CIG Asset Management Update June 2020: The Ride

The pandemic-infused markets have been a roller coaster ride during the first half of 2020. After a short climb in January and February, the S&P 500 Index fell by 35% in just over one month and then staggered back up the lift hill[i]. What twists and turns the market roller coaster will offer next is difficult to know.

Going forward, the best possible outcome in our opinion would be a widely available vaccine by year-end and everyone goes back to work. The U.S. would just need to figure out servicing trillions of additional government debt. Many worse outcomes would likely include no effective vaccine like most viruses, millions of permanent job losses, and enduring changes to business models in multiple industries.

When the market reached its high on June 8, our view was investors seemed to be focused predominantly on the best possible outcome. It is our opinion that the massive rally from the March 23 low was largely driven by “Stimulus” winning the tug-of-war over “COVID-19.” According to Cornerstone Macro, until last week when the European Union agreed to a unified stimulus fund which brought them in line, the U.S. has led the world in fiscal and monetary stimulus.[ii] But the U.S. has continued to lag the world in COVID-19 response. Only some emerging markets now have infection rate trends worse than those of the United States.[iii]

Regardless of any value judgment about the present situation, one could theoretically pull out the playbook for a traditional recession, review the history books, assess the probabilities/outcomes and lock in a portfolio for the next two years and perhaps experience a ride like Cedar Point’s kiddie coaster Woodstock Express.

If only more of us were alive back in the 1918 global pandemic and the structure of the economy, technology and banking had more resemblance to today’s world; if only probability theory could be easily be applied to a pandemic occurring in a non-ergodic, uncertain time, maybe we could do that. A non-ergodic system, such as this time, has no real long-term properties i.e., history is no help to predicting the future. It is prone to path dependency – which is just a fancy statistical way of saying that “THE RIDE is everything”.

Months like March keep us up at night. When we think about the markets, we are thinking about our goals, dreams, fears, and hopes. These long-term goals end up in the financial plan and are embedded in the portfolio strategy that our clients may select. Given a choice between being down -35% or losing -15% in March, many of us would choose -15%. At the same time, we try to stay focused on the long-term goals.

Now that we may be again back at the metaphorical top of the coaster’s lift hill, it is important to consider the next moves both prudently and imaginatively. Since June 8, the S&P 500 Index has been alternating between gains and losses around a 250-point range[iv]. There have been several 2%+ declines, including June 11’s -6% loss when Federal Reserve Chairman Powell said, “We’re not even thinking about raising rates” any time soon. Investors were distressed that the dovish Fed does not expect to raise rates until 2023. With almost 40 +/-2% days this year, the markets are on pace for the most swings since 1933[v]. For the month of June, the S&P 500 index returned just 1.8% while gaining 20.5% during the quarter (the best quarter since 1998)[vi].

For now, the stunning market rally from the March 23 low appears to have come to a pause in the U.S. Investors are back to that nervous feeling when checking the market each morning as if looking over the precipice of the rollercoaster’s first hill. What investors see is a stock market that is at peak valuations, as measured by total market capitalization / GDP (which we have talked about in the past)[vii]:

As the chart above clearly illustrates, there is no history that shows valuations over 150% to GDP are sustainable, even for brief periods of time. Yesterday, GDP for the second quarter was announced and the -33% annualized decrease was its worst quarterly hit since the Great Depression[viii]. With GDP falling from approximately $21.5 trillion to $19.4 trillion, valuations are now over 170% to GDP.

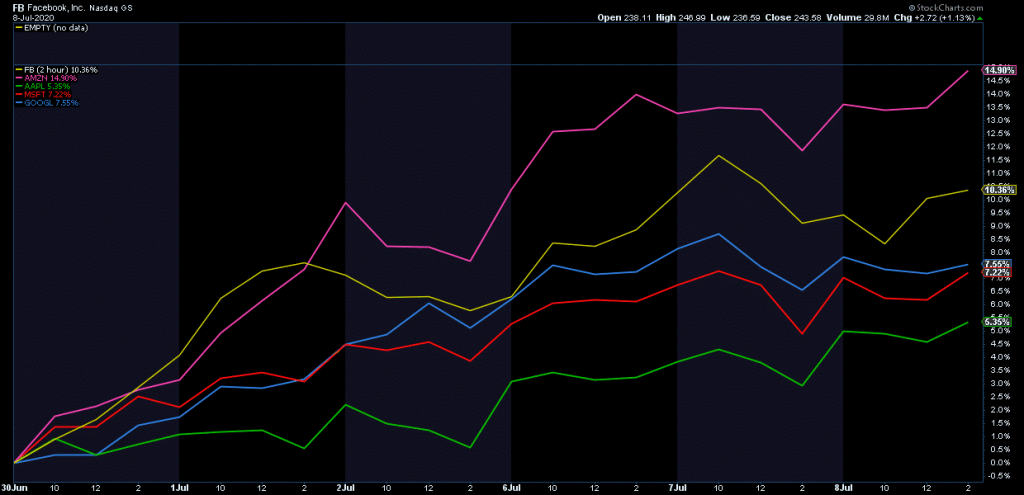

The S&P5, the so called FAAMG[ix] stocks, earlier this month added over a half a trillion in market cap in just 6 days. (Please see the chart[x] below showing the percentage return of these five stocks from June 29 to July 8.) In 2020, these stocks have added over $1.6 trillion in market cap[xi], a striking feat during any bull market with excellent growth, not a historic recession. Sure, some of these companies may have grabbed market share and pulled some sales forward during the shutdown but they all face anti-trust concerns which seem to be bi-partisan and international concerns. These stocks are disproportionately driving the market.

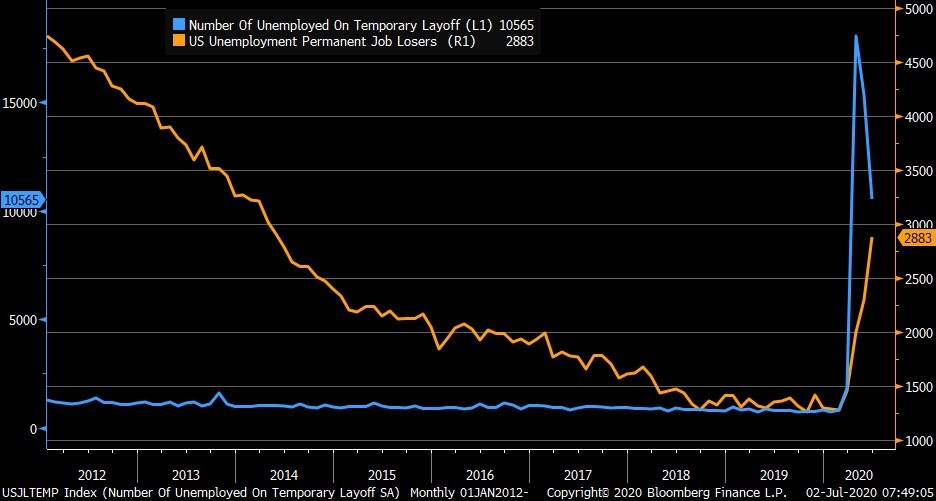

Certainly, economic data has seen a massive improvement from the recent historic collapses. However, it important to keep focused on year-over-year data and especially permanent job losses, which keep mounting. The chart[xii] below shows data from the US Department of Labor with the blue line indicating the number of temporarily laid off workers in the US and the yellow line displaying the number of permanently laid off workers.

Today, past experience is not unworkable, but if relied on thoughtlessly it can be hazardous. Some events will play out in the future as they have in the preceding times, but many will not. As indicated above, markets are rich and driven by a few stocks and simultaneously, the U.S. is experiencing some of the worst economic conditions in a long time.

Based upon CIG’s investment process and what we saw in the markets, we had fortunately already started to get more conservative in 2019 in the Strategic and Dynamic portfolios. Fast forward to 2020, at the beginning of February when the markets became more volatile, we acted within the Dynamic portfolios to reduce risk further, primarily by reducing the portfolios’ exposures to equities and adding to diversifying assets generally believed to be protective in a downdraft. We continued to act in March to attempt to dial-in the appropriate market exposure in the Dynamic portfolios, increasing risk, primarily by adding equities, after the market bottomed on March 23.

Hopefully, our strategic and tactical actions have allowed our clients to sleep better at night. CIG attempts in its client portfolios to get closer to the kiddie coaster experience versus the full rollercoaster ride of the S&P 500 index. The most important job is to strike the appropriate balance between offense and defense, i.e., the risk of losing money and the risk of missing opportunity. There will continue to be twists and turns along the ride but so far, all the previous scary rollercoaster rides in the market have concluded the same way: eventually, they stopped.

We will see in the coming months how the tug-of-war between Stimulus and COVID-19 plays out. There is probably nothing more path dependent than re-opening an economy in a pandemic. Let us hope for the best – a confidence-inspiring Goldilocks-style “not-too-fast / not-too-slow” opening, while also considering the myriad of possible economic and financial outcomes. Of course, never ignore the extreme risks which do not appear to be going away, especially as positive COVID-19 cases trend higher. We continue to be thoughtful, adaptable and at your service.

[i] Calculated from data obtained from Yahoo Finance, as of July 27, 2020

[ii] Cornerstone Macro, CSM Weekly Narrative, July 26, 2020, page 2.

[iii] Coronavirus.jhu.edu/map.html, as of July 30, 2020.

[iv] Calculated from data obtained from Yahoo Finance, as of July 27, 2020

[v] Bespoke Investment Group, July 2020

[vi] Calculated from data obtained from Yahoo Finance, as of July 27, 2020

[vii] Bloomberg as of July 30, 2020

[viii] Source: U.S. Bureau of Economic Analysis

[ix] Facebook, Apple, Amazon, Microsoft, Google

[x] StockCharts.com via NorthmanTrader on July 9, 2020

[xi] “Warning”, NorthmanTrader, July 9, 2020

[xii] U.S. Department of Labor via Bloomberg as of July 6, 2020.

Expanding your medical or dental practice to offer telehealth patient care

Telehealth (also called telemedicine) is the use of information and telecommunications technologies to provide health care across time and/or distance1, and its use has become more prevalent during the 2020 coronavirus pandemic. The two-way, real time interactive communication between a patient and a practitioner at a distant site through telecommunications equipment that includes, at a minimum, audio and visual equipment 2 can be done on one of four main telehealth platforms: live video, store and forward, remote patient monitoring and mHealth.

One of the early benefits of telehealth was its ability to provide rural communities with practitioner access even if the patient couldn’t be physically present. Given the COVID-19 crisis, the use of telehealth as a means to adhere to stay-at-home and social distancing laws has also garnered greater attention.

The Centers for Medicare & Medicaid Services have significantly expanded access to telehealth services for Medicare beneficiaries.3 The majority of these regulation changes are temporary and effective during the public health emergency, but Medicare will now pay for telehealth services at the same rate as regular, in-person visits and include the patient’s home as a telehealth site.3 The department of Human and Health Services (HHS) Office of Civil Rights has announced that it will waive HIPAA violations against providers acting in good faith to serve patients through everyday communication technologies, such as FaceTime or Skype. This allows the use of smartphones; however, the encounter may not be conducted over a public platform, such as Facebook Live.4 Further, providers can use telemedicine to prescribe controlled substances without a prior medical evaluation.5

Currently, licensure requirements are waived to allow providers to virtually treat patients in other states, increasing telehealth opportunities.6 In addition, practitioners will not be subject to any waivers or sanctions for reducing cost-sharing obligations. HHS will not conduct audits to ensure that a prior relationship existed between a patient and practitioner for telehealth visits.3

Please note that telehealth laws may differ from state to state, and commercial insurance carrier policies may differ from policy to policy.

There are many ways patients and practitioners can benefit from incorporating telehealth into a care plan. Telehealth allows providers to free up space in waiting rooms, expand catchment areas and reduce overhead expenses. Done right, it can also serve to improve patient accessibility and convenience as well as eliminate transportation expenses for regular checkups.

For providers who decide to pursue telehealth, be aware that there are many different platforms to choose from. Remember to reach out to the patient network so they are aware of the practice’s telehealth capabilities, and be sure to highlight the service on the practice website.

A professional at CIG Capital Advisors can help you with telehealth planning, such as choosing the right telehealth platform and marketing strategy. For a confidential consultation with a CIG Capital Advisors medical practice advisor, email Brian Lasher.

Sources

- https://effectivehealthcare.ahrq.gov/products/telehealth-acute-chronic/research-protocol

- https://www.medicaid.gov/medicaid/benefits/telemedicine/index.html

- https://www.cms.gov/newsroom/fact-sheets/medicare-telemedicine-health-care-provider-fact-sheet

- https://www.hhs.gov/about/news/2020/03/17/ocr-announces-notification-of-enforcement-discretion-for-telehealth-remote-communications-during-the-covid-19.html

- https://www.dea.gov/press-releases/2020/03/20/deas-response-covid-19

- https://www.cms.gov/files/document/covid-19-physicians-and-practitioners.pdf

Your Legacy: Why Act Now?

To take advantage of these or any other financial resiliency strategies, please schedule an initial complimentary consultation with Brian Lasher.

Your Legacy: Building Resilience

To take advantage of these or any other financial resiliency strategies, please schedule an initial complimentary consultation with Brian Lasher.

Your Legacy: What’s Changed?

To take advantage of these or any other financial resiliency strategies, please schedule an initial complimentary consultation with Brian Lasher.

Boosting your healthcare practice’s cash flow during a pandemic

Many medical and dental practice owners were surprised to find their offices closed by statewide shutdown orders preventing non-essential medical and dental services. Even as states reopen elective healthcare, practices may find a drastically different market for services. That demand uncertainty for medical and dental services, coupled with the threat of future intermittent care stoppages, makes this a good time for physicians and dentists to focus on boosting their practice’s cash flows in order to better prepare for the short- and long-term future of healthcare during a pandemic:

Telehealth

Telehealth is a great ancillary service to add to your practice. More than ever, it should be incorporated to boost your practice’s revenue stream.

Centers for Medicare & Medicaid Services (CMS) has issued temporary measures to facilitate the use of telehealth services during the COVID-19 Public Health Emergency. Included in these changes is the ability to bill for telehealth services as if they were provided in person. Another temporary change allows providers to deliver care to both established and new patients through telehealth.

In addition, CMS has also expanded the list of covered telehealth services that can be provided in Medicare through telehealth.

Providers may provide telehealth services to patients through commonly used apps that normally would not fully comply with HIPAA rules. Some of the more popular examples of these apps include FaceTime, Zoom, or Skype. However, the platforms should not be public-facing, such as Facebook Live.

Healthcare providers may also reduce or waive cost-sharing for telehealth visits during the COVID-19 Public Health Emergency.

Coverage for telehealth services may differ throughout the various commercial payors as well as from state to state.

Chronic Care Management

The popularity of Chronic Care Management (CCM) services has been increasing in recent years, especially as providers are realizing that they may bill for services they would regularly provide free of charge.

Chronic Care Management is defined as the non-face-to-face services provided to Medicare beneficiaries who have multiple (two or more), significant chronic conditions. Rather than being exclusive to physicians, other clinicians, such as Nurse Practitioners and Physician’s Assistants, may also provide CCM services; however only one clinician can furnish and bill for any particular patient during a calendar month.

The practice must have the patient’s written or oral consent and use a certified EHR to bill CCM codes. The creation and revision of comprehensive electronic care plans is a key component of CCM.

CCM incentivizes a higher standard of care for patients with multiple chronic conditions and offers an additional $42 to $139 per patient per month based on time and complexity.

U.S. Department of Human & Health Services (HHS) Provider Relief Fund

The Provider Relief Fund is provided to support healthcare providers fighting the COVID-19 pandemic. The funding supports healthcare-related lost revenue attributable to COVID-19.

Providers must accept the HHS Terms and Conditions and submit revenue information by June 3, 2020 to be considered for an additional General Allocation payment. All facilities and health care professionals that billed Medicare FFS in 2019 are eligible for the funds. It is important to note that these are grants, not loans.

A physician can estimate his or her payment by dividing 2019 Medicare FFS (not including Medicare Advantage) payments received by $484 billion, and multiplying that ratio by $30 billion.

Paycheck Protection Program Loan Forgiveness

The Paycheck Protection Program (PPP) is a loan designed to provide a direct incentive for small businesses to keep their workers on payroll. The main attractive feature of this program is the ability to have some if not all of the loan proceeds forgiven. Forgiveness is based on the employer maintaining or quickly rehiring employees and maintaining salary levels. If a laid-off employee declines an offer to be re-hired, the forgiveness amount will not be reduced, however it is advised to get written confirmation of the fact.

The forgiveness portion of the loan consists of money used for payroll, rent, mortgage interest, or utilities. A reduction in payroll may reduce the amount that may be forgiven; 75% of the potential forgiveness amount should be used for payroll.

It may be in your best interest to review the PPP Loan Forgiveness Application to help you understand how the forgiveness portion will be calculated. We advise you to review with your accountant and/or legal counsel before submission to the U.S Small Business Administration.

Creative solutions and persistent actions to boost cash flow may help your practice overcome the COVID-19 crisis. Contact a CIG Capital Advisors Business Advisory Services professional to look for ways your practice might be able to increase cash flow amid the pandemic.

Sources

Telehealth

Chronic Care Management

- https://www.acponline.org/system/files/documents/running_practice/payment_coding/medicare/chronic_care_management_toolkit.pdf

- https://phamily.com/ccm/

HHS Provider Relief Fund

Payroll Protection Program

- https://www.sba.gov/sites/default/files/2020-05/3245-0407%20SBA%20Form%203508%20PPP%20Forgiveness%20Application.pdf

- https://www.aicpa.org/content/dam/aicpa/interestareas/privatecompaniespracticesection/qualityservicesdelivery/ussba/downloadabledocuments/coronavirus-ppp-loan-forgiveness-calculation-steps.pdf

Safeguarding Your Wealth with Proper Asset Protection Planning

Protecting accumulated wealth should be a cornerstone of your financial plan. A solid financial plan will address who or what poses the threat of taking away what you have earned and puts measures in place to limit the severity of those threats. These threats are often unseen and not easily predictable and therefore may cause a derailment from the path to your goals if your plan is not properly structured. Do you understand what your plan has put in place for asset protection?

Risk Management

It is not easy to think about, but just imagine that today was your last day alive. Who will be there tomorrow to protect your family and the assets you leave behind? Who will replace the high amount of income that you provide? Will your current savings be enough to provide for the day-to-day basics, let alone the big expenses of the future such as college tuition? Proper planning aims to assess the capital needs of an individual and his or her family to ensure that given any unfortunate event, the family will be taken care of first. A less often considered, but nonetheless important, scenario is disability due to injury or sickness. Will you still be able to pay your mortgage, car loan or other payments? What if this disability is for an extended period of time? You must, again, ask what your financial plan has in place for the future of your family and goals.

Personal and Business Liabilities

For physicians and other highly visible professionals, the possibility of becoming the defendant in a lawsuit based on work performed or expertise given is not out of the question. How is your medical practice structured? Which of your personal assets will be exposed to liabilities? There are particular are strategies to help protect and separate your business assets from your personal assets (Domestic Asset Protection Trusts).

Estate Planning & Titling

Do your estate planning documents match your intentions? Your estate plan may be designed to leave assets to your children; however, if your accounts and assets are not titled properly, your children may not receive those assets as intended. For example, accounts titled as Joint Tenants with Rights of Survivorship, all assets will remain in the account under control of the surviving owner, regardless of the estate plan documents. It is critical that your account titling matches your estate plan documents to avoid unintended consequences.

Mistakes and Unforeseen Problems

Without proper planning, your accumulated wealth could be exposed to numerous risks. With proper planning, those risks can be mitigated. CIG Capital Advisors Wealth Management team can make sure your wealth plan accounts for unforeseen personal events (death, disability or lawsuit) as well as financial hazards that could jeopardize the assets you’ve built over a lifetime. It can take many years, often decades, of hard work to accumulate significant assets. Unfortunately, it can only take one event to erase your progress. Contact a CIG Capital Advisors professional to prepare for the unexpected.

Planning for a Rebound: Preparing to Buy a Medical Practice

For some time, you have thought about expanding your practice. However, you haven’t taken things much further because the right opportunity hasn’t appeared. Now, the micro-economic climate in your market is rapidly changing and a nearby practice may be put on the market soon. It looks like it would fit in perfectly with your plans for expansion, but before you make an offer, you need to proceed with care.

Consider the Big Picture

Review the financial projections for the practice you plan on buying. Revisit your assumptions about patient numbers. Determine how long it will be before the practice begins paying for itself. Look into potential staffing issues.

Clarify What You Are Buying

Before considering what may be an appropriate purchase price, other important aspects of the sale — structure, payment terms, tax allocation, collateral, and post-sale employment of the seller — must be discussed. Be sure that such items as accounts receivable, deposits on equipment, and property leases are discussed as part of the negotiations. Determining exactly what’s included in the sale will minimize potentially costly future disputes.

Benchmark the Asking Price

Work with a professional advisor to determine whether the asking price is in line with recent sales of similar-sized medical practices in your region. You have more room to negotiate on the asking price if you have recent sales data for comparison purposes.

Determine the Type of Sale

Will it be an asset sale or stock sale? If it’s a stock sale, you generally will not get a tax deduction for any of the purchase price since stock is not a depreciable asset. The seller is, however, able to pay tax at capital gains rates. An asset sale may be more advantageous for the buyer from a tax perspective, as assets can be depreciated. Depending on the tax allocation of the purchase price among the assets acquired, you may be able to dramatically reduce the after-tax cost of your purchase by taking all the available write-offs from depreciating the assets included in the sale. In addition, an asset sale excludes the practice’s liabilities.

Select the Method of Financing

Some lenders are more aggressive in seeking out business, so you should be willing to work with out-of-state and out-of-region lenders to get the best terms.

Have the seller finance part of the sale because it creates an incentive for him or her to cooperate on any of the many issues that may arise after the sale is completed. Just be aware that the seller may expect a security interest in the practice, including its future receivables.

Use an Escrow

The typical sales agreement contains numerous assurances, known as “seller representations and warranties,” promises from the seller that all statements about debts, assets, and tax liabilities are true. However, if the sale is for cash, it may be wise to negotiate to hold back part of the purchase payments in an escrow fund to protect your interest in case any representations turn out to be untrue.

Be Aware of Pre-sale Practice Expenses

All of the practice’s bills should be paid off before the transfer occurs, if practical. Adjustments can be made at the time the sale is closed.

Use a Covenant Not to Compete

If retirement is not the motivation for the sale, it is generally advisable to negotiate a covenant not to compete. The covenant should be reasonable as to the duration of the covenant and any geographic restrictions.

We Can Help

If you are planning the purchase of another medical practice, either now or in the future, we strongly recommend that you talk to us first. We can help you review the financials and help protect your interests throughout the process. To schedule a complimentary consultation with a CIG Capital Advisors professional, click here.

NUCLASSICA benefitting Henry Ford Health System Bob and Sandy Helping Hands Fund: Thursday, July 2 at 7:30 p.m. LIVE on Zoom

Register here: https://zoom.us/webinar/register/WN_J-NIMhAlRTiNaRXyNq4Idw

CIG Capital Advisors is pleased to host a special live virtual concert event on Thursday, July 2 at 7:30 p.m. exclusively for our clients and friends, with Detroit electro-pop violin band NUCLASSICA! This hour-long concert is dedicated to the many members of the healthcare community we’re proud to call not just our clients, but our heroes. To those on the front lines of the pandemic, please enjoy this special evening as our way of saying thank you. Simply register here, tune in on Zoom and relax for an hour of entertainment just for you! The concert, streaming live virtually on Zoom, will benefit Henry Ford Health System’s Bob and Sandy Helping Hands Fund, which provides for HFHS employees with unexpected hardships. CIG Capital Advisors will donate $100 to the fund on behalf of every guest who attends the concert on July 2, so please invite friends and join us! Appearing on Season 11 of NBC’s “America’s Got Talent”, the electro-pop violin and DJ band NUCLASSICA is transforming and redefining the traditional concert experience. With a fiery hot image, engaging virtuosity and high-energy stage presence, NUCLASSICA’s electrifying, one-of-a-kind show is one you don’t want to miss! Register here: https://zoom.us/webinar/register/WN_J-NIMhAlRTiNaRXyNq4Idw |

Tax Strategies for Physicians to Help Meet your Retirement Goals

Tax Strategy for Physicians A common mistake in do-it-yourself retirement planning is not understanding the numerous options available to save for and fund your retirement years. The mistake is not in the act of saving itself, but rather in the misallocation of dollars to taxable accounts before tax-advantaged accounts. That’s where tax strategy for physicians […]