The act of adding medical practice value through an administrator’s eyes

CIG Capital Advisors authored a recent article for Fierce Healthcare where we discuss how physician-owners can assess growth metrics in their medical practice and make adjustments that may affect the practice’s value with an eye toward a future sale:

“The act of adding medical practice value through an administrator’s eyes”

The average primary care physician sees more than 20 patients a day, according to a 2018 survey of nearly 9,000 doctors by the Physicians Foundation.

That, along with the 11 hours they devote every week, on average, to paperwork, helps explain why 78% of those same physicians told surveyors they feel burned out at least some of the time.

Oftentimes, this adds up to physicians being too busy with day-to-day responsibilities to have time left over for running the business end of their medical practice, let alone for crafting strategies to drive long-term practice growth, or to consider their legacy as they chart a course toward future retirement.

Ask most physicians about their hopes for the future and they might say that, of course, they want to grow their practice and increase revenue.

It’s one thing to set that as a goal. It’s quite another to determine how and what kind

of growth—and how much—will best suit a particular medical practice and its individual members.

Difficult as it may be, the reality is that growth won’t just result from hard work and hopes. Physicians who are truly serious about strategic growth or maximizing the practice’s value with an eye toward a future sale have

to invest in the process—possibly even setting aside an entire day or more for business building.

Either way, the process always begins with something already familiar to doctors: diagnostics.

Rather than X-rays or blood tests, doctors who want to grow their practice must begin with a panel of financial indicators: tax returns, productivity reports, an evaluation of their payer mix and more. It’s important to examine outlays, too. If a practice is spending more on equipment or staffing, or real estate, than peers of comparable size, bringing those expenditures in line with benchmarks may be the most effective treatment.

It also helps to examine the market. If your practice is in an area with an aging population, your approach to growth is oftentimes different than it would be in a location teeming with young families.

It sounds obvious, but just having the time to find those sorts of data may be well beyond the reach of the average overworked physician. That also explains why achieving growth by simply adding more patients isn’t practical.

This acknowledgment of limitations leads to questions about how best to grow. Is it more advantageous to acquire new locations and the physicians that come with them? Or does it better suit your goals to grow organically with more patients and a handpicked crop of new colleagues?

Finding colleagues who share your treatment philosophy and practice goals is vital, whether planning expansion or an exit strategy. As doctors well know, it’s not a given that those goals and philosophies will be shared. Culture fit is far more art than science, so while acquisitions or mergers may seem like an easy shortcut to growth and the added value that comes with it, they also require due diligence that goes well beyond spreadsheets.

For physicians who anticipate handing off their medical practice, the first step is also diagnostic, although in this case it is an honest valuation of the practice. This isn’t just a matter of placing a price tag on equipment or real estate, though that is part of it. Intangibles play a role, too: your reputation, and your practice’s reputation, have value as well.

For any medical practice contemplating a growth strategy, and for any physician planning a career exit, the most important thing to remember is that, just like patients, no two practices are identical. Consequently, there is no single prescription that will work for every practice.

And that is why a careful, individualized strategy is key to building and maintaining growth, whether for the purposes of seeing a practice through for the next two decades or for the next two years until a buyer arrives.

To schedule an initial complementary consultation to discuss how you can add value to your medical or dental pratice, email Brian Lasher.

2019 Asset Management Year in Review and Look Ahead to 2020

What a difference a year makes. Last December, equity markets plunged almost into bear market territory driven by fears that the Federal Reserve and their rate hikes would throw the economy into a recession. Today, the Federal Reserve is buying more treasury bills than they ever bought in prior Quantitative Easing (QE) periods and have pushed the markets to new all-time highs[1]. QT, or “Quantitation Tightening” – increasing short term rates and a shrinking Federal Reserve balance sheet – is but a vague memory now. So, just as last year’s pessimism clearly was overdone, today’s optimism is likely outpacing the economic evidence that the economy is moving to higher growth.

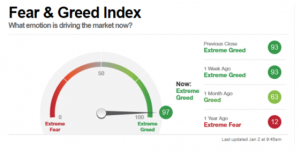

A measure of that is the CNN Fear & Greed Index- below reaching the “Extreme Greed” level as we started trading for 2020 versus 1 Year Ago[2].

2019 was a stellar year for the equity and bond markets. Nearly every major asset class had significant outperformance versus the rate of inflation. That said, it is important to recognize 2019’s good returns were primarily driven by what investors are willing to pay for a dollar of company earnings (the “earnings multiple”), as annual earnings growth is likely to be only single digits when companies complete announcing their 2019 Fourth Quarter results this month. 2018’s disappointing equity market returns were the result of the exact opposite situation: 22% earnings growth but declining earnings multiples. You may recall from our January 2019 letter that almost no asset classes beat inflation in 2018. While such a dichotomy between the years is not unheard of, it was historically extreme as noted by Morgan Stanley[3].

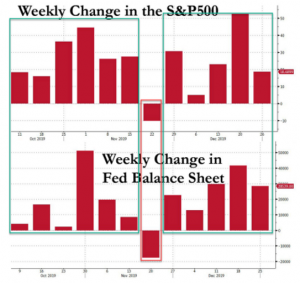

Central Banks, including the Federal Reserve, can have a large impact on earnings multiples. According to economic theory, when money growth is faster than the growth of the economy, the excess money goes into financial assets driving even expensive stocks and bonds higher. Ever since the start of October when the Fed launched QE4 in response to the September stealth banking crisis, the Federal Reserve balance sheet rose 11 of 12 weeks starting October 9, and declined just 1 of 12, and magically, the S&P did just that as well[4].

We remain concerned that the New York Federal Reserve continues to inject reserves into the banking system to keep some short-term rates from rising. This system, the overnight repo market, is where the interest rates that central banks set meet the interest rates that real economic actors use. You may recall the unrest in September in the money markets, when short-term interest rates got out of the Federal Reserve’s control and briefly spiked to 9%[5]. This could signal that something’s potentially wrong with the financial system, especially as it relates to banks and liquidity.

During 2019, we counted over 50 Central Bank easing actions, and global short term rates declined about -0.6%[6]. The aggressiveness of the Central Banks has been a surprise to many with the Federal Reserve, in particular, adding almost $400 billion dollars to the markets in just four months! (Note dramatic upturn in the graph below[7].)

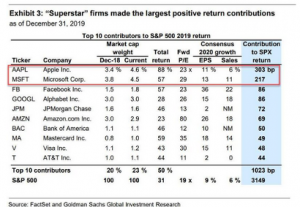

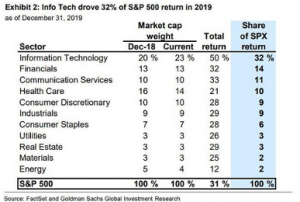

It is also remarkable how skewed the S&P 500’s 2019 return is toward a small handful of larger-cap firms and sectors. Apple (+88% return) and Microsoft (+57% return) accounted for almost one-fifth, and Information Technology was 50% of the S&P 500 index’s return. The largest source of stock buying was the companies themselves, with Information Technology buying back the most stock of any sector.

Companies buying back their own shares has been a major contributor to the rally since 2009. A Goldman Sachs analysis warns that they anticipate 2019 stock buybacks will drop 15% in 2019 to $710 billion and continue to drop in 2020. Corporate buybacks currently provide more demand for stocks than any other individual source, including households, mutual funds or exchange-traded funds. Buybacks as a percentage of trailing annual free cash flow has historically peaked near the highs of the market, i.e.: 2000, 2008, and 2016[8]. A slower pace of buybacks should not only drag on companies’ earnings per share, but also lead to increased market volatility as corporations provide less support to the equity markets.

The last time that we saw such dynamics in the market was the late 1990s, with “insurance” rate cuts, skewed returns and political risks. We remember what happened in 2000: a severe market downturn.

All of this is in the background of an investment market that wants to find a narrative to support driving asset prices higher. In December, the narrative was that the three biggest worries of 2019 have been solved during the week of December 9. On trade, the U.S. and China agreed to a “Phase One” deal and additional tariffs scheduled for December 15 were delayed. In the UK, Prime Minister Boris Johnson won a landslide victory, ensuring that “Brexit” would finally take place. Lastly, the Federal Reserve said that interest rates should remain steady through 2020. As we entered 2020, markets started off slow but now have begun to make some new highs. Given recent events in the Middle East, it feels like anything could happen.

Where does this leave the investment markets? One of the best indicators of the fair value of the stock market in the U.S. is the total market value relative to the total economy, or GDP. At this point, an argument could be made that the market is significantly overvalued, given that the total market value is almost 155% of the last reported GDP. The last time that this happened was the Dot Com Boom of the late 1990s.

While some may argue that low interest rates and the amount of company sales overseas have impacted this ratio, on the face of it, the U.S. stock market would likely need to return about -3% per year in the next eight years to get back to the long term trend for the economy.

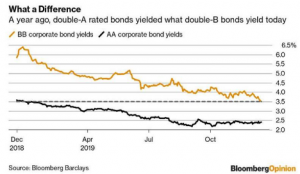

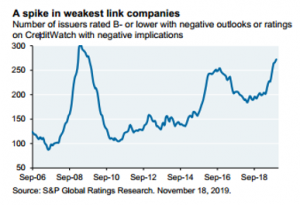

The corporate bond market has also benefited from declining interest rates over the last 18 months. As interest rates and bond yields have fallen in Europe and Japan into negative territory, investors there have bought more corporate bonds in the U.S[9]. As a result, the current market requires investors to increase risk in order to maintain the interest payments that they received in previous years. As of mid-December, the average junk bond (BB rated) yielded just 3.5%, an all-time low, including a credit premium or “spread” of just 1.64% more than risk-free Treasuries. A year before, the average high quality corporate bond (AA rated), such as those issued by Berkshire Hathaway, Apple and Exxon, was yielding 3.6%, more than the yield one now gets for bonds whose rating is some nine credit rating levels lower, in deep junk territory[10]. Meanwhile, cracks are starting to show in the lowest rated bonds[11].

Consequently, our objective in 2019 was to generate returns ahead of client financial plan targets by taking restrained risk in relation to client general risk preferences. We accomplished that by being:

- Slightly less invested in stocks and 25% less invested in bonds versus our benchmarks.

- Invested in shorter-term bonds to avoid the risk of rising interest rates.

- Diversified internationally and in alternatives investments like Gold.

- Underweight expensive corporate bonds and loans with deteriorating protections for investors like those mentioned above.

In 2020, the CIG team will continue to weigh the potential risks in the markets and plan for a wide range of scenarios, both positive and negative, while steadily reevaluating and managing the appropriate level of risk so that clients can achieve their financial plan goals. Specifically, our strategy remains consistent with prior years and will encompass:

- A core portfolio which focuses on stock and bond characteristics – Factors – that are a persistent source of investment return. We will attempt to limit the Momentum Factor in our portfolios. Momentum manifests itself in investors simply buying what has been making money (i.e., high growth names and consumer staples stocks) and selling what hasn’t (i.e., energy). The problem is that it leads to crowding into the same stocks. As soon as those stocks stop making money, these investors rush for the exits and the stocks fall significantly, which is what happened in the first two weeks of September.

- Meaningful diversification. After a 10-year equity bull market in the United States, the prudent approach for client portfolios is to have some investments in different geographies, fixed income and alternatives. We seek to deliver a nuanced, material understanding of diversification, which typically means carefully buying assets that have not appreciated and selling investors’ favorites. Diversification remains our best defense.

- A long-term approach. This methodology is particularly true in clients’ variable annuity and educational accounts, which generally do not have as extensive Factor or diversification exposure as the main portfolios.

- Tactical risk management. When the markets become, in our estimation, too volatile, we take risk management action in CIG’s Dynamic portfolios.

The bottom line is that we expect 2020’s market returns to be much lower than those of 2019 and less uniform. We continue to seek out “value-additive” investments to take advantage of market opportunities and be more contrarian and tactical to enhance portfolio returns in 2020. Markets are expensive and likely to get more expensive as a result of “easy money” from Central Banks. The risk of policymakers losing control is rising along with geopolitical risks. In this late cycle environment, CIG has taken a defensive stance and is prepared to take further action as the market direction dictates; we continue to focus on our clients’ risk-adjusted returns in support of their financial objectives and goals. In the words of Warren Buffet, the “Oracle of Omaha” and legendary investor, we will be “fearful when others are greedy and greedy when others are fearful.”

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[1] Yahoo Finance

[2] https://money.cnn.com/data/fear-and-greed/ as of 1/2/20 at 9:45AM

[3] “On the Markets,” Morgan Stanley, January 2020

[4] “Market Your Calendar: Next Week The Fed’s Liquidity Drain Begins,” ZeroHedge.com, January 2020

[5] https://www.chicagofed.org/publications/chicago-fed-letter/2019/423

[6] Cornerstone Macro, November 3, 2019

[7] https://fred.stlouisfed.org/series/WALCL

[8] Goldman Sachs 10/21/2019

[9] “Even Goldman Bristles As Junk Bond Rally Smashers All Records,” Zerohedge.com, December 2019

[10] Bloomberg Opinion and Bloomberg Barclays

[11] “Eye on the Market,” J.P. Morgan

Dermatology Industry Trading Multiples and Recent Buyers

In the first part of our look at merger and acquisition activity in the dermatology industry, we examined dermatology practice valuation strategies and the buying/selling process. In the second part, we look at the trading multiples that dermatology practice sellers could expect to see in today’s market, and a few of the recent larger transactions […]

Dermatology Practice Valuation Strategies

A practice valuation exercise can enhance the overall optimization of your dermatology practice, as well as allow you to comfortably entertain potential acquisition offers. In addition to obtaining an idea of what your practice is worth, the economic climate, competitive landscape, and private-equity infusion of funds should also influence the path you decide to take. […]

Dental Practice Valuation Strategies

A dental practice valuation exercise can enhance the overall optimization of your dental practice, as well as allow you to comfortably entertain potential acquisition offers. In addition to obtaining an idea of what your practice is worth, the economic climate, competitive landscape, and private-equity infusion of funds should also influence the path you decide to […]

Urology Practice Valuation Strategies

A medical practice valuation exercise can enhance the overall optimization of your urology practice, as well as allow you to comfortably entertain potential acquisition offers. In addition to obtaining an idea of what your practice is worth, the economic climate, competitive landscape, and private-equity infusion of funds should also influence the path you decide to […]