CIG Asset Management Update May 2020: Stay the Course

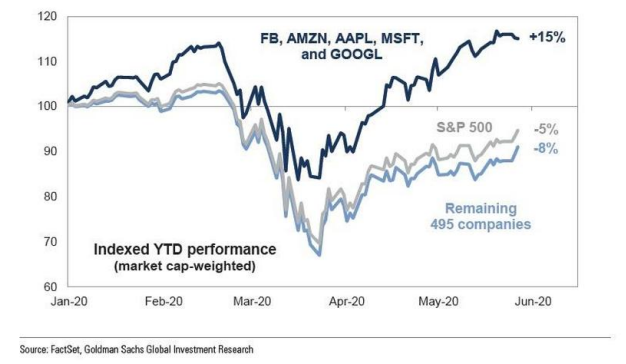

| Equity markets continued their recovery from the March 2020 lows. In the month of May, the S&P 500(1) gained +4.5% and outside of the U.S., the MSCI EAFE net was up +4.1% and the MSCI Emerging Markets Index was up +0.6%(2). Growth outperformed value as measured by the Russell 1000 Growth Index, +6.6% versus the Russell 1000 Value Index which was up +1.1%. Small-cap stocks, as measured by the Russell 2000 index, were up +2.6%(3). Within fixed income, the Barclays U.S. Aggregate Total Return Index returned +0.5% and the Barclays U.S. High Yield Index increased +4.4% for the month(4). The FAAMG stocks, as mentioned in our April letter: Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL), continue to drive performance within the S&P 500. Year-to-date through May 27, the FAAMG stocks are up an average of +15% versus the other 495 companies in the S&P 500 down -8%(5). |

The good news within these numbers is that for the month of May, the FAAMG stocks and other 495 stocks were up almost equally. This could be quite constructive, as a broader number of stocks contributing to the overall return of the S&P 500 may lead to a healthier market.

We are encouraged as more states begin the process of re-opening their economies. It remains to be seen how the civil unrest that has followed the death of George Floyd in Minneapolis over the past few days will impact re-opening efforts.

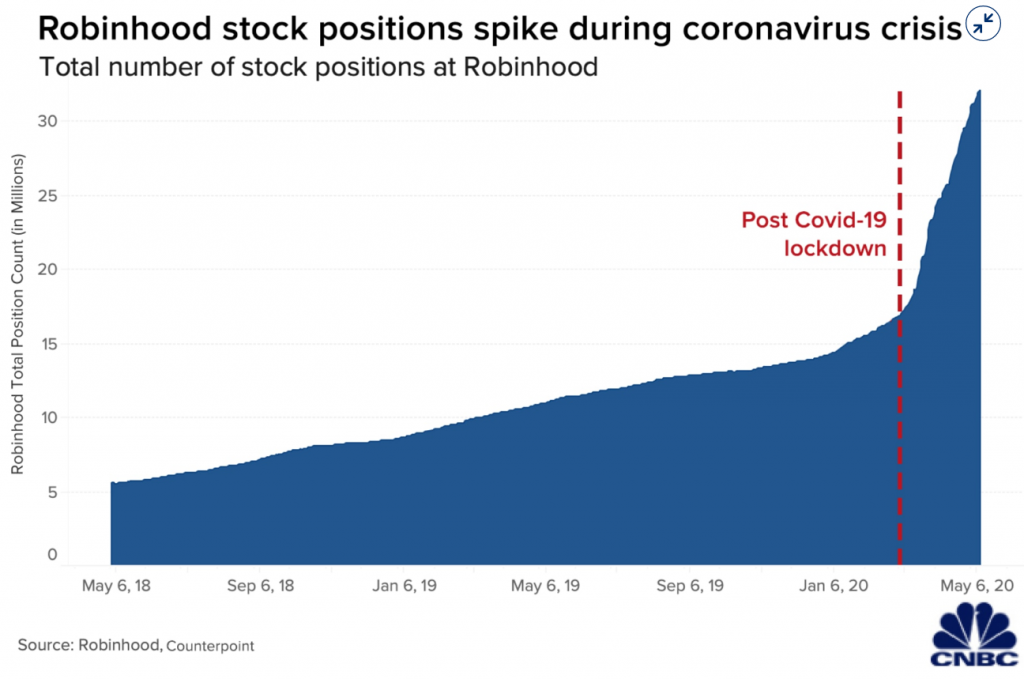

On May 22, Barron’s published an article, “Day Trading Has Replaced Sports Betting as America’s Pastime. It Can’t Support the Stock Market Forever.” Within this article, Jim Bianco from Bianco research argues many people who typically would gamble on sports went to the stock market as sports have been shut down. In addition, many Americans took their coronavirus stimulus check and invested it into stocks. Online brokerages have seen a surge in new accounts this year. Robinhood saw three million new accounts in the first quarter, and the total number of stock positions more than doubled year-to-date(6), even with the platform suffering crashes and glitches on heavy trading volume days.

Bianco believes that this retail investor mania has driven much of the markets’ 30%+ retracement from the low.(7) Retail investors piled into low-priced stocks that were down considerably, hoping to make big profits if they rebounded. The dangers here are i) hundreds of companies have withdrawn their revenue guidance for 2020(8), ii) only 63% of companies beat analysts’ consensus expectation – the lowest quarterly figure in seven years(9), and, finally, iii) multiple pharmaceutical companies have put out “market-moving” positive press releases without remotely having the vaccine data to back up their claims(10).

As we talked about in our recent webinar, we at CIG believe the path to successful investing over the long term is to develop a plan, exercise discipline, and stay the course. Retail investors piling into stocks that are down significantly or betting on vaccine cures, looking for short term profits, is not a long-term plan.

The most encouraging news in May was the May 28 unemployment claims report that showed continuing claims decreased by 3.86 million to 21.05 million. This is the first decrease since February, before the shut-downs. Although the absolute level of continuing claims is still over three times higher than the post-Great Financial Crisis high of 6.64 million(11), we are happy to see claims heading in the right direction. Volatility, as measured by the VIX, has also decreased from 34.15 on April 30, to 28.43 on June 1. This is still high versus historical averages; however, it is a far cry from the March 16 high of 82.69(12).

If volatility continues to fall and high frequency data following the progression of the economy reopening improves, we are likely to continue with the plan to rebalance towards the strategic equity targets. If volatility surges and reopening efforts are hindered by a resurgence in coronavirus cases due to the recent crowds of people protesting, we have a plan. Please always be mindful that our main objective is to reach the return necessary to achieve your goals as outlined in your financial plan, not to pursue returns without regard to risk. Valuations remain excessively high.

| This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. SOURCES: 1. Calculated from data obtained from Yahoo Finance, as of June 1, 2020 2. MSCI, as of June 1, 2020 3. FTSE Russell, as of June 1, 2020 4. Calculated from data obtained from Bloomberg, as of June 1, 2020 5. FactSet, Goldman Sachs Global Investment Research, May 27, 2020 6. CNBC, May 12, 2020 7. Barron’s, May 22, 2020 8. https://www.wsj.com/graphics/how-coronavirus-spread-through-corporate-america/ 9. https://www.jhinvestments.com/weekly-market-recap, Week ended May 29, 2020 10. https://www.businessinsider.com/perfect-storm-of-stupid-in-stock-market-right-now-2020-5 11. US Department of Labor, May 28, 2020 12. Data obtained from Yahoo Finance, as of June 1, 2020 |

CIG Asset Management Update March 2020: March Madness

Market volatility continued through the month of March and continues month to date at extreme levels. Long time readers of our updates know that we have been warning about asset bubbles and Central Banks’ recent actions since last year. Valuation, volatility and liquidity are the three main areas that we believe investors should focus on right now.

Valuation: In spite of a -20% year to date return for the S&P 500(1) through March 31st, U.S. stock market valuations are still quite high relative to the size of the U.S. economy on a historical basis. The ratio of total U.S. market capitalization to GDP (TMC/GDP), reached an all-time high of 151.3% in December 2019(2). As a result of the sharp sell-off in March 2020, TMC/GDP dropped -21% to 119.2% as of March 30th(2). As easy as it is to measure total market capitalization on a daily basis, nobody knows how much or for how long the U.S. economy (GDP) will decline. The TMC/GDP ratio fell to 75 or lower during the post-Dot Com recession in 2001 and the Great Financial Crisis in 2009. An argument could be made that if the contraction in the economy is large and persistent enough, the U.S. stock market may not have yet seen its low.

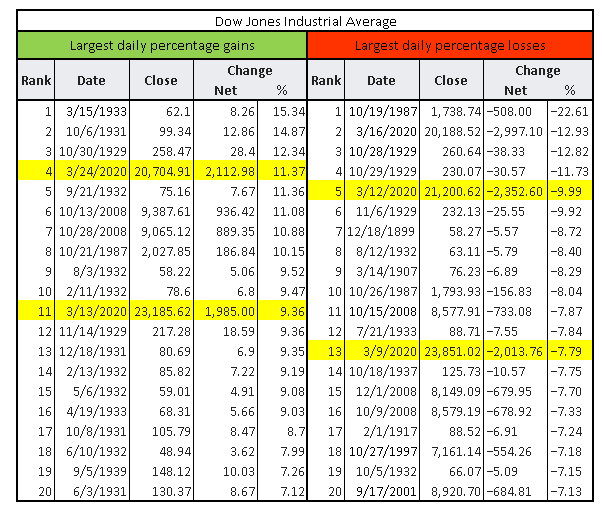

Volatility: March witnessed two of the top 20 daily percentage gains and two of the top 20 percentage daily losses for the Dow Jones Industrials Average (Dow), ever(3). Generally, these periods of extreme moves to the upside and downside have not occurred at or near market bottoms. Major market bottoms have occurred once volatility becomes more muted. Please reference the table below. As of this writing, we can add an additional top 20 up day. The Dow was up +7.7% on April 6, 2020(3).

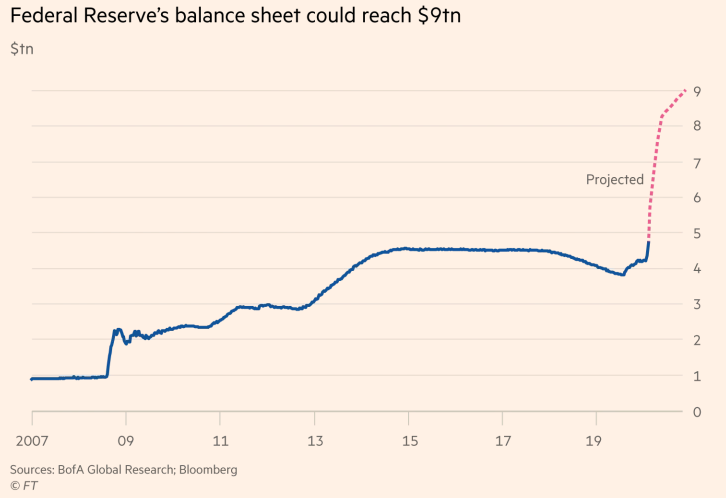

Liquidity: Following the rare emergency interest rate cut on March 3rd, the Fed cut the fed funds rate again by 1% to a 0 to 0.25% range at a subsequent emergency meeting on Sunday, March 14th. The Fed balance sheet expanded by an average $1 million per second from March 18th to March 31st. Bank of America believes the balance sheet could expand to $9 trillion by the end of the year (~40% of the U.S. economy.)(4) This is an exponential move from the expansion that began in late 2018. Typically, when the Federal Reserve pumps money into the financial system, stock market volatility calms down. In spite of unprecedented Fed action, volatility in March remained high. In fact, for the month of March, the stock market as measured by the S&P 500, moved intra-day an average of 5%, the most for any month on record. Even through the depths of the Depression or the Great Financial Crisis, the average intra-day move did not surpass 4%.(5)

Despite the continued ups and down, we would offer a little additional commentary beyond what we have discussed in the two recent webinars and above. For March, the numbers speak for themselves. The S&P 500(1) lost -12.4%, while the MSCI EAFE Net Index(6) of developed international equities was down -13.3% and the Emerging Markets Net Index(6) declined -15.4%. The Barclays U.S. Aggregate Total Return Index (7) returned -0.6% last month. The Barclays US High Yield Index(7) decreased -11.5% for the month. Hopefully, you are not too glued to CNBC or Fox Business News which we have warned house-bound market watchers about, given the media’s continued emotional rollercoaster and market manipulation (yes, we are talking about you, Bill Ackman).

In March, we kept our heads down and continued to focus on the one of the most important aspects of our relationship with clients. Beyond the investment expertise that we offer, our job is to ensure when times like this arise that we work together to restrain any exuberant investment behaviors as well as moderate our fearful investment behaviors.

The actions that we took in March in the Dynamic portfolios exemplify this goal. When the ten-year Treasury bond declined to an all-time low yield, we reduced portfolios exposures to long-term bonds. As you may recall, prices increase when bond yields fall. When it appeared that equity markets were temporarily bottoming, we increased our stock market exposure by adding to the equity hedge fund manager. During the last week of the month, when it looked like the House of Representatives would approve the CARES Act, we increased Treasury Inflation Protected Securities (TIPs) and more market sensitive equity positions. Overall, the Dynamic portfolios ended the month with more stock market exposure but not dramatically so.

Last week, we began our quarterly rebalancing of portfolios towards their strategic targets. We identified some areas that seem to be successful in this current environment, and we reduced cash and bonds that previously worked but are less likely to do so going forward. We are taking incrementally more risk via adding to defensive equities like healthcare and consumer staples. In certain portfolios, we added a “value-add” fund that is focused on a trend-following process which can work in higher-volatility markets.

On a positive note, we would quote Dr. Anthony Fauci: “You can’t rush the science, but when the science points you in the right direction, then you can start rushing.”(8) We have many laboratories looking to develop and roll out a vaccine. When the science is ready, a solution to the virus could come well before the usual 18 months. Even if we end up “going old school” and transferring plasma from previously infected individuals, we will get to the mountaintop and, ultimately, see a safer public health, economic and investment environment. Until then, we will continue to very nimble and proactive as we manage the portfolio allocation.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

- Calculated from data obtained from Yahoo Finance, as of April 1, 2020.

- https://www.gurufocus.com/stock-market-valuations.php

- https://en.wikipedia.org/wiki/List_of_largest_daily_changes_in_the_Dow_Jones_Industrial_Average

- “How big could the Fed’s balance sheet get?” Financial Times, April 5, 2020 citing report from Bank of America

- Bloomberg, Jonathan Ferro as of March 31, 2020

- MSCI, as of April 1, 2020.

- NEPC

- https://www.brainyquote.com/lists/authors/top-10-anthony-fauci-quotes