Summary:

* S&P 500 declined for the first month since January 2021

* Increasing economic and geopolitical uncertainty

* Market volatility rising

* Do we know?

Commentary:

The S&P 500 index fell -4.65% in September, its first monthly decline since January 2021 and the worst monthly decline since March 2020.[i] In overseas markets, the MSCI EAFE net index declined -3.19% and the MSCI Emerging markets fell -4.25%.[ii] Chinese stocks, represented by the SSE Composite Index, gained +0.68%[iii] and was one of the very few equity markets with positive performance for the month. Fixed income did not offer much protection against the decline in stocks as the Bloomberg US Agg Bond Index fell -0.87%.[iv]

What changed in the month of September? Economic and geopolitical uncertainty appears to have increased.

On September 3rd, the Federal Reserve Bank of New York issued a suspension notification for Nowcast, its official forecast for growth in the U.S. Gross Domestic Product (the total value of goods produced and services provided during one year) stating the following, “The uncertainty around the pandemic and the consequent volatility in the data have posed a number of challenges to the Nowcast model. Therefore, we have decided to suspend the publication of the Nowcast while we continue to work on methodological improvements to better address these challenges.”[v] Upon hearing this announcement, we were reminded of Yogi Berra, the great baseball player and sometimes philosopher who once said “It’s tough to make predictions, especially about the future.”[vi]

Later in the month, Federal Reserve Chairman Powell held a very unconvincing press conference after the FOMC meeting on September 22. Regarding inflation, Powell said the current inflation is “a very modest overshoot. You’re looking at 2.2[%] and 2.1[%], you know, two years and three years out. These are very, very – I don’t think that households are going to, you know, notice a couple of tenths of an overshoot.”[vii] Did investors notice on September 23 that the National Association of Realtors’ August existing homes sales report showed that the median sales price of existing single-family homes in the U.S. rose +14.9% year over year to $356,700?[viii] Did investors notice that the price of U.S. natural gas hit a 12-year high of 6.325 as of October 5, 2021?[ix]

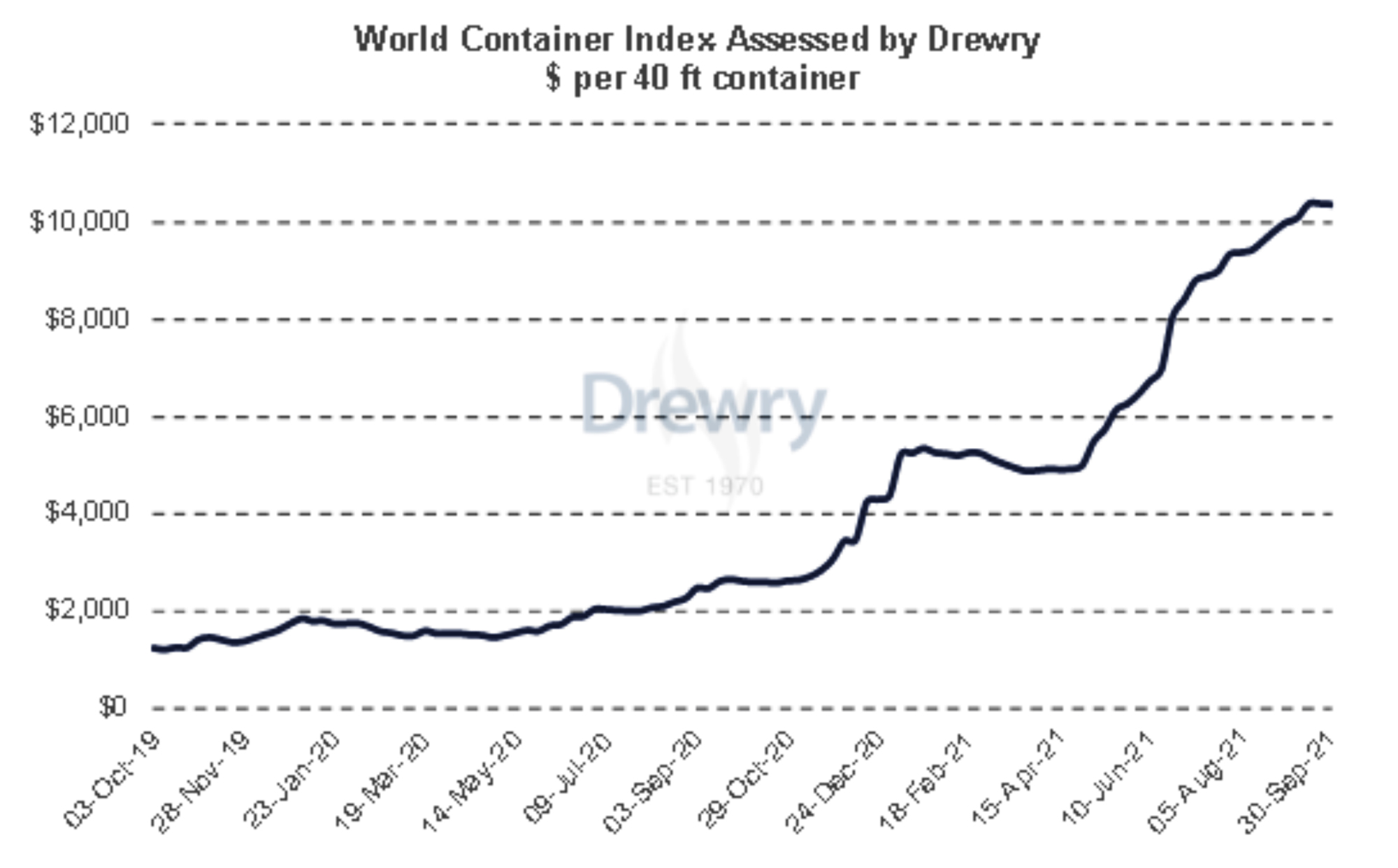

Chairman Powell also said the current inflation is a “reflection of bottlenecks and shortages that…seem to be going to be with us at least for a few more months and perhaps into next year.” As of September 24, there were 600 large container ships waiting to dock at ports in Asia, Europe, and North America. In June there was an average 14-hour delay of ships arriving to Canadian and U.S. ports. Now the delay is almost 10 days![x] There is not much in the way of historical data regarding the current world-wide supply chain issues. But, as the Drewry World Container Index chart below shows, shipping prices have more than doubled year to date.

Source: Drewry.co.uk

Actionable idea: buy your year-end holiday gifts early and locally.

To make things worse, tensions with China are growing and Taiwan is extremely important to the world economy. Semiconductor companies in Taiwan generated almost 65% of global revenues from outsourced chip manufacturing in the first quarter of 2021. Taiwan Semiconductor (TSMC) alone accounted for 56% of global revenues. Most of the 1.4 billion smartphone processors are made by TSMC.[xi] On Friday, October 1, as China celebrated the National Day of the People’s Republic of China, the People’s Liberation Army (PLA) flew 38 warplanes into Taiwan’s air defense identification zone (ADIZ). October 2 saw 39 planes and on October 3, 16 more planes entered the ADIZ. On October 3 the United States State Department issued a statement urging Beijing to “cease its military, diplomatic, and economic pressure and coercion against Taiwan.” China responded on Monday, October 4, by sending a record 56 Chinese warplanes into the ADIZ.

We do not know i) how much GDP will grow next year, ii) whether supply chain issues will abate soon, or iii) if China and the U.S. will lower tensions. This economic and geopolitical uncertainty appears to be contributing to stock market volatility. Historically we have observed that usually when volatility increases by a large margin, stock markets head lower. In market terms, it has been a long while since we had such volatility.

Meanwhile equity markets are near record highs and record valuations. So, we continue to stay the course of risk balanced investing – take enough risk to reach your goals but not much more. We remain focused on striking the right aggressiveness versus defensiveness in client portfolios given the evolving uncertainty in the markets and the economy.