CIG Asset Management Update May 2020: Stay the Course

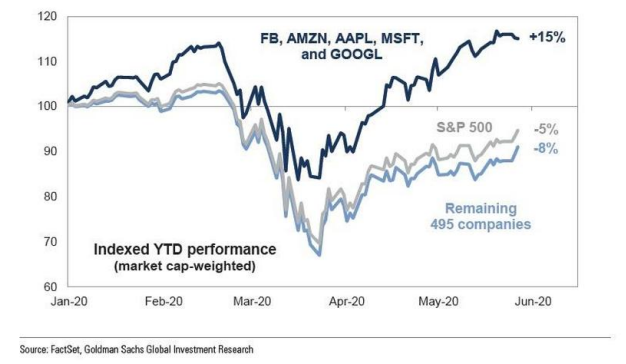

| Equity markets continued their recovery from the March 2020 lows. In the month of May, the S&P 500(1) gained +4.5% and outside of the U.S., the MSCI EAFE net was up +4.1% and the MSCI Emerging Markets Index was up +0.6%(2). Growth outperformed value as measured by the Russell 1000 Growth Index, +6.6% versus the Russell 1000 Value Index which was up +1.1%. Small-cap stocks, as measured by the Russell 2000 index, were up +2.6%(3). Within fixed income, the Barclays U.S. Aggregate Total Return Index returned +0.5% and the Barclays U.S. High Yield Index increased +4.4% for the month(4). The FAAMG stocks, as mentioned in our April letter: Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL), continue to drive performance within the S&P 500. Year-to-date through May 27, the FAAMG stocks are up an average of +15% versus the other 495 companies in the S&P 500 down -8%(5). |

The good news within these numbers is that for the month of May, the FAAMG stocks and other 495 stocks were up almost equally. This could be quite constructive, as a broader number of stocks contributing to the overall return of the S&P 500 may lead to a healthier market.

We are encouraged as more states begin the process of re-opening their economies. It remains to be seen how the civil unrest that has followed the death of George Floyd in Minneapolis over the past few days will impact re-opening efforts.

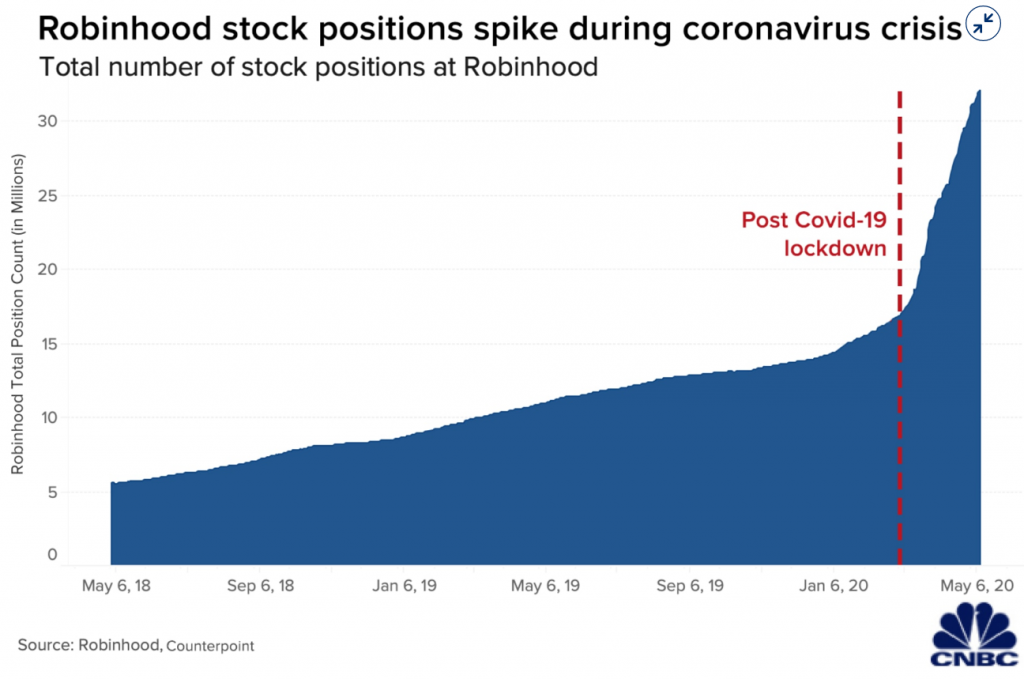

On May 22, Barron’s published an article, “Day Trading Has Replaced Sports Betting as America’s Pastime. It Can’t Support the Stock Market Forever.” Within this article, Jim Bianco from Bianco research argues many people who typically would gamble on sports went to the stock market as sports have been shut down. In addition, many Americans took their coronavirus stimulus check and invested it into stocks. Online brokerages have seen a surge in new accounts this year. Robinhood saw three million new accounts in the first quarter, and the total number of stock positions more than doubled year-to-date(6), even with the platform suffering crashes and glitches on heavy trading volume days.

Bianco believes that this retail investor mania has driven much of the markets’ 30%+ retracement from the low.(7) Retail investors piled into low-priced stocks that were down considerably, hoping to make big profits if they rebounded. The dangers here are i) hundreds of companies have withdrawn their revenue guidance for 2020(8), ii) only 63% of companies beat analysts’ consensus expectation – the lowest quarterly figure in seven years(9), and, finally, iii) multiple pharmaceutical companies have put out “market-moving” positive press releases without remotely having the vaccine data to back up their claims(10).

As we talked about in our recent webinar, we at CIG believe the path to successful investing over the long term is to develop a plan, exercise discipline, and stay the course. Retail investors piling into stocks that are down significantly or betting on vaccine cures, looking for short term profits, is not a long-term plan.

The most encouraging news in May was the May 28 unemployment claims report that showed continuing claims decreased by 3.86 million to 21.05 million. This is the first decrease since February, before the shut-downs. Although the absolute level of continuing claims is still over three times higher than the post-Great Financial Crisis high of 6.64 million(11), we are happy to see claims heading in the right direction. Volatility, as measured by the VIX, has also decreased from 34.15 on April 30, to 28.43 on June 1. This is still high versus historical averages; however, it is a far cry from the March 16 high of 82.69(12).

If volatility continues to fall and high frequency data following the progression of the economy reopening improves, we are likely to continue with the plan to rebalance towards the strategic equity targets. If volatility surges and reopening efforts are hindered by a resurgence in coronavirus cases due to the recent crowds of people protesting, we have a plan. Please always be mindful that our main objective is to reach the return necessary to achieve your goals as outlined in your financial plan, not to pursue returns without regard to risk. Valuations remain excessively high.

| This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. SOURCES: 1. Calculated from data obtained from Yahoo Finance, as of June 1, 2020 2. MSCI, as of June 1, 2020 3. FTSE Russell, as of June 1, 2020 4. Calculated from data obtained from Bloomberg, as of June 1, 2020 5. FactSet, Goldman Sachs Global Investment Research, May 27, 2020 6. CNBC, May 12, 2020 7. Barron’s, May 22, 2020 8. https://www.wsj.com/graphics/how-coronavirus-spread-through-corporate-america/ 9. https://www.jhinvestments.com/weekly-market-recap, Week ended May 29, 2020 10. https://www.businessinsider.com/perfect-storm-of-stupid-in-stock-market-right-now-2020-5 11. US Department of Labor, May 28, 2020 12. Data obtained from Yahoo Finance, as of June 1, 2020 |

CIG Asset Management Update April 2020: Uncharted Territory

Equity markets embarked on their own version of the much hoped-for “v” shaped economic recovery during the month of April, even as economic data continued to record nasty numbers. The S&P 500(1) gained +12.7%, recovering much of the prior month’s losses. Outside of the U.S., the MSCI EAFE net(2) was up +6.5% and the MSCI Emerging Markets Index was up +9.2%(2). Within fixed income, the Barclays U.S. Aggregate Total Return Index (3) returned +1.8% and the Barclays U.S. High Yield Index(3) increased +4.5% for the month.

In April, there was a continued tug-of-war between economic reality and hopes that the worst of the pandemic may be behind us:

On Friday, April 3, it was reported that the March unemployment rate rose to 4.4%, the highest since August 2017.(4) Over the following weekend, many anecdotal news stories came out, spreading hope that COVID-19 was peaking. The ensuing Monday, April 8, the S&P 500 was up +7.03% for the day(5).

The weekly unemployment report on April 9 showed another 6.6 million in weekly claims(6), only to be quickly forgotten about as the Federal Reserve issued a statement within seconds of the Department of Labor release. The Fed announced a $2.3 trillion relief package including the Main Street Lending Program, to lend money to mid-sized businesses, and a municipal and corporate bond buying program. This latest Fed action put them far past anything they attempted during the 2008 Great Financial Crisis.

The April 16 weekly unemployment claims were 5.2 million(6), and the following day, a report that Remdesivir, an anti-viral drug may help treat symptoms of COVID-19, was made public.

Then on April 21, West Texas Intermediate oil futures settled at a negative number – never before had that happened! The following day, President Trump tweeted that we could shoot Iran boats down in the Persian Gulf, and of course, the oil and the stock markets rallied.

On April 23, weekly unemployment claims totaled 4.4 million(6). The following day, April 24, President Trump said that Apple CEO Tim Cook told him in a private conversation that he believes there will be a “v” shaped economic recovery, and markets moved higher.

April 30 weekly report brought another 3.8 million unemployed claims(6). The following weekend, several states began to gradually reopen their economies.

As can be clearly seen in the above timeline, every extremely negative economic statistic that was reported in April was met soon after by either a Federal Reserve announcement, a Trump tweet or positive news stories about pandemic hopes.

No rallies are more violent than bear market rallies and seeing April produce one of the most forceful rallies in decades fits that playbook. We would argue that the markets just followed a historic playbook given historic interventions on the monetary and fiscal fronts. Warren Buffett indicated at his May shareholders’ meeting that he’s not finding places of value to invest and has announced the selling of all airline shares with the view that the impacts of the recent crisis will not magically disappear but will take time to filter through the system.

In the meantime, what is driving the performance of the S&P 500 Index? To oversimplify, it comes down to five companies; Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL). The acronym that most on Wall Street use is FAAMG. Year-to-date through April 30, the FAAMG stocks are up an average of +10% versus the other 495 companies in the S&P 500 down -13%(7).

The performance spread between the FAAMG stocks and rest of the S&P 500 will most likely narrow over time. The lagging 495 stocks could begin to catch up with the leaders, FAAMG could start underperforming, or a combination of the two.

We have mentioned before that it’s not possible to forecast the path of the pandemic. In contrast to the above, states reopening and the massive Federal stimulus have already produced “green shoots” suggesting that the economy could begin to recover. Starbucks announced on May 5 they planned to open 85% of its locations by the end of the week, with contactless pickup and cashless payments. Simon Properties, the country’s largest shopping mall operator, announced it would open malls as states allow it. Recent activity on the Apple map app is showing signs that driving activity is starting to rebound. We would especially like to strike an optimistic tone on that last point.

Here at CIG we continue to be proactive and nimble as we see how long this bear market rally and tug-of-war can continue.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

SOURCES:

- Calculated from data obtained from Yahoo Finance, as of May 1, 2020.

- MSCI, as of May 1, 2020

- NEPC

- Bureau of Labor Statistics, April 3, 2020

- Calculated from data obtained from Yahoo Finance, as of May 1, 2020

- United States Department of Labor.

- FactSet, Goldman Sachs Global Investment Research