Summary:

* The economy may be heading toward a period of stagflation.

* How to be prudent ahead of possible stagflation.

May 2022 Returns:

Commentary:

Energy prices continued to climb during the month of May, adding to fears that inflation may be persistent. Natural gas gained +12.4%, adding to its +28.3% gain in April.[ix] Crude oil advanced +9.53% for the month to $114.67 per barrel.[x] The S&P 500 hit its 52-week low on May 20 and briefly entered “bear market territory”, down -20% from its all-time high and then bounced in the last week of trading to close up for the month.

Stagflation is the “perfect storm” of negative news: rising unemployment, rising costs and a slowing economy. The classical definition is persistent inflation combined with stagnant consumer demand and relatively high unemployment. Is the U.S. economy about to be hit by a stagflation storm the likes of which have not been seen since the 1970s? Let’s consider each of these indicators:

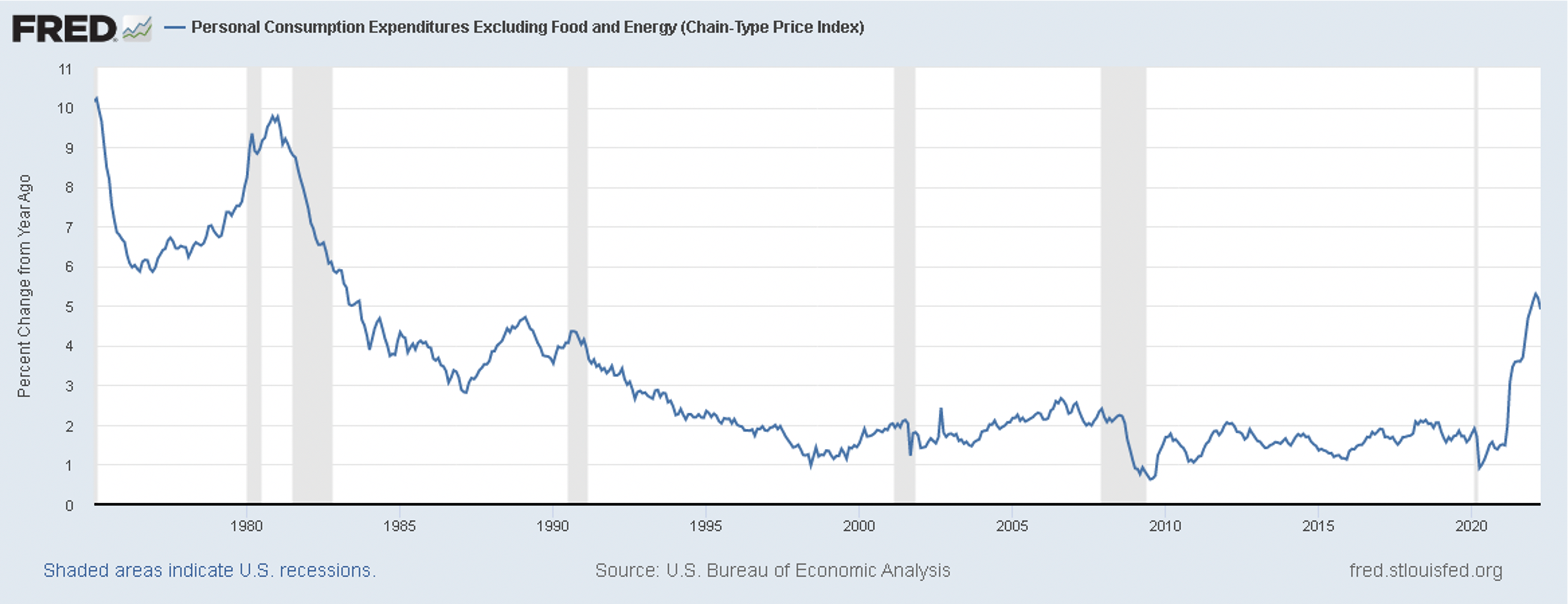

Is the U.S. economy experiencing persistent inflation? Yes. Personal Consumption Expenditures Index excluding Food and Energy was up +4.9% year-over-year in April 2022.[xi]

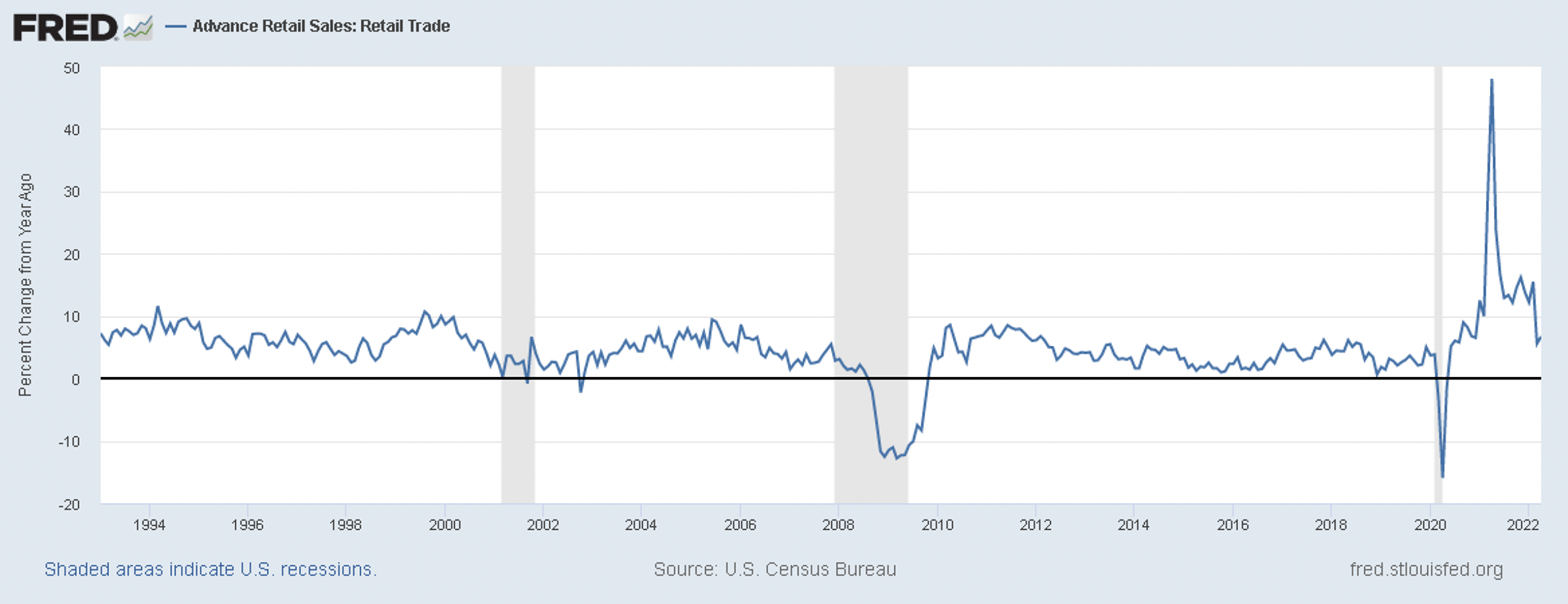

Has consumer demand stagnated? Not yet. April retail sales were up +6.7% year-over-year. Slowing from the large gains that were seen after lockdowns ended in 2021.[xii]

Retailers are starting to see a big shift in consumer spending away from non-discretionary (things you want) to discretionary (things you need). Walmart’s Chief Executive Officer Doug McMillon said the disappointing earnings were “unexpected” and reflect an “unusual” environment. Inflation squeezed consumer discretionary spending and staffing costs increased.[xiii] Walmart stock fell over -11%, its worst one-day performance since the crash of 1987.[xiv] Target fell -25%, also its worst performance since the 1987 crash, as it saw unusually high costs and consumers shift spending away from discretionary purchases.[xv]

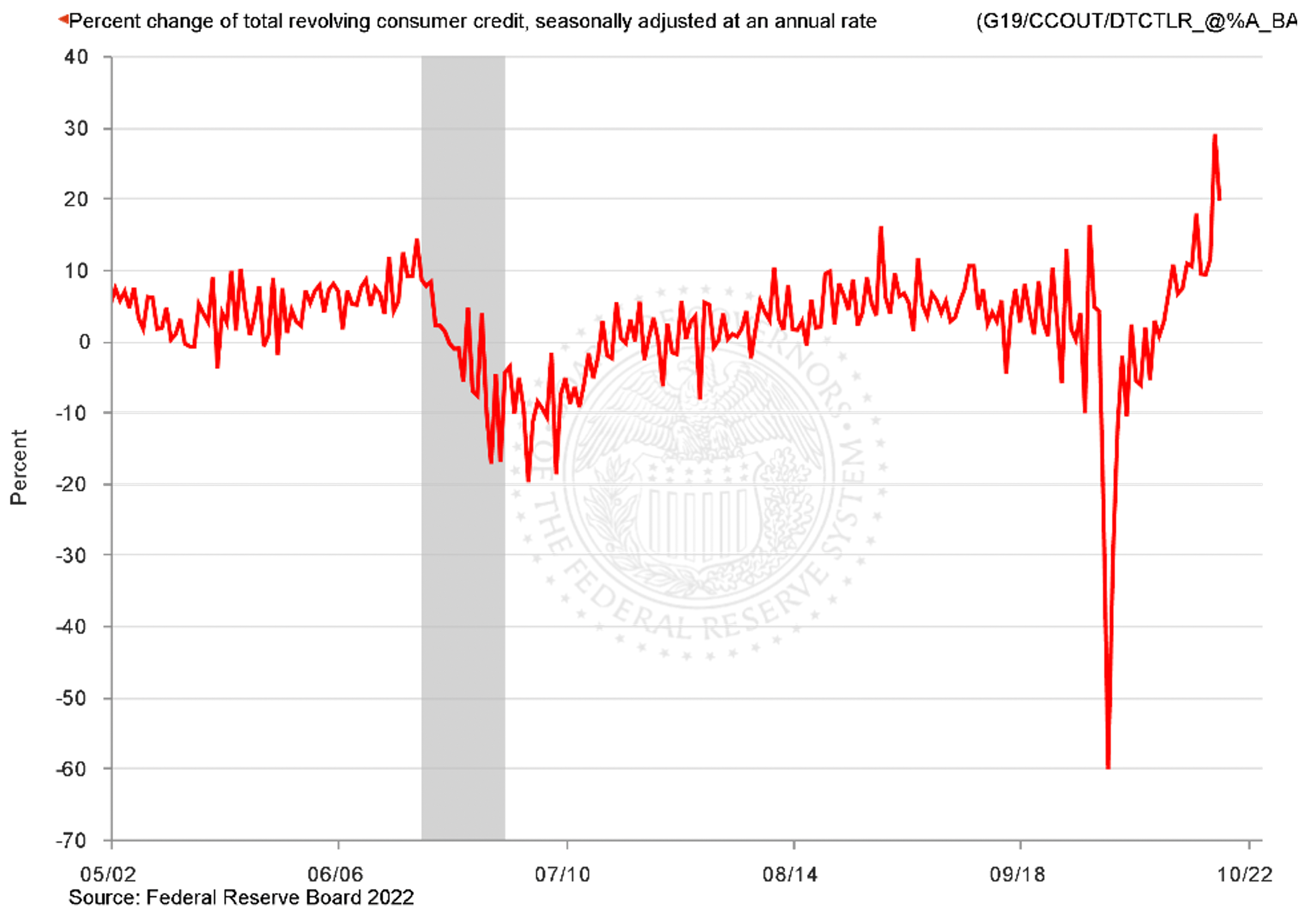

We believe that spending has been propped up by consumers buying what they need on credit. March saw a +29% increase year-over-year in revolving consumer credit, followed by a +19.6% year-over-year advance in April.[xvi] Revolving consumer credit consists mainly of credit card debt. We do not believe the trajectory of the chart below is sustainable.

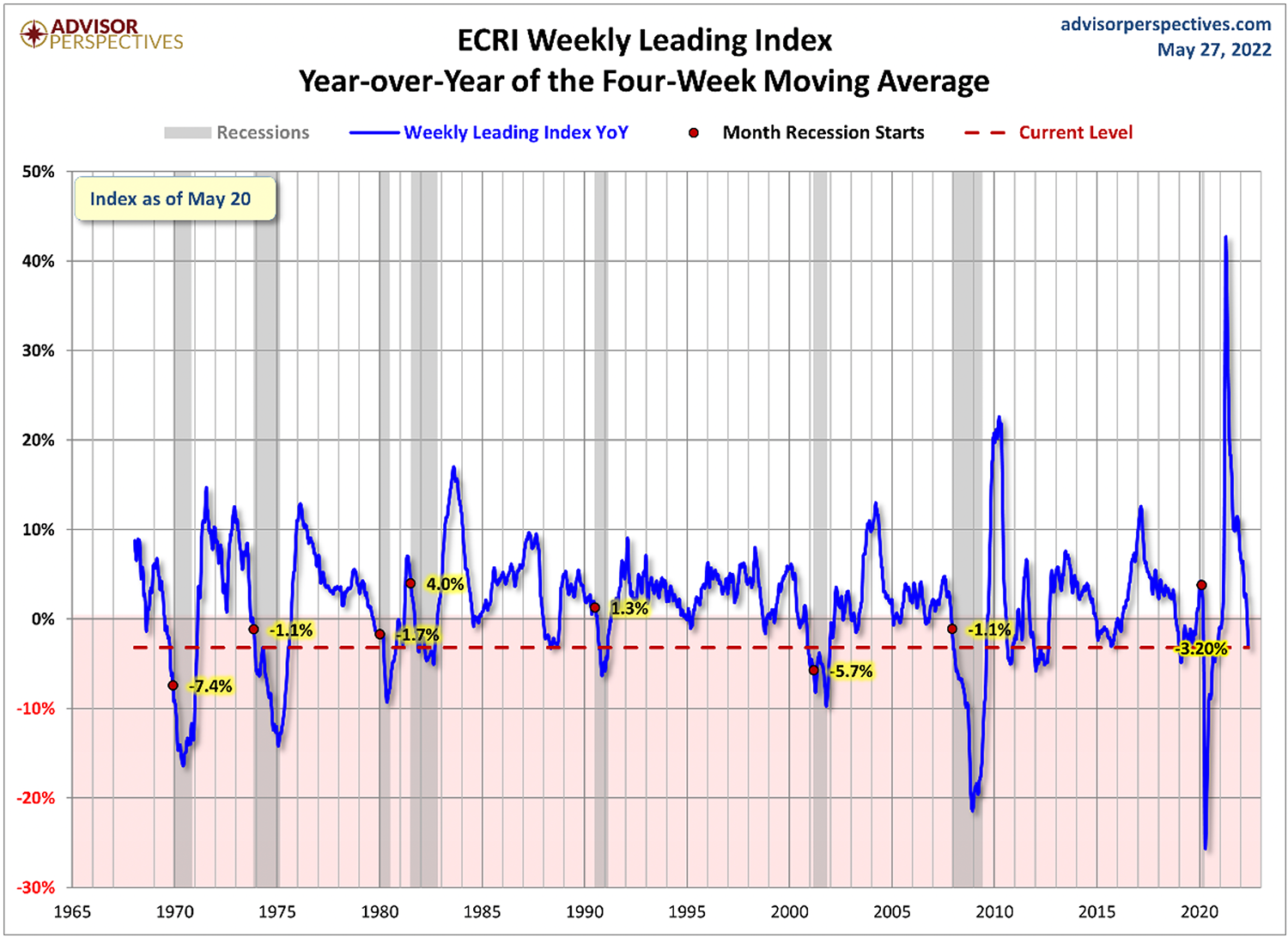

Personal consumption expenditures and retail sales are both lagging indicators. If we look at a leading indicator, the Economic Cycle Research Institute (ECRI) Weekly Leading Index, we see signs that the economy is rapidly slowing. The year-over-year change of the four-week moving average of the ECRI Weekly Leading Index was -3.2% as of May 20, 2022.[xvii]

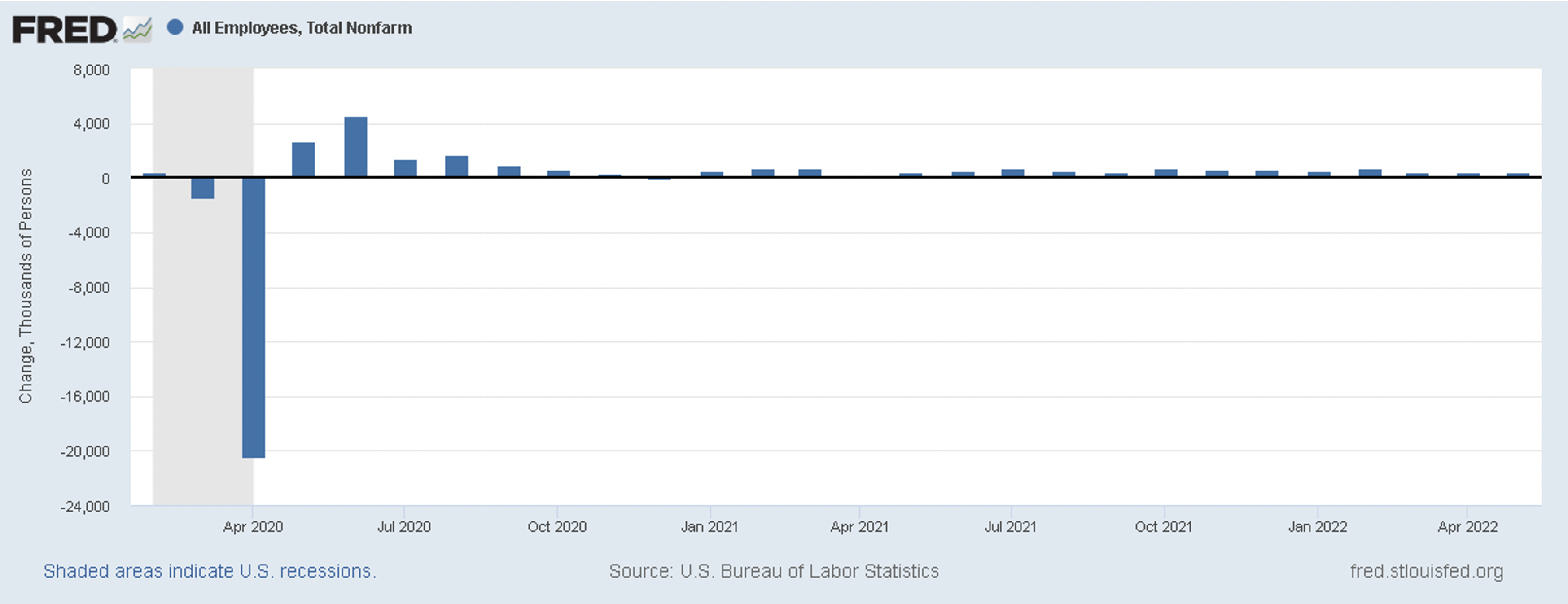

Relatively high unemployment? No. May Nonfarm Payrolls showed +390,000 jobs added to the economy.[xviii] We are still seeing healthy gains in employment, but at a more muted level than mid-2020.

Already this year, we have seen a small wave of companies, including Wells Fargo, Robinhood, Netflix, Carvana, and Peloton, announce employee cuts.[xix] On June 2, 2022, Elon Musk emailed Tesla executives and told them the company needs to reduce its workforce by 10%, citing a “super bad feeling” about the economy.[xx] As the economy slows, we may see increased layoffs.

We may continue to see persistent inflation, slowing consumer spending and slower job growth and layoffs. The Federal Reserve may have to raise rates faster and higher than expected to combat inflation and in doing so could likely impact consumer demand and increase unemployment. Economist Mohamed El-Erian, in an interview with Fortune magazine, said stagflation is “unavoidable” and investors should prepare for a “significant slowdown in growth.”[xxi] On June 1, 2022, Jamie Dimon, CEO of JPMorgan – the largest bank in the U.S. – spoke to analysts and investors and said current conditions are “fine”, but then warned, “You’d better brace yourself. JPMorgan is bracing ourselves and we’re going to be very conservative with our balance sheet.” Dimon continued, “You know, I said there’s storm clouds but I’m going to change it … it’s a hurricane.” Dimon went on to say he doesn’t know if it’s going to be “a minor one or Superstorm Sandy.”[xxii]

It is possible inflation will subside, the consumer will remain strong and unemployment will remain near record low levels. However, if these three things don’t happen, how does one to prepare for the storm?

Many investment strategists believe owning Treasury Inflation-Protected Securities (TIPS) and real assets, such as real estate and commodities, can help reduce inflation risk. We have also observed that during past environments where growth is slowing, that consumer staples (the things you need) tend to outperform the rest of the market. We have already positioned a healthy weighting of TIPS, gold, and gold miners in our Dynamic and Strategic strategies.

We may or may not be interpreting these deteriorating graphs smartly while the business leaders discussed above are shouting danger “at the top of their lungs.” Regardless, the rational act for today is to continue these investments in CIG’s client portfolios to potentially protect against inflation or stagflation. But we also recognize that the markets are remarkably unstable right now. It’s hard to predict when Chairman Powell or some other market missionary will unleash a torrent of “inflation has peaked and that the Fed is overshooting.” What ultimately may offer a safe harbor for CIG’s clients is our focus and ability to quickly adjust to changing circumstances and to pursue new investment opportunities as they emerge.

We would welcome the opportunity to connect with you to address your questions and concerns and discuss the economy, as well as the value of careful active management in uncertain times.