Update From CIG Asset Management: Time to Reconsider Regret

When you or your advisor make changes to your investment portfolio, it’s natural to feel regret. When you buy investments, there’s always a chance you’ll regret it later. More importantly, if you sell some of your investments and the market keeps rising, you might regret selling too soon—especially if you must pay taxes on the gains. On the other hand, if you sell and the market drops dramatically, you may regret not selling more.

In 2021, we discussed the concept of regret [i], and it turned out to be an important moment for many of our clients. By making timely adjustments to their portfolios, in 2022 our CIG Dynamic Growth Strategy avoided 60% of the growth benchmark’s -17.3% loss and our CIG Dynamic Balanced Strategy avoided 65% of the balanced benchmark’s -15.8% loss. [ii] Here’s what we highlighted:

“It is so easy at this stage, to miss the disconnect between the real-world economy and the stock market and be tempted to chase stock valuations that as a whole are trading near all-time highs based on many historical measures. One could follow narratives like, “stocks only go up over the long term” while listening to CNBC and ever bullish Wall Street strategists and act against your best interest.” [iii]

Today, we’re witnessing and hearing about a continuous stream of almost daily market records, based on the extreme concentration in the passive indices. Meanwhile, Wall Street strategists emphasize that survival in the evolving business landscape very well may hinge on embracing AI-driven innovations. [iv]

If you invest based on this information, your maximum regret may be missing out on the current surge in these markets.

Our perspective diverges from the consensus. The economic landscape remains challenging for everyday consumers. During the COVID crisis, consumers saved more money than usual. However, the Federal Reserve now reports that these “excess savings” have been fully spent. [v] Consumers drive nearly two-thirds of the U.S. economy. Unfortunately, many are financially strained – credit card delinquencies are at their highest level in over a decade and auto loan delinquencies are also soaring. [vi] No surprise – May retail sales were weaker than expected. When adjusted for inflation, they’ve been negative year-over-year throughout 2024. [vii]

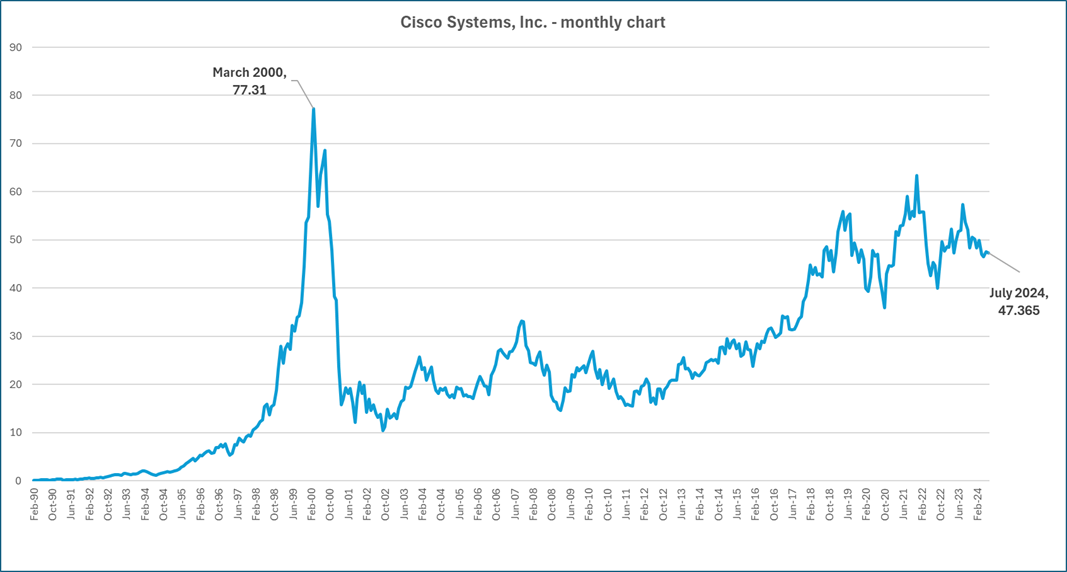

While Wall Street remains bullish on AI, some companies are taking a different stance. Lucidworks, in a survey of over 2,500 business leaders, found that only 63% of companies surveyed plan to increase AI spending versus 93% in 2023. [viii] AI investments, once hyped as the next big thing, are now facing company scrutiny. AI’s trajectory resembles that of the Internet in 2000. Back then, the Internet was a long-term success story, but many companies struggled to turn it into a profitable investment. We wonder if Nvidia – whose sales of its advanced AI platform is driving enormous sales growth and its market capitalization to over $3 trillion [ix] – will suffer the same fate as Cisco Systems. Cisco’s routers were an integral part of connecting to the internet in the late 1990s. While Cisco soared to great heights during the dot-com boom, its long-term stock chart reveals that it lost 87% of its March 2000 value when the bubble burst and it has never fully recovered to those highs. [x]

Chart by CIG Asset Management using data from Barchart.com

Given the current market conditions—where we see extreme valuations, unusual market indicators, and daily anomalies abound—we’ve increased our vigilance and are adjusting as needed. Our primary goal is to align risk with our clients’ financial plan targets. We’re cautious, and strive to avoid unnecessary risks. We don’t want to fight against the Federal Reserve or make hasty judgments. The Federal Reserve plays a significant role in stabilizing the economy. However, recent poorly received Treasury auctions raise questions about its effectiveness in a market slump this time.

If you invest and ignore this information, and stocks fall, your maximum regret could be not being able to retire, donate or spend when you choose or create your desired legacy.

Balancing risk and reward is at the heart of successful investing. Our primary goal is safeguarding our clients’ financial health. We achieve this by maintaining both intellectual and emotional distance. Drawing from game theory, we consider “mini-max regret” to guide our decisions. This means minimizing the maximum potential regret while pursuing client goals. Since 2020, we’ve emphasized that the journey matters as much as the destination. Even during speculative peaks, immediate significant market losses aren’t guaranteed. Historical examples reveal that markets can recover and even surpass previous highs for a time.

Given the inevitable twists and turns, we don’t attempt to make crystal ball forecasts; instead, we observe and endeavor to adapt. Flexibility is our compass in ever-changing market conditions. If you’re a passive or do-it-yourself investor, you may want to brace yourself for potential portfolio roller coasters. Wild market swings can lead to substantial losses of greater than 25%. History reminds us that the S&P 500 can lag Treasury bill returns for a decade or more. [xi] Regardless of your investment style, we suggest you analyze your risk exposure carefully and understand your maximum regret threshold.

We continue to believe that there are other ways to potentially make money in the stock market outside of the Magnificent 7 stocks. On July 11, 2024, the June CPI release showed inflation fell -0.1% – the first month to month drop since May 2020. [xii] On this same day, the Magnificent 7 stocks, as measured by the Roundhill Magnificent Seven ETF (MAGS), fell -4.5%. The Russell 2000 small-cap index, which year-to-date was only up +1.2% the day before, gained +3.6%! Three of our clean transition investments which we own in our dynamic growth and dynamic balanced strategies – all gained over +2.0% on this day. [xiii] The small-cap outperformance on July 11 was historical. The Russell 2000 ETF (IWM) outperformed the S&P 500 ETF (SPY) by 4.5% – the second largest outperformance on record. The only day that saw larger small-cap outperformance was October 10, 2008, in the throes of the Great Financial Crisis and right before the Fed’s Quantitative Easing program began. [xiv] One day does not make a trend, but we are encouraged that market participation may broaden out to investments outside of the Magnificent 7.

Now, more than ever, having a professional fiduciary by your side is crucial. If you would like to explore ways to safeguard your financial interests during this wild ride, please contact Brian Lasher (blasher@cigcapitaladvisors.com) or Eric T. Pratt (epratt@cigcapitaladvisors.com).

[i] CIG Asset Management Review: Outlook 2021

[ii] Figures calculated based on CIG Composite returns. Full composite returns are available upon request. Performance has been attested to by ACA Group for the period August 1, 2018, through December 31, 2022. Strategy returns are calculated independently on a daily basis and linked geometrically to produce a monthly return. Total investment performance includes realized and unrealized gains and losses, dividends, and interest. Accrual accounting is used to record interest income while dividends are recorded on a cash basis. Trade date accounting is used for calculation and valuation purposes. Past performance is not indicative of future results.) The Growth Benchmark is a blend of 60% Russell 3000, 25% MSCI All-Country World ex US and 15% Bloomberg US Aggregate Bond indices. The Balanced Benchmark is a blend of 45% Russell 3000, 10% MSCI All-Country World ex US and 45% Bloomberg US Aggregate Bond indices.

[iii] https://cigcapitaladvisors.com/cig-asset-management-review-outlook-2021/

[iv] Merrill Lynch report: Artificial intelligence: The next great tech wave?

[v] Federal Reserve Bank of San Francisco: Pandemic Savings Are Gone: What’s Next for U.S. Consumers? May 3, 2024

[vi] Federal Reserve Bank of New York: Household Debt and Credit Report. Q1 2024.

[vii] https://www.advisorperspectives.com/dshort/updates/2024/06/18/the-big-four-recession-indicators-real-retail-sales-up-0-1-in-may

[viii] https://lucidworks.com/ebooks/2024-ai-benchmark-survey/

[ix] Nvidia market capitalization as of July 15, 2024 – finance.yahoo.com

[x] Calculated by CIG Asset Management using data from Barchart.com

[xi] Hussman Market Comment – “Cluster of Woe” February 2024

[xii] John Hancock weekly market recap 7/12/2024.

[xiii] Calculated by CIG Asset Management using data from finance.yahoo.com

[xiv] https://bilello.blog/2024/the-great-reversal-chart-of-the-day-7-11-24

Financial Resiliency Amid Disruption: Your Healthcare Practice

Your medical or dental practice may have to adjust to a “new normal” as states slowly return to broader care permissions after weeks or months of tight, lockdown restrictions. Have you taken advantage of the programs offered to help medical and dental practices survive and what changes can you make to help ensure your practice thrives in a post-lockdown environment?.

Here are some management aspects dentists and physician-owners may want to consider in planning for financial resiliency amid the global disruption brought by the pandemic:

Cash Flow Summary

With so much uncertainty, being able to visualize your cash flows for the next 12 months is crucial. Taking proactive measures to forecast your incoming cash flows will allow you to implement a strategy early on and to timely take appropriate steps. The process includes analyzing your historical revenue stream and collection rates with an objective to forecast your future collections. Reviewing your procedure mix will help you determine what the impact of delaying non-essential procedures will be to your top-line.

Expenses should be adjusted to reflect cost management strategies and cash inflows from government establishments and banking institutions should be factored in to estimate cash balances throughout the pandemic as well as into the recovery period. Conducting a sensitivity analysis may also be beneficial to envision best case/worst case scenarios.

Telehealth

During the COVID-19 crisis, CMS has significantly expanded access to telehealth services for Medicare beneficiaries. This includes the easing of many of the stringent regulations set place by various government entities. Time should be spent reviewing the latest changes, highlighting the different opportunities available to you, and researching different telehealth platforms to see which is most appropriate for your practice.

Due diligence should also be conducted to highlight services that you may virtually perform and bill via telehealth. Disseminating the service to your patients as well as the general public is key to optimizing this tool.

A/R Management

Insurance companies don’t typically pay out as fast as many dental and medical practice managers would like. Understanding tools available to healthcare providers during the crisis could allow you to speed up your collection process. For example, CMS is expanding its payment acceleration program and HHS has announced a provider relief program. Your billing staff may also be utilized to effectuate collections through aggressive A/R management.

Expense Management

Having a handle on your expenses is one key to sustaining a positive cash flow. A first step may be to look into your historical expenses as a percentage of revenue as well as the year-over-year trends. Recent changes should be taken into consideration as well to prudently forecast your budget.

Fixed expenses are typically the biggest threat. However, there may be options available to you depending on the language in your contracts. Review the contracts and agreements you have in place and look for ways to renegotiate with an objective to defer or abate payments. It may be in your best interest to terminate some agreements.

Grant and Loan Opportunities

Keeping businesses up and running is almost just as crucial to owners as it is to the economy. For that reason, there are many grants and loans available to assist you with perfecting your payroll, rent and other costs. Time should be spent pinpointing your situation, reviewing various programs available to you, and working with your financial institution and accountant to pursue loan programs, grants, and line of credits to supplement your cash reserves.

Business Continuity and Recovery Planning

Having a Business Continuity Plan in place is imperative not only to weather crisis times but also to transition back to what many are calling the new normal. This involves reviewing your remote work capabilities, adjusting staff tasks to keep them engaged, increasing oversight of vendors, and other organizational modifications.

Let us help

As experienced medical and dental practice business advisors, we can dig deeper into your numbers and show where you can make changes that will improve your practice’s bottom line. Let us help support your practice’s resiliency by scheduling an initial complimentary consultation with Brian Lasher.

Securing your wishes through charitable giving

Charitable giving plays an important role in many financial plans. However, many people tend to approach charitable giving as a quick exercise they think about once a year. In reality, it requires thoughtful planning, especially if you’re making larger charitable gifts, to ensure your wishes for your money both now and in the future are […]