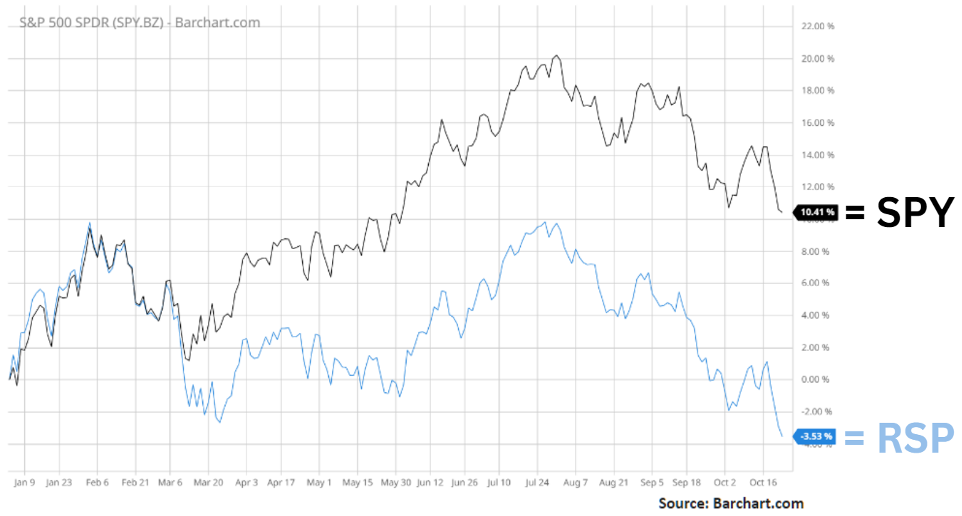

The chart below shows the year-to-date performance through October 20, 2023, of the market cap-weighted S&P 500 – represented by the SPDR S&P 50 ETF (SPY) gaining +10.4% versus the equal-weighted S&P 500 – represented by the Invesco S&P 500 Equal Weight ETF (RSP) falling -3.5%. [i]

Source: Barchart.com

Why is there such a big difference in returns between the two indices?

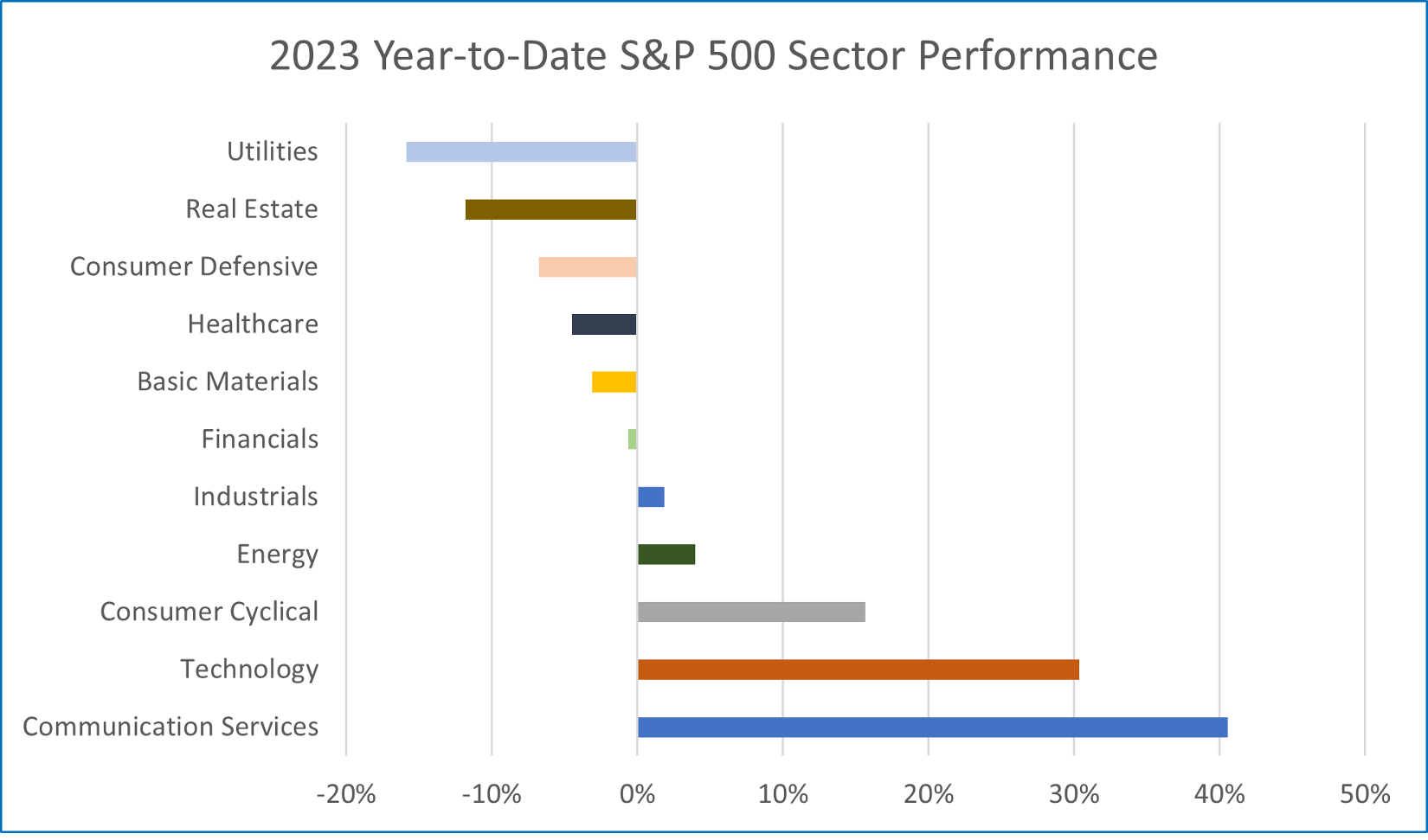

Year-to-date through October 24, 2023, the performance of the stock market and its 11 major S&P sectors may best be described as the battle between the “haves” and the “have nots”.

Three sectors, Communication Services, Technology, and Consumer Cyclicals are outperforming the other eight by a wide margin. As seen in the chart below, six sectors are down year-to-date.

Source: FinViz.com as of October 24, 2023

What is driving the performance of the three outperforming sectors? Why is performance so skewed?

The answer to why there is such a big difference in returns between the equal-weighted S&P 500 and the size-weighted S&P 500 and in returns between sectors lies in this heat map which shows all 500 companies that are included in the S&P 500. [ii]

Source: FinViz.com as of October 24, 2023

The answer lies with the seven large bright green boxes with their symbols circled in yellow. All seven of these stocks are in one of the three outperforming sectors previously identified on the S&P 500 Sector Performance bar chart. Bank of America analyst Michael Hartnett has called this group of seven stocks the “Magnificent 7”.[iii] Currently, over 25% of the S&P 500’s total market capitalization is in these Magnificent 7 stocks. [iv]

According to Torsten Slok, Chief Economist at Apollo Asset Management, “The bottom line is that returns this year in the S&P 500 have been driven entirely by returns in the seven biggest stocks, and these seven stocks have become more and more overvalued.”[v] Apollo Asset Management manages over half a trillion dollars in assets.

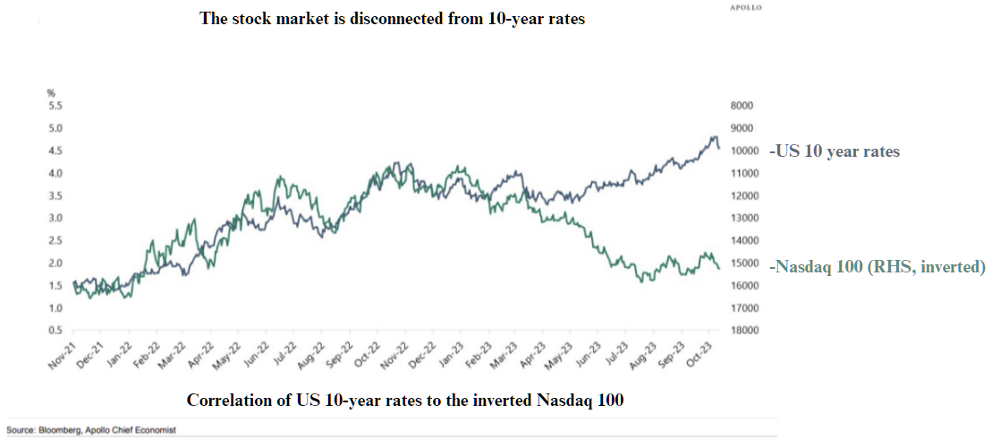

Why is this so remarkable and when will this situation end?

Slok concludes that “tech valuations are very high and inconsistent with the significant rise in long-term interest rates… In short, something has to give. Either stocks have to go down to be consistent with the current level of interest rates. Or long-term interest rates have to go down to be consistent with the current level of stock prices.”[vi]

Year-to-date through September 30, if you invested in a DIVERSIFIED portfolio with 60% invested in the Equal Weighted S&P 500 (RSP) and 40% invested in Bloomberg Barclay Aggregate Bond Index (AGG), you would have generated lower returns than if one chased only these Magnificent 7 stocks. [vii]

Some investors might describe us at CIG as being bearish because we don’t find the Magnificent 7 attractive, but we’re not so pessimistic as to believe there are only seven growth opportunities in the entire global equity market. In particular, we feel that we have identified an investment theme for long-term investors.

We are beginning to allocate money into Clean Transition Investing – a theme where one invests in different areas that work towards net zero emissions, or clean energy. The Paris Agreement of 2015 outlined the long-term goal of reaching net zero emissions by the year 2050.[viii] Fixing the electrical grid, focusing on renewable energy, hydrogen, energy storage, electric vehicles and the required infrastructure that goes along with them, sustainable mining, and smart agriculture are just examples of what need to be worked on.

While the eventual changing of sector leadership across cycles tends to be accompanied by significant market volatility, we will be there to guide you through these changes. CIG’s goals are to provide a financial roadmap for our clients and their families – over both near-term and long-term time horizons – as we implement structures to potentially increase protection of your assets and optimize investment risks and returns, and aid in the creation of legacy platforms.

We would welcome a conversation with you regarding how we can help you navigate these interesting times. We would like to hear from you. Please reach out to Brian Lasher (blasher@cigcapitaladvisors.com), Eric T. Pratt (epratt@cigcapitaladvisors.com) or the rest of the CIG team.