Summary:

* Stocks added to October’s gains.

* Are markets fighting the Fed?

* What happens when short-term interest rates are higher than long-term rates?

November 2022 Returns:

Commentary:

Domestic stocks continued October’s gains with the S&P 500 gaining +5.2% in November.[ix] Fixed income advanced +3.7% as measured by the Bloomberg U.S. Aggregate Index[x], as the yield on the 10-Year U.S. Treasury bonds fell -0.37% to 3.70% on November 30.[xi] Gold gained +6.7%[xii], International Equities in developed markets gained +11.3%[xiii], and Emerging Market Equities soared +14.8%[xiv], as the U.S. Dollar Index fell -4.9%.

Equities have benefited over the past two months from longer-term interest rates, as measured by the yield on the 10-Year U.S. Treasury bond, falling from their recent peak of 4.33% on October 20, to 3.41% on December 7.[xv] Investors appear to be encouraged by the September and October Consumer Price Index (CPI) reports that showed the rate of inflation has decelerated on a month-over-month basis (i.e., CPI was 8.2% in September and 7.7% in October).[xvi] Despite CPI remaining at 7.7% over the past year[xvii], some feel that the Federal Reserve has already raised rates too much and will need to cut rates as early as next year to keep the economy out of a recession.

“Don’t fight the Fed”, coined in 1970 by Martin Zweig, a finance professor and famed investor, is a mantra that suggests investors should align their investments with the current monetary policies of the Federal Reserve; that not doing so imperils investors’ portfolios. On November 30, Federal Reserve Chairman Jerome Powell spoke at the Hutchins Center on Fiscal and Monetary Policy, Brookings Institution, in Washington, D.C. In his speech, Powell noted, “It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting.” Powell continued, “The timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level. It is likely that restoring price stability will require holding policy at a restrictive level for some time.”[xviii]

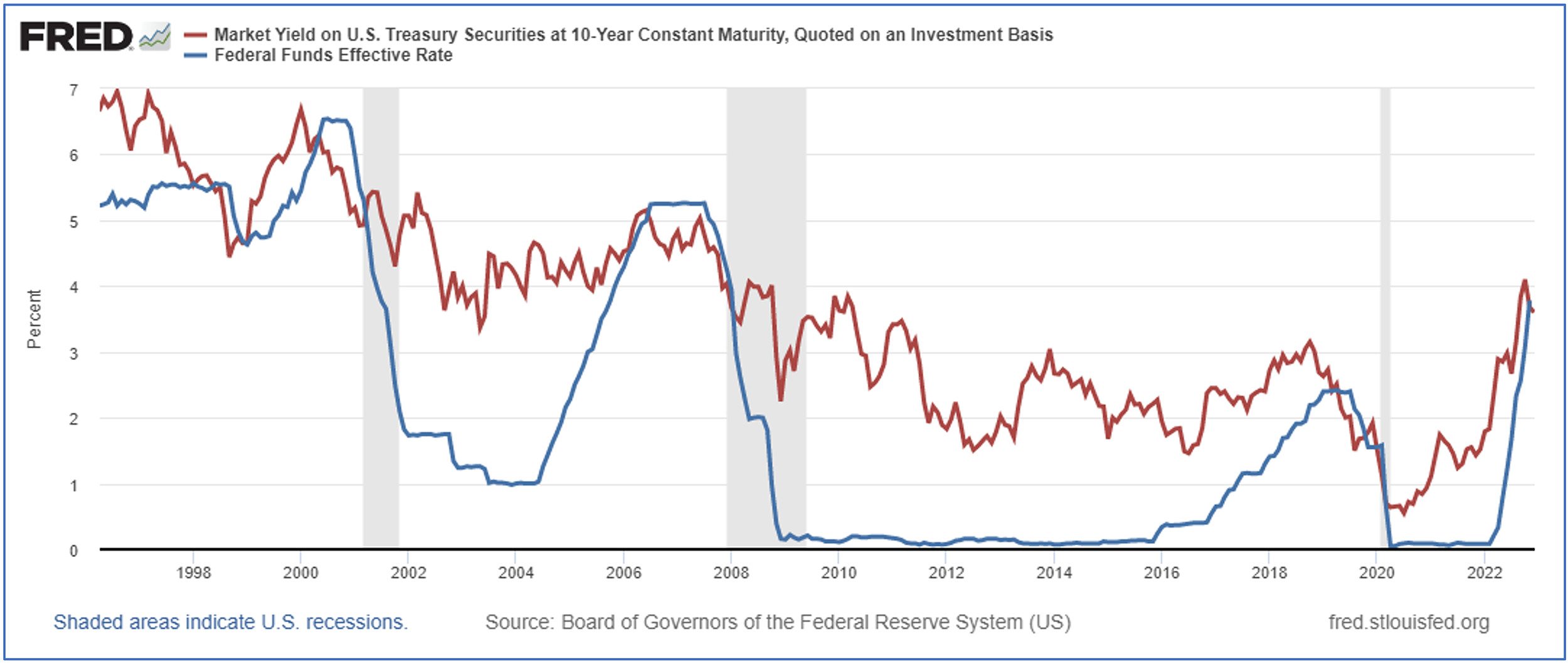

Investors appear to be “fighting the Fed” as long-term bond yields continue to fall even as short-term rates like the Federal Funds Effective Rate (Fed Funds), an overnight interest rate, are moving higher. In a normal (or less abnormal) world, short-term debt has a lower yield than longer-term debt of the same quality (i.e., it costs more — the interest rate — to borrow for a longer time). On rare occasion, short-term debt has traded at higher yields than long-term debt — this is called an inverted yield curve. Even rarer is when the Fed Funds is at a higher yield than the 10-Year U.S. Treasury bond, which is what just occurred in November 2022.

Let’s explore what has happened after the Fed Funds Rate (blue line) exceeds the yield on a 10-year U.S. Treasury bond (red line), as shown in the following chart:

Source: fred.stlouisfed.org

Source: fred.stlouisfed.org

- May 2000. Stocks traded lower for two years; the dot-com bubble burst; and the U.S. economy entered a recession.[xix]

- July 2006. A year later, Bear Stearns failed; the housing bubble began to burst; and the 2007-2008 Great Financial Crisis sent the U.S. economy into a deep recession.[xx]

- Spring 2019. A year later, COVID-19 shut down the word economy; stocks fell; and the U.S. economy entered a brief recession.[xxi]

Perhaps inflation will drop to the Federal Reserve’s 2% goal and they will be able to engineer a soft-landing for the economy. Perhaps not. Regardless, as illustrated in the above chart, be careful what you wish for: markets and the economy suffered initially each of the last three times the Fed started cutting rates.

As we maneuver through these difficult conditions, we continue to apply our disciplined approach to Asset Management. Our CIG Dynamic Growth Strategy composite was able to capture 85% of the upside of the growth benchmark during November 2022 while year-to-date through 11/30/2022, it has avoided approximately 57% of the losses of the growth benchmark. Our CIG Dynamic Balanced Strategy captured 79% of the upside of the balanced benchmark during November 2022 while year-to-date through 11/30/2022, it has avoided approximately 65% of the losses of the balanced benchmark.[xxii]

We would welcome the opportunity to connect with you via voice or email to discuss how active management could protect your portfolio and capture opportunities when other investors are “fighting the Fed”.