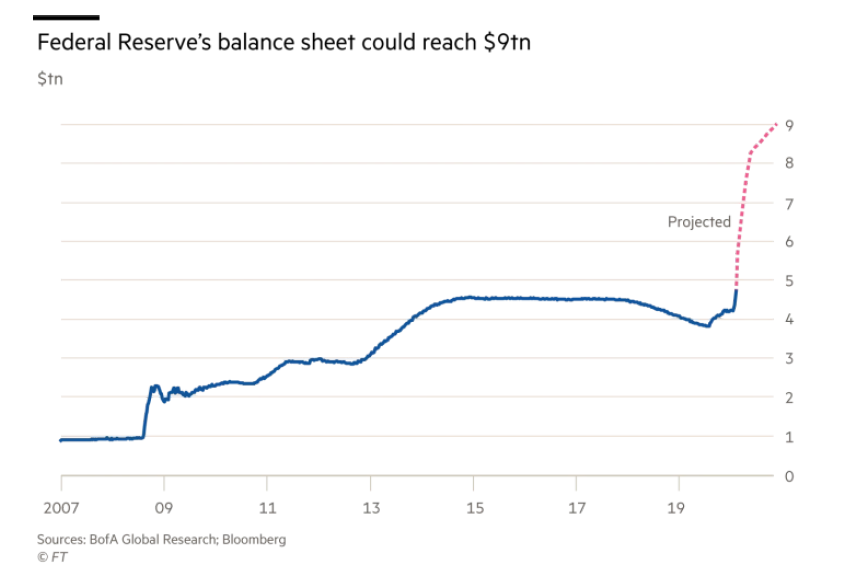

In

March 2020, the Federal Reserve balance sheet has increased +$1.1 trillion and

the European Central Bank’s balance sheet has increased +$400 billion[iii].

Another $2 trillion fiscal stimulus bill is being considered in the U.S.[iv]

So, we may yet again be lulled into believing

that a period of elevated U.S. stock market valuations and low market

volatility could persist throughout this decade. In that case, diversification may

return to its regret-maximizing ways, where there will often be an underperforming

asset (in this case, bonds or cash) in your portfolio that you wish you had

sold, just like there will often be the asset (usually, equities) you wish you

owned more of because its price went up the most. That said, when market

volatility inevitably returns, you realize that staying diversified is worth it

in the long run.

At CIG Capital Advisors, we attempt to pursue diversified

portfolios for clients by employing the following thought processes. First, we

invest only in investment choices we understand. Second, we determine

investment and asset allocations based on collecting as much data as possible,

employing common sense constraints, doing fundamental research, and rebalancing

portfolios regularly. Lastly, we adapt to change, try to learn continuously,

seek new sources of returns, and re-evaluate allocations regularly. We tend to

shy away from an investment with an effortlessly smooth return history. These might

or might not be safe as many of these strategies are the equivalent of picking

up pennies in front of a steamroller.

While

there are many known unknowns related to COVID-19, we anticipate continued

volatility in the near term as the economic fallout from the pandemic is

realized. As always, we maintain diversified, risk-balanced portfolios for

clients to help ride out potential market selloffs, and to evaluate, and

sometimes capture, the opportunities that present themselves. We conclude with

a famous quote from Benjamin Graham, the British-born American investor known

as the “father of value of investing,” “the essence of investment

management is the management of risks, not the management of returns.”[v]

Thus, diversify!

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i]

Yahoo Finance

[ii]

Bloomberg, Goldmoney Research

[iii] https://docs.google.com/spreadsheets/d/1s6EgMa4KGDfFzcsZJKqwiH7yqkhnCQtW7gI7eHpZuqg/edit#gid=0

[iv] Source:

“How big could the Fed’s balance sheet get?” Financial Times, April 5, 2020

citing a report from Bank of America