CIG in the News: MedCityNews, “Why now is a good time to consider exit strategies for your practice”

The coronavirus pandemic has been a catalyst, both supercharging the investment demand for physician practices and accelerating the consolidation trend in the healthcare industry. With strong sale prices on an upward trend, CIG Capital Advisors discusses in MedCity News what physician-owned practices should know before considering a deal.

Why now is a good time to consider exit strategies for your practice

Independent practices are grappling with increasing technology costs, regulatory requirements, and tighter margins and now may be an opportune time to consider exiting.

As the financial and emotional stress caused by the Covid-19 pandemic drags on, many physician-owners are taking a hard look at their professional — and personal — priorities. For some, that means finally moving forward on plans to exit their practice. Despite the turmoil and uncertainty, now may be an opportune time to make a move. Read more here.

For a confidential consultation with a CIG Capital Advisors medical practice advisor, email Brian Lasher.

CIG Asset Management Update October 2020: A New Hope?

Summary:

- Diversifying to include Emerging Markets helps in tough month for Developed Markets.i,ii,iii

- Continued worries about rising COVID-19 cases and the economy.iv

- Narratives appear to be shifting as more evidence of a potential market inflexion point.

Commentary:

Globally, this month was tough for Developed Markets and not for Emerging Markets. In October, returns for the S&P 500 were -2.8%[i] and MSCI EAFE was -4.1%[ii] while the MSCI Emering Markets was +2.0%[iii]. It was the second month in a row of monthly declines in U.S. equities. As mentioned before, we continue to employ diversification specifically to areas like Emerging Markets to potentially cushion against U.S. equity losses as in October.

Overall, Developed Markets suffered from increasing COVID-19 cases[iv] and in the U.S., diminished hopes of a pre-election stimulus package. The month culminated with a -5.6%[v] sell off during the last week when technology earnings missed expectations, with Microsoft disappointing most in our opinion.

Underneath the surface of a post-election rising market tide, the relative price movement in sectors and investing styles (Factors) appears staggering. Our broad measures of the underlying health of the market continue to worsen. Events happen daily that have either likely never happened before or not happened in a long time. For example, on November 4, the Dow Jones Transportation sector had its worst day relative to the S&P 500 since April 2009, down almost -4%[vi]. Growth had its best day versus Value (using Russell 1000 indices as proxies) since January 2001 – almost 20 years![vii] In our opinion, the market narrative appears to be that the Federal Reserve has everything under control and that it has “got your back.” Meanwhile, we continue to worry about how COVID-19 will affect the economy this winter given the explosion of cases shown by the Johns Hopkins University’s Daily COVID-19 Data in Motion.

In October, we saw the beginnings of a narrative shift to a scenario that reminds us of 2000, similar to what we discussed in our August update. In that market cycle, the technology bubble was formed by companies from buying to prepare for the risk that at the stroke of midnight on January 1, 2000 their computers would be unable to function. In 2020, companies and individuals spent on technology to work from home during a pandemic. In both cases, decelerating earnings occurred once priorities shifted away from investments in technology. Last month, it appeared that investors started to choose between decelerating and expensive large companies versus opportunities in growing and cheaper small companies where client portfolios have some investments. Specifically, the Russell 1000 Growth Index (large) lost -4.7%i versus the Russell 2000 Index (small) gained 3.4%i in October. This shift is potentially bullish for CIG’s portfolios and less so for investors indulging in passive investments[viii].

We would like to thank our clients and friends for their continued trust and support, as well as to respectfully encourage all to focus on the positives on Thanksgiving Day. Obviously, 2020 has been an excruciatingly difficult year for many of us and it continues with the contested election and the division in the country. However, we have a newfound appreciation for going to family gatherings, restaurants and sporting events, for more frequent phone calls with elders, and for being able to see our children during the workday at home.

Lastly, we suggest that you listen to the replay of our webinar “Keeping your Financial Plans Alive Amid Chaos.” We discuss the challenges, opportunities and questions ahead as we navigate the current and future market conditions.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

SOURCES:

[i] Yahoo Finance

[ii] https://www.msci.com/end-of-day-data-search

[iii] https://www.msci.com/end-of-day-data-search

[iv] https://coronavirus.jhu.edu/covid-19-daily-video

[v] Calculated by CIG using data from Yahoo Finance for 10/23 to 10/30.

[vi] Research report from Epsilon Theory, “The King is Dead. Long Live the King” dated 11/5/20.

[vii] Research report from Epsilon Theory, “The King is Dead. Long Live the King” dated 11/5/20.

[viii] While small companies as measured by the Russell 2000 small-cap index has had six 10%+ multi-day moves in 2020, per Bespoke Investment Group, the number of underlying companies with negative profits appears to be quite large relative to history and could pose a problem if investors just buy the index versus those stocks which have positive earnings.

Keeping your Financial Plans Alive Amid Chaos

Regardless of who occupies the halls of power in Washington, D.C., we should expect a tumultuous decade ahead. Because frankly, today reminds us too much of the conditions of the late 1930s.

In 2020, interest rates are at zero, government deficit spending is spiraling, national debt is soaring, and many still work from home – amid political panic, our society deeply at odds and our natural environment literally in flames around us.

To see the complete presentation, click here: https://zoom.us/rec/share/MImknez9Qj500ZQX9Ui_zGH2X9b3XK_BbjupWa0zk9jA1pRjAD4vUXqSGRL4Vm0J.OtuuygPZV71w8jGm

This presentation was prepared by CIG Asset Management and is based upon sources and

data believed to be accurate and reliable. It is not intended to serve as a solicitation, recommendation, or offer of sale for any product or security. Opinions and forward-looking statements expressed reflect the current opinion of its presenters and are subject to change without notice.

CIG Capital Advisors and its affiliates do not provide tax, legal or accounting advice.

This material being presented is for informational purposes only and is not intended to provide, nor be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

If you’d like to schedule a conversation with a CIG Capital Advisors Senior Wealth Manager, please click here or call 248-827-1010.

CIG Asset Management Update September 2020: Continuing Stimulus Hope

Summary:

- Stocks fell in September as big technology companies faltered [i] .

- COVID-19 deaths hit a grim milestone in the U.S. and increased around the world [v] .

- The markets traded up or down based upon the probability of a new stimulus bill.

Commentary:

The S&P 500 declined -3.9% and the tech-heavy NASDAQ dropped -5.2%.[i] Outside of the U.S., developed markets, as measured by the MSCI EAFE net, were down -2.9% and the MSCI Emerging Markets Index retreated -1.8%.[ii] Little protection was offered by Gold as it moved -4.1% lower as the US Dollar Index gained +1.9%.[iii] Fixed income (the Barclays U.S. Aggregate Total Return Index) returned -0.1% and the Barclays U.S. High Yield Index fell -1.0% for the month.[iv]

Republicans and Democrats struggled to come to an agreement to provide more stimulus to the economy. Republicans in the Senate were unable to pass their own “skinny” stimulus bill on September 10. Meanwhile, markets traded lower throughout the month as the COVID-19 death toll in the United States continued to increase and finally surpassed 200,000 on September 22.[v] Over the following two days, there were no less than sixteen Federal Reserve speeches in two days, but investors were unimpressed. Fed speakers reasserted that the Fed will do what it takes to support the economy and cautioned that what is really needed right now is more fiscal stimulus. On September 25, economy re-opening hopes blossomed when Governor DeSantis announced on that he was lifting all restrictions on the Florida economy. The following Monday, stimulus hopes were re-ignited as Speaker of the House Nancy Pelosi said she was hopeful to get a $2.4 trillion coronavirus stimulus bill passed.

September’s weakness in equities and their back and forth nature keep investors on notice that both the financial markets and the economy remain on thin ice. Uncertainty abounds and volatility could increase dramatically on short notice, especially as the election nears. Investors’ latest reminder was on October 6, when these stimulus machinations whipsawed the markets again.

We continue to employ diversification, discipline and flexibility in managing client portfolios to potentially avoid air pockets like the one above. Our focus on clients’ long term financial plans remains paramount.

Please join the team at CIG Capital Advisors for an engaging discussion looking at the challenges, opportunities and questions ahead as we navigate the current and future market conditions:

WEBINAR: “Keeping your Financial Plans Alive Amid Chaos”

Tuesday, October 20 at 6 p.m.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Calculated from data obtained from Yahoo Finance, as of September 30, 2020

[ii] MSCI, as of September 30, 2020

[iii] Calculated from data obtained from Yahoo Finance, as of September 30, 2020

[iv] Calculated from data obtained from Bloomberg, as of September 30, 2020

[v] John Hopkins / NPR September 22, 2020

Optimizing Your Healthcare Practice’s Income

Enhancing revenue and controlling expenses should be a financial focus of every medical practice. Improving operational efficiencies can help bring a practice closer to optimal performance. Here are some ways you can maximize your medical or dental practice’s revenue stream and reduce costs without sacrificing patient care.

Keep Coding Current

Coding errors are all too common. Simple errors can end up costing medical practices money as well as time to rectify mistakes. Delays or denied claims may translate into reduced reimbursements, which, in turn, affect cash flow.

To minimize coding errors, you need to identify the cause of the problem. Typically, miscodes are due to under-coding to avoid penalty risk, using outdated data, or leaving coding decisions to inexperienced support staff. Periodic assessments of your practice’s coding accuracy can help uncover problem areas. These assessments could include a review of your practice’s forms and a comparison of billing codes with the actual services that were provided.

Maintaining updated coding manuals and software, keeping a code reference summary handy in exam rooms, and using online coding resources can help your practice attain a more accurate coding rate. So too will making notes during each patient visit. Be sure to have your staff attend refresher courses to help them stay current with coding practices.

Improve Employee Productivity

Eliminating inefficiencies and boosting employee productivity can directly benefit your practice’s bottom line. Try these approaches to improving the productivity of your practice:

- Define productivity goals and offer incentives to your staff for reaching those goals.

- Delegate administrative functions so that physicians spend the greater part of their day seeing patients.

- Maximize physician and medical assistant billable time by planning patient flow carefully.

Better Control of Staff Time

Are your overtime expenses increasing from quarter to quarter? While some overtime is unavoidable, a consistent rise in overtime hours deserves some scrutiny. Review the payroll records of your non-exempt employees to determine who worked overtime and why. Was your practice fully staffed and simply busy or was it short one or more employees on the days when the overtime occurred? If overtime was necessary because you were short-staffed, see if this was due to vacations or some other controllable situation. It may be time to revise your practice’s policy on vacation time if scheduled time off was the cause of the overtime.

Update Fee Schedules

If your practice hasn’t raised fees in some time, you may want to consider appropriate increases. Just be aware that some patients may be resistant to fee increases and could switch to another provider. In addition, take a look at the reimbursement rates of all the plans you participate in. Run the numbers to determine whether it makes financial sense to continue accepting patients from some of the plans that reimburse poorly.

Buy Smarter

Medical and office supplies make up a portion of a practice’s expenses. Yet, some practices rarely shop around for more competitive prices. You can control expenses by becoming a smarter shopper. Pick some of your practice’s “high-volume” items and find out how much other vendors are charging. Use that information to negotiate lower prices with your current suppliers, consolidate orders with fewer vendors, or switch to new suppliers to save money.

We Can Help

We can work with you to identify areas in your practice where streamlining operations may help optimize your healthcare practice’s bottom line. For a confidential consultation with a CIG Capital Advisors medical practice advisor, email Brian Lasher.

Risks of Improper Titling and Inadequate Asset Protection

Physicians are acutely aware of liability risks and the exposure of personal assets to the claims of creditors. Given the publicity of large malpractice verdicts and the incessant amount of malpractice-related attorney advertising, this concern is understandable. However, malpractice liability is hardly the only financial risk that physicians face.

Although physicians may be inclined to view an asset-protection strategy in the context of a medical malpractice claim, physicians can pay or lose money as the result of the many non-malpractice liability claims, including:

- uninsured or underinsured casualty losses;

- ill-advised investments;

- personal guarantees of business obligations;

- alimony and property payments that could have been minimized with a pre-nuptial agreement;

- uninsured sexual harassment claims;

- estate taxes caused by inadequate estate planning;

- victimization by fraud;

- liability for breach of fiduciary duty (e.g., ERISA claims, director or officer liability); and

- indemnification obligations.

A comprehensive asset-protection strategy for a physician could include any of the following depending on the financial complexity of each physician. Some of these include but are not limited to:

- Adequate Insurance Coverage

- Proper Titling/Transfer of Ownership of Assets Within a Family

- Exempt Asset Creation

- Creation of FLP and FLLC

- Asset-protection Trusts

- Propper Retirement Plan Assets (ERISA vs non)

- Avoidance of Indemnification Obligations

Despite the widespread adoption of state law tort reform, physicians continue to be greatly concerned with asset-protection issues. In addressing this concern, two factors should be kept in mind. First, the malpractice plaintiff is far from the only potential threat to the financial well-being of a physician. Secondly, an asset-protection strategy should be integrated into an overall financial and estate planning program to help ensure appropriate strategies are selected.

To evaluate your titling and asset protection risks, contact the CIG Wealth Management team to schedule a complimentary consultation.

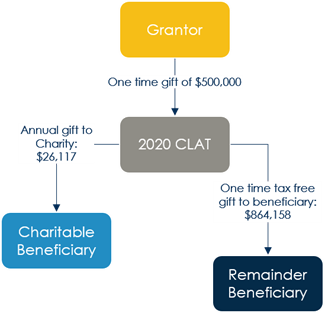

Physicians may consider a CLAT (Charitable Lead Annuity Trust) as a tax-saving strategy

The combination of a low key interest rate and a large influx of cash some physician-owners may experience, after, for instance, selling his or her private practice, could make a CLAT (Charitable Lead Annuity Trust) a desirable vehicle for tax- and legacy-planning purposes.

An illustrative case* involves a hypothetical physician-owner selling his practice and sheltering $500,000 of the proceeds in a CLAT. You can see, in the flow chart below, that the one-time contribution of $500,000 to the CLAT allows for an annual gift to the charity of his choice of $26,117 over the next 20 years, and then an eventual tax-free gift at the end of those 20 years of $864,158 to the beneficiary of his choice:

This is, of course, a hypothetical example not indicative of any particular client, with a 7% annualized growth rate assumption over 20 years. What makes this strategy relative is that it relies on a favorable IRS 7520 rate to take advantage of an arbitrage opportunity. Right now, the IRS 7520 rate is extremely low, but those rates do fluctuate, as you can see in the table below:

An IRS 7520 interest rate of 3.6% vs. 0.42% can impact the trust’s remainder value by almost $400,000 ($479,518 using December 2018’s rate vs. $864,158 using August 2020’s rate), as in our case study of the $500,000 CLAT.

Please contact our wealth management team in order to properly evaluate if this strategy is right for you and begin the financial planning process. Please speak to your tax professional to understand the cost and tax implications of your particular giving situation.

*All case studies and references are hypothetical examples developed by the CIG Capital Advisors team and the values shown are not intended to represent those of a client or known person. Assumes annualized growth rate of 7%.

CIG Asset Management Update August 2020: A Reminiscence of a Bubble Past

The S&P 500 recorded its best August return since 1986, up +7%. The S&P5, the so called FAAMG stocks, provided a majority of the S&P return for the month[i]. Developed market stocks, excluding the U.S., as measured by the MSCI EAFE Index, rose 4.9% and the MSCI Emerging Markets Index gained 2.1%[ii]. Domestic fixed income measured by the Bloomberg Barclays Aggregate, was down -0.8%[iii]. The trade-weighted U.S. dollar index continued its decline, falling an additional -1.3% in August[iv].

As we have pointed out in previous letters, stock market valuation had already reached lofty levels as measured by overall stock market capitalization versus the size of the economy (market cap/GDP). In July, we reached 171%, eclipsing the level of the Dotcom boom in March of 2000, and it has continued to grow to 178% as of this writing[v]. A perhaps more relatable valuation metric has also reached record highs: The forward price to earnings multiple on the S&P 500 is above 26, the same level reached in March 2000. March 2000 was also the peak of the market[vi].

We have vivid recollections of the Dotcom boom and the following bust from 1999 to 2002. Strangely enough, we are currently seeing many other similarities to that era 20 years ago. In addition to comparable record market valuations as illustrated to the right, we have talked at length about the lack of breadth in the market, that a very few number of stocks are providing most of the returns for the indices. This also occurred during the Dotcom bubble. Twenty years ago it was, similar to today, technology providing the majority of the returns.

Additional events in August remind us of that era 20 years ago. During the Dotcom boom, companies would add “.com” to their name to significantly boost their stock return and participate in the bubble. Yes, it really happened and we lived through it. Three professors from the University of Purdue published a study, “A Rose.com by Any Other Name” in the December 2001 issue of The Journal of Finance, that showed company managements could increase their stock price by about 74% in the 10 days after announcing that they were adding “.com” to their name! Imagine our sense of déjà vu when Walmart announced on August 27 that it was teaming up with Microsoft to bid for TikTok, a social media platform. Walmart stock gained +4.5% on this announcement. Less than one week later on September 1, Walmart gained an additional +6% as it announced it will launch a membership program similar to Amazon Prime later in the month[vii]. Walmart has traditionally been viewed as an old-school brick and mortar retailer. It appears they are trying to change that perception.

Another phenomenon during the Dotcom bubble was to split your stock into more shares, which in many cases helped to drive the price higher. Apple announced a 4-for-1 stock split on 7/30/2020. Tesla announced a 5-for-1 stock split on 8/11/2020. From the announcement of each stock split to August 31, Apple gained +34% and Tesla gained +81%[viii]. These high gains were in spite of the fact that a stock split simply lowers the price for a share of the company’s stock. A split does not add any economic value to the underlying company and investors can already buy fractional shares through many trading platforms. Ask yourself the following question: Would you like your pizza cut into 8 slices or 16? No matter how many slices you decide to cut the pizza into, you still have the same total amount. If non-value-additive stock splits and acquiring social media properties like TikTok juice your stock price, more company managements may likely be considering doing the same, but we would not rely on that as an investment strategy.

Just a couple of other similarities:

- The market has appreciated about 80% while normalized earnings have flat lined for four years. Going in to 2000, the same thing happened when the spread blew out to 70%[ix].

- The valuation gap between high valuation stocks (29x earnings) and low valuation stocks (10x earnings) remains wide and similar to 2000[x].

- The number of stocks trading over 10x revenues in the Russell 3000 is more than 400, like the year 2000. That means for a 10-year payback, the company needs to pay investors 100% of revenues for 10 straight years in dividends regardless of the cost of goods sold, payroll, taxes, etc[xi].

Where do we go from here? As of August 31, 20 of 22 prominent Wall Street strategists have a year-end 2020 price target for the S&P 500 at or below the closing price of the index[xii]. Valuations did not matter during the Dotcom bubble of 1999 – 2000 until suddenly they did, after Labor Day 2000. Then the narratives about the market and specific “darling” stocks that everyone believed that everyone believed broke. It took two years for the market to reach bottom after the bubble burst. The S&P 500 lost 50% and the NASDAQ lost 78% from the March 2000 peak to the October 2002 low[xiii].

To paraphrase the great Yogi Berra, it’s tough to make

predictions, especially about the future – of what very well may be the largest

financial bubble of all times. That said, market conditions are likely continue

to be volatile for some time. Volatility usually means that we are nearing an

inflection point. We feel strongly that having our safety nets up, bracing for some potential steep air-pockets,

and refraining from speculation in the hyper-valued growth stocks that we are

seeing like Apple and Tesla, is the correct way to be positioned as we wait for

the inflection to present new opportunities. Historically, outsized returns in out-of-favor

areas can appear swiftly and dramatically. If such a move occurs from growth to

areas such as value, dividends and small caps, we are already invested there.

At the same time, we have a plan if the markets and the economy do get better,

likely leading to the bubble marching on.

[i] Calculated from data obtained from Yahoo Finance, as of August 31, 2020

[ii] MSCI, as of August 31, 2020

[iii] Calculated from data obtained from Bloomberg, as of August 31, 2020

[iv] Calculated from data obtained from Yahoo Finance, as of August 31, 2020

[v] https://www.gurufocus.com/stock-market-valuations.php as of September 14, 2020

[vi] Factset, September 1, 2020

[vii] Calculated from data obtained from Yahoo Finance, as of September 3, 2020

[viii] Calculated from data obtained from Yahoo Finance, as of August 31, 2020

[ix] Bloomberg Data from 01/01/1990 to 7/31/2020 via Invenomic Capital

[x] Goldman Sachs Investment Research. Data from 01/01/1985 to 6/25/2020

[xi] Bloomberg Data from 01/01/1997 to 07/31/2020 via Invenomic Capital

[xii] Bloomberg, as of August 31, 2020

[xiii] Calculated from data obtained from Yahoo Finance, as of August 31, 2020

CIG Asset Management Update July 2020: Mettle versus Metal

Hopefulness around a COVID-19 vaccine, expectations of additional stimulus, and better-than-expected quarterly corporate earnings in the U.S. bolstered investor sentiment and risk assets in July. Positive vaccine announcements were dominant in investors’ psyche despite a record spike in infection rates in many parts of the country and poor macroeconomic data.

The S&P 500 Index was up for the fourth straight month, increasing 5.5% in July. By month’s end, the index was into positive territory with a 1.2% year-to-date return[1]. At the same time, gold increased 9.5% during the month, pushing year-to-date returns to 29.2%[2].

Gold became an investment across most of our portfolios about a year ago based upon what, at the time, was a high level of uncertainty within the U.S. and global economies. However, last year’s China/U.S. trade war was a walk in the park versus today’s unknowns. Gold has typically been a good hedge against uncertainty and accordingly it has performed well during 2020.

Warren Buffett, a longtime critic of gold as an investment, has said that the “magical metal” is no match for “American mettle.” Recently, he might have changed his tune by buying 21 million shares of Barrick Gold, a gold miner, while also selling shares of financial firms such as Goldman Sachs, Wells Fargo and J.P. Morgan Chase[3].

The bond market seems to be concerned over the economy as global rates moved lower. In the U.S., yields on 10-year Treasury bond fell 0.11% to 0.528% on July 31. Excluding just one single day this past spring, March 9, this is an all-time record low[4]. When factoring in inflation, U.S. real interest rates moved further into negative territory. With the help of central bank intervention and tighter credit spreads, companies issued debt hand over fist to avoid potential lower availability in the future[5].

The DXY Index, which represents a trade-weighted index for the U.S. dollar and an implicit view of the U.S. in the foreign exchange markets, fell over 4%, its worst monthly performance since 2010[6]. The combination of dollar weakness and risk-on investor sentiment helped non-U.S. equities. In July, the MSCI Emerging Markets Index gained 8.9%, while developed market stocks, excluding the U.S., as measured by the MSCI EAFE Index, rose 2.3%[7].

While gold’s recent rally partially reflects weakness in the U.S. dollar and the asset’s negative correlation to real rates, U.S. money growth (the so-called M2) has never been faster than it is today. It is two-thirds faster than during the inflationary 1970s and more than two times the growth since 2008[8]. While inflation expectations remain muted, the greater than $4 trillion of fiscal stimulus estimated to be injected in the U.S. economy would suggest that a pick-up in inflation seems quite possible, if not probable.

Going forward, it is our view that the only certainty is that uncertainty will continue. We need to muster our own METTLE to meet these challenges: stretched market valuations, any COVID intensification, grueling elections, China/ U.S. strains and U.S. social tensions. While the recent performance of risk assets has been encouraging, we continue maintain our discipline and dedicated appropriate allocations to gold, Treasuries and cash. We are also attempting to be opportunistic, adding to international and emerging markets equities that may benefit from a continuing weakening of the U.S. dollar.

[1] Yahoo Finance as of July 31, 2020

[2] Yahoo Finance as of July 31, 2020

[3] https://www.marketwatch.com/story/did-warren-buffett-just-bet-against-the-us-economy-his-latest-investment-raises-some-questions-2020-08-16

[4] Yahoo Finance as of July 31, 2020

[5] https://www.marketwatch.com/story/corporate-borrowing-in-2020-to-smash-prior-records-goldman-says-11598044749

[6] NEPC Monthly report

[8] https://www.advisorperspectives.com/commentaries/2020/08/14/charts-for-the-beach

Examine Your Healthcare Practice’s Cash Flow to Keep Business Healthier

Medical or dental practice expenses have to be paid — whether cash flow is strong or weak. Focusing on cash inflows and outflows can help ensure that your practice will have enough cash available to meet its ongoing needs.

Examine Cash Inflows

How long does it take to convert a patient visit or a medical procedure into cash in the bank? Because receiving payment for services in a timely fashion is a critical element in effective cash management, you want to be sure every charge is accounted for, recorded, and submitted for payment promptly.

Survey your past due accounts and identify where delays have occurred in receiving payment from insurers and patients. There may be places where you can tighten procedures to minimize the likelihood of payment delays.

For example, coding errors are the source of many denied claims. By training staff to focus on accuracy in coding, your practice should reduce the number of incorrect claims that have to be resubmitted to insurers. Consider setting time goals for your staff to submit clean claims after a service is rendered, and base bonus payments on your staff reaching these goals.

Have your staff check patients’ insurance coverage every time they have an appointment to ensure that you have the most up-to-date information. If insurer information is not constantly updated and verified, you could end up submitting claims to an insurer that no longer covers the patient.

Your practice should have a system for generating up-to-date information on the status of each outstanding account. These reports should include the date each bill was sent, the current balance, and the number of days delinquent. Your staff can use that information to contact delinquent patients on a predetermined schedule.

Finally, whenever possible, have your front desk staff collect patient copays, deductibles, and prepays at the time of service. You can make paying up front easier for patients by accepting debit and credit card — and possibly even online — payments.

Track Cash Outflows

Paying bills as soon as they are received may not be the most effective way for your practice to manage cash flow. An automated accounts payable system that organizes your payments by due date is preferable. However, if a vendor offers your practice a discount for early payment, you will need to take that factor into account. Rent, utilities, and key suppliers should be paid before your practice pays bills with more flexible terms.

Consider renegotiating vendor contracts. You may be able to negotiate with certain vendors for longer payment terms — extending payment terms from, for example, 30 days to 60 days is equal to receiving an interest-free loan. Schedule a meeting with key vendors at least yearly to identify where they may have some flexibility in reducing their charges for supplies or services. You can always look for alternative vendors if your current ones seem unwilling to bend on prices.

Finally, review other areas of your operations to see if you can reduce costs. If you have any outstanding bank loans and are in a cash flow crunch, ask to renegotiate for more favorable terms.

Cash flow is crucial to your practice’s financial health. If you have had periods in the past when cash flow has been tight, take a look at what created the issue. We can help you review your current cash-management practices and suggest potential improvements. To schedule a complimentary consultation with a CIG Capital Advisors professional, click here.