The combination of a low key interest rate and a large influx of cash some physician-owners may experience, after, for instance, selling his or her private practice, could make a CLAT (Charitable Lead Annuity Trust) a desirable vehicle for tax- and legacy-planning purposes.

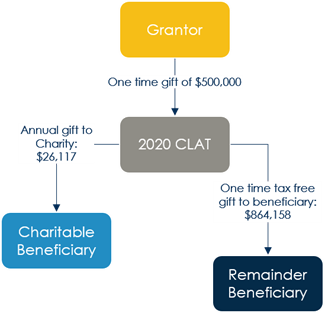

An illustrative case* involves a hypothetical physician-owner selling his practice and sheltering $500,000 of the proceeds in a CLAT. You can see, in the flow chart below, that the one-time contribution of $500,000 to the CLAT allows for an annual gift to the charity of his choice of $26,117 over the next 20 years, and then an eventual tax-free gift at the end of those 20 years of $864,158 to the beneficiary of his choice:

This is, of course, a hypothetical example not indicative of any particular client, with a 7% annualized growth rate assumption over 20 years. What makes this strategy relative is that it relies on a favorable IRS 7520 rate to take advantage of an arbitrage opportunity. Right now, the IRS 7520 rate is extremely low, but those rates do fluctuate, as you can see in the table below:

An IRS 7520 interest rate of 3.6% vs. 0.42% can impact the trust’s remainder value by almost $400,000 ($479,518 using December 2018’s rate vs. $864,158 using August 2020’s rate), as in our case study of the $500,000 CLAT.

Please contact our wealth management team in order to properly evaluate if this strategy is right for you and begin the financial planning process. Please speak to your tax professional to understand the cost and tax implications of your particular giving situation.

*All case studies and references are hypothetical examples developed by the CIG Capital Advisors team and the values shown are not intended to represent those of a client or known person. Assumes annualized growth rate of 7%.