CIG Asset Management Update: The Stock Market Rally May Be Broadening

In October 2023, we shared the CIG Asset Management Update: Year-to-Date U.S. Stock Performance in Pictures and we discussed how the Magnificent 7[i], seven mega-cap growth stocks, were driving the returns of the S&P 500.

This outperformance continued through year end as you can see in the December 31, 2023 FinViz heat map below.

Source: FinViz as of 12/31/2023

In the year, 2023, the Magnificent 7 stocks experienced an average return of +111% while the S&P 500 Index only gained +26%. The Equal-Weighted S&P 500 Index only gained +12%. If you removed the Magnificent 7 stocks from the Equal-Weighted S&P 500 Index, you would have only gained +8%. [ii]

The strong performance of the Magnificent 7 stocks has extended into 2024. As of February 29, 2024, these seven stocks have gained +12.7%, outpacing the S&P 500’s increase of +7.1% and the Equal-Weighted S&P 500 Index’s gain of +3.2%.[iii]

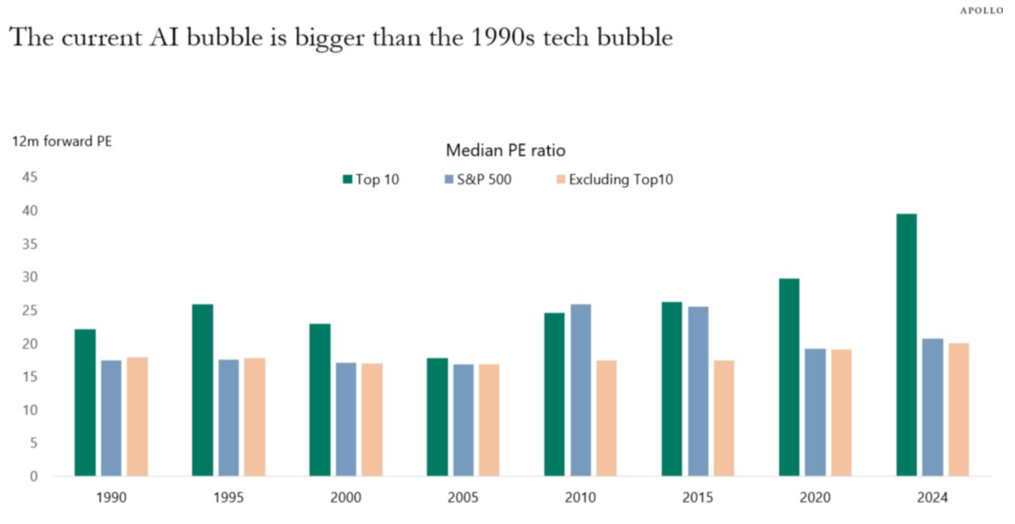

We believe the Magnificent 7 stocks are currently trading at levels considered expensive compared to historical standards. Torsten Slok, Apollo’s Chief Economist, has recently showed that when you compare the median 12-month forward price-to-earnings (PE) ratio of the top ten companies in the S&P 500, which include all of the Magnificent 7 stocks, they are much more expensive now than they were during the tech bubble of the 1990s. [iv]

Source:Bloomberg, Apollo Chief Economist. Note: Data as of January 31, 2024.

With that being said, we are seeing some encouraging signs that the stock market rally may finally be starting to broaden out. For the week ended 3/6/2024, we saw four of the Magnificent 7 stocks; Microsoft (MSFT), Apple (AAPL), Alphabet (GOOG), and Tesla (TSLA) move lower as many other stocks outside of the technology sector rose. You can see this in the March 6, 2024 FinViz heat-map below.

Source: FinViz as of 3/6/2024

While we find it encouraging to see a wider equity market participation, we still believe strongly in the value of diversification. Diversification is not supposed to maximize returns, it is designed to reduce investment risk. A diversified portfolio at times won’t keep up with the market when the bulk of returns are concentrated in a small group of stocks like the Magnificent 7. We strive to diversify our investments amongst industries and sectors, size (large-cap and small-cap), geography, growth versus value and alternative asset classes. Some of these investments are negatively correlated to the stock market – what that means is historically when the stock market traded lower – these investments gained in value. Past performance is not a guarantee of future results, but history helps guide us.

At CIG, we believe in risk-balanced investing. We believe investors should consider how much risk they are taking to achieve returns. We think that we should be striving to reach the return necessary to meet the various needs of our client’s financial plans while, at this point in the market cycle, taking as little risk as possible to meet that goal. We want you to sleep at night.

Please reach out to Brian Lasher (blasher@cigcapitaladvisors.com), Eric T. Pratt (epratt@cigcapitaladvisors.com) or the rest of the CIG team.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] The Magnificent 7 stocks are: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon.com (AMZN), Nvidia (NVDA), Tesla (TSLA), and Meta Platforms (META)

[ii] https://www.forbes.com/sites/greatspeculations/2024/01/22/2023-in-review/?sh=78aab8bd690b

[iii] Calculated by CIG Asset Management for the Roundhill Magnificent Seven ETF (MAGS) using data from finance.yahoo.com

[iv] The Daily Spark, February 25, 2024 – Apollo Academy

Transitioning your medical practice through merger or sale of an ownership stake

Constant changes in the healthcare industry, along with an aging physician-owner population eager to ramp down heavy workloads, have caused many providers to consolidate, either through merger or sale of the practice to another group, or transitioning an ownership stake in the practice to another individual. This consolidation has taken on many forms, including: Practices […]

The importance of a buy/sell agreement

All group medical practices should strongly consider having a buy/sell agreement. Typically, a buy/sell agreement states that a physician’s ownership interest in the practice cannot be sold to someone outside the practice without the approval of the other members of the practice. The other physicians in the practice have the option of buying the ownership […]