Measure Your Medical Practice’s Performance

Is your medical practice moving forward, standing still, or losing ground? You’ll know the answer if you compare different aspects of your practice’s operations to appropriate benchmarks (as you can do here using the CIG Capital Advisors Medical Practice Dashboard). Benchmarking can give you the data you need to make informed management decisions about the direction of your practice.

What To Measure

There are two types of benchmarking: Performance and process. Performance benchmarking compares a practice’s operating performance internally over time and externally against other practices of a similar size in the same specialty. Process benchmarking compares a practice’s work protocols. By tracking key benchmarks from quarter-to-quarter or year-to-year, you can identify the areas in which progress is being made.

Start by choosing a few indicators that are important to you. For each indicator, determine your objective and define what you’ll measure and how you’ll do it. Keep tracking the data regularly so that you can make meaningful comparisons over time. Here are some of the indicators your practice may want to use in its analysis.

Profitability/Cost Management

Look at measures such as net income (or loss) per full-time equivalent physician and operating cost per physician. Other useful areas to analyze would include operating costs as a percentage of total medical revenue and total support staff cost per physician.

Billings and Collections

What percentage of submitted claims is rejected by third-party payers? Is that percentage higher or lower than it has been in the past? If you determine that the number is increasing, you’ll need to review the quality of your coding. If coding errors are at fault, it’s critical that you tackle this issue immediately.

Examine the percentage of accounts receivable over 120 days. Is it higher or lower than what has been your experience? What about your practice’s fee for service collection percentage or the dollar amount of bad debts per physician? These are measures that you can evaluate.

If you track your copay collection rate for several quarters and see that it is deteriorating, have your front desk staff pull up each patients’ records when making appointments and remind them about past due payments. In addition, remind your front desk employees to ask for copays at the time of service and to request any outstanding amounts.

Patient No-shows

If your measurement of patient no- shows reveals an uptick in the numbers, consider having your staff make reminder calls or charging for missed appointments.

Time Patient Spends in Office

Patients resent lengthy waiting times. You can track the average time patients spend waiting to see a physician or physician’s assistant. Start by giving a percentage of patients (10%, for example) a card that your receptionist time stamps on arrival and collects and stamps again on departure. If the data reveal an increase in wait times, overbooking may be an issue. If that’s the case, you’ll want to reexamine your procedures and time blocking. You may even have to look into adding another physician, physician’s assistant, or nurse practitioner.

There are other indicators your practice can use to evaluate how well it is doing. Keep tracking the data regularly so that you can make meaningful comparisons over time, and be sure to try our Medical Practice Dashboard to see how your medical practice compares to other peer practices nationally. For a confidential consultation with a CIG Capital Advisors medical practice advisor, email Brian Lasher.

Boosting your healthcare practice’s cash flow during a pandemic

Many medical and dental practice owners were surprised to find their offices closed by statewide shutdown orders preventing non-essential medical and dental services. Even as states reopen elective healthcare, practices may find a drastically different market for services. That demand uncertainty for medical and dental services, coupled with the threat of future intermittent care stoppages, makes this a good time for physicians and dentists to focus on boosting their practice’s cash flows in order to better prepare for the short- and long-term future of healthcare during a pandemic:

Telehealth

Telehealth is a great ancillary service to add to your practice. More than ever, it should be incorporated to boost your practice’s revenue stream.

Centers for Medicare & Medicaid Services (CMS) has issued temporary measures to facilitate the use of telehealth services during the COVID-19 Public Health Emergency. Included in these changes is the ability to bill for telehealth services as if they were provided in person. Another temporary change allows providers to deliver care to both established and new patients through telehealth.

In addition, CMS has also expanded the list of covered telehealth services that can be provided in Medicare through telehealth.

Providers may provide telehealth services to patients through commonly used apps that normally would not fully comply with HIPAA rules. Some of the more popular examples of these apps include FaceTime, Zoom, or Skype. However, the platforms should not be public-facing, such as Facebook Live.

Healthcare providers may also reduce or waive cost-sharing for telehealth visits during the COVID-19 Public Health Emergency.

Coverage for telehealth services may differ throughout the various commercial payors as well as from state to state.

Chronic Care Management

The popularity of Chronic Care Management (CCM) services has been increasing in recent years, especially as providers are realizing that they may bill for services they would regularly provide free of charge.

Chronic Care Management is defined as the non-face-to-face services provided to Medicare beneficiaries who have multiple (two or more), significant chronic conditions. Rather than being exclusive to physicians, other clinicians, such as Nurse Practitioners and Physician’s Assistants, may also provide CCM services; however only one clinician can furnish and bill for any particular patient during a calendar month.

The practice must have the patient’s written or oral consent and use a certified EHR to bill CCM codes. The creation and revision of comprehensive electronic care plans is a key component of CCM.

CCM incentivizes a higher standard of care for patients with multiple chronic conditions and offers an additional $42 to $139 per patient per month based on time and complexity.

U.S. Department of Human & Health Services (HHS) Provider Relief Fund

The Provider Relief Fund is provided to support healthcare providers fighting the COVID-19 pandemic. The funding supports healthcare-related lost revenue attributable to COVID-19.

Providers must accept the HHS Terms and Conditions and submit revenue information by June 3, 2020 to be considered for an additional General Allocation payment. All facilities and health care professionals that billed Medicare FFS in 2019 are eligible for the funds. It is important to note that these are grants, not loans.

A physician can estimate his or her payment by dividing 2019 Medicare FFS (not including Medicare Advantage) payments received by $484 billion, and multiplying that ratio by $30 billion.

Paycheck Protection Program Loan Forgiveness

The Paycheck Protection Program (PPP) is a loan designed to provide a direct incentive for small businesses to keep their workers on payroll. The main attractive feature of this program is the ability to have some if not all of the loan proceeds forgiven. Forgiveness is based on the employer maintaining or quickly rehiring employees and maintaining salary levels. If a laid-off employee declines an offer to be re-hired, the forgiveness amount will not be reduced, however it is advised to get written confirmation of the fact.

The forgiveness portion of the loan consists of money used for payroll, rent, mortgage interest, or utilities. A reduction in payroll may reduce the amount that may be forgiven; 75% of the potential forgiveness amount should be used for payroll.

It may be in your best interest to review the PPP Loan Forgiveness Application to help you understand how the forgiveness portion will be calculated. We advise you to review with your accountant and/or legal counsel before submission to the U.S Small Business Administration.

Creative solutions and persistent actions to boost cash flow may help your practice overcome the COVID-19 crisis. Contact a CIG Capital Advisors Business Advisory Services professional to look for ways your practice might be able to increase cash flow amid the pandemic.

Sources

Telehealth

Chronic Care Management

- https://www.acponline.org/system/files/documents/running_practice/payment_coding/medicare/chronic_care_management_toolkit.pdf

- https://phamily.com/ccm/

HHS Provider Relief Fund

Payroll Protection Program

- https://www.sba.gov/sites/default/files/2020-05/3245-0407%20SBA%20Form%203508%20PPP%20Forgiveness%20Application.pdf

- https://www.aicpa.org/content/dam/aicpa/interestareas/privatecompaniespracticesection/qualityservicesdelivery/ussba/downloadabledocuments/coronavirus-ppp-loan-forgiveness-calculation-steps.pdf

CIG Asset Management Update May 2020: Stay the Course

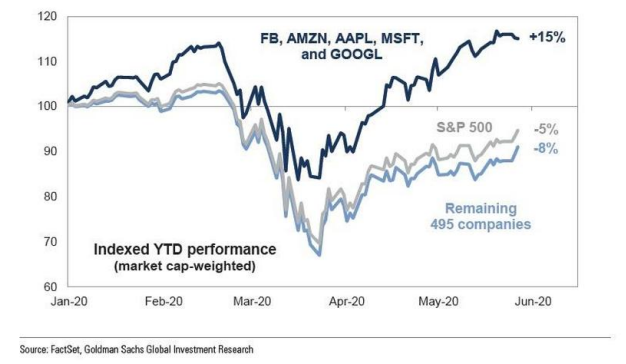

| Equity markets continued their recovery from the March 2020 lows. In the month of May, the S&P 500(1) gained +4.5% and outside of the U.S., the MSCI EAFE net was up +4.1% and the MSCI Emerging Markets Index was up +0.6%(2). Growth outperformed value as measured by the Russell 1000 Growth Index, +6.6% versus the Russell 1000 Value Index which was up +1.1%. Small-cap stocks, as measured by the Russell 2000 index, were up +2.6%(3). Within fixed income, the Barclays U.S. Aggregate Total Return Index returned +0.5% and the Barclays U.S. High Yield Index increased +4.4% for the month(4). The FAAMG stocks, as mentioned in our April letter: Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL), continue to drive performance within the S&P 500. Year-to-date through May 27, the FAAMG stocks are up an average of +15% versus the other 495 companies in the S&P 500 down -8%(5). |

The good news within these numbers is that for the month of May, the FAAMG stocks and other 495 stocks were up almost equally. This could be quite constructive, as a broader number of stocks contributing to the overall return of the S&P 500 may lead to a healthier market.

We are encouraged as more states begin the process of re-opening their economies. It remains to be seen how the civil unrest that has followed the death of George Floyd in Minneapolis over the past few days will impact re-opening efforts.

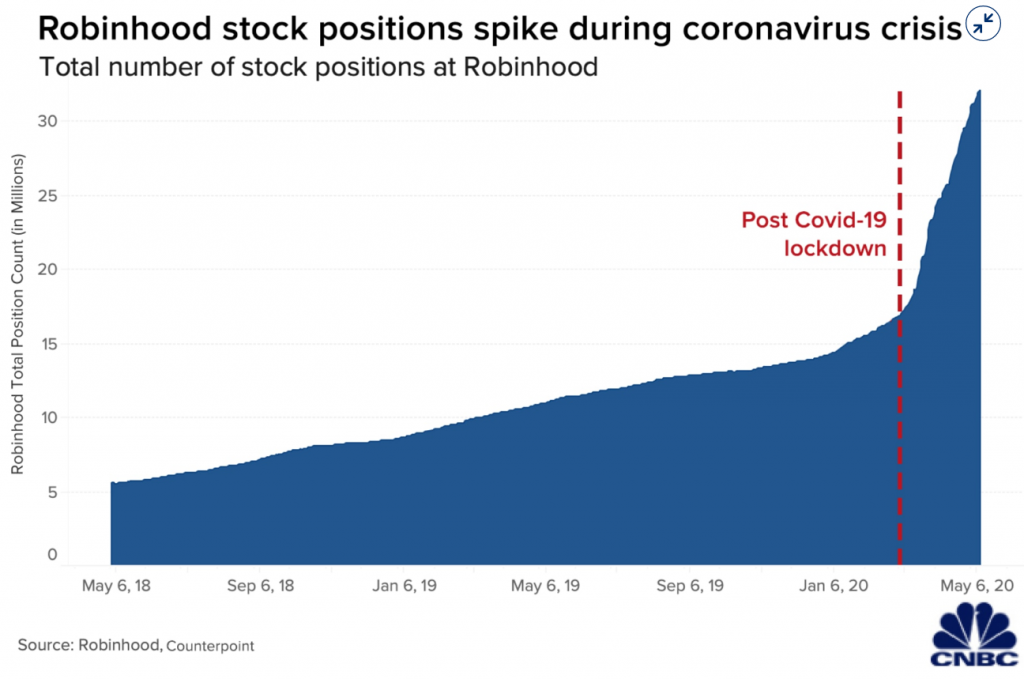

On May 22, Barron’s published an article, “Day Trading Has Replaced Sports Betting as America’s Pastime. It Can’t Support the Stock Market Forever.” Within this article, Jim Bianco from Bianco research argues many people who typically would gamble on sports went to the stock market as sports have been shut down. In addition, many Americans took their coronavirus stimulus check and invested it into stocks. Online brokerages have seen a surge in new accounts this year. Robinhood saw three million new accounts in the first quarter, and the total number of stock positions more than doubled year-to-date(6), even with the platform suffering crashes and glitches on heavy trading volume days.

Bianco believes that this retail investor mania has driven much of the markets’ 30%+ retracement from the low.(7) Retail investors piled into low-priced stocks that were down considerably, hoping to make big profits if they rebounded. The dangers here are i) hundreds of companies have withdrawn their revenue guidance for 2020(8), ii) only 63% of companies beat analysts’ consensus expectation – the lowest quarterly figure in seven years(9), and, finally, iii) multiple pharmaceutical companies have put out “market-moving” positive press releases without remotely having the vaccine data to back up their claims(10).

As we talked about in our recent webinar, we at CIG believe the path to successful investing over the long term is to develop a plan, exercise discipline, and stay the course. Retail investors piling into stocks that are down significantly or betting on vaccine cures, looking for short term profits, is not a long-term plan.

The most encouraging news in May was the May 28 unemployment claims report that showed continuing claims decreased by 3.86 million to 21.05 million. This is the first decrease since February, before the shut-downs. Although the absolute level of continuing claims is still over three times higher than the post-Great Financial Crisis high of 6.64 million(11), we are happy to see claims heading in the right direction. Volatility, as measured by the VIX, has also decreased from 34.15 on April 30, to 28.43 on June 1. This is still high versus historical averages; however, it is a far cry from the March 16 high of 82.69(12).

If volatility continues to fall and high frequency data following the progression of the economy reopening improves, we are likely to continue with the plan to rebalance towards the strategic equity targets. If volatility surges and reopening efforts are hindered by a resurgence in coronavirus cases due to the recent crowds of people protesting, we have a plan. Please always be mindful that our main objective is to reach the return necessary to achieve your goals as outlined in your financial plan, not to pursue returns without regard to risk. Valuations remain excessively high.

| This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. SOURCES: 1. Calculated from data obtained from Yahoo Finance, as of June 1, 2020 2. MSCI, as of June 1, 2020 3. FTSE Russell, as of June 1, 2020 4. Calculated from data obtained from Bloomberg, as of June 1, 2020 5. FactSet, Goldman Sachs Global Investment Research, May 27, 2020 6. CNBC, May 12, 2020 7. Barron’s, May 22, 2020 8. https://www.wsj.com/graphics/how-coronavirus-spread-through-corporate-america/ 9. https://www.jhinvestments.com/weekly-market-recap, Week ended May 29, 2020 10. https://www.businessinsider.com/perfect-storm-of-stupid-in-stock-market-right-now-2020-5 11. US Department of Labor, May 28, 2020 12. Data obtained from Yahoo Finance, as of June 1, 2020 |

Managing a Healthcare Practice through the Pandemic: Finance and Operation

Medical practices, dental practices, small and rural hospitals and larger healthcare systems alike are feeling the effects of the COVID-19 pandemic. Recent regulatory changes, like the $8.3 billion emergency funding measure that expands Medicare reimbursements for telemedicine and the prohibition of all non-essential medical, surgical, and dental procedures during the outbreak, have upended the planned revenue cycle of nearly every U.S. healthcare practice or business. How can medical practice owners, dental practice owners and other healthcare managers adjust the financial and operational levers of their business to better weather the economic turmoil caused by the pandemic?

Financial steps to take:

- Put together a 12-week cash flow statement to understand better how you can manage the disruption, assessing what should be coming in and what you must pay and can delay paying, including evaluating the best approach to manage your staff given the circumstances.

- Billing staff should work remotely in order to continue billing as usual and connect with insurance companies. Their time should be used to follow-up on past billings and accounts receivables.

- Reach out to your bank to determine if/when you can setup or increase a line of credit for your business.

- Contact your accountant for up-to-date financials and clarity regarding whether you will be paying your sales/use and withholdings taxes as normal or taking advantage of your state’s relief, if applicable.

- Look for state and federal programs you may qualify for, including the SBA’s Economic Injury Disaster Loans.

Operational steps to take:

- Consider employees carefully. Can non-essential staff work remotely or even be laid off or furloughed to find work elsewhere through a healthcare staffing company, given that many large systems are currently understaffed? Use web conferencing to hold staff meetings, utilizing services such as Zoom, WebEx, Skype, Google Hangouts and/or FaceTime.

- Move to telehealth when possible, as CMS changes are allowing increased telehealth reimbursements. Using video visits for patients with compromised health can help them avoid coronavirus exposure. Chronic medicine can be delivered to patients’ homes. Of course, when moving to telehealth solutions, notification to patients and training staff members is necessary.

- Prepare for patient visits by securing the doors and screening patients before entry. Provide hand sanitizer, face masks, and gloves and take basic sanitary precautions that can make a difference:

- Disinfect all surfaces, equipment and door knobs between patient consults.

- Shared resources should be kept clean.

- Proper hand hygiene.

- Waiting-room chairs are placed six feet apart and social distancing respected during interactions as possible; alternatively, you can allow sign-in/call-in at the entrance/via phone and ask patients to stay in their car in the parking lot and call them when you are ready to take them back.

- Deal with elective procedures by rescheduling to a later date. Serve patients when you believe it medically irresponsible to delay but disclose the risks, and keep them separate from patients coming in for non-elective procedures. Please note the difference between necessary elective procedures and not-necessary elective procedures.

- Update your website and phone greetings to communicate your current processes and availability.

Medical practices, dental practices, and small and rural hospitals are more likely to weather the pandemic storm by taking positive financial and operational steps now to mitigate business losses and emerge from the crisis in an even-stronger market position. For individual steps your medical or dental practice or hospital should take, schedule a complimentary phone consultation here or join our webinar, “Managing a Healthcare Practice through the Pandemic: Finance and Operations” on Thursday, April 2 at 12:30 p.m. by registering here.

Understanding Medical or Dental Practice Financial Statements

Financial statements are to accounting what CT scans and X-rays are to the medical profession: the financial health of a business or medical practice can be assessed by analyzing its financial statements. While most dentists would prefer to focus on dentistry rather than the business of dentistry, it can be beneficial for dentists (or any physician-owner) to familiarize himself or herself with the basics of financial statements.

Learning how to read financial statements allows a physician or dentist to see where the practice’s money came from, where it went, and where it is now. Dentists and physicians will want to be aware of the following three basic financial statements:

- Balance Sheet. The balance sheet provides detailed information about your practice’s assets, liabilities, and shareholder’s equity. It is a snapshot of the financial status of your practice as of a certain date. Assets are things the practice owns that have value. Assets may include physical property, such as office buildings and equipment, cash and investments, receivables, and intangibles, such as goodwill. Liabilities are amounts the practice owes to others. Liabilities can include items such as taxes owed to the government, bank loans, and money owed to vendors. Shareholders’ equity is the amount the practice would have left over if it sold all its assets for the amount appearing on the balance sheet and paid off its outstanding liabilities. This equity belongs to the practice owners.

- Income Statement. An income statement shows how much revenue your dental or medical practice generated over a specific period, usually a year. It also shows the costs and expenses that went into earning that revenue. The bottom line is the practice’s profit or loss for the reporting period. Pay close attention to the practice’s operating expenses, such as rent, utilities, and supplies. A practice that experiences a net loss may look to reduce its operating expenses in an attempt to return to the black.

- Cash Flow Statement. The cash flow statement reports the dental or medical practice’s inflows and outflows of cash during the reporting period. A cash flow statement tells you the net increase or decrease in cash. Cash flow statements are generally divided into three parts: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

As experienced advisors, we can help you dig deeper into your numbers and show you where you can make changes that will improve your practice’s bottom line. Contact a CIG Capital Advisors medical practice management professional today for a complimentary initial consultation.

Optimizing Your Medical Practice’s Income

Enhancing revenue and controlling expenses should be the primary financial focus of every medical practice.

Improving operational efficiencies can help bring a practice closer to achieving these financial goals. Here are some ways you can maximize your practice’s revenue stream and reduce costs without sacrificing patient care:

Keep Coding Current

Coding errors are all too common. Simple errors end up costing medical practices money as well as time to rectify mistakes. Delays or denied claims translate into reduced reimbursements, which, in turn, affect cash flow.

To minimize coding errors, you need to identify the cause of the problem. Typically, miscodes are due to undercoding to avoid penalty risk, using outdated data, or leaving coding decisions to inexperienced support staff. Periodic assessments of your practice’s coding accuracy can help uncover problem areas. These assessments could include a review of your practice’s forms and a comparison of billing codes with the actual services that were provided.

Maintaining updated coding manuals and software, keeping a code reference summary handy in exam rooms, and using online coding resources can help your practice attain a more accurate coding rate. So too will making notes during each patient visit. Be sure to have your staff attend refresher courses to help them stay current with coding practices.

Improve Employee Productivity

Eliminating inefficiencies and boosting employee productivity directly benefit your practice’s bottom line. Try these approaches to improving the productivity of your practice:

o Define productivity goals and offer incentives to your staff for reaching those goals.

o Delegate administrative functions so that physicians spend the greater part of their day seeing patients.

o Maximize physician and medical assistant billable time by planning patient flow carefully.

Better Control of Staff Time

Are your overtime expenses increasing from quarter to quarter? While some overtime is unavoidable, a consistent rise in overtime hours deserves some scrutiny. Review the payroll records of your non-exempt employees to determine who worked overtime and why. Was your practice fully staffed and simply busy or was it short one or more employees on the days when the overtime occurred? If overtime was necessary because you were short-staffed, see if this was due to vacations or some other controllable situation. It may be time to revise your practice’s policy on vacation time if scheduled time off was the cause of the overtime.

Update Fee Schedules

If your practice hasn’t raised fees in some time, you may want to consider appropriate increases. Just be aware that some patients may be resistant to fee increases and could switch to another provider. In addition, take a look at the reimbursement rates of all the plans you participate in. Run the numbers to determine whether it makes financial sense to continue accepting patients from some of the plans that reimburse poorly.

Buy Smarter

Medical and office supplies make up a portion of a practice’s expenses. Yet, some practices rarely shop around for more competitive prices. You can control expenses by becoming a smarter shopper. Pick some of your practice’s “high-volume” items and find out how much other vendors are charging. Use that information to negotiate lower prices with your current suppliers, consolidate orders with fewer vendors, or switch to new suppliers to save money.

Eliminating inefficiencies and boosting employee productivity directly benefit your practice’s bottom line. The business advisory professionals at CIG Capital Advisors can work with you to identify areas in your medical practice where streamlining operations may help optimize your practice’s bottom line.

Measure Your Medical Practice’s Performance

Is your medical practice moving forward, standing still, or losing ground? You’ll know the answer if you compare different aspects of your medical practice’s operations to appropriate benchmarks. CIG Capital Advisors’ Medical Practice Dashboard makes it easier to compare your practice to peers around the U.S. What To Measure There are two types of benchmarking: […]

Making Use of Cash Flow Projections

When you manage your medical practice’s cash flow effectively, you can better prepare your practice for both strong and weak economic times. The key to managing cash flow is the cash flow projection — a forecast of your practice’s cash receipts and expenditures. A cash flow forecast shows the anticipated flow of money entering and […]

Critical Financial Metrics for Medical Practices

Keeping a close eye on the financial health of your medical practice is essential, but it also can be time consuming. Instead of sifting through reams of data, it can be useful to identify metrics that will alert you to important issues early on. Here are some key financial metrics to consider emphasizing in your […]

Importance of Budgeting for Private Medical Practices

Budgeting for Private Medical Practices As in any other business, a budget can be an important management tool for a private medical practice. A budget is a way for you to measure and keep track of both revenues and expenses. Budgeting for private medical practices helps you identify and fix any inefficiencies in your […]