Summary:

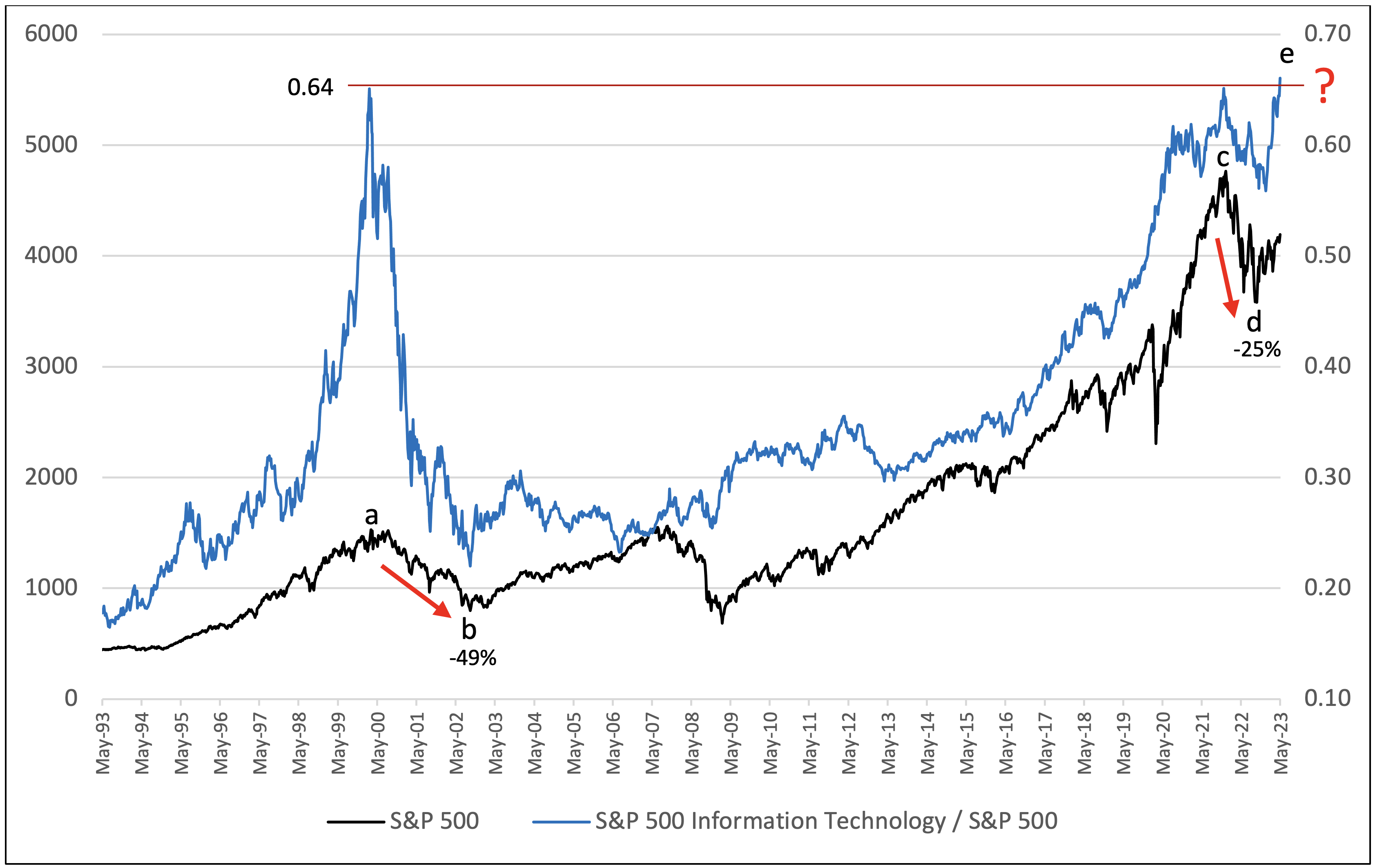

* The performance ratio of the S&P 500 Information Technology Sector to the S&P 500 has hit an all-time high.

* Market returns after hitting these levels have not been favorable in the past.

Commentary:

The performance ratio of the S&P 500 Information Technology Sector to the S&P 500[i] (the blue line on the above chart) has hit an all-time high of 0.66. The ratio’s previous all-time high was set in March 2000 at 0.64. As we previously discussed in What If the Bubble Bursts?, from March 27, 2000 (a) to October 9, 2002 (b) the S&P 500 (black line) fell -49% and then it took over 7 years to recover its losses after the peak. This same ratio hit 0.64 again on December 27, 2021 (c) and was followed by a -25% drawdown in the S&P 500 through October 10, 2022. (d) Now, as of May 15, 2023, this important ratio has hit a new all-time high of 0.66. (e)[ii] Will history repeat? Are we currently in a second massive technology bubble? No one knows for sure – but we are very cautious.

The rally thus far year-to-date has been narrow and concentrated in a few names. Six S&P 500 stocks – Apple, Microsoft, Nvidia, Alphabet, Amazon, and Meta – have contributed 90% of the gains of the overall index year-to-date through May 18, 2023.[iii] Five of these stocks are working on incorporating artificial intelligence (A.I.) into their business models and product offerings. While A.I. could be disruptive in the long run, the euphoria in anything A.I.-related reminds us of 1999, when many of the dot-com stocks soared in value with the internet as we know it now was still in its infancy.

Consequently, we continue to attempt to optimize our client’s exposure to the information technology sector in our pursuit of navigating our clients’ investments through these potentially turbulent market conditions. It is impossible to predict where these developments will lead, of course, but periods of upheaval can create opportunities for transformative change. We stand ready to possibly increase our allocation to domestic equities should the market rally broaden out to other sectors that have not kept up with the mega-cap growth stocks that have led year-to-date thus far. If we experience a significant market drawdown, then great opportunities could exist in the market which we would endeavor to evaluate and potentially participate in.

While volatility has moved lower over the course of 2023[iv], we do not expect that to persist for the remainder of the year. Therefore, we continue to stay the course of risk-balanced investing. We remain focused on striking the right aggressiveness versus defensiveness in client portfolios given the evolving uncertainty in the markets, the economy, and geopolitics.

Please reach out to Brian Lasher (BLasher@cigcapitaladvisors.com), Eric T. Pratt (EPratt@cigcapitaladvisors.com) or the rest of the CIG team if you have any questions.