CIG Asset Management Update May 2020: Stay the Course

| Equity markets continued their recovery from the March 2020 lows. In the month of May, the S&P 500(1) gained +4.5% and outside of the U.S., the MSCI EAFE net was up +4.1% and the MSCI Emerging Markets Index was up +0.6%(2). Growth outperformed value as measured by the Russell 1000 Growth Index, +6.6% versus the Russell 1000 Value Index which was up +1.1%. Small-cap stocks, as measured by the Russell 2000 index, were up +2.6%(3). Within fixed income, the Barclays U.S. Aggregate Total Return Index returned +0.5% and the Barclays U.S. High Yield Index increased +4.4% for the month(4). The FAAMG stocks, as mentioned in our April letter: Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL), continue to drive performance within the S&P 500. Year-to-date through May 27, the FAAMG stocks are up an average of +15% versus the other 495 companies in the S&P 500 down -8%(5). |

The good news within these numbers is that for the month of May, the FAAMG stocks and other 495 stocks were up almost equally. This could be quite constructive, as a broader number of stocks contributing to the overall return of the S&P 500 may lead to a healthier market.

We are encouraged as more states begin the process of re-opening their economies. It remains to be seen how the civil unrest that has followed the death of George Floyd in Minneapolis over the past few days will impact re-opening efforts.

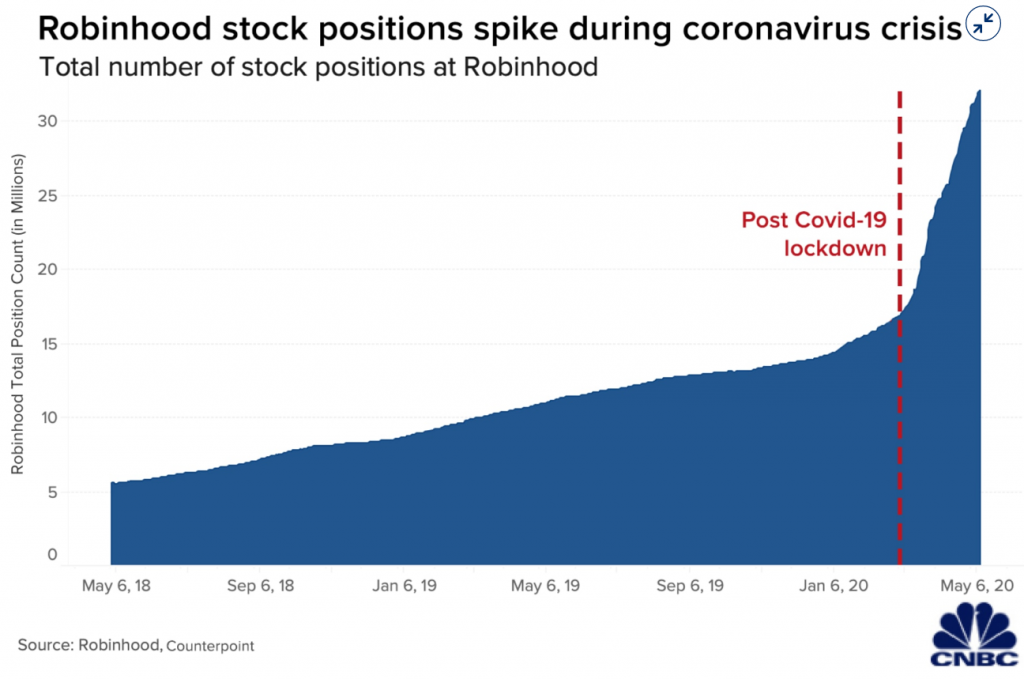

On May 22, Barron’s published an article, “Day Trading Has Replaced Sports Betting as America’s Pastime. It Can’t Support the Stock Market Forever.” Within this article, Jim Bianco from Bianco research argues many people who typically would gamble on sports went to the stock market as sports have been shut down. In addition, many Americans took their coronavirus stimulus check and invested it into stocks. Online brokerages have seen a surge in new accounts this year. Robinhood saw three million new accounts in the first quarter, and the total number of stock positions more than doubled year-to-date(6), even with the platform suffering crashes and glitches on heavy trading volume days.

Bianco believes that this retail investor mania has driven much of the markets’ 30%+ retracement from the low.(7) Retail investors piled into low-priced stocks that were down considerably, hoping to make big profits if they rebounded. The dangers here are i) hundreds of companies have withdrawn their revenue guidance for 2020(8), ii) only 63% of companies beat analysts’ consensus expectation – the lowest quarterly figure in seven years(9), and, finally, iii) multiple pharmaceutical companies have put out “market-moving” positive press releases without remotely having the vaccine data to back up their claims(10).

As we talked about in our recent webinar, we at CIG believe the path to successful investing over the long term is to develop a plan, exercise discipline, and stay the course. Retail investors piling into stocks that are down significantly or betting on vaccine cures, looking for short term profits, is not a long-term plan.

The most encouraging news in May was the May 28 unemployment claims report that showed continuing claims decreased by 3.86 million to 21.05 million. This is the first decrease since February, before the shut-downs. Although the absolute level of continuing claims is still over three times higher than the post-Great Financial Crisis high of 6.64 million(11), we are happy to see claims heading in the right direction. Volatility, as measured by the VIX, has also decreased from 34.15 on April 30, to 28.43 on June 1. This is still high versus historical averages; however, it is a far cry from the March 16 high of 82.69(12).

If volatility continues to fall and high frequency data following the progression of the economy reopening improves, we are likely to continue with the plan to rebalance towards the strategic equity targets. If volatility surges and reopening efforts are hindered by a resurgence in coronavirus cases due to the recent crowds of people protesting, we have a plan. Please always be mindful that our main objective is to reach the return necessary to achieve your goals as outlined in your financial plan, not to pursue returns without regard to risk. Valuations remain excessively high.

| This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. SOURCES: 1. Calculated from data obtained from Yahoo Finance, as of June 1, 2020 2. MSCI, as of June 1, 2020 3. FTSE Russell, as of June 1, 2020 4. Calculated from data obtained from Bloomberg, as of June 1, 2020 5. FactSet, Goldman Sachs Global Investment Research, May 27, 2020 6. CNBC, May 12, 2020 7. Barron’s, May 22, 2020 8. https://www.wsj.com/graphics/how-coronavirus-spread-through-corporate-america/ 9. https://www.jhinvestments.com/weekly-market-recap, Week ended May 29, 2020 10. https://www.businessinsider.com/perfect-storm-of-stupid-in-stock-market-right-now-2020-5 11. US Department of Labor, May 28, 2020 12. Data obtained from Yahoo Finance, as of June 1, 2020 |

Financial Resilience Amid Disruption: Your Tax Strategy

Policies around tax and some types of debt have changed during the pandemic, and some individuals may be able to take advantage of the new circumstances:

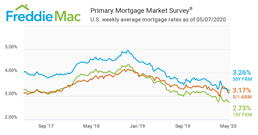

Lower Interest Rates: Interest rates are lower than they have been in several years, allowing some borrowers to refinance or take out a new loan or mortgage. If you currently have a mortgage or investment properties, restructuring the debt on these properties could yield large savings.

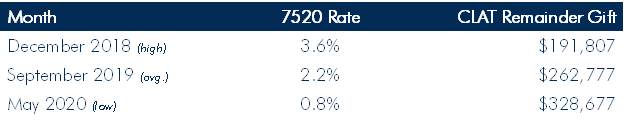

Charitable Deductions: Lower IRS 7520 rates for charitable trusts means that when gifting assets (cash or securities) to a Grantor Charitable Lead Annuity Trust, the IRS requires you to gift all the assets you contributed to the trust plus the interest. The interest rate used is the IRS 7520 rate. This rate is fixed for the life of the trust and sets the amount that needs to be distributed every year for the life of the trust. The difference between the fixed distribution and the growth within the trust will be passed to the beneficiary of the trust. The lower the 7520 rate, the greater potential for growth. For a CLAT with an initial value of $200,000, the below 7520 rates would yield the corresponding tax-free transfers to the remainder beneficiary:

Values are not intended to represent those of a client or known person.

Charitable Lead Annuity Trust (CLAT) is a plausible option to offset tax liabilities, gift annually, and set aside tax-free assets for a designated beneficiary in the future.

- Transfer

of cash/securities to trust in first year

- Immediate

deduction for gift to trust offsets…

- Increased level of income

- Realized Capital Gains

- Annually

gift for a set term from the trust to…

- Public Charity,

- Family foundation, or

- Donor Advised Fund

- Remaining balance at end of term is transferred to Remainder Beneficiary as a tax-free asset

- Immediate

deduction for gift to trust offsets…

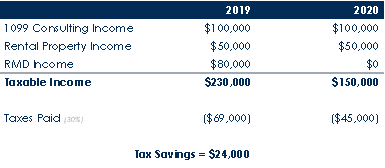

Waiver for RMD in 2020: In March, required minimum distributions for retirement accounts were waived for 2020. An example of how a hypothetical person over age 70 could save on taxes by not taking RMD in 2020:

Assumes effective combined federal and state tax rate of 30% for hypothetical purposes. Values are not intended to represent

those of a client or known person.

Increased 401k/403b Loan Limits: Previously, penalty-free early withdrawals was the lesser of $50,000 or 50% of vested balance. Now, penalties don’t kick in until the lesser of $100,000 or 100% of vested balance, allowing savers to borrow more from their retirement accounts without penalty.

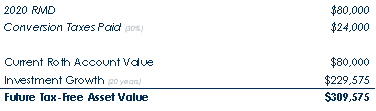

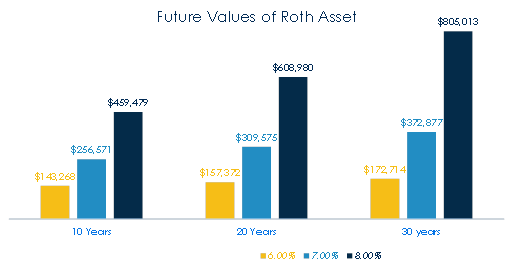

Opportunity for Roth Conversion: In a down market, with depressed values of pre-tax IRA accounts, it could be a good time to convert the account to a Roth IRA, where the funds can grow tax-free:

hypothetical purposes. Values are not intended to represent those of a client or known person.

This allows the saver to pay taxes on the lower account value this year, and once converted the money can grow, hypothetically, tax-free:

To take advantage of these or any other tax strategies, please schedule an intitial complimentary consultation at www.calendly.com/mswieckicig.

CIG Asset Management Update April 2020: Uncharted Territory

Equity markets embarked on their own version of the much hoped-for “v” shaped economic recovery during the month of April, even as economic data continued to record nasty numbers. The S&P 500(1) gained +12.7%, recovering much of the prior month’s losses. Outside of the U.S., the MSCI EAFE net(2) was up +6.5% and the MSCI Emerging Markets Index was up +9.2%(2). Within fixed income, the Barclays U.S. Aggregate Total Return Index (3) returned +1.8% and the Barclays U.S. High Yield Index(3) increased +4.5% for the month.

In April, there was a continued tug-of-war between economic reality and hopes that the worst of the pandemic may be behind us:

On Friday, April 3, it was reported that the March unemployment rate rose to 4.4%, the highest since August 2017.(4) Over the following weekend, many anecdotal news stories came out, spreading hope that COVID-19 was peaking. The ensuing Monday, April 8, the S&P 500 was up +7.03% for the day(5).

The weekly unemployment report on April 9 showed another 6.6 million in weekly claims(6), only to be quickly forgotten about as the Federal Reserve issued a statement within seconds of the Department of Labor release. The Fed announced a $2.3 trillion relief package including the Main Street Lending Program, to lend money to mid-sized businesses, and a municipal and corporate bond buying program. This latest Fed action put them far past anything they attempted during the 2008 Great Financial Crisis.

The April 16 weekly unemployment claims were 5.2 million(6), and the following day, a report that Remdesivir, an anti-viral drug may help treat symptoms of COVID-19, was made public.

Then on April 21, West Texas Intermediate oil futures settled at a negative number – never before had that happened! The following day, President Trump tweeted that we could shoot Iran boats down in the Persian Gulf, and of course, the oil and the stock markets rallied.

On April 23, weekly unemployment claims totaled 4.4 million(6). The following day, April 24, President Trump said that Apple CEO Tim Cook told him in a private conversation that he believes there will be a “v” shaped economic recovery, and markets moved higher.

April 30 weekly report brought another 3.8 million unemployed claims(6). The following weekend, several states began to gradually reopen their economies.

As can be clearly seen in the above timeline, every extremely negative economic statistic that was reported in April was met soon after by either a Federal Reserve announcement, a Trump tweet or positive news stories about pandemic hopes.

No rallies are more violent than bear market rallies and seeing April produce one of the most forceful rallies in decades fits that playbook. We would argue that the markets just followed a historic playbook given historic interventions on the monetary and fiscal fronts. Warren Buffett indicated at his May shareholders’ meeting that he’s not finding places of value to invest and has announced the selling of all airline shares with the view that the impacts of the recent crisis will not magically disappear but will take time to filter through the system.

In the meantime, what is driving the performance of the S&P 500 Index? To oversimplify, it comes down to five companies; Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL). The acronym that most on Wall Street use is FAAMG. Year-to-date through April 30, the FAAMG stocks are up an average of +10% versus the other 495 companies in the S&P 500 down -13%(7).

The performance spread between the FAAMG stocks and rest of the S&P 500 will most likely narrow over time. The lagging 495 stocks could begin to catch up with the leaders, FAAMG could start underperforming, or a combination of the two.

We have mentioned before that it’s not possible to forecast the path of the pandemic. In contrast to the above, states reopening and the massive Federal stimulus have already produced “green shoots” suggesting that the economy could begin to recover. Starbucks announced on May 5 they planned to open 85% of its locations by the end of the week, with contactless pickup and cashless payments. Simon Properties, the country’s largest shopping mall operator, announced it would open malls as states allow it. Recent activity on the Apple map app is showing signs that driving activity is starting to rebound. We would especially like to strike an optimistic tone on that last point.

Here at CIG we continue to be proactive and nimble as we see how long this bear market rally and tug-of-war can continue.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

SOURCES:

- Calculated from data obtained from Yahoo Finance, as of May 1, 2020.

- MSCI, as of May 1, 2020

- NEPC

- Bureau of Labor Statistics, April 3, 2020

- Calculated from data obtained from Yahoo Finance, as of May 1, 2020

- United States Department of Labor.

- FactSet, Goldman Sachs Global Investment Research

Financial Resiliency Amid Disruption: Your Healthcare Practice

Your medical or dental practice may have to adjust to a “new normal” as states slowly return to broader care permissions after weeks or months of tight, lockdown restrictions. Have you taken advantage of the programs offered to help medical and dental practices survive and what changes can you make to help ensure your practice thrives in a post-lockdown environment?.

Here are some management aspects dentists and physician-owners may want to consider in planning for financial resiliency amid the global disruption brought by the pandemic:

Cash Flow Summary

With so much uncertainty, being able to visualize your cash flows for the next 12 months is crucial. Taking proactive measures to forecast your incoming cash flows will allow you to implement a strategy early on and to timely take appropriate steps. The process includes analyzing your historical revenue stream and collection rates with an objective to forecast your future collections. Reviewing your procedure mix will help you determine what the impact of delaying non-essential procedures will be to your top-line.

Expenses should be adjusted to reflect cost management strategies and cash inflows from government establishments and banking institutions should be factored in to estimate cash balances throughout the pandemic as well as into the recovery period. Conducting a sensitivity analysis may also be beneficial to envision best case/worst case scenarios.

Telehealth

During the COVID-19 crisis, CMS has significantly expanded access to telehealth services for Medicare beneficiaries. This includes the easing of many of the stringent regulations set place by various government entities. Time should be spent reviewing the latest changes, highlighting the different opportunities available to you, and researching different telehealth platforms to see which is most appropriate for your practice.

Due diligence should also be conducted to highlight services that you may virtually perform and bill via telehealth. Disseminating the service to your patients as well as the general public is key to optimizing this tool.

A/R Management

Insurance companies don’t typically pay out as fast as many dental and medical practice managers would like. Understanding tools available to healthcare providers during the crisis could allow you to speed up your collection process. For example, CMS is expanding its payment acceleration program and HHS has announced a provider relief program. Your billing staff may also be utilized to effectuate collections through aggressive A/R management.

Expense Management

Having a handle on your expenses is one key to sustaining a positive cash flow. A first step may be to look into your historical expenses as a percentage of revenue as well as the year-over-year trends. Recent changes should be taken into consideration as well to prudently forecast your budget.

Fixed expenses are typically the biggest threat. However, there may be options available to you depending on the language in your contracts. Review the contracts and agreements you have in place and look for ways to renegotiate with an objective to defer or abate payments. It may be in your best interest to terminate some agreements.

Grant and Loan Opportunities

Keeping businesses up and running is almost just as crucial to owners as it is to the economy. For that reason, there are many grants and loans available to assist you with perfecting your payroll, rent and other costs. Time should be spent pinpointing your situation, reviewing various programs available to you, and working with your financial institution and accountant to pursue loan programs, grants, and line of credits to supplement your cash reserves.

Business Continuity and Recovery Planning

Having a Business Continuity Plan in place is imperative not only to weather crisis times but also to transition back to what many are calling the new normal. This involves reviewing your remote work capabilities, adjusting staff tasks to keep them engaged, increasing oversight of vendors, and other organizational modifications.

Let us help

As experienced medical and dental practice business advisors, we can dig deeper into your numbers and show where you can make changes that will improve your practice’s bottom line. Let us help support your practice’s resiliency by scheduling an initial complimentary consultation with Brian Lasher.

CIG Asset Management Update March 2020: March Madness

Market volatility continued through the month of March and continues month to date at extreme levels. Long time readers of our updates know that we have been warning about asset bubbles and Central Banks’ recent actions since last year. Valuation, volatility and liquidity are the three main areas that we believe investors should focus on right now.

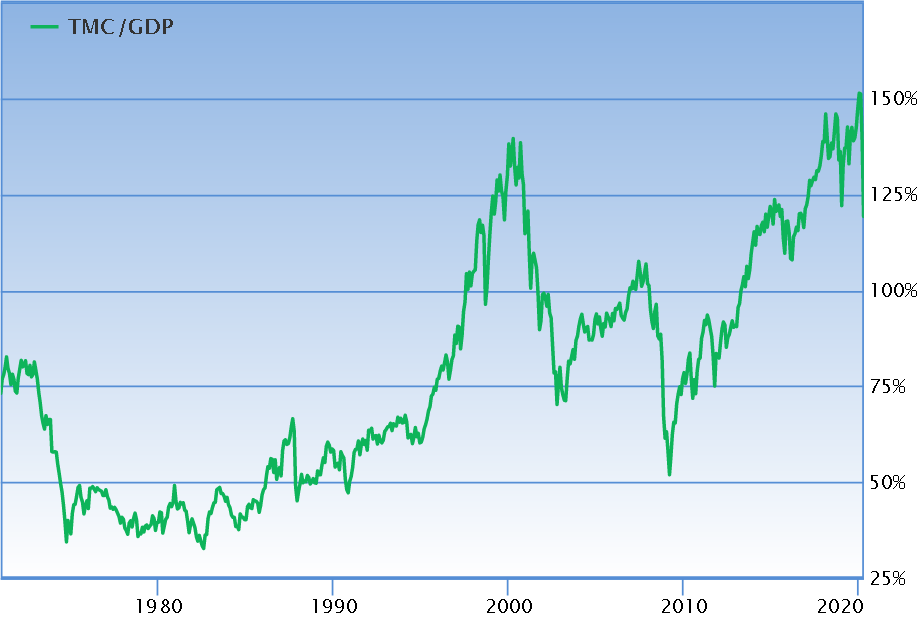

Valuation: In spite of a -20% year to date return for the S&P 500(1) through March 31st, U.S. stock market valuations are still quite high relative to the size of the U.S. economy on a historical basis. The ratio of total U.S. market capitalization to GDP (TMC/GDP), reached an all-time high of 151.3% in December 2019(2). As a result of the sharp sell-off in March 2020, TMC/GDP dropped -21% to 119.2% as of March 30th(2). As easy as it is to measure total market capitalization on a daily basis, nobody knows how much or for how long the U.S. economy (GDP) will decline. The TMC/GDP ratio fell to 75 or lower during the post-Dot Com recession in 2001 and the Great Financial Crisis in 2009. An argument could be made that if the contraction in the economy is large and persistent enough, the U.S. stock market may not have yet seen its low.

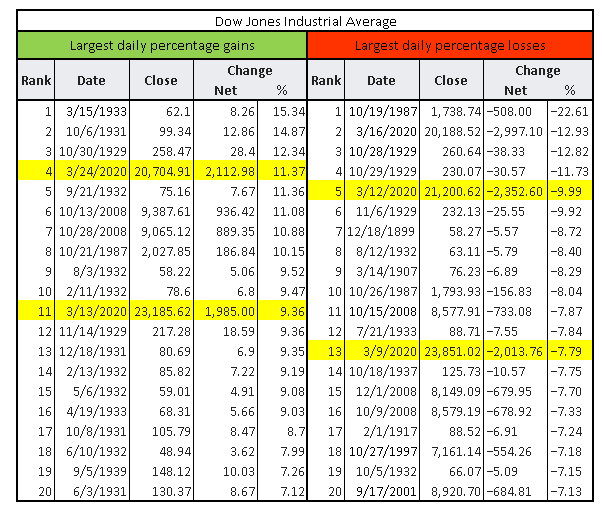

Volatility: March witnessed two of the top 20 daily percentage gains and two of the top 20 percentage daily losses for the Dow Jones Industrials Average (Dow), ever(3). Generally, these periods of extreme moves to the upside and downside have not occurred at or near market bottoms. Major market bottoms have occurred once volatility becomes more muted. Please reference the table below. As of this writing, we can add an additional top 20 up day. The Dow was up +7.7% on April 6, 2020(3).

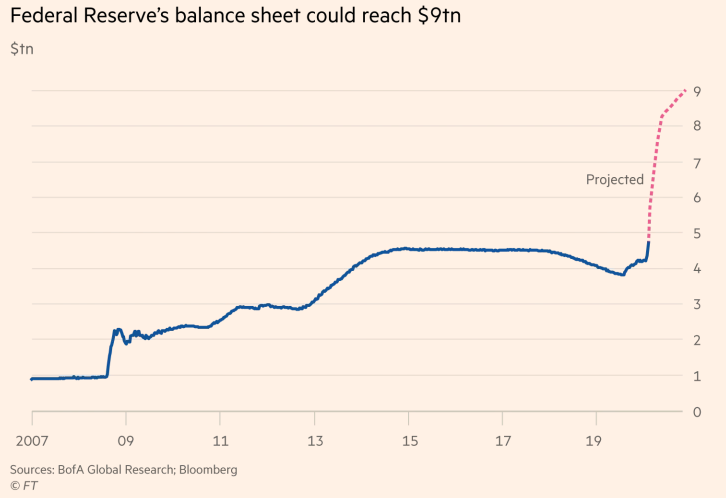

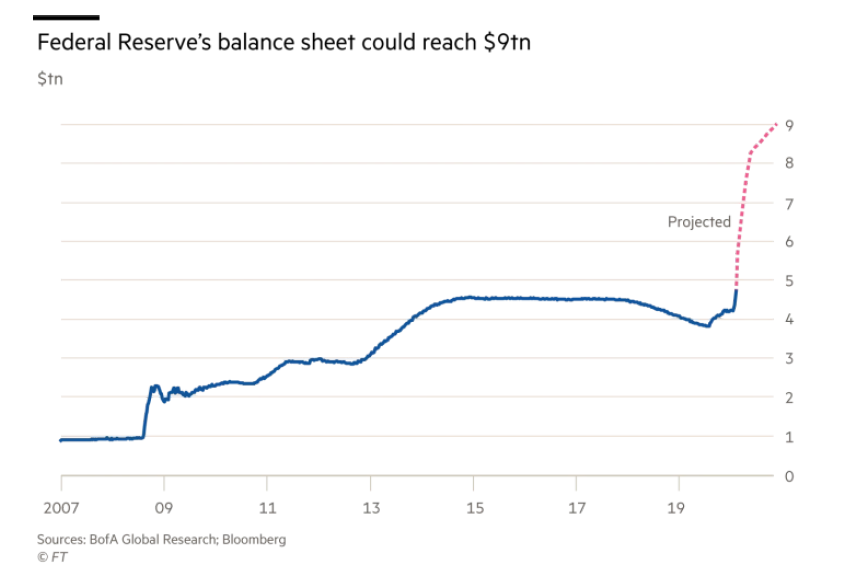

Liquidity: Following the rare emergency interest rate cut on March 3rd, the Fed cut the fed funds rate again by 1% to a 0 to 0.25% range at a subsequent emergency meeting on Sunday, March 14th. The Fed balance sheet expanded by an average $1 million per second from March 18th to March 31st. Bank of America believes the balance sheet could expand to $9 trillion by the end of the year (~40% of the U.S. economy.)(4) This is an exponential move from the expansion that began in late 2018. Typically, when the Federal Reserve pumps money into the financial system, stock market volatility calms down. In spite of unprecedented Fed action, volatility in March remained high. In fact, for the month of March, the stock market as measured by the S&P 500, moved intra-day an average of 5%, the most for any month on record. Even through the depths of the Depression or the Great Financial Crisis, the average intra-day move did not surpass 4%.(5)

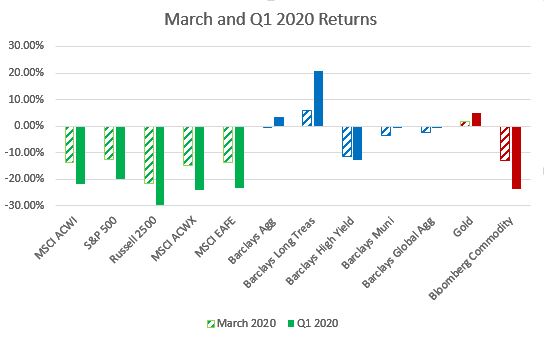

Despite the continued ups and down, we would offer a little additional commentary beyond what we have discussed in the two recent webinars and above. For March, the numbers speak for themselves. The S&P 500(1) lost -12.4%, while the MSCI EAFE Net Index(6) of developed international equities was down -13.3% and the Emerging Markets Net Index(6) declined -15.4%. The Barclays U.S. Aggregate Total Return Index (7) returned -0.6% last month. The Barclays US High Yield Index(7) decreased -11.5% for the month. Hopefully, you are not too glued to CNBC or Fox Business News which we have warned house-bound market watchers about, given the media’s continued emotional rollercoaster and market manipulation (yes, we are talking about you, Bill Ackman).

In March, we kept our heads down and continued to focus on the one of the most important aspects of our relationship with clients. Beyond the investment expertise that we offer, our job is to ensure when times like this arise that we work together to restrain any exuberant investment behaviors as well as moderate our fearful investment behaviors.

The actions that we took in March in the Dynamic portfolios exemplify this goal. When the ten-year Treasury bond declined to an all-time low yield, we reduced portfolios exposures to long-term bonds. As you may recall, prices increase when bond yields fall. When it appeared that equity markets were temporarily bottoming, we increased our stock market exposure by adding to the equity hedge fund manager. During the last week of the month, when it looked like the House of Representatives would approve the CARES Act, we increased Treasury Inflation Protected Securities (TIPs) and more market sensitive equity positions. Overall, the Dynamic portfolios ended the month with more stock market exposure but not dramatically so.

Last week, we began our quarterly rebalancing of portfolios towards their strategic targets. We identified some areas that seem to be successful in this current environment, and we reduced cash and bonds that previously worked but are less likely to do so going forward. We are taking incrementally more risk via adding to defensive equities like healthcare and consumer staples. In certain portfolios, we added a “value-add” fund that is focused on a trend-following process which can work in higher-volatility markets.

On a positive note, we would quote Dr. Anthony Fauci: “You can’t rush the science, but when the science points you in the right direction, then you can start rushing.”(8) We have many laboratories looking to develop and roll out a vaccine. When the science is ready, a solution to the virus could come well before the usual 18 months. Even if we end up “going old school” and transferring plasma from previously infected individuals, we will get to the mountaintop and, ultimately, see a safer public health, economic and investment environment. Until then, we will continue to very nimble and proactive as we manage the portfolio allocation.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

- Calculated from data obtained from Yahoo Finance, as of April 1, 2020.

- https://www.gurufocus.com/stock-market-valuations.php

- https://en.wikipedia.org/wiki/List_of_largest_daily_changes_in_the_Dow_Jones_Industrial_Average

- “How big could the Fed’s balance sheet get?” Financial Times, April 5, 2020 citing report from Bank of America

- Bloomberg, Jonathan Ferro as of March 31, 2020

- MSCI, as of April 1, 2020.

- NEPC

- https://www.brainyquote.com/lists/authors/top-10-anthony-fauci-quotes

Diversification Can Help Protect Against Market Crashes

The idea of diversification is very old and can be, in some cases, useful for survival. How many times in life have we heard “Don’t put your eggs all in one basket?” In investment terms, market crashes like the one we witnessed in March 2020 can happen. Losses such as these can be bad for your financial and mental health as well as your ability to meet your financial plan or retire. Diverse investment strategies and assets can behave differently in various crashes, and this differentiation of responses increases the chance your portfolio will survive a market crash. Here’s why a diversification strategy is important:

Diversification in terms of investing became more popular in the early 1990s and really took off in the early 2000s. Whether it is emerging market bonds, wind parks, real estate, etc., the diversification argument became more obvious after the DotCom Crash of 2000. At its core, diversification forces you to “buy low and sell high,” an adage that is arguably commonplace and easily mocked. But it really works. Just look at March 2020’s market returns.

In March 2020, COVID-19 appeared to impact most asset classes. As a result of our investment strategy and process, we became worried about the asset valuations in early to mid-2019. This led us to diversify away from an over-concentration in stocks and into a more varied portfolio of assets. Consequently, we were better prepared for March 2020 and had exposure to longer-dated Treasury bonds and gold, which were some of the only major asset classes up last month.

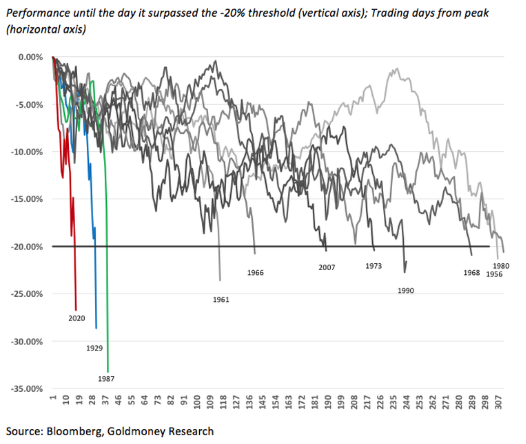

In 2019, prudence and diversification came under fire. With the S&P 500 Index up a massive 31%[i], investors with diversified portfolios felt like they left money on the table. In 2020, diversification came roaring back as investors realized the above-mentioned benefits of having parts of their portfolio perform when risky assets struggle. What a difference a few weeks and months can make! March 2020’s crash was the quickest decline in stock market history[ii]. During market crashes, diversification not only helps to potentially shore up returns, but also provides a source of money for rebalancing. With a 20% decline in equities in just under a couple of weeks, buying low and selling high is paramount for investment success over the long term.

In March 2020, the Federal Reserve balance sheet has increased +$1.1 trillion and the European Central Bank’s balance sheet has increased +$400 billion[iii]. Another $2 trillion fiscal stimulus bill is being considered in the U.S.[iv] So, we may yet again be lulled into believing that a period of elevated U.S. stock market valuations and low market volatility could persist throughout this decade. In that case, diversification may return to its regret-maximizing ways, where there will often be an underperforming asset (in this case, bonds or cash) in your portfolio that you wish you had sold, just like there will often be the asset (usually, equities) you wish you owned more of because its price went up the most. That said, when market volatility inevitably returns, you realize that staying diversified is worth it in the long run.

At CIG Capital Advisors, we attempt to pursue diversified portfolios for clients by employing the following thought processes. First, we invest only in investment choices we understand. Second, we determine investment and asset allocations based on collecting as much data as possible, employing common sense constraints, doing fundamental research, and rebalancing portfolios regularly. Lastly, we adapt to change, try to learn continuously, seek new sources of returns, and re-evaluate allocations regularly. We tend to shy away from an investment with an effortlessly smooth return history. These might or might not be safe as many of these strategies are the equivalent of picking up pennies in front of a steamroller.

While there are many known unknowns related to COVID-19, we anticipate continued volatility in the near term as the economic fallout from the pandemic is realized. As always, we maintain diversified, risk-balanced portfolios for clients to help ride out potential market selloffs, and to evaluate, and sometimes capture, the opportunities that present themselves. We conclude with a famous quote from Benjamin Graham, the British-born American investor known as the “father of value of investing,” “the essence of investment management is the management of risks, not the management of returns.”[v] Thus, diversify!

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Yahoo Finance

[ii] Bloomberg, Goldmoney Research

[iii] https://docs.google.com/spreadsheets/d/1s6EgMa4KGDfFzcsZJKqwiH7yqkhnCQtW7gI7eHpZuqg/edit#gid=0

[iv] Source: “How big could the Fed’s balance sheet get?” Financial Times, April 5, 2020 citing a report from Bank of America

Managing a Healthcare Practice through the Pandemic: Finance and Operation

Medical practices, dental practices, small and rural hospitals and larger healthcare systems alike are feeling the effects of the COVID-19 pandemic. Recent regulatory changes, like the $8.3 billion emergency funding measure that expands Medicare reimbursements for telemedicine and the prohibition of all non-essential medical, surgical, and dental procedures during the outbreak, have upended the planned revenue cycle of nearly every U.S. healthcare practice or business. How can medical practice owners, dental practice owners and other healthcare managers adjust the financial and operational levers of their business to better weather the economic turmoil caused by the pandemic?

Financial steps to take:

- Put together a 12-week cash flow statement to understand better how you can manage the disruption, assessing what should be coming in and what you must pay and can delay paying, including evaluating the best approach to manage your staff given the circumstances.

- Billing staff should work remotely in order to continue billing as usual and connect with insurance companies. Their time should be used to follow-up on past billings and accounts receivables.

- Reach out to your bank to determine if/when you can setup or increase a line of credit for your business.

- Contact your accountant for up-to-date financials and clarity regarding whether you will be paying your sales/use and withholdings taxes as normal or taking advantage of your state’s relief, if applicable.

- Look for state and federal programs you may qualify for, including the SBA’s Economic Injury Disaster Loans.

Operational steps to take:

- Consider employees carefully. Can non-essential staff work remotely or even be laid off or furloughed to find work elsewhere through a healthcare staffing company, given that many large systems are currently understaffed? Use web conferencing to hold staff meetings, utilizing services such as Zoom, WebEx, Skype, Google Hangouts and/or FaceTime.

- Move to telehealth when possible, as CMS changes are allowing increased telehealth reimbursements. Using video visits for patients with compromised health can help them avoid coronavirus exposure. Chronic medicine can be delivered to patients’ homes. Of course, when moving to telehealth solutions, notification to patients and training staff members is necessary.

- Prepare for patient visits by securing the doors and screening patients before entry. Provide hand sanitizer, face masks, and gloves and take basic sanitary precautions that can make a difference:

- Disinfect all surfaces, equipment and door knobs between patient consults.

- Shared resources should be kept clean.

- Proper hand hygiene.

- Waiting-room chairs are placed six feet apart and social distancing respected during interactions as possible; alternatively, you can allow sign-in/call-in at the entrance/via phone and ask patients to stay in their car in the parking lot and call them when you are ready to take them back.

- Deal with elective procedures by rescheduling to a later date. Serve patients when you believe it medically irresponsible to delay but disclose the risks, and keep them separate from patients coming in for non-elective procedures. Please note the difference between necessary elective procedures and not-necessary elective procedures.

- Update your website and phone greetings to communicate your current processes and availability.

Medical practices, dental practices, and small and rural hospitals are more likely to weather the pandemic storm by taking positive financial and operational steps now to mitigate business losses and emerge from the crisis in an even-stronger market position. For individual steps your medical or dental practice or hospital should take, schedule a complimentary phone consultation here or join our webinar, “Managing a Healthcare Practice through the Pandemic: Finance and Operations” on Thursday, April 2 at 12:30 p.m. by registering here.

Important Client Announcement Related to COVID-19

| At CIG Capital Advisors, the health and safety of our clients, business partners and team is our first priority. Amid the growing concerns around COVID-19, we are taking substantial measures to ensure the welfare of our clients and employees is protected: Moving In-Person Meetings to Virtual Meetings: In an effort to minimize any potential exposure, we are taking the highest level of precaution and are strongly encouraging all client service meetings be conducted in a virtual format. Should you agree to change your in-person meeting to a virtual meeting via either our secure video conference system or telephone, please contact your CIG Capital Advisors senior wealth manager. Social Distancing and our Business Continuity Plan: The Centers for Disease Control and Prevention (CDC) recommends social distancing as a measure that can help prevent the spread of COVID-19. This could eventually extend to our office environment, so in an abundance of caution, CIG Capital Advisors will conduct a trial run of a full-staff remote work day on Tuesday, March 17. Should you need to contact a CIG Capital Advisors staff member on Tuesday, the usual channels of communication like email and phone will be available per our Business Continuity Plan. Our leadership team is monitoring the situation daily, taking into account guidance from the CDC, public health agencies and state officials. We will adapt our protocols as necessary and keep you apprised of all updates and changes. Investment Management: While health and wellness must be our priority, the financial health of your portfolio is a fiduciary responsibility we take seriously every day, no matter the macro-economic conditions. However, during times of economic instability like we have seen in recent weeks, it’s natural to seek information about how your asset manager is reacting amidst the turmoil. To discuss our prudent response to the uncertainty in the global markets, we’ve scheduled a special client-only webinar on Wednesday, March 18 at 1 p.m. The webinar will last approximately 30-45 minutes. All clients are invited to register for the webinar, hosted by CIG Capital Advisors Managing Principal Osman Minkara and Vice President of Asset Management Brian Lasher; you may also want to refer to our monthly Asset Management updates and recent 2019 Asset Management Year in Review letter, all of which were previously emailed to you and can also be found on our website here. REGISTER FOR THE WEBINAR HERE: https://zoom.us/webinar/register/WN_BSWP4BA_Q-yxk9J68wm2cA Please reach out to the CIG Capital Advisors team with any questions in the meantime, and we look forward to “seeing” you virtually in the webinar on Wednesday. |