CIG Wealth Management Update: Tax-Advantaged Giving Strategies

This year — clearly a highly unusual one in so many ways — there is even more need to carefully review philanthropic options that also have tax advantages.

As we enter the holiday season, many naturally turn their thoughts to charitable giving and yet, for the first time in nearly two decades, only half of U.S. households donated to a charity, according to a study from 2021 that is published every other year by Indiana University’s Lilly Family School of Philanthropy[i]. In the wake of the COVID-19 pandemic unemployment and food insecurity soared. In 2021, 53 million people turned to food banks and community programs for help putting food on the table, according to Feeding America[ii].

Taxpayers have until the end of the year to meet IRS deadlines, take advantage of tax rates that are locked in and qualify for charitable vehicles that are currently in place. There are two strategies they may want to consider: charitable lead annuity trusts and donor-advised funds. Note: these strategies tend to work best for those who can afford to designate a proportion of their income to charity on an ongoing basis.

An Under-the-Radar Option

A charitable lead annuity trust is a philanthropic option that’s a bit under the radar. It can be a good fit for those who have recently received a large influx of cash from, for example, selling a business or investment. It’s also an option for those who haven’t been able to deduct as much they’d like from their taxes.

The trust allows a donor to give cash, stock or real estate to a trust while offsetting income tax in the current year and potentially future estate taxes.

Even Jacqueline Kennedy Onassis included a charitable lead trust in her will, perhaps attracted by this benefit: Whatever assets are left in the fund at the end of the fixed term go to the donor’s beneficiaries tax-free.

A huge reason charitable givers should think about this kind of trust now: the lower the starting interest rate, determined by Section 7520 of the IRS code, the more the donor and his or her beneficiaries may benefit.

No Double Dipping

An upfront tax deduction and the ability to reduce estate and gift taxes — as well as the potential to pass on assets to heirs — make charitable lead trusts potentially very appealing.

But there are caveats. The funds in the trust are subject to investment management risk. After the initial tax deduction, donors can’t take any more deductions. No double dipping. Also, any capital gains or losses inside the trust flow back to the donor.

Charitable lead annuity trust are very complex vehicles. In addition to consulting with attorneys and accountants, it’s critical to work with a financial adviser to make sure any use of the trust is part of a holistic plan that aligns with your overall goals and interests.

Calling the Shots

Donor-advised funds (DAFs) are another attractive option for those who may have had a windfall this year or a bump in income. DAFs are a viable alternative to writing a check directly to a qualified organization or, for those with substantial wealth, starting a private charitable foundation.

Nonprofit divisions of financial service companies and other third parties, such as a community or church group, administer and legally control donor-advised funds. But as the name implies, individuals or families who set up the funds retain the ability to suggest or advise on where the funds should go.

The donors retain the ability to suggest or advise the donor on fund distributions.

Donors designate which IRS-designated 501(c)(3) charities receive money from the fund. They can change which organizations receive money and how much they get as often as they want.

What’s more, DAFs can be more attractive than family foundations because donors don’t have to worry about legal and administrative fees and can start one with as little as $5,000.

Any gift for the fund is an immediate tax deduction and the donor isn’t required to distribute it immediately. If you’re unhappy with the way one charity is operating, you can switch the distribution to one you like better. The donor calls the shots.

The tax benefits of a donor-advised fund are similar to contributions to religious institutions, colleges or public charities. Taxpayers who itemize can write off their cash donations up to 50% of the adjusted gross income. Those donating stock, real estate or any other asset that has appreciated can write off up to 30% of adjusted gross income. The unused amount can be carried forward up to five more years to be used as a deduction against income.

DAFs can serve as an appealing tax strategy for someone holding highly appreciated stock. If you were lucky enough to buy 100 shares of Apple (AAPL), 1.80% in 2008, for example, you can claim the current price of the stock as your tax-deductible donation. Meanwhile, the fund sells the stock and keeps the proceeds, but you don’t have to pay capital gains tax. In that way, you optimize your financial liabilities and make a powerful gift to charity at the same time.

People do need to keep in mind that once a donation is made to a DAF, it’s a completed gift. There’s no going back.

How Much in Benefits?

The tax benefit depends on your effective tax rate. For philanthropic options like DAFs, the benefit is not necessarily how much more you get in tax savings today, but the control you maintain over your donation.

And in the case of a charitable lead trust, it’s the ability to potentially retain some of your money down the road in the form of a tax-free payment to an heir or a beneficiary when the term of the trust runs out.

For both these strategies, financial advisers play a crucial role.

They will — or should — have a comprehensive plan for you and can identify whether the strategy is appropriate. Does it make sense for you or not?

Advisory firms will walk you through the financial planning process to make sure the tax or philanthropic option is truly viable.

You never want a complex strategy involving significant assets to be a one-off, where you’re just trying to get an edge on your taxes. You have to know how it affects the other pieces of your overall plan.

[i] https://scholarworks.iupui.edu/bitstream/handle/1805/26934/philanthropy-crisis-nov21.pdf?sequence=1&isAllowed=y

[ii] https://www.feedingamerica.org/hunger-in-america

CIG Capital Advisors and its affiliates do not provide tax, legal or accounting advice. This material being presented is for informational purposes only and is not intended to provide, nor be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Image: seraficus/iStock

CIG in the News: MarketWatch, “Three ways to maximize your wealth”

With rising taxes and inflation likely on the horizon, what are you doing to adjust your wealth management plan? CIG Capital Advisors’ managing principal Osman Minkara outlines a three-bucket strategy to help you prepare in MarketWatch.

Risks of Improper Titling and Inadequate Asset Protection

Physicians are acutely aware of liability risks and the exposure of personal assets to the claims of creditors. Given the publicity of large malpractice verdicts and the incessant amount of malpractice-related attorney advertising, this concern is understandable. However, malpractice liability is hardly the only financial risk that physicians face.

Although physicians may be inclined to view an asset-protection strategy in the context of a medical malpractice claim, physicians can pay or lose money as the result of the many non-malpractice liability claims, including:

- uninsured or underinsured casualty losses;

- ill-advised investments;

- personal guarantees of business obligations;

- alimony and property payments that could have been minimized with a pre-nuptial agreement;

- uninsured sexual harassment claims;

- estate taxes caused by inadequate estate planning;

- victimization by fraud;

- liability for breach of fiduciary duty (e.g., ERISA claims, director or officer liability); and

- indemnification obligations.

A comprehensive asset-protection strategy for a physician could include any of the following depending on the financial complexity of each physician. Some of these include but are not limited to:

- Adequate Insurance Coverage

- Proper Titling/Transfer of Ownership of Assets Within a Family

- Exempt Asset Creation

- Creation of FLP and FLLC

- Asset-protection Trusts

- Propper Retirement Plan Assets (ERISA vs non)

- Avoidance of Indemnification Obligations

Despite the widespread adoption of state law tort reform, physicians continue to be greatly concerned with asset-protection issues. In addressing this concern, two factors should be kept in mind. First, the malpractice plaintiff is far from the only potential threat to the financial well-being of a physician. Secondly, an asset-protection strategy should be integrated into an overall financial and estate planning program to help ensure appropriate strategies are selected.

To evaluate your titling and asset protection risks, contact the CIG Wealth Management team to schedule a complimentary consultation.

Examine Your Healthcare Practice’s Cash Flow to Keep Business Healthier

Medical or dental practice expenses have to be paid — whether cash flow is strong or weak. Focusing on cash inflows and outflows can help ensure that your practice will have enough cash available to meet its ongoing needs.

Examine Cash Inflows

How long does it take to convert a patient visit or a medical procedure into cash in the bank? Because receiving payment for services in a timely fashion is a critical element in effective cash management, you want to be sure every charge is accounted for, recorded, and submitted for payment promptly.

Survey your past due accounts and identify where delays have occurred in receiving payment from insurers and patients. There may be places where you can tighten procedures to minimize the likelihood of payment delays.

For example, coding errors are the source of many denied claims. By training staff to focus on accuracy in coding, your practice should reduce the number of incorrect claims that have to be resubmitted to insurers. Consider setting time goals for your staff to submit clean claims after a service is rendered, and base bonus payments on your staff reaching these goals.

Have your staff check patients’ insurance coverage every time they have an appointment to ensure that you have the most up-to-date information. If insurer information is not constantly updated and verified, you could end up submitting claims to an insurer that no longer covers the patient.

Your practice should have a system for generating up-to-date information on the status of each outstanding account. These reports should include the date each bill was sent, the current balance, and the number of days delinquent. Your staff can use that information to contact delinquent patients on a predetermined schedule.

Finally, whenever possible, have your front desk staff collect patient copays, deductibles, and prepays at the time of service. You can make paying up front easier for patients by accepting debit and credit card — and possibly even online — payments.

Track Cash Outflows

Paying bills as soon as they are received may not be the most effective way for your practice to manage cash flow. An automated accounts payable system that organizes your payments by due date is preferable. However, if a vendor offers your practice a discount for early payment, you will need to take that factor into account. Rent, utilities, and key suppliers should be paid before your practice pays bills with more flexible terms.

Consider renegotiating vendor contracts. You may be able to negotiate with certain vendors for longer payment terms — extending payment terms from, for example, 30 days to 60 days is equal to receiving an interest-free loan. Schedule a meeting with key vendors at least yearly to identify where they may have some flexibility in reducing their charges for supplies or services. You can always look for alternative vendors if your current ones seem unwilling to bend on prices.

Finally, review other areas of your operations to see if you can reduce costs. If you have any outstanding bank loans and are in a cash flow crunch, ask to renegotiate for more favorable terms.

Cash flow is crucial to your practice’s financial health. If you have had periods in the past when cash flow has been tight, take a look at what created the issue. We can help you review your current cash-management practices and suggest potential improvements. To schedule a complimentary consultation with a CIG Capital Advisors professional, click here.

Safeguarding Your Wealth with Proper Asset Protection Planning

Protecting accumulated wealth should be a cornerstone of your financial plan. A solid financial plan will address who or what poses the threat of taking away what you have earned and puts measures in place to limit the severity of those threats. These threats are often unseen and not easily predictable and therefore may cause a derailment from the path to your goals if your plan is not properly structured. Do you understand what your plan has put in place for asset protection?

Risk Management

It is not easy to think about, but just imagine that today was your last day alive. Who will be there tomorrow to protect your family and the assets you leave behind? Who will replace the high amount of income that you provide? Will your current savings be enough to provide for the day-to-day basics, let alone the big expenses of the future such as college tuition? Proper planning aims to assess the capital needs of an individual and his or her family to ensure that given any unfortunate event, the family will be taken care of first. A less often considered, but nonetheless important, scenario is disability due to injury or sickness. Will you still be able to pay your mortgage, car loan or other payments? What if this disability is for an extended period of time? You must, again, ask what your financial plan has in place for the future of your family and goals.

Personal and Business Liabilities

For physicians and other highly visible professionals, the possibility of becoming the defendant in a lawsuit based on work performed or expertise given is not out of the question. How is your medical practice structured? Which of your personal assets will be exposed to liabilities? There are particular are strategies to help protect and separate your business assets from your personal assets (Domestic Asset Protection Trusts).

Estate Planning & Titling

Do your estate planning documents match your intentions? Your estate plan may be designed to leave assets to your children; however, if your accounts and assets are not titled properly, your children may not receive those assets as intended. For example, accounts titled as Joint Tenants with Rights of Survivorship, all assets will remain in the account under control of the surviving owner, regardless of the estate plan documents. It is critical that your account titling matches your estate plan documents to avoid unintended consequences.

Mistakes and Unforeseen Problems

Without proper planning, your accumulated wealth could be exposed to numerous risks. With proper planning, those risks can be mitigated. CIG Capital Advisors Wealth Management team can make sure your wealth plan accounts for unforeseen personal events (death, disability or lawsuit) as well as financial hazards that could jeopardize the assets you’ve built over a lifetime. It can take many years, often decades, of hard work to accumulate significant assets. Unfortunately, it can only take one event to erase your progress. Contact a CIG Capital Advisors professional to prepare for the unexpected.

Tax Strategies for Physicians to Help Meet your Retirement Goals

Tax Strategy for Physicians A common mistake in do-it-yourself retirement planning is not understanding the numerous options available to save for and fund your retirement years. The mistake is not in the act of saving itself, but rather in the misallocation of dollars to taxable accounts before tax-advantaged accounts. That’s where tax strategy for physicians […]

Financial Resilience Amid Disruption: Your Tax Strategy

Policies around tax and some types of debt have changed during the pandemic, and some individuals may be able to take advantage of the new circumstances:

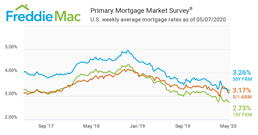

Lower Interest Rates: Interest rates are lower than they have been in several years, allowing some borrowers to refinance or take out a new loan or mortgage. If you currently have a mortgage or investment properties, restructuring the debt on these properties could yield large savings.

Charitable Deductions: Lower IRS 7520 rates for charitable trusts means that when gifting assets (cash or securities) to a Grantor Charitable Lead Annuity Trust, the IRS requires you to gift all the assets you contributed to the trust plus the interest. The interest rate used is the IRS 7520 rate. This rate is fixed for the life of the trust and sets the amount that needs to be distributed every year for the life of the trust. The difference between the fixed distribution and the growth within the trust will be passed to the beneficiary of the trust. The lower the 7520 rate, the greater potential for growth. For a CLAT with an initial value of $200,000, the below 7520 rates would yield the corresponding tax-free transfers to the remainder beneficiary:

Values are not intended to represent those of a client or known person.

Charitable Lead Annuity Trust (CLAT) is a plausible option to offset tax liabilities, gift annually, and set aside tax-free assets for a designated beneficiary in the future.

- Transfer

of cash/securities to trust in first year

- Immediate

deduction for gift to trust offsets…

- Increased level of income

- Realized Capital Gains

- Annually

gift for a set term from the trust to…

- Public Charity,

- Family foundation, or

- Donor Advised Fund

- Remaining balance at end of term is transferred to Remainder Beneficiary as a tax-free asset

- Immediate

deduction for gift to trust offsets…

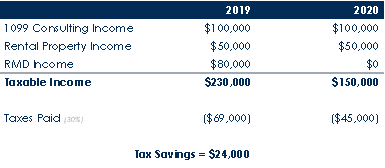

Waiver for RMD in 2020: In March, required minimum distributions for retirement accounts were waived for 2020. An example of how a hypothetical person over age 70 could save on taxes by not taking RMD in 2020:

Assumes effective combined federal and state tax rate of 30% for hypothetical purposes. Values are not intended to represent

those of a client or known person.

Increased 401k/403b Loan Limits: Previously, penalty-free early withdrawals was the lesser of $50,000 or 50% of vested balance. Now, penalties don’t kick in until the lesser of $100,000 or 100% of vested balance, allowing savers to borrow more from their retirement accounts without penalty.

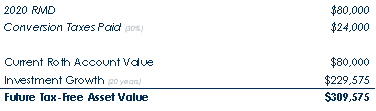

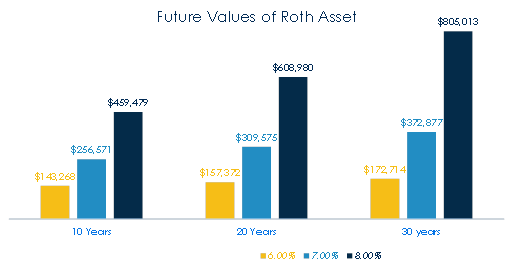

Opportunity for Roth Conversion: In a down market, with depressed values of pre-tax IRA accounts, it could be a good time to convert the account to a Roth IRA, where the funds can grow tax-free:

hypothetical purposes. Values are not intended to represent those of a client or known person.

This allows the saver to pay taxes on the lower account value this year, and once converted the money can grow, hypothetically, tax-free:

To take advantage of these or any other tax strategies, please schedule an intitial complimentary consultation at www.calendly.com/mswieckicig.

New Year Resolutions for Better Financial Health

As we approach the new year, it is a good idea to examine and review a financial health checklist and make changes as necessary. Here is a list of some of the items the CIG Capital Advisors Wealth Management team recommends you review as part of your resolution for better financial health in the new year and to help establish good personal finance habits in the years to come:

- Review and update beneficiaries. Confirm who is designated as your beneficiaries on your retirement accounts. For many people, naming beneficiaries happens one time, when they set up the account or policy. However, life changes (birth, marriage, divorce, death) are inevitable, and when these changes occur, you, or your family, may find that the designated beneficiary on your retirement account is not who you think it should be now.When it comes to planning for wealth transfers, it’s extremely important to review your beneficiaries periodically, especially if you have had children, divorced, or remarried since you first established your retirement account. This also applies if you had previously named a charity or trust as your beneficiary upon account setup and that organization no longer exists.

- Review and/or prepare for Required Minimum Distributions (RMDs) If you’re 70½ or older, you’re required by the IRS to take RMDs from certain retirement accounts by December 31—or face a penalty equal to 50% of the sum you failed to withdraw. If you turned 70½ this year, you have until April 1, 2020, to take your first RMD, albeit with potential consequences. Additionally, if you will be turning 70½ soon, now is the time to review your distribution strategy.

- Retirement Plan Contribution Increase. The contribution limit for employees who participate in 401(k), 403(b), most 457 plans, and the federal government’s Thrift Savings Plan, is increased from $19,000 to $19,500 for tax year 2020. Consider reviewing and changing your contribution limits if appropriate.

- Review Living Wills and Trusts. Most often people wait to do their estate planning and draft a Will until they absolutely have to, which is often after they have children, get married, buy a house, start a significant business or have a spouse or family member convince them of its importance. If nothing sudden or significant has happened such as the birth of a child, divorce, marriage, death of a family member, change in jobs, or change in your balance sheet or assets, then a good benchmark for reviewing your estate plan is once every five years. Otherwise, it’s a healthy habit to do a general review once a year.

- Revisit Tax Withholding. Changes in dependents, income and marital status can all affect your tax bill. Use the IRS’s withholding calculator to ensure you’re withholding enough—but not too much.

- Check your credit reports. Under the Fair Credit Reporting Act, each of the national credit-reporting agencies is required to provide you with a free copy of your credit report, upon request, once every 12 months. Get yours at annualcreditreport.com.

- Review your insurance needs. Make sure your loved ones and the things you’ve worked so hard for are protected. Ensure that there are no gaps in your home, auto, business insurance coverage.

Resolve to get take care of your financial health in the new year. To get assistance with a complete, holistic review of your financial plan, contact a CIG Capital Advisor to schedule a brief introductory call today.

Charitable trusts and the difference between a charitable lead trust and a charitable remainder trust

For many of us, philanthropy can provide great personal satisfaction. However, when properly planned for, charitable giving can provide financial benefits both today (as an income tax deduction and/or capital gains tax shelter) and in the future (when the amount of taxes your estate may owe when you die can be reduced).

There are many ways to give to charity. A common vehicle for many families is a charitable trust, where a charity is named as the sole beneficiary. You may name a non-charitable beneficiary as well, splitting the beneficial interest (this is referred to as making a partial charitable gift). The most common types of trusts used to make partial gifts to charity are the charitable lead trust and the charitable remainder trust.

What is a charitable lead trust?

A charitable lead trust pays income to a charity for a certain period of years, and then the trust principal passes back to you, your family members, or other heirs. The trust is known as a charitable lead trust because the charity gets the first, or lead, interest. A charitable lead trust can be an excellent estate planning vehicle if you own assets that you expect will substantially appreciate in value. If created properly, a charitable lead trust allows you to keep an asset in the family and still enjoy some tax benefits.

SOURCE: Broadridge Investor Communication Solutions, Inc. Copyright 2017

What is a charitable remainder trust?

A charitable remainder trust is the mirror image of the charitable lead trust. Trust income is payable to you, your family members, or other heirs for a period of years, then the principal goes to your favorite charity. A charitable remainder trust can be beneficial because it provides you with a stream of current income — a desirable feature if there won’t be enough income from other sources.

SOURCE: Broadridge Investor Communication Solutions, Inc. Copyright 2017

Note: There are expenses and fees associated with the creation of a trust. Please speak to your financial and/or tax professional to understand the cost and tax implications of your particular giving situation.

Securing your wishes through charitable giving

Charitable giving plays an important role in many financial plans. However, many people tend to approach charitable giving as a quick exercise they think about once a year. In reality, it requires thoughtful planning, especially if you’re making larger charitable gifts, to ensure your wishes for your money both now and in the future are […]