Policies around tax and some types of debt have changed during the pandemic, and some individuals may be able to take advantage of the new circumstances:

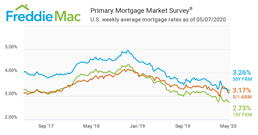

Lower Interest Rates: Interest rates are lower than they have been in several years, allowing some borrowers to refinance or take out a new loan or mortgage. If you currently have a mortgage or investment properties, restructuring the debt on these properties could yield large savings.

Charitable Deductions: Lower IRS 7520 rates for charitable trusts means that when gifting assets (cash or securities) to a Grantor Charitable Lead Annuity Trust, the IRS requires you to gift all the assets you contributed to the trust plus the interest. The interest rate used is the IRS 7520 rate. This rate is fixed for the life of the trust and sets the amount that needs to be distributed every year for the life of the trust. The difference between the fixed distribution and the growth within the trust will be passed to the beneficiary of the trust. The lower the 7520 rate, the greater potential for growth. For a CLAT with an initial value of $200,000, the below 7520 rates would yield the corresponding tax-free transfers to the remainder beneficiary:

Values are not intended to represent those of a client or known person.

Charitable Lead Annuity Trust (CLAT) is a plausible option to offset tax liabilities, gift annually, and set aside tax-free assets for a designated beneficiary in the future.

- Transfer

of cash/securities to trust in first year

- Immediate

deduction for gift to trust offsets…

- Increased level of income

- Realized Capital Gains

- Annually

gift for a set term from the trust to…

- Public Charity,

- Family foundation, or

- Donor Advised Fund

- Remaining balance at end of term is transferred to Remainder Beneficiary as a tax-free asset

- Immediate

deduction for gift to trust offsets…

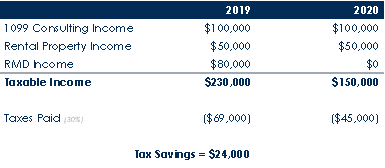

Waiver for RMD in 2020: In March, required minimum distributions for retirement accounts were waived for 2020. An example of how a hypothetical person over age 70 could save on taxes by not taking RMD in 2020:

Assumes effective combined federal and state tax rate of 30% for hypothetical purposes. Values are not intended to represent

those of a client or known person.

Increased 401k/403b Loan Limits: Previously, penalty-free early withdrawals was the lesser of $50,000 or 50% of vested balance. Now, penalties don’t kick in until the lesser of $100,000 or 100% of vested balance, allowing savers to borrow more from their retirement accounts without penalty.

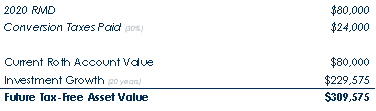

Opportunity for Roth Conversion: In a down market, with depressed values of pre-tax IRA accounts, it could be a good time to convert the account to a Roth IRA, where the funds can grow tax-free:

hypothetical purposes. Values are not intended to represent those of a client or known person.

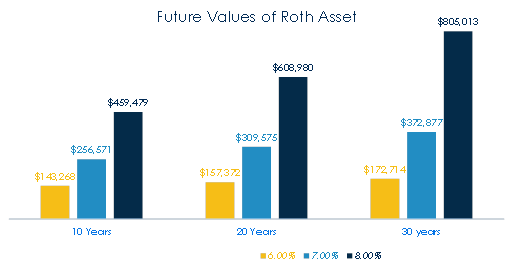

This allows the saver to pay taxes on the lower account value this year, and once converted the money can grow, hypothetically, tax-free:

To take advantage of these or any other tax strategies, please schedule an intitial complimentary consultation at www.calendly.com/mswieckicig.