Important Client Announcement Related to COVID-19

| At CIG Capital Advisors, the health and safety of our clients, business partners and team is our first priority. Amid the growing concerns around COVID-19, we are taking substantial measures to ensure the welfare of our clients and employees is protected: Moving In-Person Meetings to Virtual Meetings: In an effort to minimize any potential exposure, we are taking the highest level of precaution and are strongly encouraging all client service meetings be conducted in a virtual format. Should you agree to change your in-person meeting to a virtual meeting via either our secure video conference system or telephone, please contact your CIG Capital Advisors senior wealth manager. Social Distancing and our Business Continuity Plan: The Centers for Disease Control and Prevention (CDC) recommends social distancing as a measure that can help prevent the spread of COVID-19. This could eventually extend to our office environment, so in an abundance of caution, CIG Capital Advisors will conduct a trial run of a full-staff remote work day on Tuesday, March 17. Should you need to contact a CIG Capital Advisors staff member on Tuesday, the usual channels of communication like email and phone will be available per our Business Continuity Plan. Our leadership team is monitoring the situation daily, taking into account guidance from the CDC, public health agencies and state officials. We will adapt our protocols as necessary and keep you apprised of all updates and changes. Investment Management: While health and wellness must be our priority, the financial health of your portfolio is a fiduciary responsibility we take seriously every day, no matter the macro-economic conditions. However, during times of economic instability like we have seen in recent weeks, it’s natural to seek information about how your asset manager is reacting amidst the turmoil. To discuss our prudent response to the uncertainty in the global markets, we’ve scheduled a special client-only webinar on Wednesday, March 18 at 1 p.m. The webinar will last approximately 30-45 minutes. All clients are invited to register for the webinar, hosted by CIG Capital Advisors Managing Principal Osman Minkara and Vice President of Asset Management Brian Lasher; you may also want to refer to our monthly Asset Management updates and recent 2019 Asset Management Year in Review letter, all of which were previously emailed to you and can also be found on our website here. REGISTER FOR THE WEBINAR HERE: https://zoom.us/webinar/register/WN_BSWP4BA_Q-yxk9J68wm2cA Please reach out to the CIG Capital Advisors team with any questions in the meantime, and we look forward to “seeing” you virtually in the webinar on Wednesday. |

CIG Asset Management Update February 2020: The Unknown Unknowns and Our Thoughts on COVID-19

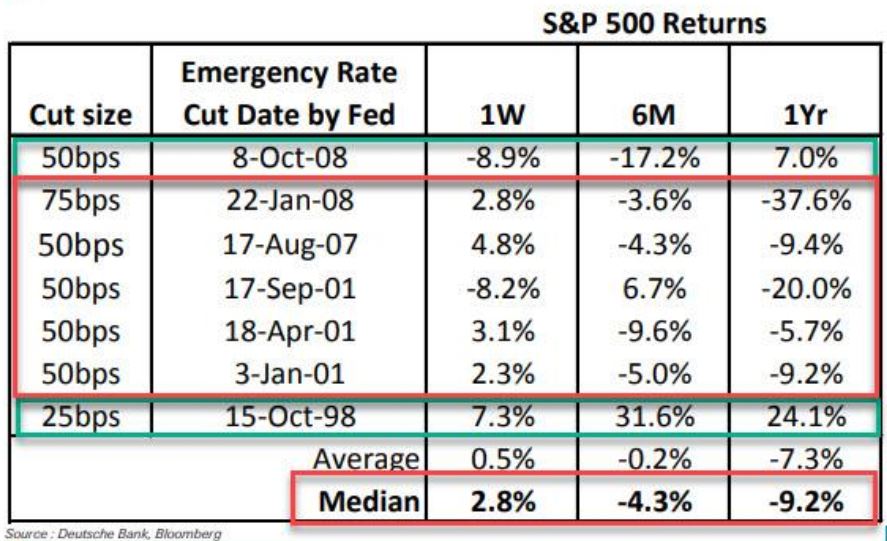

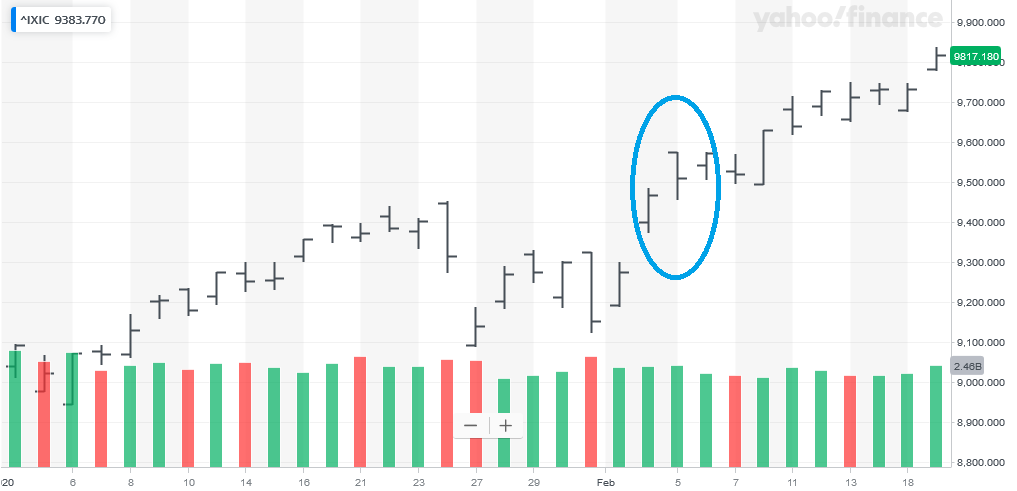

| Market volatility spiked starting at the end of February and continues today at extreme levels. Long time readers of our updates know that we have been warning about asset bubble and Central Banks’ recent actions since last year. On March 3rd, The Federal Open Market Committee (FOMC) cut the federal funds rate by 0.5 percentage points to a 1 to 1.25% range. An emergency interest rate cut between regular meetings is very rare. The last such cut was during the Great Financial Crisis (GFC) in October 2008. In fact, there have only been 7 emergency actions since October 1998. Interestingly, the FOMC took this action after only a -8.2% decline in February for the S&P 500 Total Return Index(1). Similarly other markets around the world showed “orderly” selling – the MSCI EAFE Net index of Developed Markets was down only -9.0% while Emerging Markets, as measured by the MSCI Emerging Markets Net Index, lost only -5.3% during the month(2). How have stocks performed in the past after the FOMC cuts rates unexpectedly? The answer in the table below(3) is that they tend to go lower the following 12 months. The average one year return on the S&P 500 following an emergency cut is -7.3%. The October 15, 1998 emergency cut was in reaction to a hedge fund, Long Term Capital Management (LTCM), imploding. Excluding the LTCM cut, the average one year return after the other six actions was much worse, -12.5%.  On February 20 and 21, FOMC speakers were cheerleading the market and saying that no rate cuts were necessary. We must ask ourselves, why did the Federal Reserve deem it necessary to act so suddenly? Ultimately, fears intensified over the new coronavirus (COVID-19) turning into a pandemic given that the number of new cases appearing outside of China were outpacing those within China, all this without adequate testing in many places. However, we remain skeptical that monetary policy can solve the global economic issues. Amazon, Google, Facebook and Microsoft are now pushing working from home(6). All, in addition to Apple, JP Morgan, Proctor & Gamble and others, have limited employee travel(6). Major events such as the St. Patrick’s Day Parade in Dublin have been cancelled, and forthcoming cancellations will be likely, too. Corporate management teams know that they will be forgiven if they lump as much bad news as possible into the first half of 2020 whether it is COVID-19-related or not. The bad news is likely to keep coming and the economic damage may be significant. It is possible that that Central Banks can regain control as Central Banks have managed to restrain volatility for the six previous times issues arose since the GFC. However, with the VIX at 60+, they appear to be more challenged than ever post-2008. Already, Treasury yields have reached record lows in February. Accordingly, the Barclays U.S. Long Treasury Index increased 6.7% during the month(4). Market participants are now anticipating three interest rate cuts to occur in 2020(5) and in March, Treasury yields have reached unprecedented low levels! The 30-year Treasury is below 1% as we write(1). In this high volatility environment, anything is possible and we are watching the markets and economy like a hawk. The CIG-managed portfolios have benefited from being positioned for late cycle volatility since October, with the Dynamic portfolios even more so since late February. There is massive risk to the downside as well as the upside. On the plus side, we may get a global fiscal stimulus package which would in turn boost markets. In that case, markets are very oversold, meaning assets that have traded lower/ gotten cheaper have the potential for a price bounce. On the other hand, the constant subsidy of the markets and the economy has led us to a large bond and stock market bubble and very high debt levels while the Federal Reserve has left themselves with way fewer tools. We have plans for both scenarios. CIG has a robust business continuity plan to lessen any interruption to service and allow us to remain fully operational at all times. We can accommodate a fully remote staff if necessary. We believe the communication procedures that we have in place will help ensure that there is no disruption to your service. We remain committed to meeting your expectations regarding meeting attendance and recognize that some clients may prefer conference calls or videoconferencing in lieu of in-person gatherings. Finally, we are persistently following the investment markets and repercussions of COVID-19 and will continue to communicate with you when appropriate about the portfolio impact and opportunities that are created. Until then, please stay well and support your friends and neighbors. The elderly who are deeply concerned now and neighbors without alternative childcare will need our help. As long as it is advisable, please visit your service vendors like restaurants and tip generously. We also ask that you generously give to local organizations who support the needs of lower-income families who might rely on travel, retail and hospitality sources of income. They will suffer disproportionately. Even if COVID-19 burns out in the coming months, as we hope it will, the economic issues could possibly linger for some time. This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. SOURCES: 1. Calculated from data obtained from Yahoo Finance, as of February 28, 2020. 2. MSCI, as of February 28, 2020 3. Deutsche Bank report using Bloomberg Data 4. NEPC 5. https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html as of March 9, 2020. 6. https://www.businessinsider.com/companies-asking-employees-to-work-from-home-due-to-coronavirus-2020 |

CIG Asset Management Update January 2020: How Much to Dance?

| Meanwhile, the worsening of the coronavirus appears to have caused a plunge in bond yields in January as investors seek additional safe havens and the VIX Index(2) (the CBOE Volatility Index® which measures U.S. equity market volatility) has also risen. Consequently, we have acted in client portfolios to adjust to our perception of the ongoing exaggeration of the market environment that we talked about above and in the recent year-end letter (we highly encourage you to read it if you have not done so already.) Given these risks in the market, we continue to proceed with caution and feel that portfolio discipline remains paramount. While recessionary concerns remain low given the massive central bank stimulus around the globe, CIG’s outlook can rapidly adjust as a result of a material change in economic indicators or a dramatic shift in central bank policy. Accordingly, we ask ourselves, “How and how much do we want to dance with this market today?” |

CIG Asset Management Update December 2019: When Others are Greedy

November was a “risk-on” month, with the CNN Fear & Greed Index(1) reaching the “Extreme Greed” level. With the Federal Reserve buying more treasury bills than they ever bought in prior Quantitative Easing (QE) periods(2), a variety of U.S. equity indices did very well last month. The S&P 500 Index(3) returned 3.4% while riskier small company stocks, as measured by the Russell 2000 Index(3), were up 4.0%. The VIX Index(3) (The CBOE Volatility Index® which measures U.S. equity market volatility) posted a low for the year of 11.5 on November 26 as complacency in the market set in.

Given the lack of additional Central Bank stimulus, developed market foreign stocks in the MSCI EAFE Net(4) Index produced a more modest return of +1.1% while Emerging Markets as measured by the MSCI Emerging Markets Net(4), lost -0.1%. Investors also did not appear to be interested in bonds, as The Barclays U.S. Aggregate Total Return Bond Index(5) decreased by -0.1%. Surprisingly, market participants did not bid up the price of high yield issues, a traditional “risk-on” asset, with The Barclays High Yield Index(5) only gaining +0.3%.

Warren Buffet, the “Oracle of Omaha” and legendary investor, once said to be “fearful when others are greedy and greedy when others are fearful.”(6) With that in mind, the most important aspect of client relationships, beyond the investment expertise that we offer, is to ensure when these times arise and risk appetites are high, that we work together to restrain any exuberant investment behaviors. The same is true when risk appetites are low and we need to moderate our fearful investment behaviors (e.g., early 2009).

Consequently, the objective right now is to generate returns ahead of client financial plan targets by taking restrained risk in relation to client general risk preferences (i.e., growth models may look more balanced while still attempting to generate double-digit returns). In consideration of the massive QE mentioned above and trade war uncertainty, along with weakening global growth, CIG transitioned to “a later cycle approach” in portfolios during the last quarterly rebalance in furtherance of that goal. Overall, equity holdings were decreased, quality increased and fixed income increased slightly.

On the other hand, given the substantial QE (which one can wonder its rationale), the growth of the money supply has accelerated at a more rapid pace than last year. According to theory, when money growth is faster than the growth of the economy, the excess money goes into financial assets driving even expensive stocks and bonds higher. In addition, according to DataTrek, U.S. stocks rarely reverse course in a dramatic fashion after a year like 2019, but they also don’t usually do quite as well as the long run averages. The one exception was when the Federal Reserve tightened in 1937 and the S&P 500 Index delivered a -35% return(7).

We continue to weigh the potential risks in the markets and plan for a wide range of scenarios, both positive and negative, with the goal of consistently reevaluating and managing the appropriate level of risk so that clients can achieve their financial plan goals. It means delivering a nuanced, material understanding of diversification, which typically means carefully buying assets that have not appreciated and selling investors’ favorites. Diversification remains our best defense and recently healthcare stocks, a lesser performer in 2019, were increased in the portfolios. This increase in equities highlights our continued flexibility and our devotion to offering a fundamental value proposition to clients who seek long-term out-performance.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

SOURCES:

- https://money.cnn.com/data/fear-and-greed/

- Market Commentary by Art Cashin, UBS Financial Services, November 13, 2019

- Calculated from data obtained from Yahoo Finance, as of 12/11/19

- MSCI, as 12/11/19

- NEPC, as of 12/11/19

- https://www.investopedia.com/articles/investing/012116/warren-buffett-be-fearful-when-others-are-greedy.asp

- From DataTrek in Market Commentary by Art Cashin, UBS Financial Services, October 16, 2019

CIG Asset Management August 2019 Update: Top of the Ninth Inning

The end of July and beginning of August has proven to be very tricky. The S&P 500(1) declined almost 100 points. Bond yields plunged almost 25 basis points. Some of the culprits behind these movements included Federal Reserve Chairman Powell’s “mid-cycle adjustment” comment post the recent rate cut, and Trump’s new tariffs announcement. A number […]

CIG Asset Management July 2019 Update: Central Banks Drive Market Rebound

Reversing their sharp declines from May, global equity markets came roaring back in June as global central banks appeared more accommodative because of subdued inflation, ongoing trade war anxieties and waning economic data. The S&P 500(1) gained 7%, while the MSCI EAFE Net Index(2) of developed international equities and Emerging Markets Net Index(2) were up […]

Three ways your medical practice might lose out by not being transparent enough

In reaction to sweeping changes occurring in the healthcare industry, private practice physician-owners and network providers are seeing an increase in their patient population’s enrollment in High-Deductible Health Plans (HDHPs), which place a bigger financial burden on the consumer and require price transparency from providers. Patients, providers and payors can all view transparency in different […]