Summary:

- Stocks fell in September as big technology companies faltered [i] .

- COVID-19 deaths hit a grim milestone in the U.S. and increased around the world [v] .

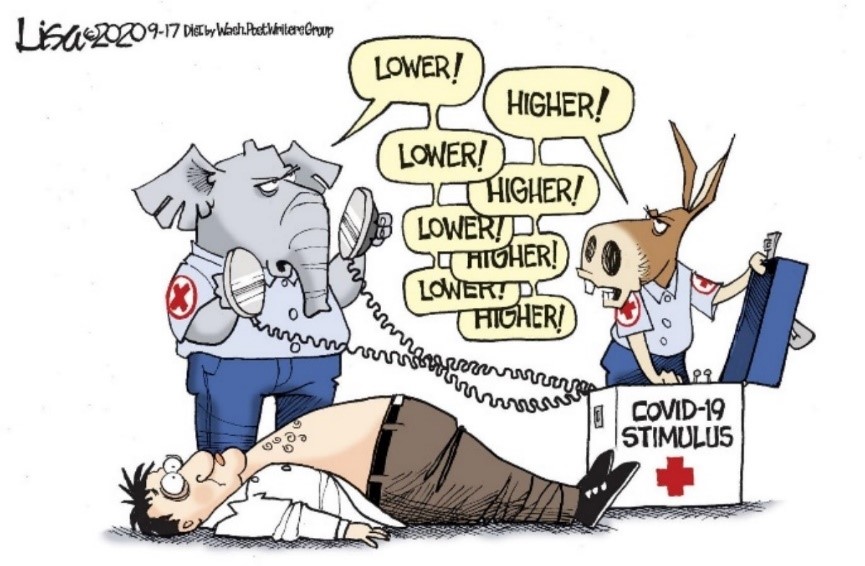

- The markets traded up or down based upon the probability of a new stimulus bill.

Commentary:

The S&P 500 declined -3.9% and the tech-heavy NASDAQ dropped -5.2%.[i] Outside of the U.S., developed markets, as measured by the MSCI EAFE net, were down -2.9% and the MSCI Emerging Markets Index retreated -1.8%.[ii] Little protection was offered by Gold as it moved -4.1% lower as the US Dollar Index gained +1.9%.[iii] Fixed income (the Barclays U.S. Aggregate Total Return Index) returned -0.1% and the Barclays U.S. High Yield Index fell -1.0% for the month.[iv]

Republicans and Democrats struggled to come to an agreement to provide more stimulus to the economy. Republicans in the Senate were unable to pass their own “skinny” stimulus bill on September 10. Meanwhile, markets traded lower throughout the month as the COVID-19 death toll in the United States continued to increase and finally surpassed 200,000 on September 22.[v] Over the following two days, there were no less than sixteen Federal Reserve speeches in two days, but investors were unimpressed. Fed speakers reasserted that the Fed will do what it takes to support the economy and cautioned that what is really needed right now is more fiscal stimulus. On September 25, economy re-opening hopes blossomed when Governor DeSantis announced on that he was lifting all restrictions on the Florida economy. The following Monday, stimulus hopes were re-ignited as Speaker of the House Nancy Pelosi said she was hopeful to get a $2.4 trillion coronavirus stimulus bill passed.

September’s weakness in equities and their back and forth nature keep investors on notice that both the financial markets and the economy remain on thin ice. Uncertainty abounds and volatility could increase dramatically on short notice, especially as the election nears. Investors’ latest reminder was on October 6, when these stimulus machinations whipsawed the markets again.

We continue to employ diversification, discipline and flexibility in managing client portfolios to potentially avoid air pockets like the one above. Our focus on clients’ long term financial plans remains paramount.

Please join the team at CIG Capital Advisors for an engaging discussion looking at the challenges, opportunities and questions ahead as we navigate the current and future market conditions:

WEBINAR: “Keeping your Financial Plans Alive Amid Chaos”

Tuesday, October 20 at 6 p.m.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Calculated from data obtained from Yahoo Finance, as of September 30, 2020

[ii] MSCI, as of September 30, 2020

[iii] Calculated from data obtained from Yahoo Finance, as of September 30, 2020

[iv] Calculated from data obtained from Bloomberg, as of September 30, 2020

[v] John Hopkins / NPR September 22, 2020