CIG Asset Management Update March 2020: March Madness

Market volatility continued through the month of March and continues month to date at extreme levels. Long time readers of our updates know that we have been warning about asset bubbles and Central Banks’ recent actions since last year. Valuation, volatility and liquidity are the three main areas that we believe investors should focus on right now.

Valuation: In spite of a -20% year to date return for the S&P 500(1) through March 31st, U.S. stock market valuations are still quite high relative to the size of the U.S. economy on a historical basis. The ratio of total U.S. market capitalization to GDP (TMC/GDP), reached an all-time high of 151.3% in December 2019(2). As a result of the sharp sell-off in March 2020, TMC/GDP dropped -21% to 119.2% as of March 30th(2). As easy as it is to measure total market capitalization on a daily basis, nobody knows how much or for how long the U.S. economy (GDP) will decline. The TMC/GDP ratio fell to 75 or lower during the post-Dot Com recession in 2001 and the Great Financial Crisis in 2009. An argument could be made that if the contraction in the economy is large and persistent enough, the U.S. stock market may not have yet seen its low.

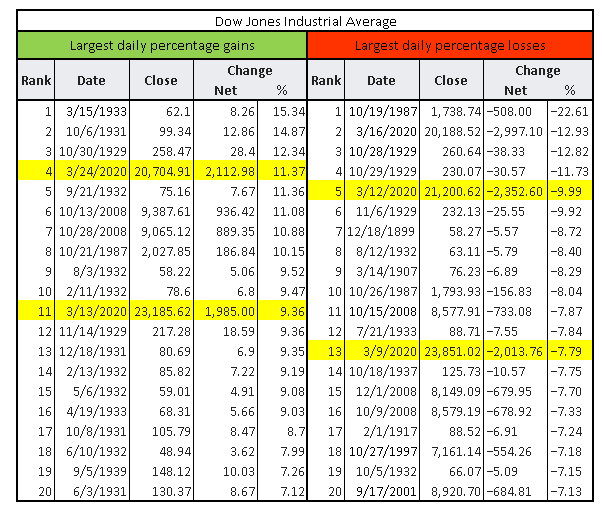

Volatility: March witnessed two of the top 20 daily percentage gains and two of the top 20 percentage daily losses for the Dow Jones Industrials Average (Dow), ever(3). Generally, these periods of extreme moves to the upside and downside have not occurred at or near market bottoms. Major market bottoms have occurred once volatility becomes more muted. Please reference the table below. As of this writing, we can add an additional top 20 up day. The Dow was up +7.7% on April 6, 2020(3).

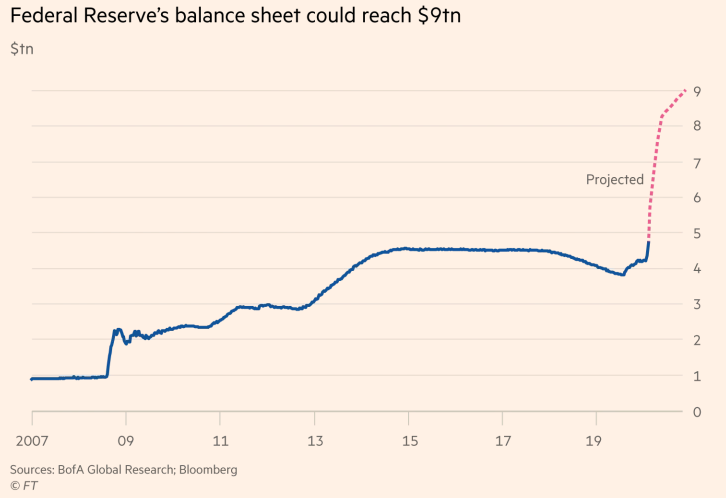

Liquidity: Following the rare emergency interest rate cut on March 3rd, the Fed cut the fed funds rate again by 1% to a 0 to 0.25% range at a subsequent emergency meeting on Sunday, March 14th. The Fed balance sheet expanded by an average $1 million per second from March 18th to March 31st. Bank of America believes the balance sheet could expand to $9 trillion by the end of the year (~40% of the U.S. economy.)(4) This is an exponential move from the expansion that began in late 2018. Typically, when the Federal Reserve pumps money into the financial system, stock market volatility calms down. In spite of unprecedented Fed action, volatility in March remained high. In fact, for the month of March, the stock market as measured by the S&P 500, moved intra-day an average of 5%, the most for any month on record. Even through the depths of the Depression or the Great Financial Crisis, the average intra-day move did not surpass 4%.(5)

Despite the continued ups and down, we would offer a little additional commentary beyond what we have discussed in the two recent webinars and above. For March, the numbers speak for themselves. The S&P 500(1) lost -12.4%, while the MSCI EAFE Net Index(6) of developed international equities was down -13.3% and the Emerging Markets Net Index(6) declined -15.4%. The Barclays U.S. Aggregate Total Return Index (7) returned -0.6% last month. The Barclays US High Yield Index(7) decreased -11.5% for the month. Hopefully, you are not too glued to CNBC or Fox Business News which we have warned house-bound market watchers about, given the media’s continued emotional rollercoaster and market manipulation (yes, we are talking about you, Bill Ackman).

In March, we kept our heads down and continued to focus on the one of the most important aspects of our relationship with clients. Beyond the investment expertise that we offer, our job is to ensure when times like this arise that we work together to restrain any exuberant investment behaviors as well as moderate our fearful investment behaviors.

The actions that we took in March in the Dynamic portfolios exemplify this goal. When the ten-year Treasury bond declined to an all-time low yield, we reduced portfolios exposures to long-term bonds. As you may recall, prices increase when bond yields fall. When it appeared that equity markets were temporarily bottoming, we increased our stock market exposure by adding to the equity hedge fund manager. During the last week of the month, when it looked like the House of Representatives would approve the CARES Act, we increased Treasury Inflation Protected Securities (TIPs) and more market sensitive equity positions. Overall, the Dynamic portfolios ended the month with more stock market exposure but not dramatically so.

Last week, we began our quarterly rebalancing of portfolios towards their strategic targets. We identified some areas that seem to be successful in this current environment, and we reduced cash and bonds that previously worked but are less likely to do so going forward. We are taking incrementally more risk via adding to defensive equities like healthcare and consumer staples. In certain portfolios, we added a “value-add” fund that is focused on a trend-following process which can work in higher-volatility markets.

On a positive note, we would quote Dr. Anthony Fauci: “You can’t rush the science, but when the science points you in the right direction, then you can start rushing.”(8) We have many laboratories looking to develop and roll out a vaccine. When the science is ready, a solution to the virus could come well before the usual 18 months. Even if we end up “going old school” and transferring plasma from previously infected individuals, we will get to the mountaintop and, ultimately, see a safer public health, economic and investment environment. Until then, we will continue to very nimble and proactive as we manage the portfolio allocation.

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

- Calculated from data obtained from Yahoo Finance, as of April 1, 2020.

- https://www.gurufocus.com/stock-market-valuations.php

- https://en.wikipedia.org/wiki/List_of_largest_daily_changes_in_the_Dow_Jones_Industrial_Average

- “How big could the Fed’s balance sheet get?” Financial Times, April 5, 2020 citing report from Bank of America

- Bloomberg, Jonathan Ferro as of March 31, 2020

- MSCI, as of April 1, 2020.

- NEPC

- https://www.brainyquote.com/lists/authors/top-10-anthony-fauci-quotes

Diversification Can Help Protect Against Market Crashes

The idea of diversification is very old and can be, in some cases, useful for survival. How many times in life have we heard “Don’t put your eggs all in one basket?” In investment terms, market crashes like the one we witnessed in March 2020 can happen. Losses such as these can be bad for your financial and mental health as well as your ability to meet your financial plan or retire. Diverse investment strategies and assets can behave differently in various crashes, and this differentiation of responses increases the chance your portfolio will survive a market crash. Here’s why a diversification strategy is important:

Diversification in terms of investing became more popular in the early 1990s and really took off in the early 2000s. Whether it is emerging market bonds, wind parks, real estate, etc., the diversification argument became more obvious after the DotCom Crash of 2000. At its core, diversification forces you to “buy low and sell high,” an adage that is arguably commonplace and easily mocked. But it really works. Just look at March 2020’s market returns.

In March 2020, COVID-19 appeared to impact most asset classes. As a result of our investment strategy and process, we became worried about the asset valuations in early to mid-2019. This led us to diversify away from an over-concentration in stocks and into a more varied portfolio of assets. Consequently, we were better prepared for March 2020 and had exposure to longer-dated Treasury bonds and gold, which were some of the only major asset classes up last month.

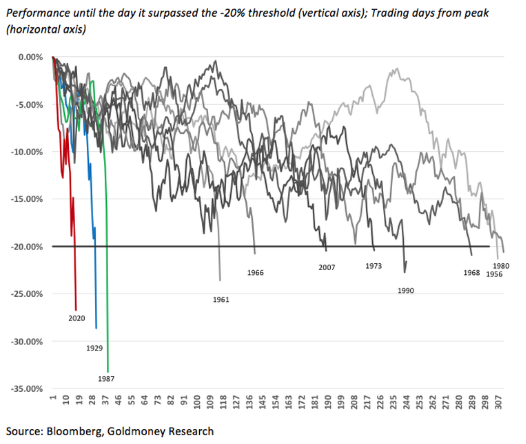

In 2019, prudence and diversification came under fire. With the S&P 500 Index up a massive 31%[i], investors with diversified portfolios felt like they left money on the table. In 2020, diversification came roaring back as investors realized the above-mentioned benefits of having parts of their portfolio perform when risky assets struggle. What a difference a few weeks and months can make! March 2020’s crash was the quickest decline in stock market history[ii]. During market crashes, diversification not only helps to potentially shore up returns, but also provides a source of money for rebalancing. With a 20% decline in equities in just under a couple of weeks, buying low and selling high is paramount for investment success over the long term.

In March 2020, the Federal Reserve balance sheet has increased +$1.1 trillion and the European Central Bank’s balance sheet has increased +$400 billion[iii]. Another $2 trillion fiscal stimulus bill is being considered in the U.S.[iv] So, we may yet again be lulled into believing that a period of elevated U.S. stock market valuations and low market volatility could persist throughout this decade. In that case, diversification may return to its regret-maximizing ways, where there will often be an underperforming asset (in this case, bonds or cash) in your portfolio that you wish you had sold, just like there will often be the asset (usually, equities) you wish you owned more of because its price went up the most. That said, when market volatility inevitably returns, you realize that staying diversified is worth it in the long run.

At CIG Capital Advisors, we attempt to pursue diversified portfolios for clients by employing the following thought processes. First, we invest only in investment choices we understand. Second, we determine investment and asset allocations based on collecting as much data as possible, employing common sense constraints, doing fundamental research, and rebalancing portfolios regularly. Lastly, we adapt to change, try to learn continuously, seek new sources of returns, and re-evaluate allocations regularly. We tend to shy away from an investment with an effortlessly smooth return history. These might or might not be safe as many of these strategies are the equivalent of picking up pennies in front of a steamroller.

While there are many known unknowns related to COVID-19, we anticipate continued volatility in the near term as the economic fallout from the pandemic is realized. As always, we maintain diversified, risk-balanced portfolios for clients to help ride out potential market selloffs, and to evaluate, and sometimes capture, the opportunities that present themselves. We conclude with a famous quote from Benjamin Graham, the British-born American investor known as the “father of value of investing,” “the essence of investment management is the management of risks, not the management of returns.”[v] Thus, diversify!

This report was prepared by CIG Asset Management and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security.

[i] Yahoo Finance

[ii] Bloomberg, Goldmoney Research

[iii] https://docs.google.com/spreadsheets/d/1s6EgMa4KGDfFzcsZJKqwiH7yqkhnCQtW7gI7eHpZuqg/edit#gid=0

[iv] Source: “How big could the Fed’s balance sheet get?” Financial Times, April 5, 2020 citing a report from Bank of America