CIG Asset Management Update: Pain Points – What Can Be Learned; What Can Be Done?

Summary:

* Ready, Fire, Aim: Fed Chair Powell Jackson Hole speech sends stocks sharply lower.

* Reading the Room: “Some pain to households and businesses”

* Active Management: Possible strategies and implementations to relieve pain

August 2022 Returns:

Commentary:

Approximately $2 trillion in global stock market capitalization was lost as Federal Reserve Chairman Jerome Powell spoke and said the word “inflation” 47 times in the span of his eight-minute speech.[ix]

Until his short presentation at the Jackson Hole Economic Symposium on August 25 sent stocks lower, U.S. equities spent most of the month of August adding on to July’s gains. By month’s end, however, U.S. equities, as measured by the S&P 500, were down -4.1% in August. International Equities in developed markets erased -4.8%[x], while Emerging Market Equities interestingly gained +0.4%.[xi] Fixed income lost -2.8% as measured by the Bloomberg U.S. Aggregate Index[xii] as the 10-Year U.S. Treasury bond yield rose +49 basis points to end the month at 3.13%.[xiii] Gold fell -2.8%[xiv] and crude oil lost -9.2%[xv] as the U.S. Dollar Index gained +2.8%.[xvi]

At the end of a market cycle, bear market rallies like the recent one from mid-July to mid-August are not uncommon and ultimately painful to optimistic buyers. According to the Wall Street Journal, “it is the worst year for buying the stock-market dip since the 1930s.”[xvii]

Pain remains the operative word all around. “While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain”, said Chairman Powell.[xviii]

Slower Growth and Softer Labor Markets

Markets have been volatile since Powell’s Jackson Hole speech as investors try to determine how fast and how high the Fed will raise rates, and perhaps most importantly, how long before the Fed cuts rates. It is our opinion that inflation will remain elevated for longer than many may hope for and as a result, the Fed will need to continue raising rates in efforts to fight inflation. Indeed, Chairman Powell said, “Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions.”

Lower Asset Prices

The Federal Reserve’s doubling of its balance sheet sent a big liquidity wave through the economy that helped increase prices of assets from houses to stocks. As of September 14, 2022, the Federal Reserve balance sheet was $8.8 trillion, roughly double the $4.3 trillion pre-pandemic level on March 11, 2020, and only slightly lower than the $8.9 trillion balance as of June 1, 2022, the day the Federal Reserve began systematically reducing debt.[xix]

Long-time readers of our Asset Management updates may appreciate that we have been concerned about debt for some time. We discussed the Fed balance sheet more than a year ago in our June 2021 CIG Asset Management Review: Inflation and Fragility.

This same Federal Reserve is now intent on draining liquidity out of the economy to combat inflation. What will happen to these inflated asset prices as the Federal Reserve attempts to take liquidity out of the economy as it sells bonds to reduce its balance sheet and takes in hundreds of billions of dollars in cash?

Higher Government Debt Burden

The pandemic greatly increased the indebtedness of the United States. The total federal debt at the end of 2Q 2022 totaled $30.6 trillion, +32% more than the $23.2 trillion in early 2020.[xx]

We believe there is a consequence to all this debt and that this amount of debt is becoming unwieldy. The U.S. Treasury has paid out $590 billion in interest on its debt since October 1, 2021, when the Federal government’s fiscal year began.[xxi] This interest expense is quickly approaching the $777 billion that Congress approved for 2022 defense spending and is approximately 2.5% of the roughly $24 trillion annual U.S. economy.[xxii] If the economy is able to grow at a healthy pace, many may overlook the interest on the U.S. debt, but in a recession, this interest expense becomes magnified as the total output of the economy shrinks. Tax hikes may very well be in our future as the government tries to manage this debt. We would not be surprised to see taxes on capital gains increased in the near future.

Given this pain, why would you leave your hard-earned assets in a less active, less flexible account?

We took steps in our actively managed strategies in 2021 to significantly reduce risk versus the benchmarks and it continues to be rewarding. Publicly traded alternatives, which are generally less correlated to market movements, have also been part of our focus. Most recently, during the last week of September we reduced domestic equity and fixed income exposures in both the CIG Dynamic Growth and CIG Dynamic Balanced strategies and allocated the proceeds to cash.

Through 8/31/2022, our CIG Dynamic Growth Strategy composite has avoided approximately 50% of the losses of the growth benchmark and our CIG Dynamic Balanced Strategy has avoided approximately 55% of the losses of the balanced benchmark.[xxiii]

Meanwhile, anecdotally, we suspect that assets held in traditionally less flexible, company-sponsored 401(k) and 403(b) plans or in less actively managed accounts may have experienced greater losses. We would suggest that you review your recent statements or discuss this with your investment advisor when they call you next.

We would welcome the opportunity to connect with you via voice or email to discuss market challenges and opportunities, as well as the benefits of active investment management.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] The Growth Benchmark is a blend of 60% Russell 3000, 25% MSCI All-Country ex U.S. and 15% Bloomberg U.S. Aggregate Bond indices. Sources: CIG, Zephyr, and Morningstar.

[ii] The Balanced Benchmark is a blend of 45% Russell 3000, 10% MSCI All-Country ex U.S. and 45% Bloomberg U.S. Aggregate Bond indices. Sources: CIG, Zephyr, and Morningstar.

[iii] Zephyr: S&P 500

[iv] Zephyr: Bloomberg U.S. Aggregate Bond

[v] Zephyr: MSCI EAFE Net

[vi] Zephyr: MSCI Emerging Markets Net

[vii] Calculated using data from finance.yahoo.com

[viii] Calculated using data from finance.yahoo.com

[ix] Twitter: @Schuldensuehner 08/28/2022

[x] Zephyr: MSCI EAFE Net

[xi] Zephyr: MSCI Emerging Markets Net

[xii] Zephyr: Bloomberg U.S. Aggregate

[xiii] Calculated using data from finance.yahoo.com

[xiv] Calculated using data from finance.yahoo.com

[xv] Calculated using data from finance.yahoo.com

[xvi] Calculated using data from finance.yahoo.com

[xvii] https://www.wsj.com/articles/buying-the-stock-market-dip-is-backfiring-this-year-11664064845?reflink=desktopwebshare_permalink

[xviii] https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

[xix] https://fred.stlouisfed.org/series/WALCL

[xx] https://fred.stlouisfed.org/series/GFDEBTN

[xxi] https://www.politico.com/news/magazine/2022/09/20/fed-inflation-powell-debt-00057606

[xxii] https://www.armed-services.senate.gov/download/fy22-ndaa-agreement-summary

[xxiii] Calculated by CIG

Image: Torsten Dederichs/Unsplash

CIG Asset Management Update October 2020: A New Hope?

Summary:

- Diversifying to include

Emerging Markets helps in tough month for Developed Markets.i,ii,iii - Continued worries

about rising COVID-19 cases and the economy.iv - Narratives appear

to be shifting as more evidence of a potential market inflexion point.

Commentary:

Globally, this month

was tough for Developed Markets and not for Emerging Markets. In October,

returns for the S&P 500 were -2.8%[i]

and MSCI EAFE was -4.1%[ii]

while the MSCI Emering Markets was +2.0%[iii].

It was the second month in a row of monthly declines in U.S. equities. As

mentioned before, we continue to employ diversification specifically to areas

like Emerging Markets to potentially cushion against U.S. equity losses as in

October.

Overall, Developed

Markets suffered from increasing COVID-19 cases[iv]

and in the U.S., diminished hopes of a pre-election stimulus package. The month

culminated with a -5.6%[v]

sell off during the last week when technology earnings missed expectations,

with Microsoft disappointing most in our opinion.

Underneath the surface of a post-election rising market

tide, the relative price movement in sectors and investing styles (Factors)

appears staggering. Our broad measures of the underlying health of the market

continue to worsen. Events happen daily that have either likely never happened

before or not happened in a long time. For example, on November 4, the Dow

Jones Transportation sector had its worst day relative to the S&P 500 since

April 2009, down almost -4%[vi]. Growth

had its best day versus Value (using Russell 1000 indices as proxies) since

January 2001 – almost 20 years![vii] In

our opinion, the market narrative appears to be that the Federal Reserve has

everything under control and that it has “got your back.” Meanwhile, we

continue to worry about how COVID-19 will affect the economy this winter given

the explosion of cases shown by the Johns Hopkins

University’s Daily COVID-19 Data in Motion.

In October, we saw

the beginnings of a narrative shift to a scenario that reminds us of 2000,

similar to what we discussed in our August update. In that market cycle, the

technology bubble was formed by companies from buying to prepare for the risk

that at the stroke of midnight on January 1, 2000 their computers would be

unable to function. In 2020, companies and individuals spent on technology to

work from home during a pandemic. In both cases, decelerating earnings occurred

once priorities shifted away from investments in technology. Last month, it

appeared that investors started to choose between decelerating and expensive

large companies versus opportunities in growing and cheaper small companies

where client portfolios have some investments. Specifically, the Russell 1000

Growth Index (large) lost -4.7%i versus the Russell 2000 Index

(small) gained 3.4%i in October. This shift is potentially bullish

for CIG’s portfolios and less so for investors indulging in passive investments[viii].

We would like to

thank our clients and friends for their continued trust and support, as well as

to respectfully encourage all to focus on the positives on Thanksgiving Day.

Obviously, 2020 has been an excruciatingly difficult year for many of us and it

continues with the contested election and the division in the country. However,

we have a newfound appreciation for going to family gatherings, restaurants and

sporting events, for more frequent phone calls with elders, and for being able

to see our children during the workday at home.

Lastly, we suggest

that you listen to the replay of our webinar “Keeping

your Financial Plans Alive Amid Chaos.” We discuss the challenges, opportunities and questions ahead

as we navigate the current and future market conditions.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

SOURCES:

[i]

Yahoo Finance

[ii] https://www.msci.com/end-of-day-data-search

[iii] https://www.msci.com/end-of-day-data-search

[iv] https://coronavirus.jhu.edu/covid-19-daily-video

[v]

Calculated by CIG using data from Yahoo Finance for 10/23 to 10/30.

[vi]

Research report from Epsilon Theory, “The King is Dead. Long Live the King”

dated 11/5/20.

[vii]

Research report from Epsilon Theory, “The King is Dead. Long Live the King”

dated 11/5/20.

[viii]

While small companies as measured by the Russell 2000 small-cap index has had

six 10%+ multi-day moves in 2020, per Bespoke Investment Group, the number of

underlying companies with negative profits appears to be quite large relative

to history and could pose a problem if investors just buy the index versus

those stocks which have positive earnings.

Managing a Healthcare Practice through the Pandemic: Finance and Operation

Medical practices, dental practices, small and rural hospitals and larger healthcare systems alike are feeling the effects of the COVID-19 pandemic. Recent regulatory changes, like the $8.3 billion emergency funding measure that expands Medicare reimbursements for telemedicine and the prohibition of all non-essential medical, surgical, and dental procedures during the outbreak, have upended the planned revenue cycle of nearly every U.S. healthcare practice or business. How can medical practice owners, dental practice owners and other healthcare managers adjust the financial and operational levers of their business to better weather the economic turmoil caused by the pandemic?

Financial steps to take:

- Put together a 12-week cash flow statement to understand better how you can manage the disruption, assessing what should be coming in and what you must pay and can delay paying, including evaluating the best approach to manage your staff given the circumstances.

- Billing staff should work remotely in order to continue billing as usual and connect with insurance companies. Their time should be used to follow-up on past billings and accounts receivables.

- Reach out to your bank to determine if/when you can setup or increase a line of credit for your business.

- Contact your accountant for up-to-date financials and clarity regarding whether you will be paying your sales/use and withholdings taxes as normal or taking advantage of your state’s relief, if applicable.

- Look for state and federal programs you may qualify for, including the SBA’s Economic Injury Disaster Loans.

Operational steps to take:

- Consider employees carefully. Can non-essential staff work remotely or even be laid off or furloughed to find work elsewhere through a healthcare staffing company, given that many large systems are currently understaffed? Use web conferencing to hold staff meetings, utilizing services such as Zoom, WebEx, Skype, Google Hangouts and/or FaceTime.

- Move to telehealth when possible, as CMS changes are allowing increased telehealth reimbursements. Using video visits for patients with compromised health can help them avoid coronavirus exposure. Chronic medicine can be delivered to patients’ homes. Of course, when moving to telehealth solutions, notification to patients and training staff members is necessary.

- Prepare for patient visits by securing the doors and screening patients before entry. Provide hand sanitizer, face masks, and gloves and take basic sanitary precautions that can make a difference:

- Disinfect all surfaces, equipment and door knobs between patient consults.

- Shared resources should be kept clean.

- Proper hand hygiene.

- Waiting-room chairs are placed six feet apart and social distancing respected during interactions as possible; alternatively, you can allow sign-in/call-in at the entrance/via phone and ask patients to stay in their car in the parking lot and call them when you are ready to take them back.

- Deal with elective procedures by rescheduling to a later date. Serve patients when you believe it medically irresponsible to delay but disclose the risks, and keep them separate from patients coming in for non-elective procedures. Please note the difference between necessary elective procedures and not-necessary elective procedures.

- Update your website and phone greetings to communicate your current processes and availability.

Medical practices, dental practices, and small and rural hospitals are more likely to weather the pandemic storm by taking positive financial and operational steps now to mitigate business losses and emerge from the crisis in an even-stronger market position. For individual steps your medical or dental practice or hospital should take, schedule a complimentary phone consultation here or join our webinar, “Managing a Healthcare Practice through the Pandemic: Finance and Operations” on Thursday, April 2 at 12:30 p.m. by registering here.

Important Client Announcement Related to COVID-19

| At CIG Capital Advisors, the health and safety of our clients, business partners and team is our first priority. Amid the growing concerns around COVID-19, we are taking substantial measures to ensure the welfare of our clients and employees is protected: Moving In-Person Meetings to Virtual Meetings: In an effort to minimize any potential exposure, we are taking the highest level of precaution and are strongly encouraging all client service meetings be conducted in a virtual format. Should you agree to change your in-person meeting to a virtual meeting via either our secure video conference system or telephone, please contact your CIG Capital Advisors senior wealth manager. Social Distancing and our Business Continuity Plan: The Centers for Disease Control and Prevention (CDC) recommends social distancing as a measure that can help prevent the spread of COVID-19. This could eventually extend to our office environment, so in an abundance of caution, CIG Capital Advisors will conduct a trial run of a full-staff remote work day on Tuesday, March 17. Should you need to contact a CIG Capital Advisors staff member on Tuesday, the usual channels of communication like email and phone will be available per our Business Continuity Plan. Our leadership team is monitoring the situation daily, taking into account guidance from the CDC, public health agencies and state officials. We will adapt our protocols as necessary and keep you apprised of all updates and changes. Investment Management: While health and wellness must be our priority, the financial health of your portfolio is a fiduciary responsibility we take seriously every day, no matter the macro-economic conditions. However, during times of economic instability like we have seen in recent weeks, it’s natural to seek information about how your asset manager is reacting amidst the turmoil. To discuss our prudent response to the uncertainty in the global markets, we’ve scheduled a special client-only webinar on Wednesday, March 18 at 1 p.m. The webinar will last approximately 30-45 minutes. All clients are invited to register for the webinar, hosted by CIG Capital Advisors Managing Principal Osman Minkara and Vice President of Asset Management Brian Lasher; you may also want to refer to our monthly Asset Management updates and recent 2019 Asset Management Year in Review letter, all of which were previously emailed to you and can also be found on our website here. REGISTER FOR THE WEBINAR HERE: https://zoom.us/webinar/register/WN_BSWP4BA_Q-yxk9J68wm2cA Please reach out to the CIG Capital Advisors team with any questions in the meantime, and we look forward to “seeing” you virtually in the webinar on Wednesday. |

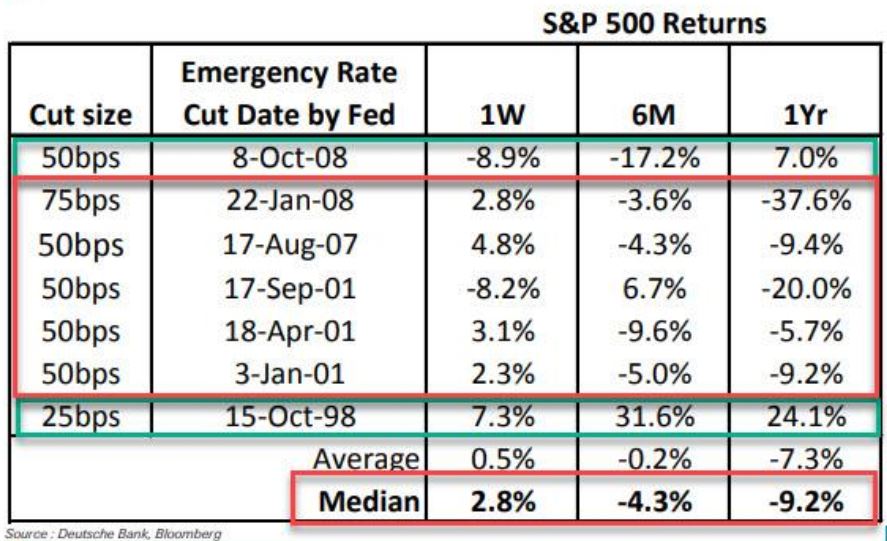

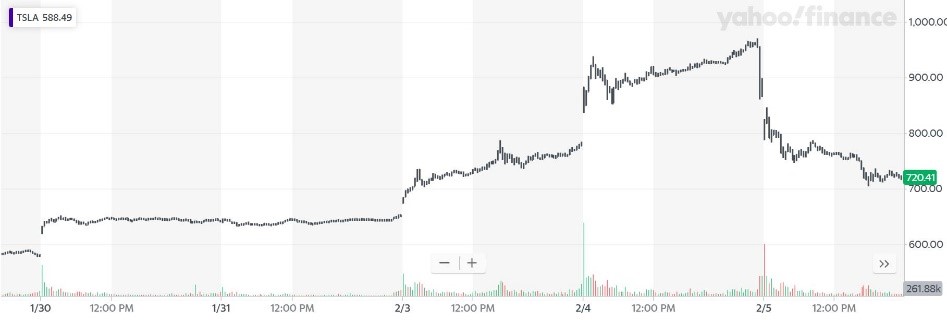

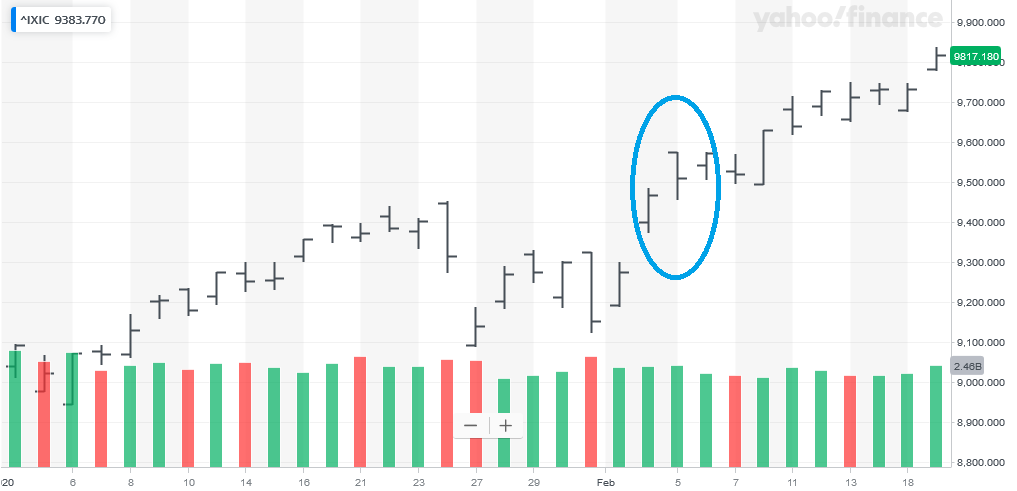

CIG Asset Management Update February 2020: The Unknown Unknowns and Our Thoughts on COVID-19

| Market volatility spiked starting at the end of February and continues today at extreme levels. Long time readers of our updates know that we have been warning about asset bubble and Central Banks’ recent actions since last year. On March 3rd, The Federal Open Market Committee (FOMC) cut the federal funds rate by 0.5 percentage points to a 1 to 1.25% range. An emergency interest rate cut between regular meetings is very rare. The last such cut was during the Great Financial Crisis (GFC) in October 2008. In fact, there have only been 7 emergency actions since October 1998. Interestingly, the FOMC took this action after only a -8.2% decline in February for the S&P 500 Total Return Index(1). Similarly other markets around the world showed “orderly” selling – the MSCI EAFE Net index of Developed Markets was down only -9.0% while Emerging Markets, as measured by the MSCI Emerging Markets Net Index, lost only -5.3% during the month(2). How have stocks performed in the past after the FOMC cuts rates unexpectedly? The answer in the table below(3) is that they tend to go lower the following 12 months. The average one year return on the S&P 500 following an emergency cut is -7.3%. The October 15, 1998 emergency cut was in reaction to a hedge fund, Long Term Capital Management (LTCM), imploding. Excluding the LTCM cut, the average one year return after the other six actions was much worse, -12.5%.  On February 20 and 21, FOMC speakers were cheerleading the market and saying that no rate cuts were necessary. We must ask ourselves, why did the Federal Reserve deem it necessary to act so suddenly? Ultimately, fears intensified over the new coronavirus (COVID-19) turning into a pandemic given that the number of new cases appearing outside of China were outpacing those within China, all this without adequate testing in many places. However, we remain skeptical that monetary policy can solve the global economic issues. Amazon, Google, Facebook and Microsoft are now pushing working from home(6). All, in addition to Apple, JP Morgan, Proctor & Gamble and others, have limited employee travel(6). Major events such as the St. Patrick’s Day Parade in Dublin have been cancelled, and forthcoming cancellations will be likely, too. Corporate management teams know that they will be forgiven if they lump as much bad news as possible into the first half of 2020 whether it is COVID-19-related or not. The bad news is likely to keep coming and the economic damage may be significant. It is possible that that Central Banks can regain control as Central Banks have managed to restrain volatility for the six previous times issues arose since the GFC. However, with the VIX at 60+, they appear to be more challenged than ever post-2008. Already, Treasury yields have reached record lows in February. Accordingly, the Barclays U.S. Long Treasury Index increased 6.7% during the month(4). Market participants are now anticipating three interest rate cuts to occur in 2020(5) and in March, Treasury yields have reached unprecedented low levels! The 30-year Treasury is below 1% as we write(1). In this high volatility environment, anything is possible and we are watching the markets and economy like a hawk. The CIG-managed portfolios have benefited from being positioned for late cycle volatility since October, with the Dynamic portfolios even more so since late February. There is massive risk to the downside as well as the upside. On the plus side, we may get a global fiscal stimulus package which would in turn boost markets. In that case, markets are very oversold, meaning assets that have traded lower/ gotten cheaper have the potential for a price bounce. On the other hand, the constant subsidy of the markets and the economy has led us to a large bond and stock market bubble and very high debt levels while the Federal Reserve has left themselves with way fewer tools. We have plans for both scenarios. CIG has a robust business continuity plan to lessen any interruption to service and allow us to remain fully operational at all times. We can accommodate a fully remote staff if necessary. We believe the communication procedures that we have in place will help ensure that there is no disruption to your service. We remain committed to meeting your expectations regarding meeting attendance and recognize that some clients may prefer conference calls or videoconferencing in lieu of in-person gatherings. Finally, we are persistently following the investment markets and repercussions of COVID-19 and will continue to communicate with you when appropriate about the portfolio impact and opportunities that are created. Until then, please stay well and support your friends and neighbors. The elderly who are deeply concerned now and neighbors without alternative childcare will need our help. As long as it is advisable, please visit your service vendors like restaurants and tip generously. We also ask that you generously give to local organizations who support the needs of lower-income families who might rely on travel, retail and hospitality sources of income. They will suffer disproportionately. Even if COVID-19 burns out in the coming months, as we hope it will, the economic issues could possibly linger for some time. This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. SOURCES: 1. Calculated from data obtained from Yahoo Finance, as of February 28, 2020. 2. MSCI, as of February 28, 2020 3. Deutsche Bank report using Bloomberg Data 4. NEPC 5. https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html as of March 9, 2020. 6. https://www.businessinsider.com/companies-asking-employees-to-work-from-home-due-to-coronavirus-2020 |

CIG Asset Management Update January 2020: How Much to Dance?

| Meanwhile, the worsening of the coronavirus appears to have caused a plunge in bond yields in January as investors seek additional safe havens and the VIX Index(2) (the CBOE Volatility Index® which measures U.S. equity market volatility) has also risen. Consequently, we have acted in client portfolios to adjust to our perception of the ongoing exaggeration of the market environment that we talked about above and in the recent year-end letter (we highly encourage you to read it if you have not done so already.) Given these risks in the market, we continue to proceed with caution and feel that portfolio discipline remains paramount. While recessionary concerns remain low given the massive central bank stimulus around the globe, CIG’s outlook can rapidly adjust as a result of a material change in economic indicators or a dramatic shift in central bank policy. Accordingly, we ask ourselves, “How and how much do we want to dance with this market today?” |

CIG Asset Management Update December 2019: When Others are Greedy

November was a “risk-on” month, with the CNN Fear & Greed Index(1) reaching the “Extreme Greed” level. With the Federal Reserve buying more treasury bills than they ever bought in prior Quantitative Easing (QE) periods(2), a variety of U.S. equity indices did very well last month. The S&P 500 Index(3) returned 3.4% while riskier small company stocks, as measured by the Russell 2000 Index(3), were up 4.0%. The VIX Index(3) (The CBOE Volatility Index® which measures U.S. equity market volatility) posted a low for the year of 11.5 on November 26 as complacency in the market set in.

Given the lack of additional Central Bank stimulus, developed market foreign stocks in the MSCI EAFE Net(4) Index produced a more modest return of +1.1% while Emerging Markets as measured by the MSCI Emerging Markets Net(4), lost -0.1%. Investors also did not appear to be interested in bonds, as The Barclays U.S. Aggregate Total Return Bond Index(5) decreased by -0.1%. Surprisingly, market participants did not bid up the price of high yield issues, a traditional “risk-on” asset, with The Barclays High Yield Index(5) only gaining +0.3%.

Warren Buffet, the “Oracle of Omaha” and legendary investor, once said to be “fearful when others are greedy and greedy when others are fearful.”(6) With that in mind, the most important aspect of client relationships, beyond the investment expertise that we offer, is to ensure when these times arise and risk appetites are high, that we work together to restrain any exuberant investment behaviors. The same is true when risk appetites are low and we need to moderate our fearful investment behaviors (e.g., early 2009).

Consequently, the objective right now is to generate returns ahead of client financial plan targets by taking restrained risk in relation to client general risk preferences (i.e., growth models may look more balanced while still attempting to generate double-digit returns). In consideration of the massive QE mentioned above and trade war uncertainty, along with weakening global growth, CIG transitioned to “a later cycle approach” in portfolios during the last quarterly rebalance in furtherance of that goal. Overall, equity holdings were decreased, quality increased and fixed income increased slightly.

On the other hand, given the substantial QE (which one can wonder its rationale), the growth of the money supply has accelerated at a more rapid pace than last year. According to theory, when money growth is faster than the growth of the economy, the excess money goes into financial assets driving even expensive stocks and bonds higher. In addition, according to DataTrek, U.S. stocks rarely reverse course in a dramatic fashion after a year like 2019, but they also don’t usually do quite as well as the long run averages. The one exception was when the Federal Reserve tightened in 1937 and the S&P 500 Index delivered a -35% return(7).

We continue to weigh the potential risks in the markets and plan for a wide range of scenarios, both positive and negative, with the goal of consistently reevaluating and managing the appropriate level of risk so that clients can achieve their financial plan goals. It means delivering a nuanced, material understanding of diversification, which typically means carefully buying assets that have not appreciated and selling investors’ favorites. Diversification remains our best defense and recently healthcare stocks, a lesser performer in 2019, were increased in the portfolios. This increase in equities highlights our continued flexibility and our devotion to offering a fundamental value proposition to clients who seek long-term out-performance.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

SOURCES:

- https://money.cnn.com/data/fear-and-greed/

- Market Commentary by Art Cashin, UBS Financial Services, November 13, 2019

- Calculated from data obtained from Yahoo Finance, as of 12/11/19

- MSCI, as 12/11/19

- NEPC, as of 12/11/19

- https://www.investopedia.com/articles/investing/012116/warren-buffett-be-fearful-when-others-are-greedy.asp

- From DataTrek in Market Commentary by Art Cashin, UBS Financial Services, October 16, 2019

CIG Asset Management August 2019 Update: Top of the Ninth Inning

The end of July and beginning of August has proven to be very tricky. The S&P 500(1) declined almost 100 points. Bond yields plunged almost 25 basis points. Some of the culprits behind these movements included Federal Reserve Chairman Powell’s “mid-cycle adjustment” comment post the recent rate cut, and Trump’s new tariffs announcement. A number […]

CIG Asset Management July 2019 Update: Central Banks Drive Market Rebound

Reversing their sharp declines from May, global equity markets came roaring back in June as global central banks appeared more accommodative because of subdued inflation, ongoing trade war anxieties and waning economic data. The S&P 500(1) gained 7%, while the MSCI EAFE Net Index(2) of developed international equities and Emerging Markets Net Index(2) were up […]

Three ways your medical practice might lose out by not being transparent enough

In reaction to sweeping changes occurring in the healthcare industry, private practice physician-owners and network providers are seeing an increase in their patient population’s enrollment in High-Deductible Health Plans (HDHPs), which place a bigger financial burden on the consumer and require price transparency from providers. Patients, providers and payors can all view transparency in different […]